Ohio Check Requisition Report

Description

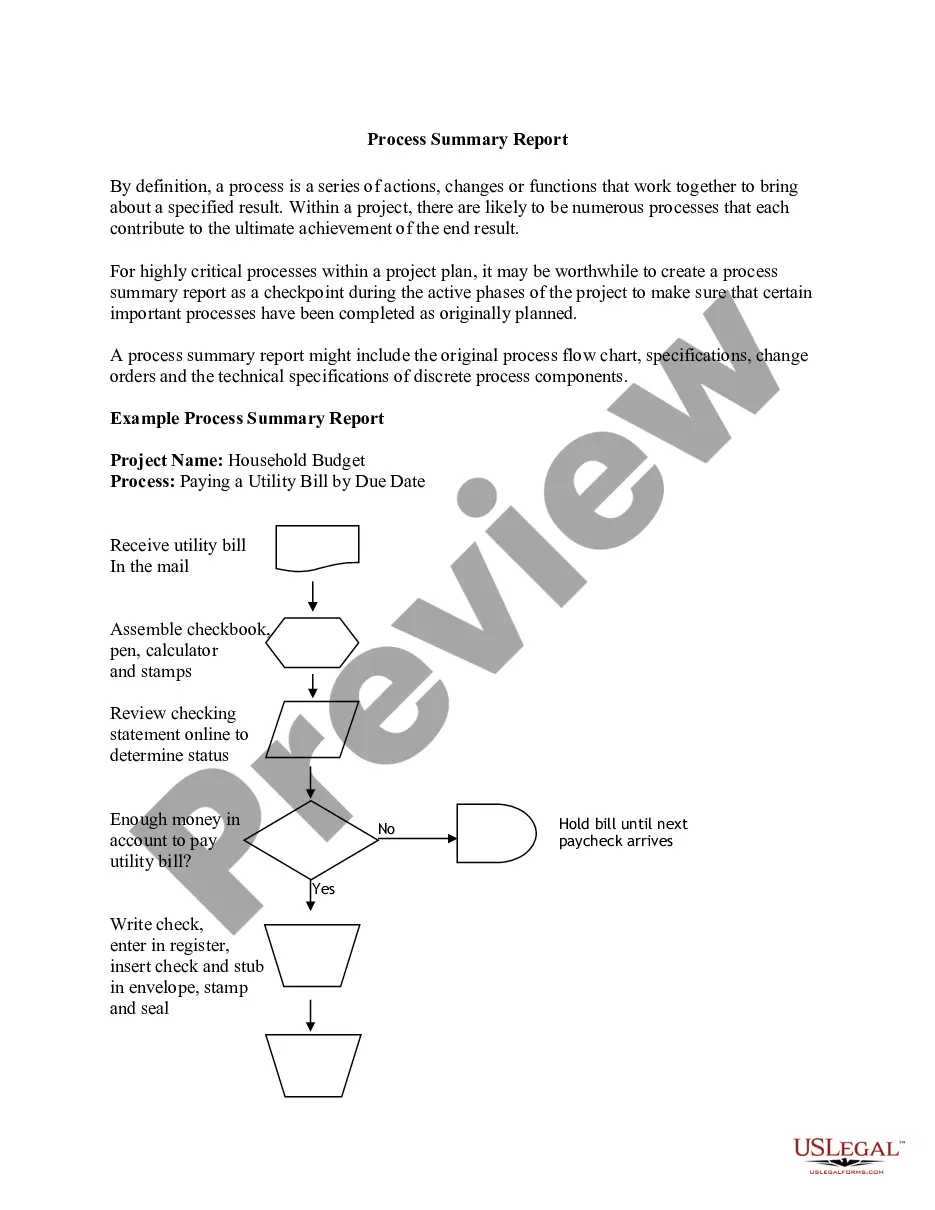

How to fill out Check Requisition Report?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal paperwork templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can quickly obtain the latest versions of forms like the Ohio Check Requisition Report.

If you already have a subscription, Log In and download the Ohio Check Requisition Report from the US Legal Forms database. The Download option will appear on every form you view. You can access all previously obtained forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the obtained Ohio Check Requisition Report. Each template you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the desired form.

- Ensure you select the correct form for your region/county.

- Click the Preview option to review the content of the form.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get it now option.

- Next, choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Form IT SD 100 is an Ohio Individual Income Tax form. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Paper filing, Ohio return says attach any 1099(s) and copy of all supporting documents? Attach your W-2. Do not attach any 1099s unless it shows state (OH) income tax withholding. TurboTax automatically prints out a copy of the entire federal return, when it prints the OH return.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

You'll need to attach any IRS form or schedule used to prepare your return to your 1040 form before mailing your tax return off. All the forms and schedules used in preparation create your entire return, and the IRS needs these in order to process your tax return and the items you report.

Simply add an additional amount on Line 4(c) for "extra withholding." That will increase your income tax withholding, reduce the amount of your paycheck and either jack up your refund or reduce any amount of tax you owe when you file your tax return.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

Ohio requires the same filing status used on the federal return, with no exceptions.