Ohio Agreement to Compromise Debt

Description

How to fill out Agreement To Compromise Debt?

It is feasible to utilize time on the Internet searching for the sanctioned document template that aligns with the state and federal regulations you will require.

US Legal Forms offers countless sanctioned forms that can be examined by experts.

You can effortlessly obtain or print the Ohio Agreement to Compromise Debt from my service.

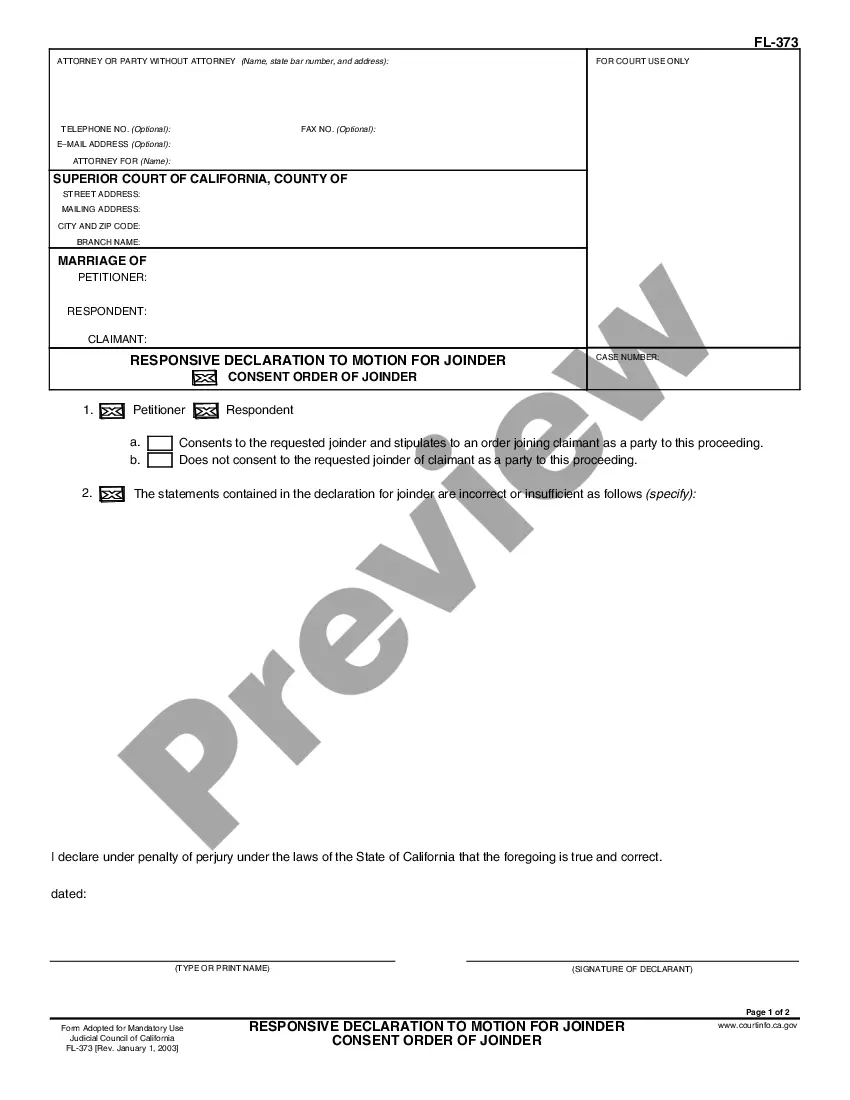

If available, utilize the Preview button to browse through the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Ohio Agreement to Compromise Debt.

- Each sanctioned document template you receive is yours indefinitely.

- To obtain another copy of any purchased type, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your county/city of choice.

- Review the type description to make certain you have selected the appropriate type.

Form popularity

FAQ

An offer in compromise can be rejected if the IRS determines that your financial situation allows for a payment plan that is more beneficial than the compromise. Additionally, if you fail to provide the necessary documentation or if there are outstanding tax obligations, your offer may not be accepted. If your submitted Ohio Agreement to Compromise Debt lacks sufficient detail, it could also lead to rejection. Therefore, it's essential to be thorough and transparent when presenting your case.

The Ohio Attorney General primarily collects debts related to state taxes, state-funded loans, and certain public obligations. This often includes situations where individuals have defaulted on necessary payments. If you're dealing with such debt, exploring an Ohio Agreement to Compromise Debt may provide relief. US Legal Forms can assist you in navigating this process effectively.

Compromising debt refers to the process of negotiating a lower payment amount with your creditors to settle your outstanding debts. This can result in a significant reduction in the total amount you owe. An Ohio Agreement to Compromise Debt allows you to proactively manage your finances and relieve some of the burden. Utilizing this method can lead to a fresh financial start.

Writing a debt settlement agreement requires clarity and precision. Start by detailing the parties involved, the exact amount being settled, and the payment terms. It's important to ensure the agreement reflects the terms of your Ohio Agreement to Compromise Debt, which helps you achieve a fair resolution. For additional support, US Legal Forms offers templates and guidance to simplify the process.

The Ohio Attorney General may offset your taxes to recover debts owed to the state or other governmental entities. This often occurs if you have an outstanding obligation, such as unpaid taxes or child support. In some cases, this offset can stem from debt related to an Ohio Agreement to Compromise Debt, which aims to alleviate your financial burden. Understanding your financial standing is crucial, and resources like US Legal Forms can guide you in managing these situations.

The downside of an offer in compromise is that it may negatively impact your credit score and can lead to future financial scrutiny. Additionally, some debtors may feel uncertain about completing the requirements for a successful compromise. It’s wise to consult with professionals who can help you understand the Ohio Agreement to Compromise Debt and make informed decisions on this matter.

Ohio can generally collect back taxes for up to 15 years from the date they are assessed. After this period, the state may lose the ability to collect through legal means. To avoid complications and find your best options, you can refer to the Ohio Agreement to Compromise Debt for assistance in negotiating any outstanding tax issues.

The offer in compromise for Ohio state taxes is an agreement that allows taxpayers to settle their tax liabilities for less than the full amount owed. This option is available for those who qualify based on their financial circumstances. Using the Ohio Agreement to Compromise Debt can assist you in navigating this process and potentially reducing your state tax burdens.

Compromising a debt involves negotiating with a creditor to settle for less than the total amount owed. This process allows you to resolve your financial obligations, often leading to a more manageable payment plan. The Ohio Agreement to Compromise Debt is designed to help individuals find a way to alleviate their financial burdens effectively.