Ohio Sworn Statement of Identity Theft

Description

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.

Identity theft statutes vary by state and usually do not include use of false identification by a minor to obtain liquor, tobacco, or entrance to adult business establishments. The types of information protected from misuse by identity theft statutes includes, among others:

-Name

-Date of birth

-Social Security number

-Driver's license number

-Financial services account numbers, including checking and savings accounts

-Credit or debit card numbers

-Personal identification numbers (PIN)

-Electronic identification codes

-Automated or electronic signatures

-Biometric data

-Fingerprints

-Passwords

-Parent's legal surname prior to marriage

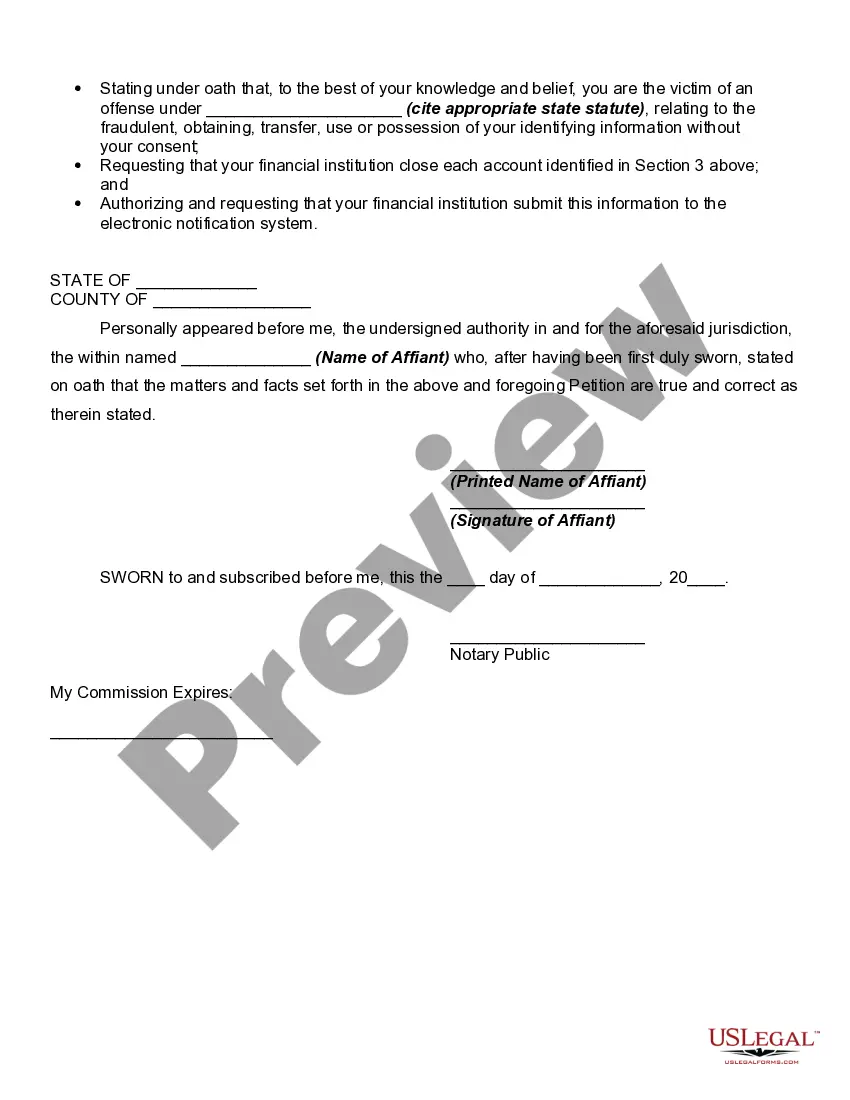

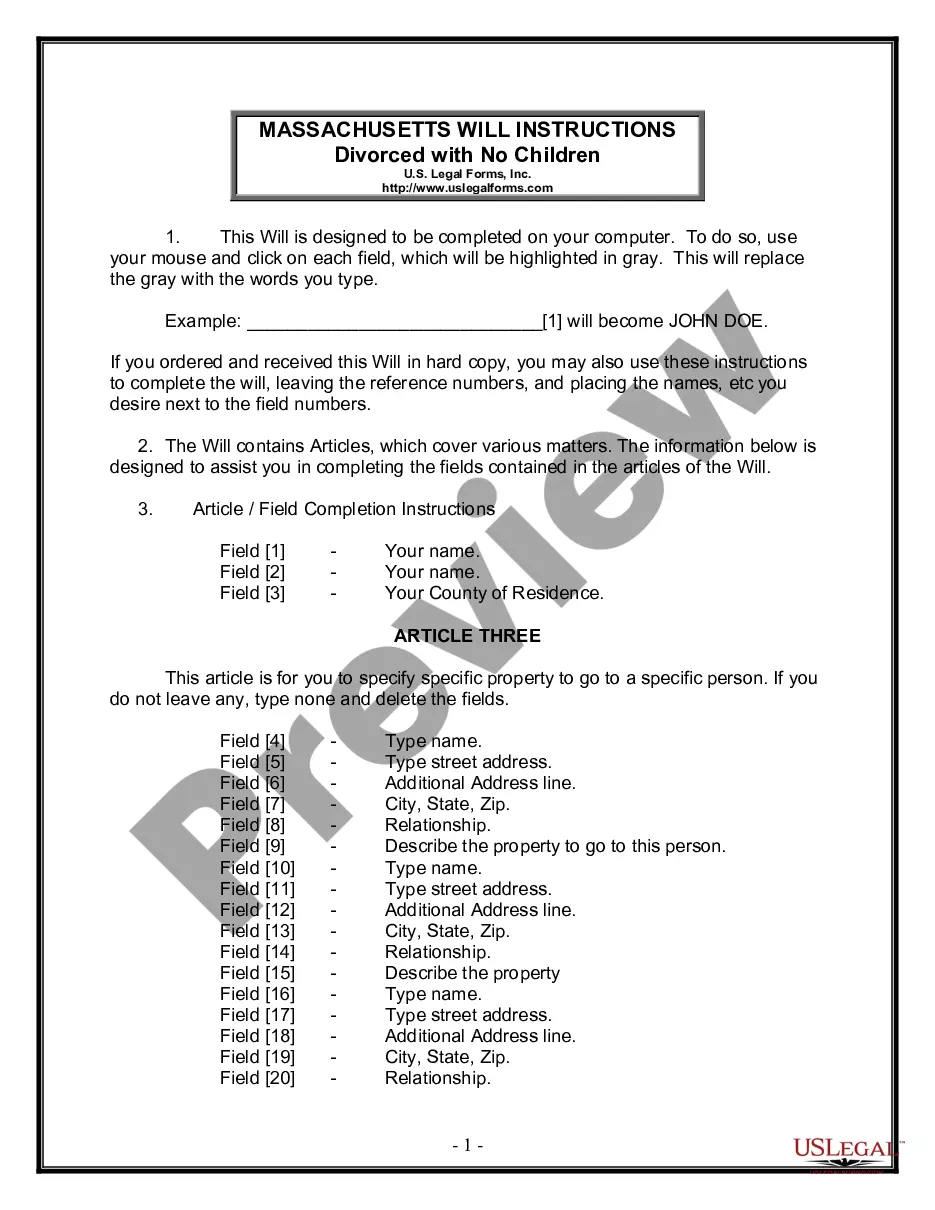

How to fill out Sworn Statement Of Identity Theft?

US Legal Forms - one of the greatest libraries of authorized types in the States - gives a wide range of authorized file themes you may down load or printing. Making use of the site, you can find 1000s of types for business and individual uses, sorted by classes, states, or keywords and phrases.You can find the latest versions of types such as the Ohio Sworn Statement of Identity Theft within minutes.

If you already have a membership, log in and down load Ohio Sworn Statement of Identity Theft through the US Legal Forms catalogue. The Obtain key can look on every type you view. You have access to all in the past delivered electronically types from the My Forms tab of your own bank account.

If you wish to use US Legal Forms for the first time, listed here are straightforward guidelines to help you began:

- Be sure you have picked out the correct type for your personal town/area. Go through the Preview key to examine the form`s articles. Read the type description to ensure that you have chosen the proper type.

- In case the type does not match your needs, take advantage of the Look for area towards the top of the screen to find the the one that does.

- Should you be pleased with the shape, validate your selection by clicking the Buy now key. Then, choose the rates program you prefer and supply your credentials to sign up for an bank account.

- Procedure the deal. Make use of charge card or PayPal bank account to accomplish the deal.

- Pick the file format and down load the shape on your gadget.

- Make modifications. Fill up, modify and printing and signal the delivered electronically Ohio Sworn Statement of Identity Theft.

Each and every template you included with your bank account does not have an expiry time and is the one you have permanently. So, if you would like down load or printing one more copy, just visit the My Forms portion and click on on the type you want.

Get access to the Ohio Sworn Statement of Identity Theft with US Legal Forms, probably the most extensive catalogue of authorized file themes. Use 1000s of specialist and state-specific themes that meet up with your organization or individual requires and needs.

Form popularity

FAQ

I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Fill out an identity theft complaint form with the Ohio Attorney General's Office. File a complaint with the Federal Trade Commission by calling 877-ID-THEFT.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

You received an identity verification letter because an Ohio income tax return was filed OR an OH|TAX eServices account was created using your SSN. You should check with your spouse or tax preparer to ensure an Ohio return was not legitimately filed or an OH|TAX eServices account was not created on your behalf.