Ohio Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Are you currently engaged in a situation where you'll require documents for both professional or personal purposes almost every day.

There are numerous authentic document templates available online, yet finding ones you can trust is not straightforward.

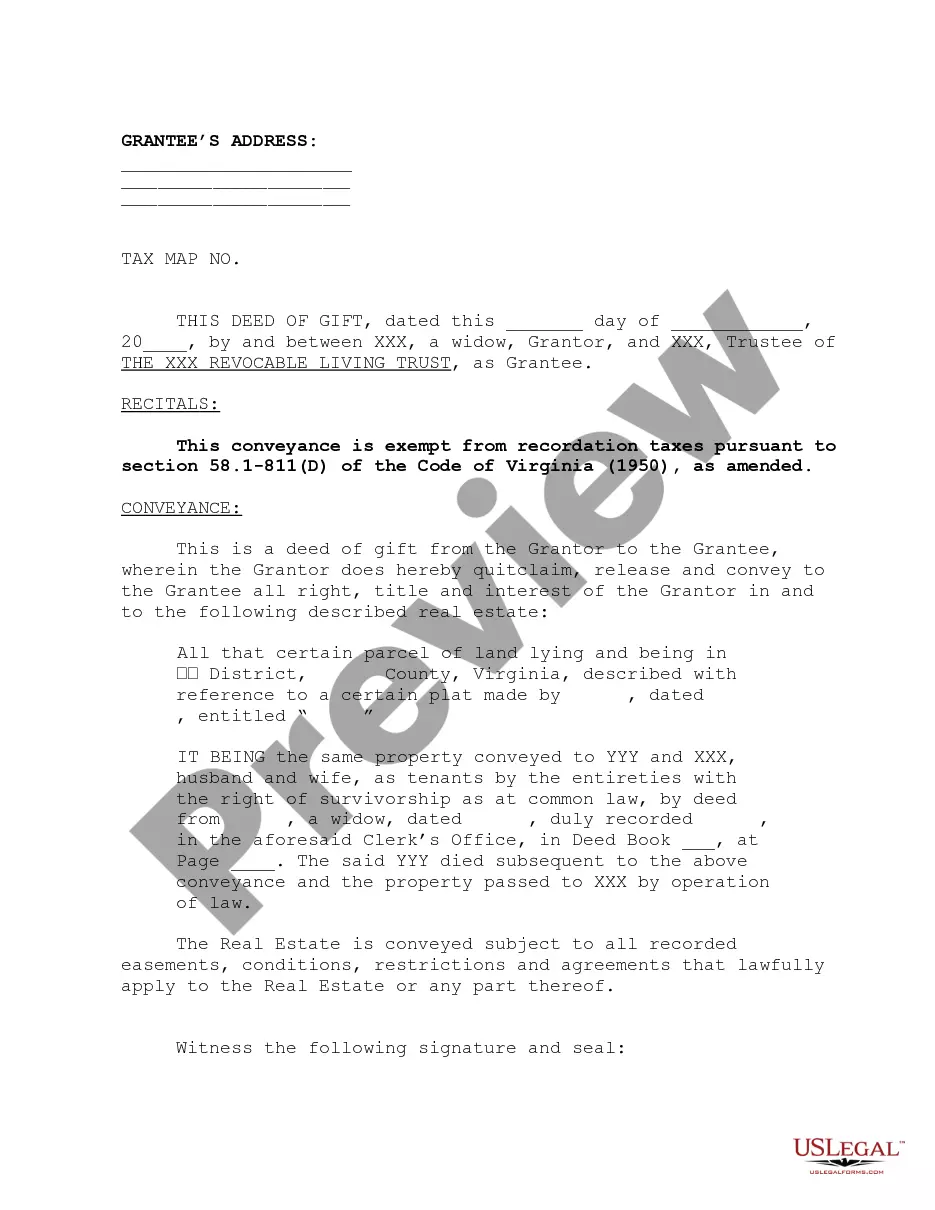

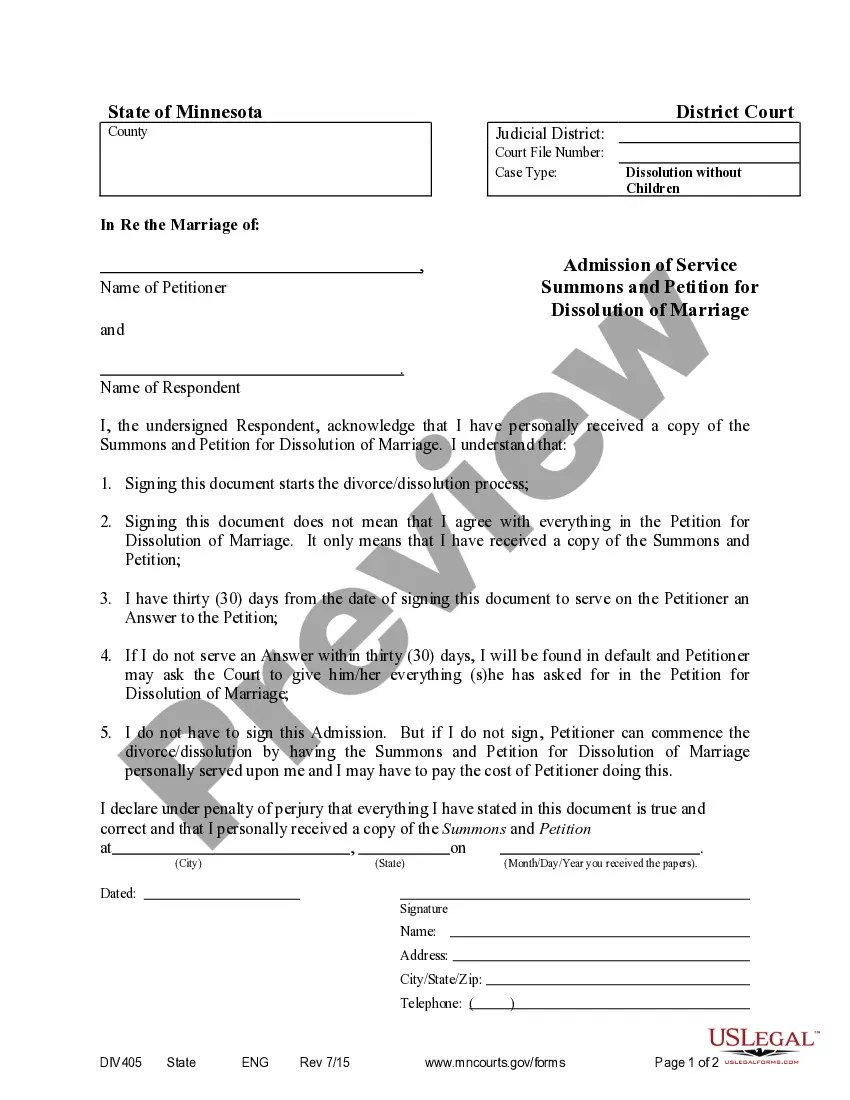

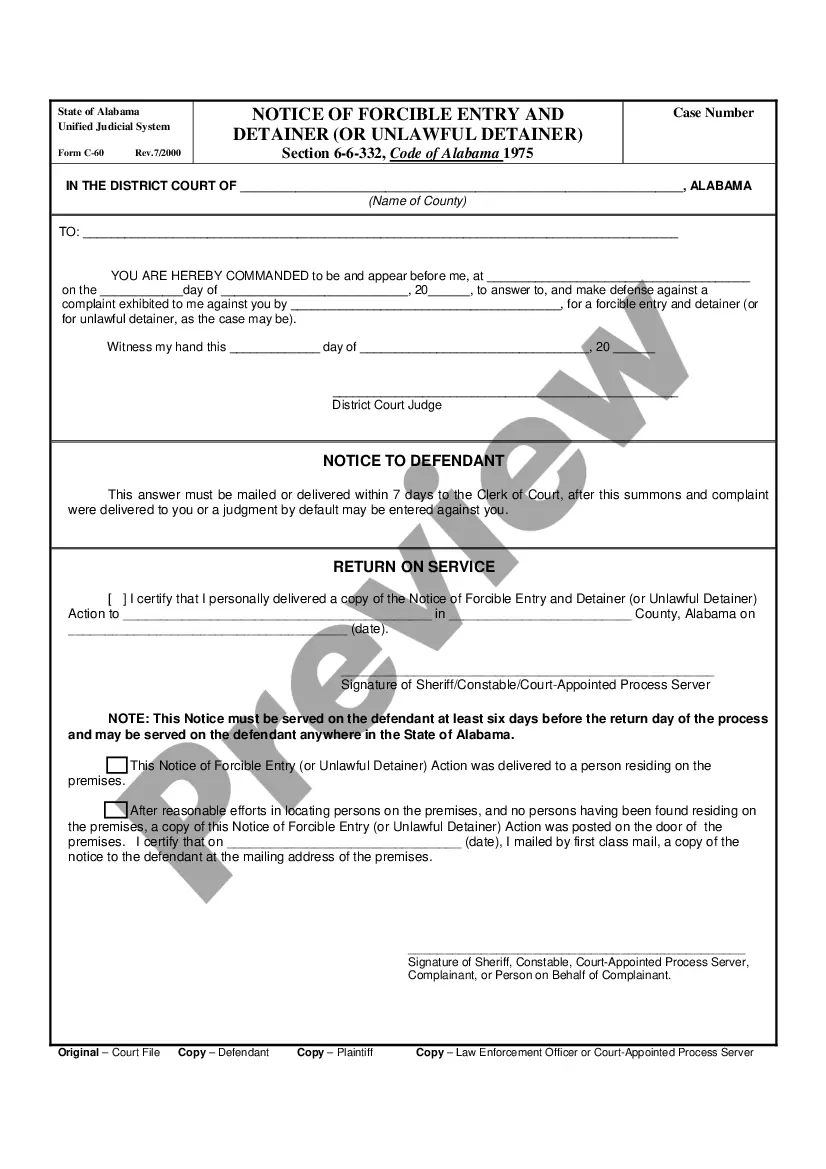

US Legal Forms offers a plethora of template documents, such as the Ohio Agreement to Settle Debt by Surrendering Secured Property, which can be tailored to fulfill federal and state requirements.

If you find the right document, click on Buy now.

Select the pricing plan you desire, input the necessary information to process your payment, and complete your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterwards, you can download the Ohio Agreement to Settle Debt by Surrendering Secured Property template.

- If you do not have an account and wish to begin utilizing US Legal Forms, follow these steps.

- Obtain the document you need and verify it is for the correct city/county.

- Utilize the Review button to examine the document.

- Check the information to ensure you have selected the correct document.

- If the document is not what you are looking for, use the Search box to find the document that fits your needs and requirements.

Form popularity

FAQ

Innocent spouse relief in Ohio allows one spouse to avoid liability for taxes owed if they can prove that they were unaware of the tax issues caused by the other spouse. This relief can protect you from significant financial repercussions. If you believe you qualify, utilizing the Ohio Agreement to Compromise Debt by Returning Secured Property can be an effective course of action to reduce your overall liabilities.

Ohio can generally collect back taxes for up to 21 years from the assessment date of those taxes. This lengthy period can be daunting for taxpayers. If you find yourself in this predicament, consider the Ohio Agreement to Compromise Debt by Returning Secured Property as a way to address your tax liabilities and find relief.

One downside of an offer in compromise is that it can negatively impact your credit score. Additionally, the IRS or state may require you to provide detailed financial information and documentation that can be time-consuming. However, if you're facing overwhelming debts, the Ohio Agreement to Compromise Debt by Returning Secured Property might be a necessary step toward improving your financial situation.

The Ohio Attorney General may offset your taxes to collect on certain types of debts, including unpaid taxes and child support. This action can significantly reduce your tax refund. If you want to address this and protect your assets, consider looking into the Ohio Agreement to Compromise Debt by Returning Secured Property to find a viable solution.

The amount you should offer in your offer in compromise depends on your financial situation and the total amount of debt you owe. It's essential to evaluate your assets, income, and expenses carefully. You can use the Ohio Agreement to Compromise Debt by Returning Secured Property as a framework for determining a fair and manageable offer when dealing with your debts.

In Ohio, the state can collect back taxes for up to 21 years from the date the taxes were assessed. Understanding this timeline is crucial for property owners. If you're struggling with back taxes, the Ohio Agreement to Compromise Debt by Returning Secured Property can help you address these situations effectively.

The Ohio Attorney General can take your taxes if you have outstanding debts or obligations, such as unpaid loans or taxes that have not been settled. This process might be a direct result of an enforced collection strategy aimed at recovering owed amounts. Utilizing the Ohio Agreement to Compromise Debt by Returning Secured Property can be a beneficial way to negotiate your liabilities and potentially avoid tax garnishments. Engaging with a platform like uslegalforms can simplify this process and help you understand your rights.

Your tax refund may be offset for several reasons, such as unpaid debt, child support obligations, or other financial responsibilities owed to state or federal agencies. The Ohio Agreement to Compromise Debt by Returning Secured Property provides a means to negotiate these debts, potentially preventing such offsets in the future. If you find your refund is being withheld, consider seeking advice to explore your options for debt resolution. This proactive step can help you regain financial stability.

The IRS can pursue collection from either spouse if you filed a joint tax return. However, if you can demonstrate that your wife was unaware of the issues, she may be eligible for relief. This situation highlights the importance of understanding options like the Ohio Agreement to Compromise Debt by Returning Secured Property, which can help address debts while protecting your spouse.

Factors for equitable relief include the knowledge of the tax liability, the financial situation of both spouses, and any significant hardship caused by collecting the tax debt from one spouse alone. As you explore options such as the Ohio Agreement to Compromise Debt by Returning Secured Property, these factors can influence your decisions and potential outcomes.