Request for Extension of Loan Closing Date

Understanding this form

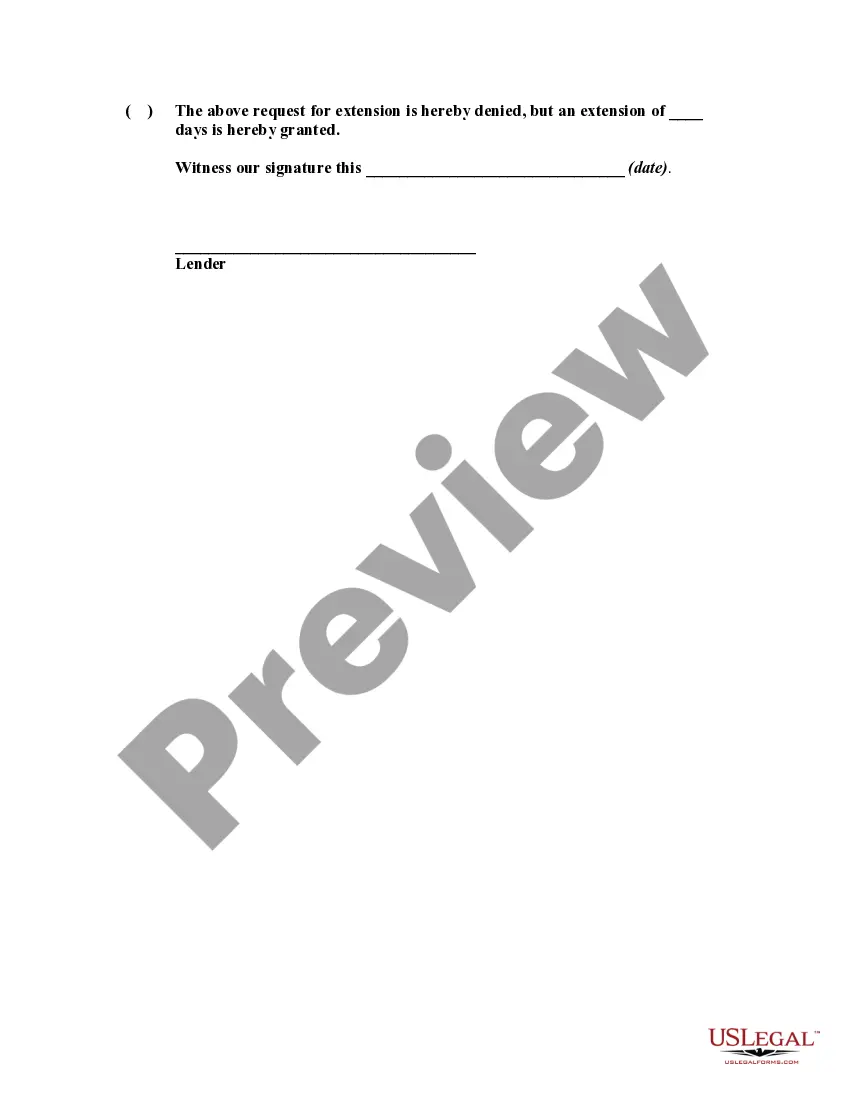

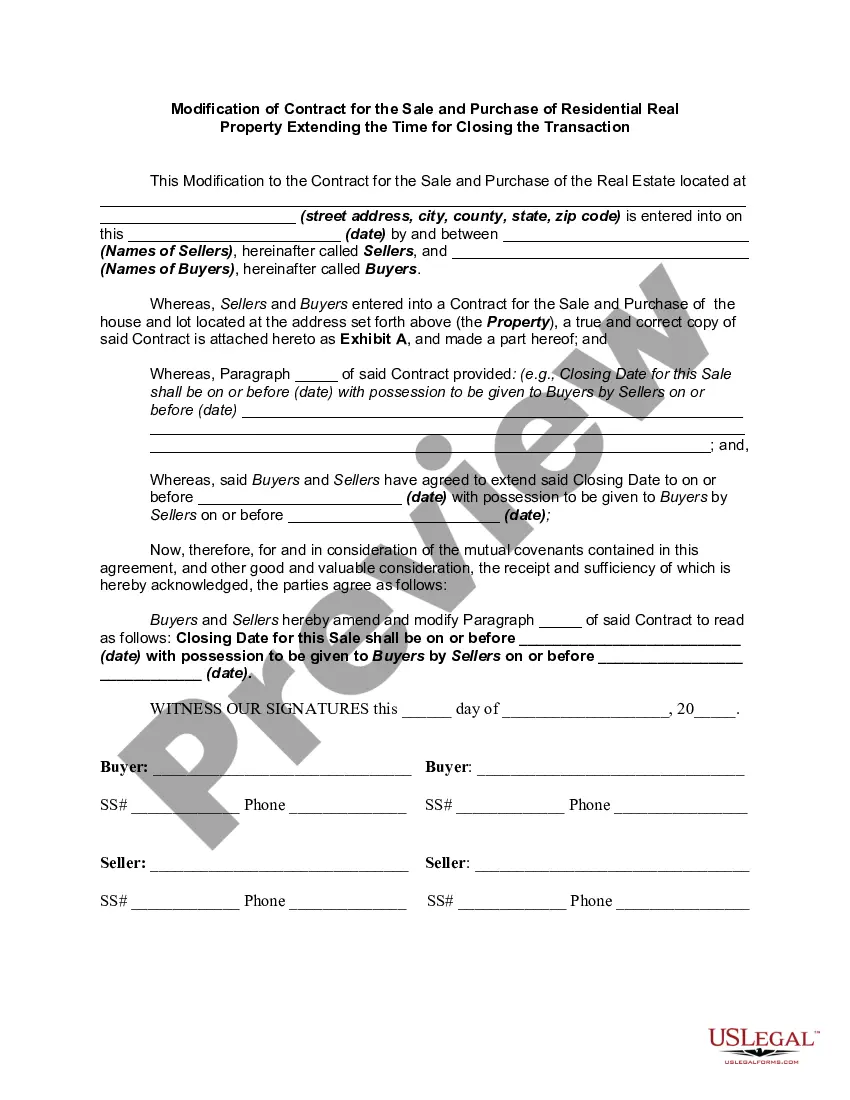

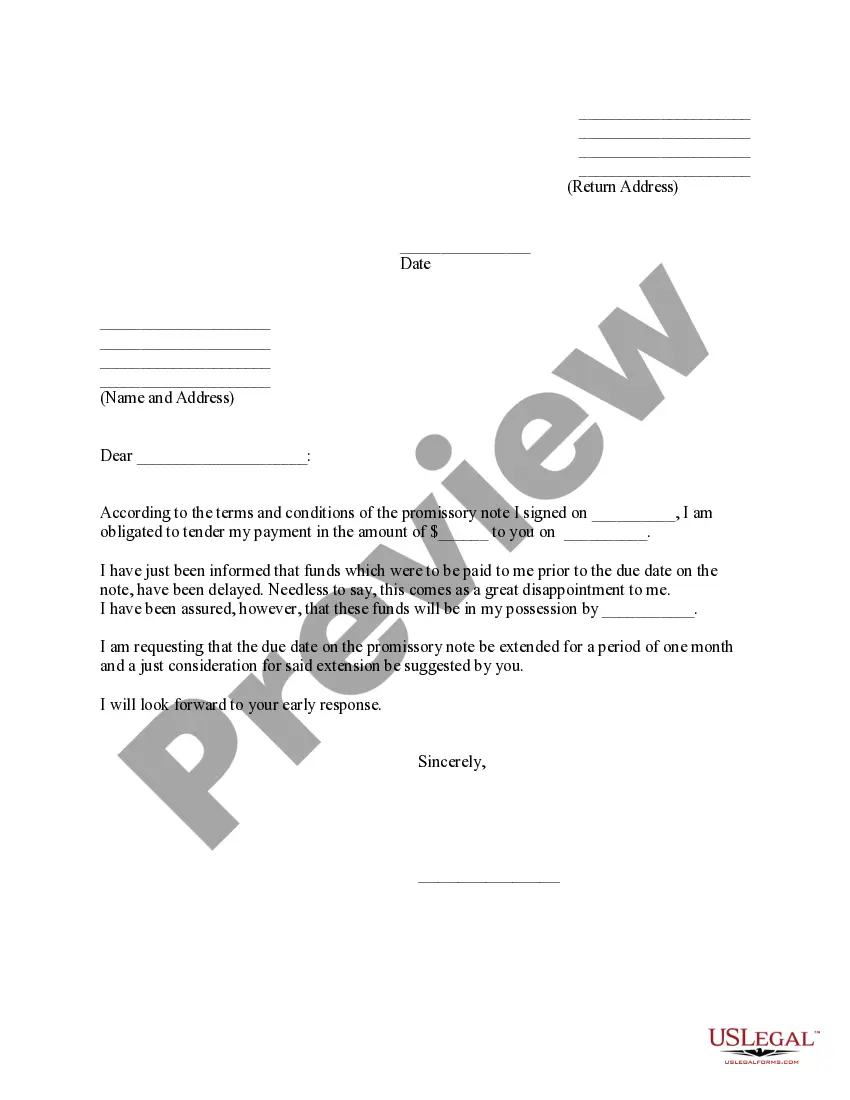

The Request for Extension of Loan Closing Date is a legal document used by loan applicants to request additional time to finalize the closing of a property purchase. This form is specifically designed to extend the original closing date set in a loan agreement, allowing borrowers to complete necessary tasks without losing their mortgage commitment. Unlike other forms related to loans, this request focuses solely on the timing of the closing process.

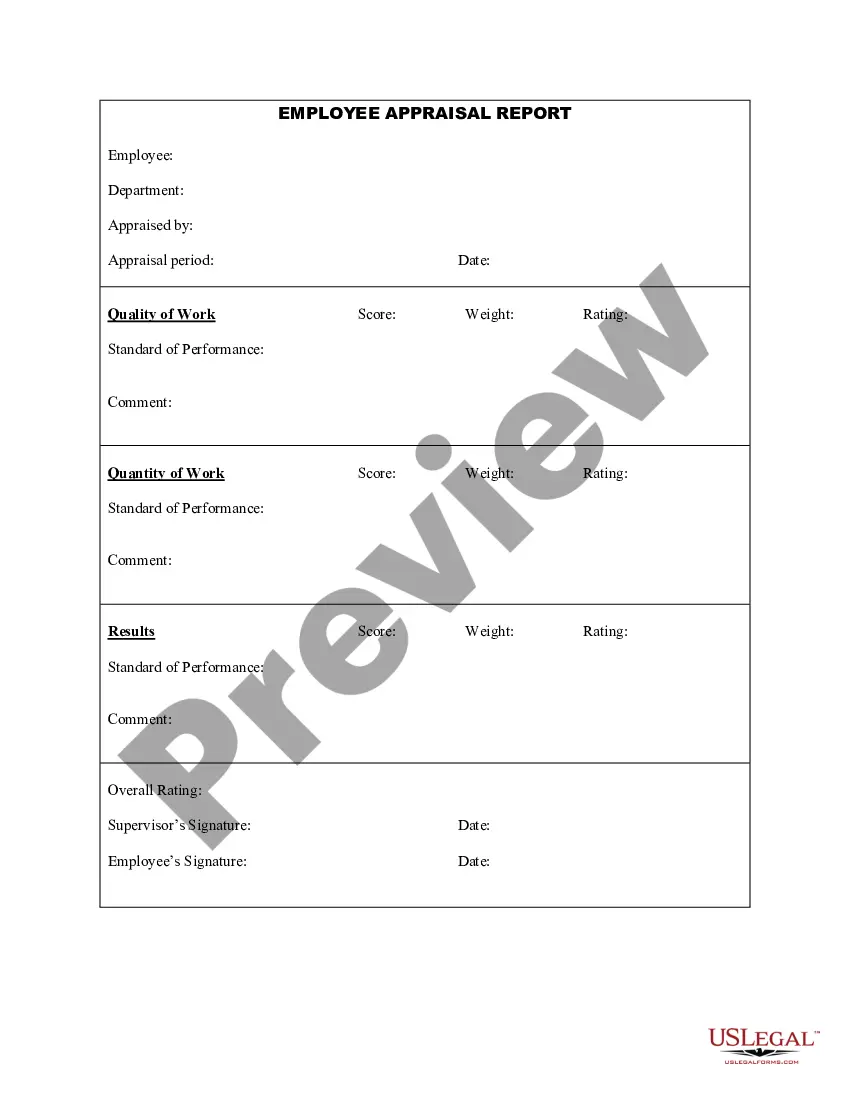

Key parts of this document

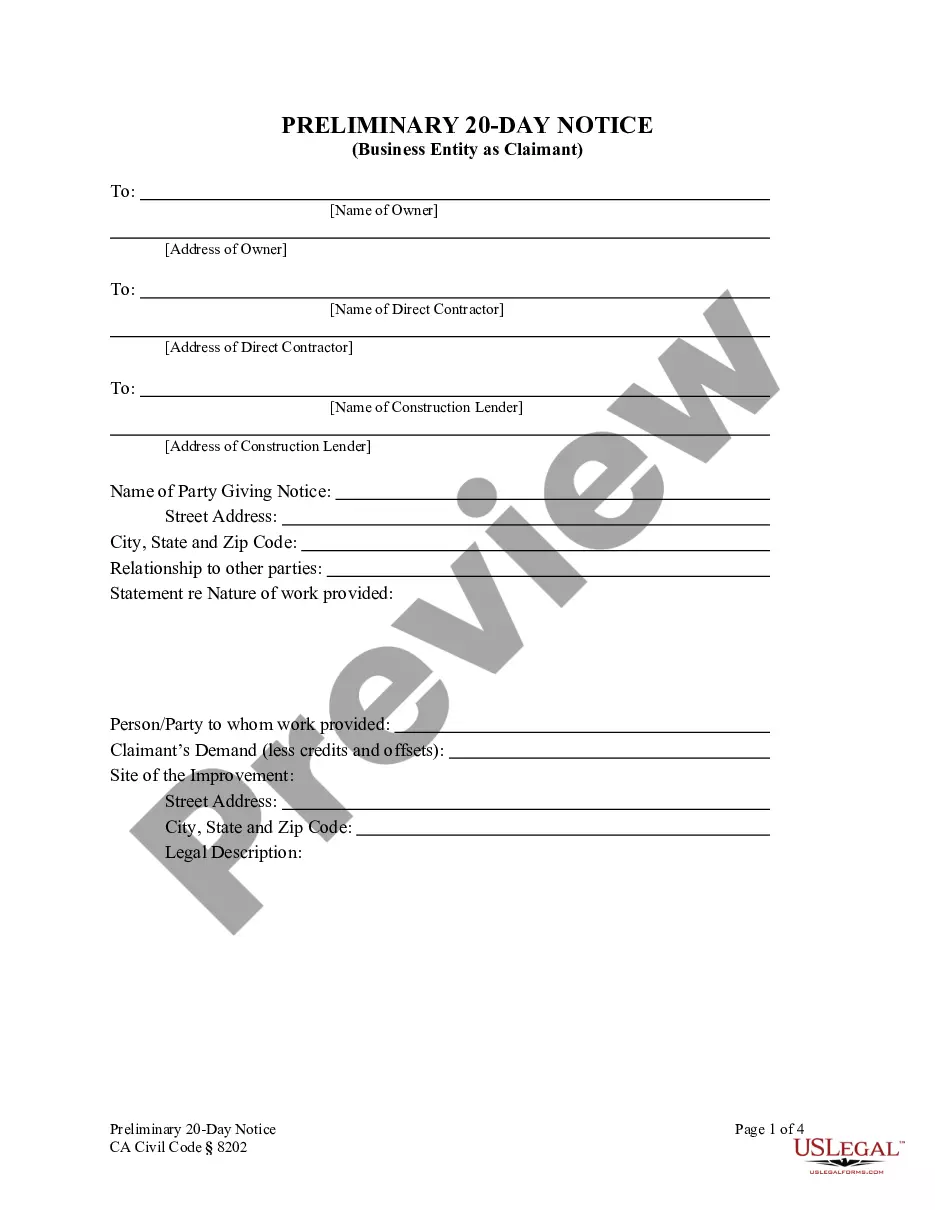

- Property address: Information on the location of the real property involved.

- Loan number: The reference number for the mortgage associated with the property.

- Date of application: The date the loan application was initially submitted.

- Original closing date: The date when the closing was originally scheduled.

- Requested extension: The number of days the applicant is requesting to extend the closing date.

- Enclosure details: Payment information for the extension fee associated with the request.

- Supporting documentation: A list of documents required to substantiate the request.

When to use this document

This form should be used when an applicant realizes that they cannot meet the originally scheduled closing date for a property transaction. Common scenarios include delays in financing, issues with property inspections, or unforeseen circumstances that require additional time to finalize the loan. By submitting this form, borrowers can communicate the need for an extension to their lender formally.

Intended users of this form

- Individuals or couples applying for a mortgage to purchase property.

- Real estate agents representing clients in real estate transactions.

- Those experiencing delays that prevent them from closing on a loan by the original date.

Steps to complete this form

- Identify the property by entering the complete address and associated loan number.

- Document the original closing date and outline the new requested closing date along with the extension period.

- Attach the required supporting documents mentioned in the form, such as the sales contract and loan application confirmation.

- Complete the payment section by providing the amount for the extension fee and related payee information.

- Ensure all applicants sign the form to validate the request.

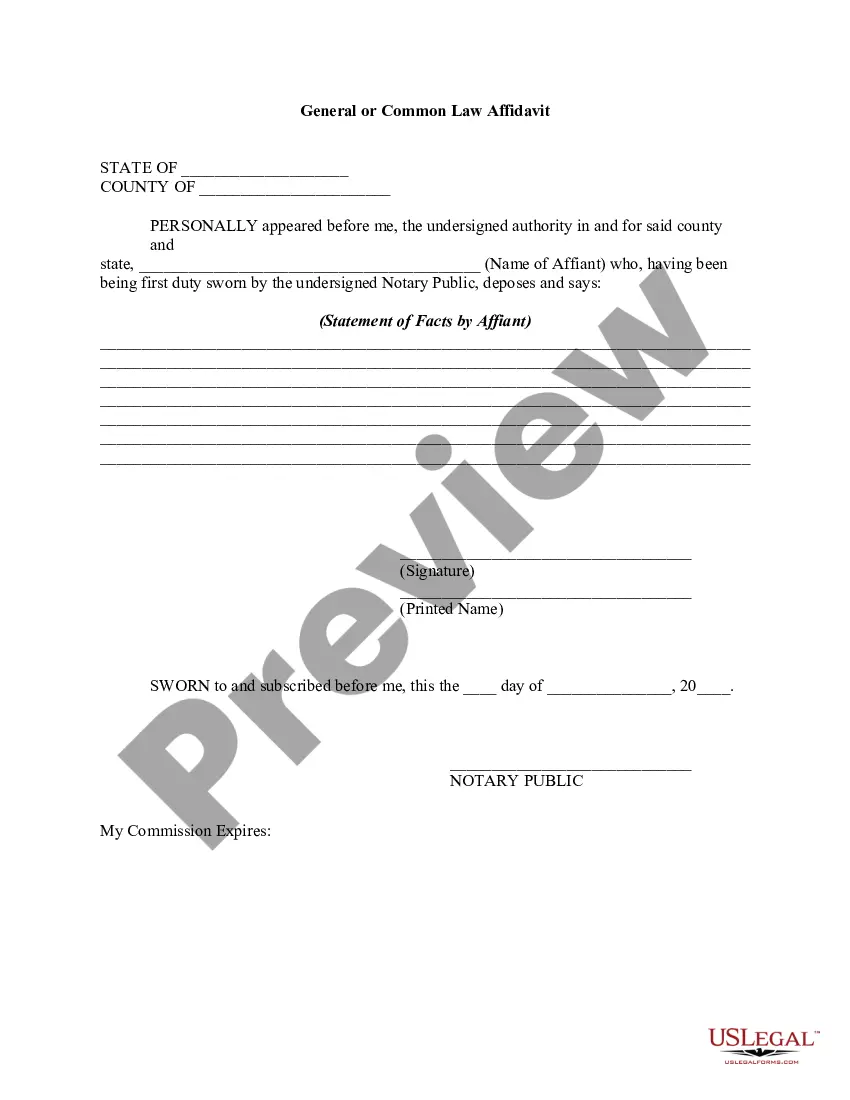

Notarization guidance

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Common mistakes to avoid

- Failing to attach necessary supporting documents.

- Not clearly stating the length of the requested extension.

- Submitting the form without all required signatures.

Why use this form online

- Easy access to downloadable and fillable legal documents tailored for your needs.

- Reliability of professionally drafted forms, ensuring legal compliance.

- Convenience of completing the form at your pace and without the need for in-person meetings.

Key takeaways

- The Request for Extension of Loan Closing Date allows borrowers to formally request extra time for closing.

- It is crucial to provide all necessary documentation and follow proper procedures to avoid delays.

- Using this form online simplifies the process and ensures that all requirements are met efficiently.

Form popularity

FAQ

When the closing date was originally determined and the contract signed by both parties, that contract is binding. When the buyer misses the closing date, the seller has the right to terminate the contract and re-list the house for sale or contact other parties who had previously made offers on the property.

If your lender delays closing, you have two options: Do nothing. Request to cancel escrow or serve a Notice to Perform.

Depending on your purchase contract and whose fault the delay is, you may have to pay the seller a penalty for every day the closing is late. The seller could also refuse to extend the closing date, and the whole deal could fall through.

There are many different parties involved in closing escrow.Depending on your purchase contract and whose fault the delay is, you may have to pay the seller a penalty for every day the closing is late. The seller could also refuse to extend the closing date, and the whole deal could fall through.

Typically, lenders will allow a 30-day rate lock at no cost. If your buyer needs a 60 or 90-day rate lock to meet your closing schedule, that is going to cost money.If you are looking for an abnormally long closing time, you may even want to offer concessions for the buyer to purchase a long-term rate lock.

Every property purchase also has to be reviewed by a title company, and scheduling a time for that can delay the closing date.It's up to the seller to pay the liens (or fight them in court), which can delay closing by weeks, if not months. Personal issues can also delay a closing, Hardy notes.

Most closing dates are open to negotiation, but some are set in stone, so check your contract to see if you can even make a change.That means a final closing date is set, but there's room in the contract for either the buyer or seller to ask the other party for some wiggle room.

Review the details in the contract to see what the allowable time is for a delay on the part of the seller. Usually a 30-day window is applicable. However, if the house closing delayed by the seller moves beyond the allowable window, the seller could be liable for financial losses incurred by the buyer due to a delay.

Asking for 90 days in our market would never happen unless you guaranteed the Seller the EMD if the deal falls through, or put a limited time clause in the contract saying the Seller can still have it listed as active and if they get another offer you have X amount of days to move forward and close now.