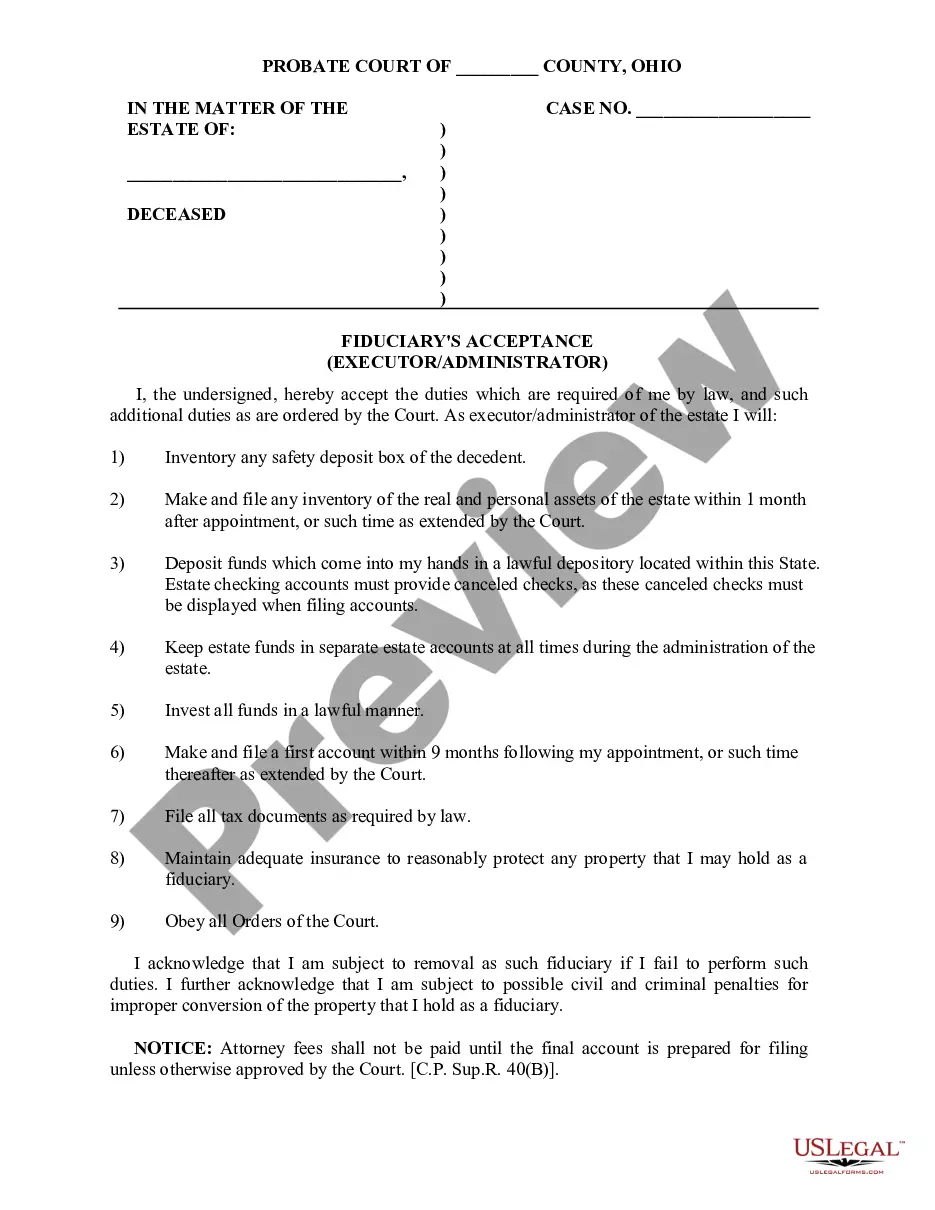

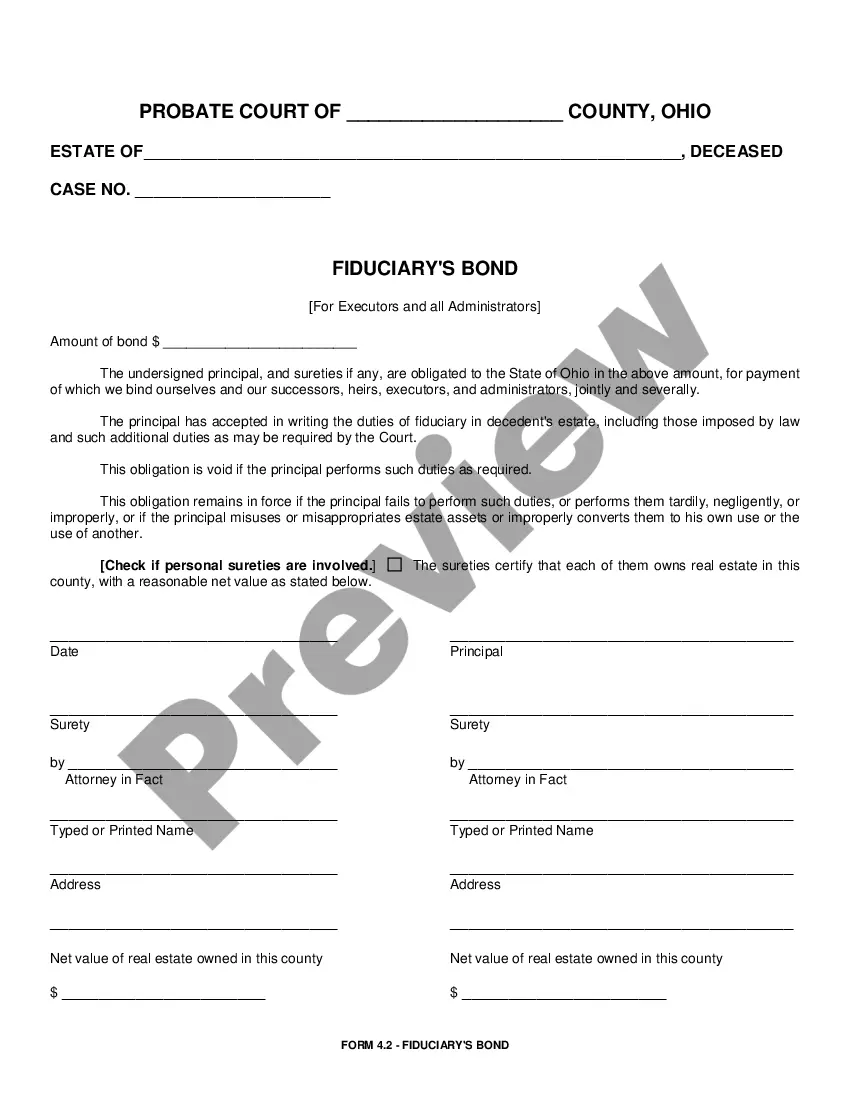

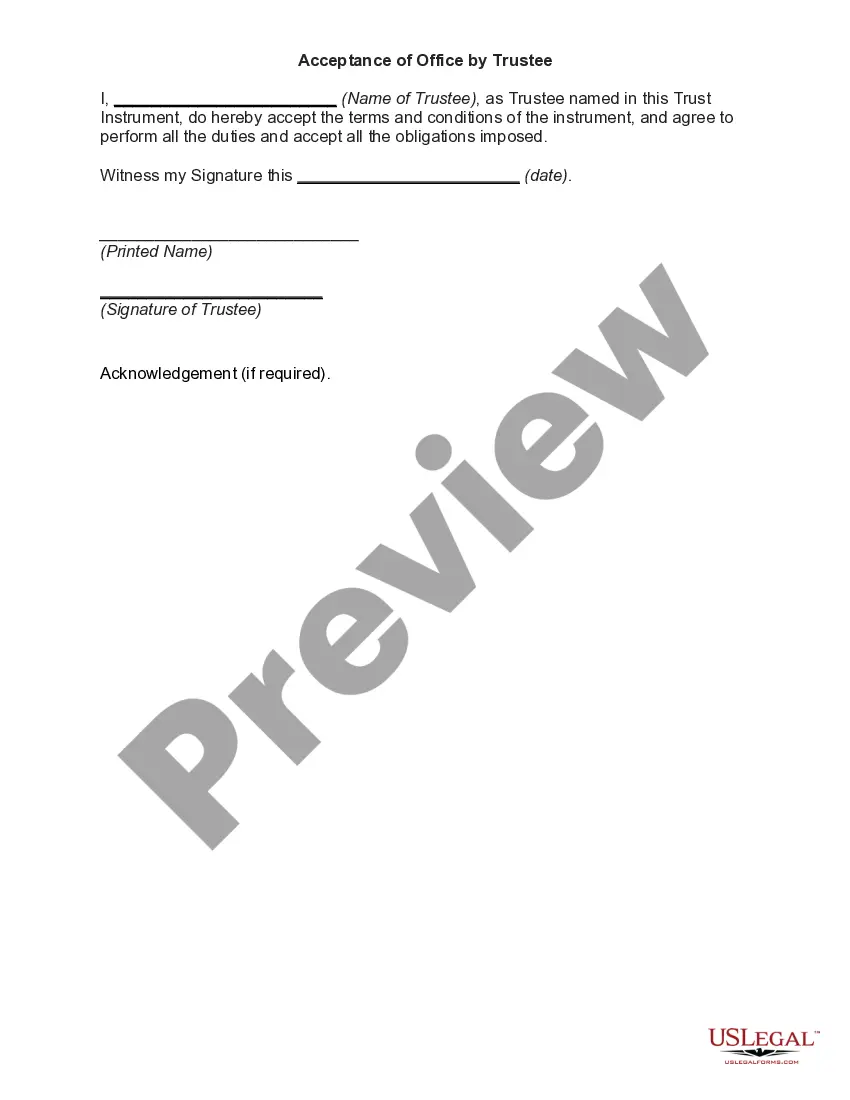

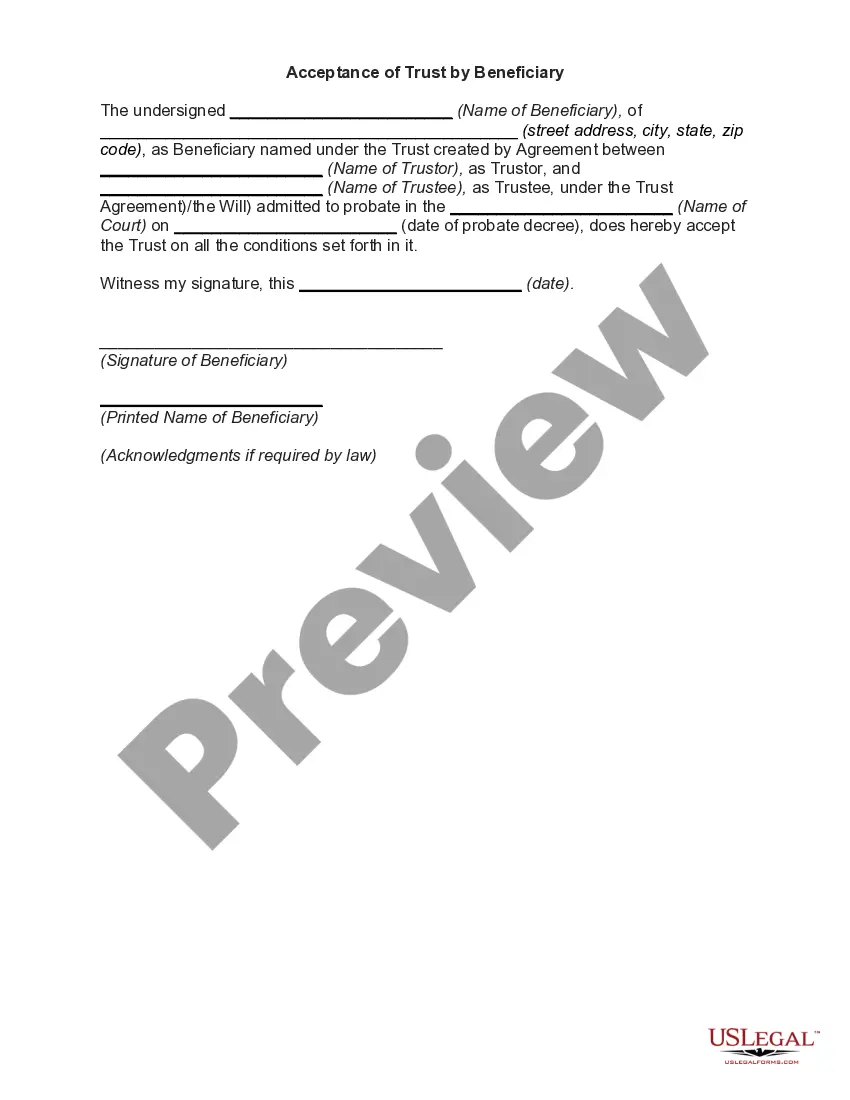

This sample form is a Fiduciary Acceptance - Executor/Administrator document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Fiduciary Acceptance - Executor - Administrator

Description

How to fill out Ohio Fiduciary Acceptance - Executor - Administrator?

In terms of submitting Ohio Fiduciary Acceptance - Executor - Administrator, you almost certainly visualize an extensive procedure that involves choosing a ideal sample among hundreds of very similar ones then needing to pay out a lawyer to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific template in just clicks.

For those who have a subscription, just log in and click Download to get the Ohio Fiduciary Acceptance - Executor - Administrator form.

If you don’t have an account yet but want one, follow the step-by-step guide below:

- Be sure the document you’re getting applies in your state (or the state it’s needed in).

- Do this by reading the form’s description and also by visiting the Preview option (if offered) to find out the form’s information.

- Click on Buy Now button.

- Select the appropriate plan for your budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Skilled legal professionals work on creating our samples to ensure that after downloading, you don't have to bother about editing and enhancing content material outside of your personal information or your business’s info. Be a part of US Legal Forms and receive your Ohio Fiduciary Acceptance - Executor - Administrator document now.

Form popularity

FAQ

The successor trustee does not have to live in the same state as you do.But for transfers of property such as securities and bank accounts, it usually won't make much difference where the successor trustee lives.

A backdoor way to modifying an irrevocable trust might be through a change in the situs of the trust's administration. Some trust instruments permit the trustee to move the situs of the trust to another jurisdiction and then adopt the laws of that new jurisdiction for purposes of trust administration.

No. Trust does not need to be filed in California. Trusts are private documents and usually there are compelling reasons not to file the trust.

If your will and revocable trusts were properly executed in accordance with the laws of one state, they are usually valid in other states.Your heirs might need to rely on the laws of another state to establish the validity of your will and trusts, and opinions from attorneys in two separate states may be required.

Out-of-State Trustees The successor trustee does not have to live in the same state as you do.But for transfers of property such as securities and bank accounts, it usually won't make much difference where the successor trustee lives.

Situs is the state that the trust originated and whose laws will govern the trust.In general, for tax purposes, trust situs is determined by the combined jurisdictions that have the legal authority to tax a trust or trustees.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

If your will and revocable trusts were properly executed in accordance with the laws of one state, they are usually valid in other states.Your heirs might need to rely on the laws of another state to establish the validity of your will and trusts, and opinions from attorneys in two separate states may be required.