Ohio Employment Application for Accountant

Description

How to fill out Employment Application For Accountant?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can search through thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly obtain the latest versions of forms such as the Ohio Employment Application for Accountant.

If you already possess a subscription, Log In to access the Ohio Employment Application for Accountant from the US Legal Forms repository. The Download option will be available for each form you view. You can find all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the file format and download the form to your device. Edit. Fill out, edit, and print, then sign the downloaded Ohio Employment Application for Accountant. Each template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Ohio Employment Application for Accountant with US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To begin using US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your area/state.

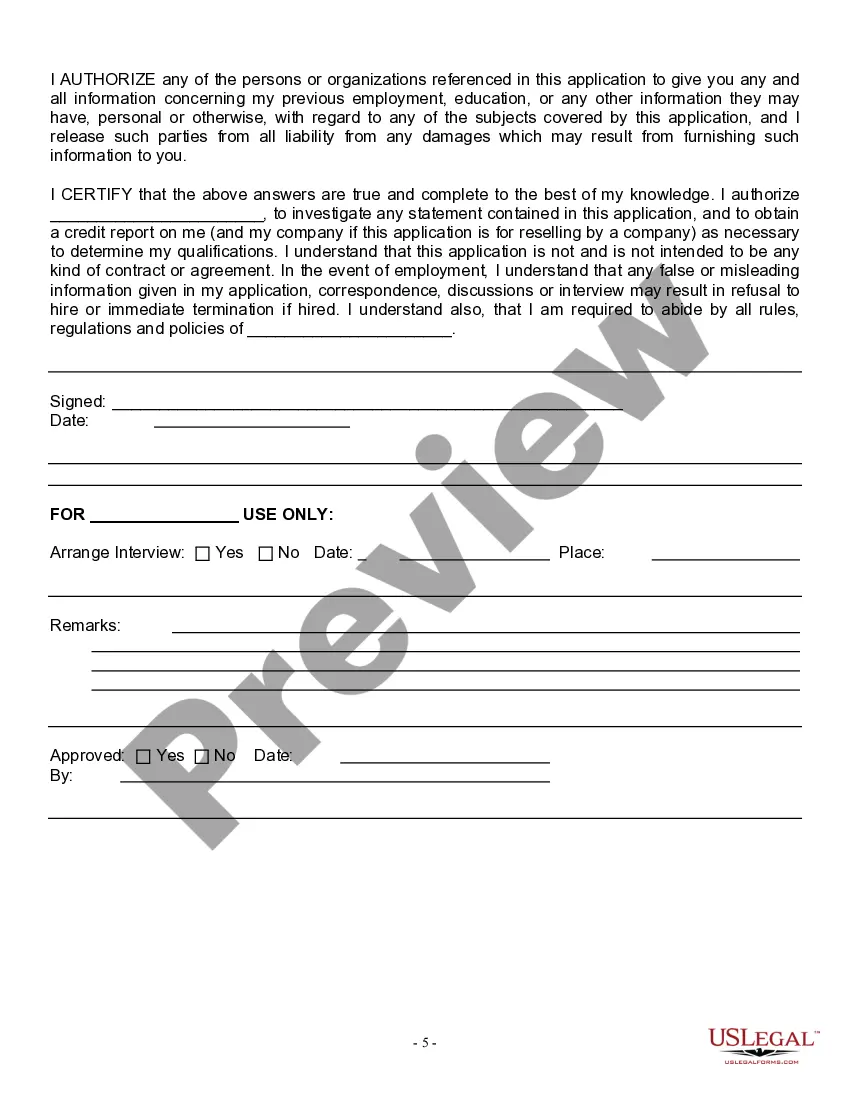

- Click the Preview option to review the content of the form.

- Review the description of the form to confirm that it meets your needs.

- If the form does not suit your requirements, utilize the Search box at the top of the page to find one that does.

- If you are satisfied with the form, finalize your choice by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your information to create your account.

Form popularity

FAQ

While associate degrees in accounting are available, most professionals in the field have at least a bachelor's degree. Accountants with a four-year degree are able to complete most accounting duties. These include examining records, reconciling accounts, preparing financial reports and completing tax returns.

Aspiring accountants need a bachelor's degree in accounting or business to begin work in the field. A bachelor's degree usually takes about four years and 120 credits to complete. Those with an associate degree might enter the field as bookkeepers or accounting clerks.

Most accountants complete at least a bachelor's degree with a focus on accounting. Individuals who want to work for public accounting firms must pass the Certified Public Accountant (CPA) exam. Almost all states require accountants to acquire at least 150 college credits in order to sit for the CPA exam.

In general, it takes four years of study to earn a degree in accounting.

The first phase towards becoming qualified begins with registering at any accredited institution that offers a Bachelor of Commerce: Accounting or a Bachelor of Science: Accounting and Finance degree or an equivalent diploma.

How to find a job in accounting with no experienceResearch accounting types and roles. Most successful journeys begin with a sense of direction.Complete your education.Pursue additional training or certifications.Intern or volunteer.Network effectively.Apply for entry-level positions.Continue developing.Stay positive.More items...?

Steps to become an accountantObtain a bachelor's degree.Choose a specialty.Get an internship or entry-level position.Determine whether you will be an accountant or CPA.Pass all required exams.Consider pursuing continuing education.

Steps to Become a CPA in OhioComplete 150 semester hours of college-level education in accounting.Accumulate the required hours of experience.Complete an approved course in professional standards and responsibilities.Pass the Uniform CPA Examination.Complete the criminal background check.Apply for a license.More items...

It can be very difficult to get that first accounting job. Employers want a candidate with accounting experience, but you can't get hired to get the experience. Fortunately, there are a variety of ways to get your foot in the door. With a bit of creative thinking, you can persuade an employer to give you a chance.