Ohio Sample Letter for Withheld Delivery

Description

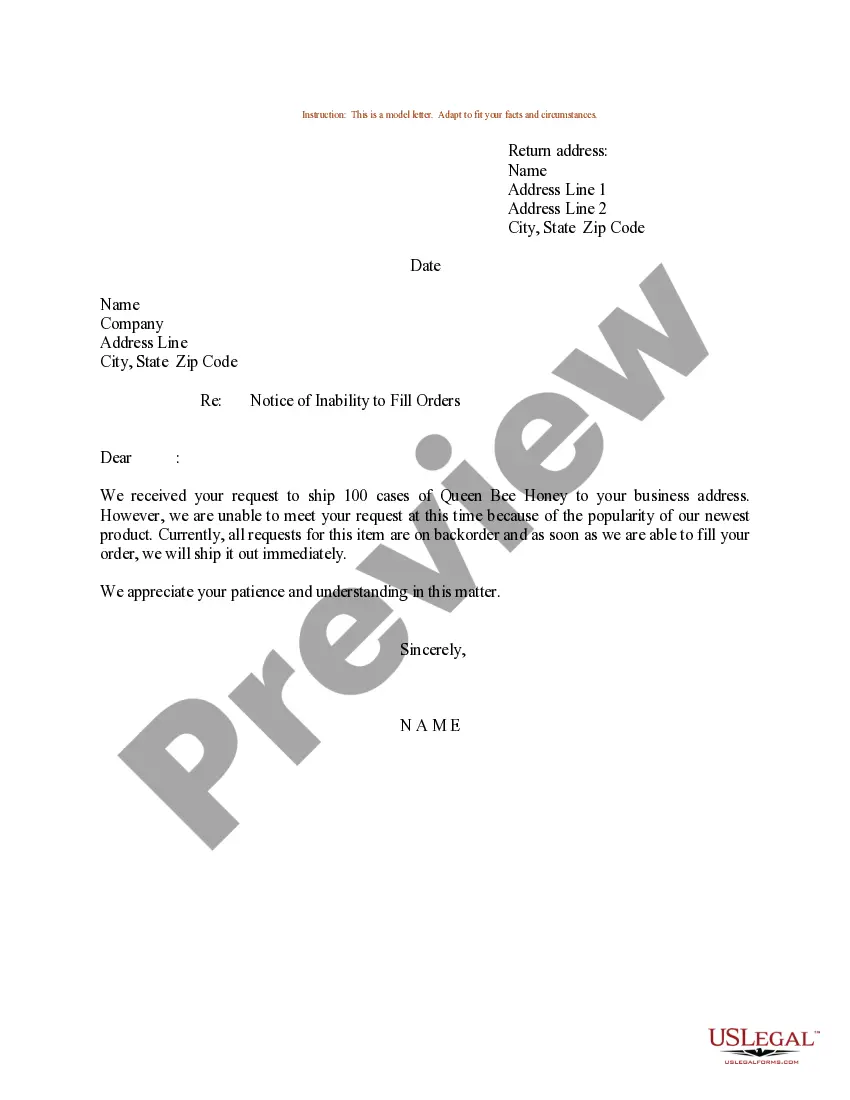

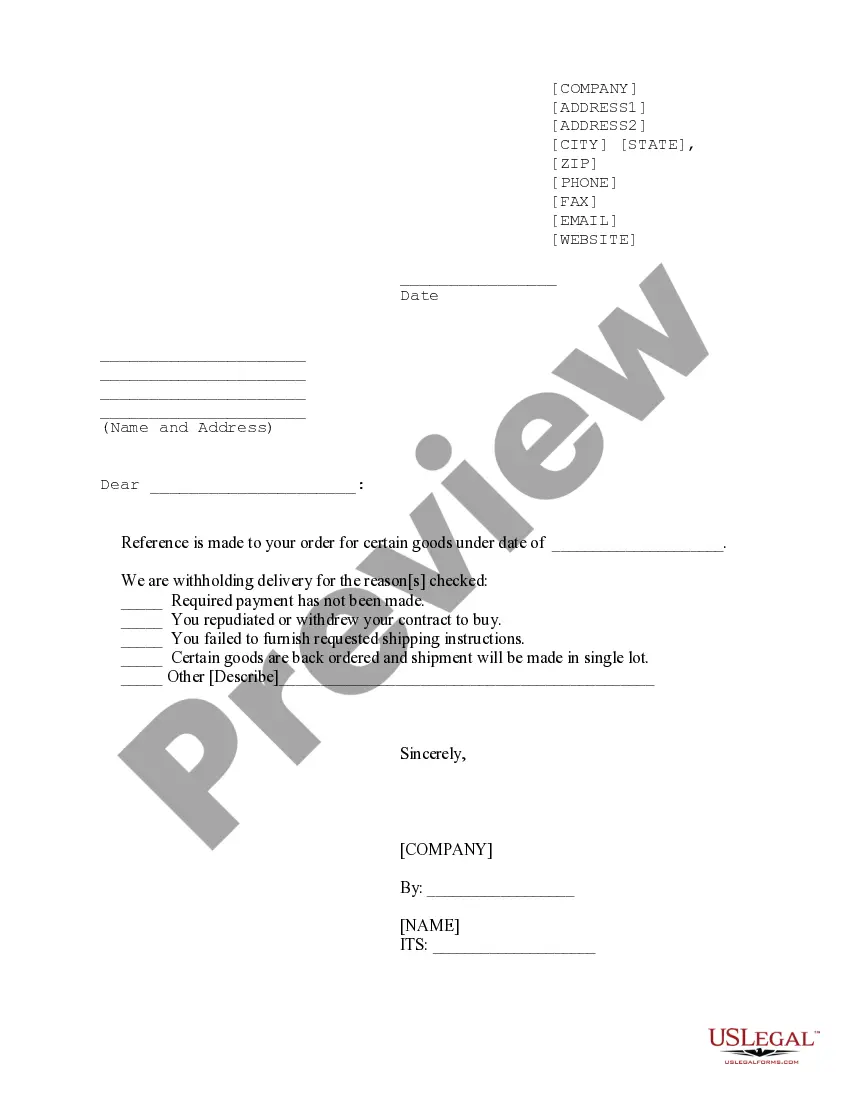

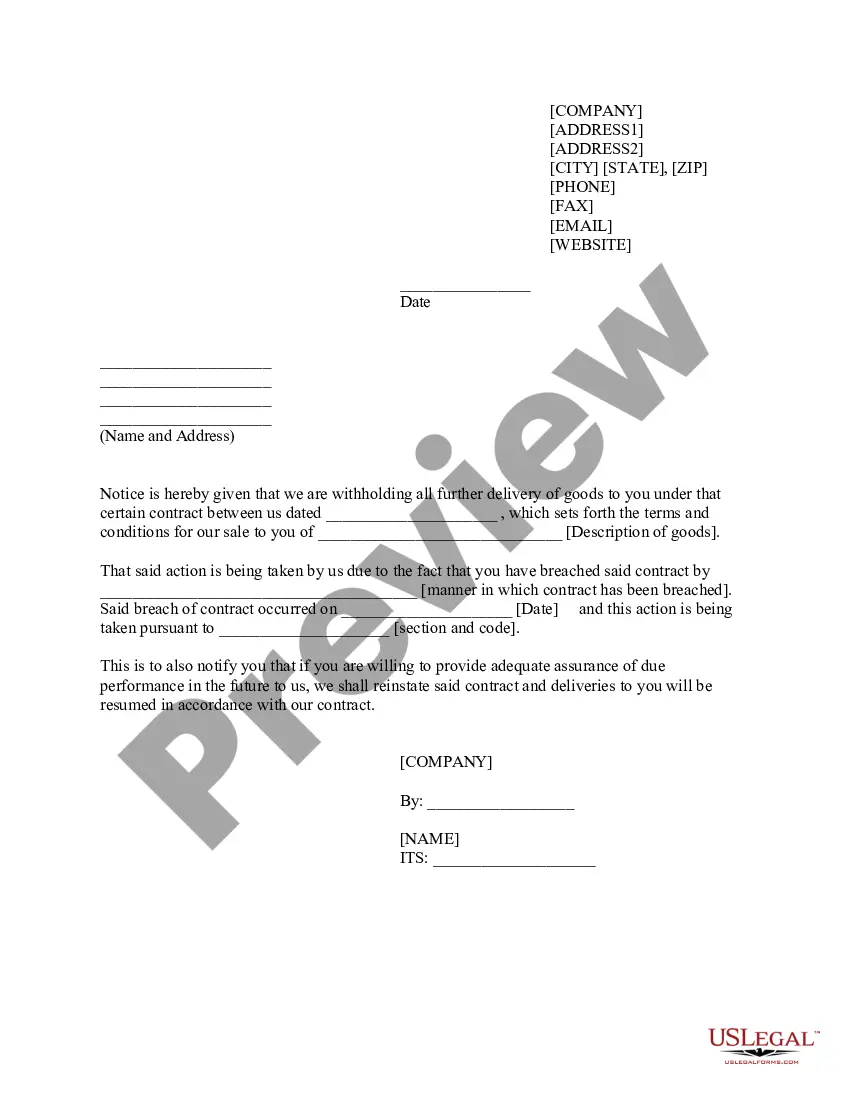

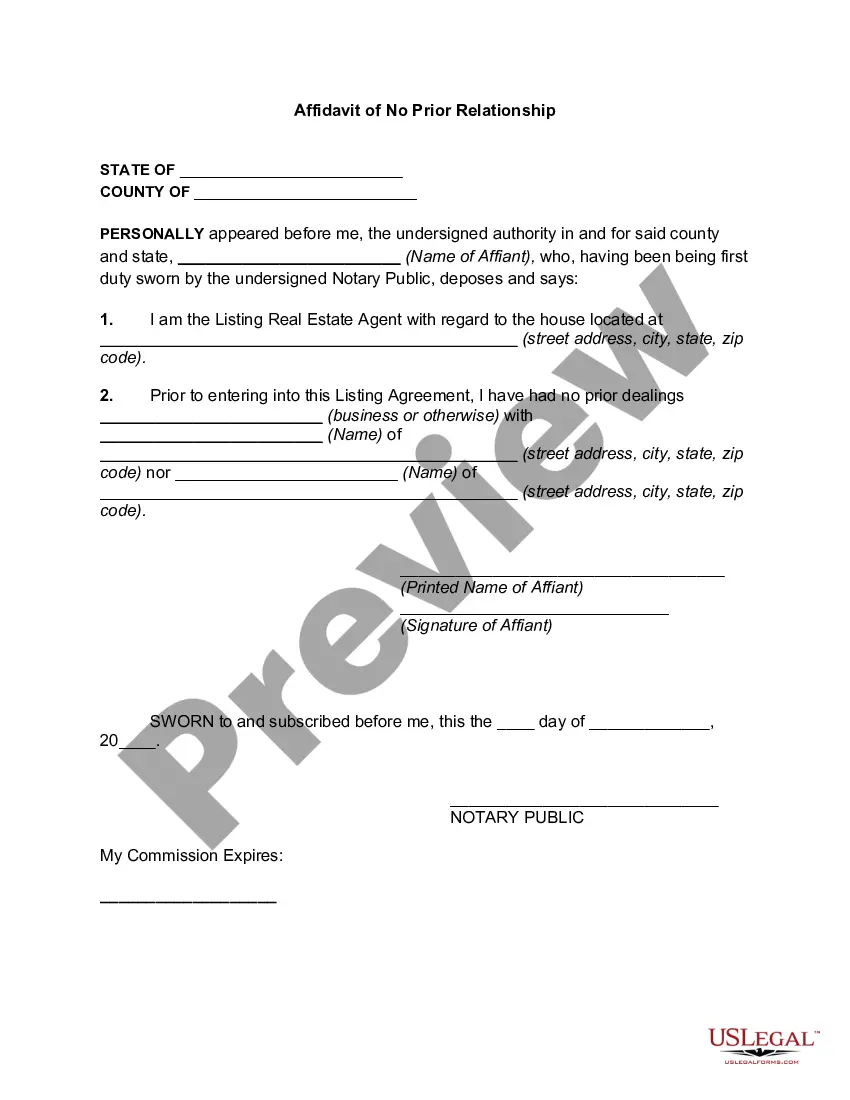

How to fill out Sample Letter For Withheld Delivery?

Are you in a situation where you require documents for potential business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a wide array of form templates, including the Ohio Sample Letter for Withheld Delivery, designed to meet federal and state requirements.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Ohio Sample Letter for Withheld Delivery whenever needed by selecting the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service provides properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Ohio Sample Letter for Withheld Delivery template.

- If you do not have an account and wish to start using US Legal Forms, take these steps.

- Find the form you need and verify that it is for the correct city/county.

- Utilize the Review button to examine the form.

- Read the description to ensure that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your requirements.

- Once you identify the correct form, click Acquire now.

- Select the payment plan you want, provide the required information to create your account, and pay for your order using PayPal or a credit card.

- Choose a convenient paper format and download your copy.

Form popularity

FAQ

If your employer did not withhold taxes, you will need to take action to rectify this issue. This might involve submitting estimated tax payments or addressing the employer directly. Using the Ohio Sample Letter for Withheld Delivery can help you formally communicate your concerns, and US Legal Forms is there to provide the resources you need for this letter.

Your employer should withhold taxes for the state where you perform your work. This is generally where your employment is based. If you have questions about your situation, the Ohio Sample Letter for Withheld Delivery can be a helpful tool to communicate any issues or clarify with your employer regarding tax withholding.

Setting up an Ohio withholding account involves registering with the Ohio Department of Taxation. Employers must complete the necessary registration forms and provide required information about their business. For clear steps and templates, reviews of the Ohio Sample Letter for Withheld Delivery on US Legal Forms can simplify your understanding and management process.

Yes, employers in Ohio are generally required to withhold local taxes if the municipality has a local income tax. However, the rules can vary based on the specific locality. If you have questions about your specific situation, consider referencing the Ohio Sample Letter for Withheld Delivery for outlining your needs directly to your employer.

If your employer failed to withhold local taxes, you may find yourself responsible for paying those taxes directly to your local tax authority. This situation can complicate your tax filing process. Using the Ohio Sample Letter for Withheld Delivery can help you formally address this issue with your employer, and US Legal Forms can assist you in creating this letter.

In Ohio, state withholding refers to the amount of income tax that employers are required to deduct from employees' paychecks. The state tax rate is generally a percentage of what you earn, and it helps fund public services. If you need help understanding how this relates to the Ohio Sample Letter for Withheld Delivery, consider using US Legal Forms for guidance.

Yes, you can file Ohio school district taxes online through the Ohio Department of Taxation's e-filing options. This method is convenient and ensures quick processing of your tax return. To help navigate this process, consider accessing the Ohio Sample Letter for Withheld Delivery, which can provide you with helpful tips.

You should send your Ohio state tax return to the address specified on the form you are using, typically provided by the Ohio Department of Taxation. If you are filing electronically, ensure you follow the online instructions carefully. For additional guidance, you might refer to the Ohio Sample Letter for Withheld Delivery for detailed mailing information.

Filing Ohio withholding tax involves calculating the taxes withheld from employees' wages and submitting the necessary forms to the Ohio Department of Taxation. Make sure to file using the appropriate forms, such as the IT-4 or IT-501. If you need additional support, the Ohio Sample Letter for Withheld Delivery can guide you through your filing requirements.

In Ohio, most information technology services are subject to sales tax, but certain exemptions may apply. It's essential to review Ohio's tax guidelines to determine what qualifies. For clarity on your tax obligations, consult the Ohio Sample Letter for Withheld Delivery, which can provide insights and guidance.