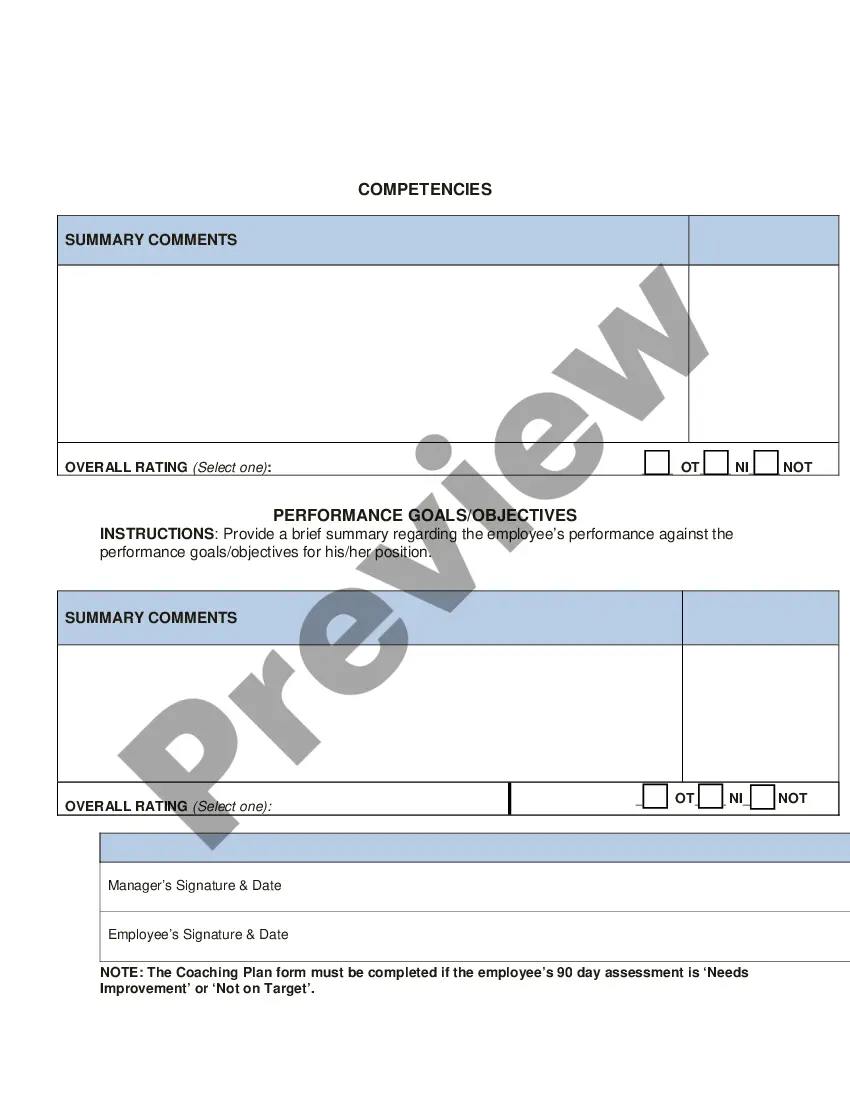

Missouri Employee 90 Day Performance Evaluation

Description

How to fill out Employee 90 Day Performance Evaluation?

Have you ever found yourself in a location where you require documents for potential business or particular purposes almost daily.

There are numerous legal document templates available online, but finding ones you can rely on isn't simple.

US Legal Forms provides thousands of form templates, such as the Missouri Employee 90 Day Performance Evaluation, designed to meet state and federal requirements.

Once you discover the proper form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Employee 90 Day Performance Evaluation template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds to the correct city/state.

- Utilize the Review button to evaluate the form.

- Examine the description to confirm you've selected the correct form.

- If the form isn't what you're searching for, use the Lookup field to find the form that fits your requirements.

Form popularity

FAQ

Yes, tips are considered taxable income in Missouri. Whether you receive tips as an employee or independent contractor, you should report this income on your tax return. It's essential to keep accurate records of all earned tips as you consider your performance in light of a Missouri Employee 90 Day Performance Evaluation.

year resident in Missouri is someone who has lived in the state for part of the year while earning income. This classification affects how taxes are filed, as partyear residents must report income earned during their residency. This can be especially relevant during a Missouri Employee 90 Day Performance Evaluation process.

Missouri determines residency based on various factors, including where you spend most of your time and maintain your home. They will consider your physical presence, where you are registered to vote, and more. Knowing these details is beneficial when navigating assessments tied to a Missouri Employee 90 Day Performance Evaluation.

The 183 day rule in Missouri helps determine tax residency based on the number of days spent in the state. If you live or work in Missouri for more than 183 days in a calendar year, you are generally considered a resident. Understanding this rule is vital for accurate tax filings, particularly during assessments like the Missouri Employee 90 Day Performance Evaluation.

Some services are non-taxable in Missouri, including certain medical and educational services. This can impact financial planning and budgeting for businesses and individuals. Being informed about these services can also help maintain compliance during evaluations related to a Missouri Employee 90 Day Performance Evaluation.

Part-year tax residents in Missouri are individuals who lived in the state for a portion of the year while earning taxable income. They are typically subject to Missouri tax for the income earned during their residency period. It's crucial to consider your residency status when undergoing a Missouri Employee 90 Day Performance Evaluation.

A nonresident is someone who does not live in Missouri and doesn't earn income from Missouri sources. In contrast, a part-year resident is someone who lived in Missouri for part of the year while earning income. Understanding these distinctions can help during tax season, especially when evaluating work performance as per Missouri Employee 90 Day Performance Evaluation standards.

You can mail Missouri W2 forms to the Missouri Department of Revenue. Use the address specified on the form for paper filings. Always ensure that you submit them correctly to avoid delays in processing, particularly when you want to address performance evaluations, like in a Missouri Employee 90 Day Performance Evaluation.

Severance packages generally fall under taxable income in Missouri. You may need to report the severance amount on your income tax return. It's wise to consult a tax professional to ensure proper reporting, especially when considering a Missouri Employee 90 Day Performance Evaluation.

In a 90-day review, consider asking questions like, 'What support do you need to succeed?' or 'What have you learned so far?' These questions help foster a culture of growth and open dialogue. Engaging in this way is central to the Missouri Employee 90 Day Performance Evaluation process.