Illinois Dissolution Package to Dissolve Limited Liability Company LLC

About this form

The Illinois dissolution package for a Limited Liability Company (LLC) is a comprehensive set of documents designed to help members of an LLC formally dissolve their business in compliance with Illinois law. This package includes all necessary forms and instructions for voluntary dissolution, distinguishing it from other dissolution methods such as judicial or administrative dissolution. By using this package, members can ensure they follow the correct procedures to properly wind down their business operations and fulfill legal obligations.

Key parts of this document

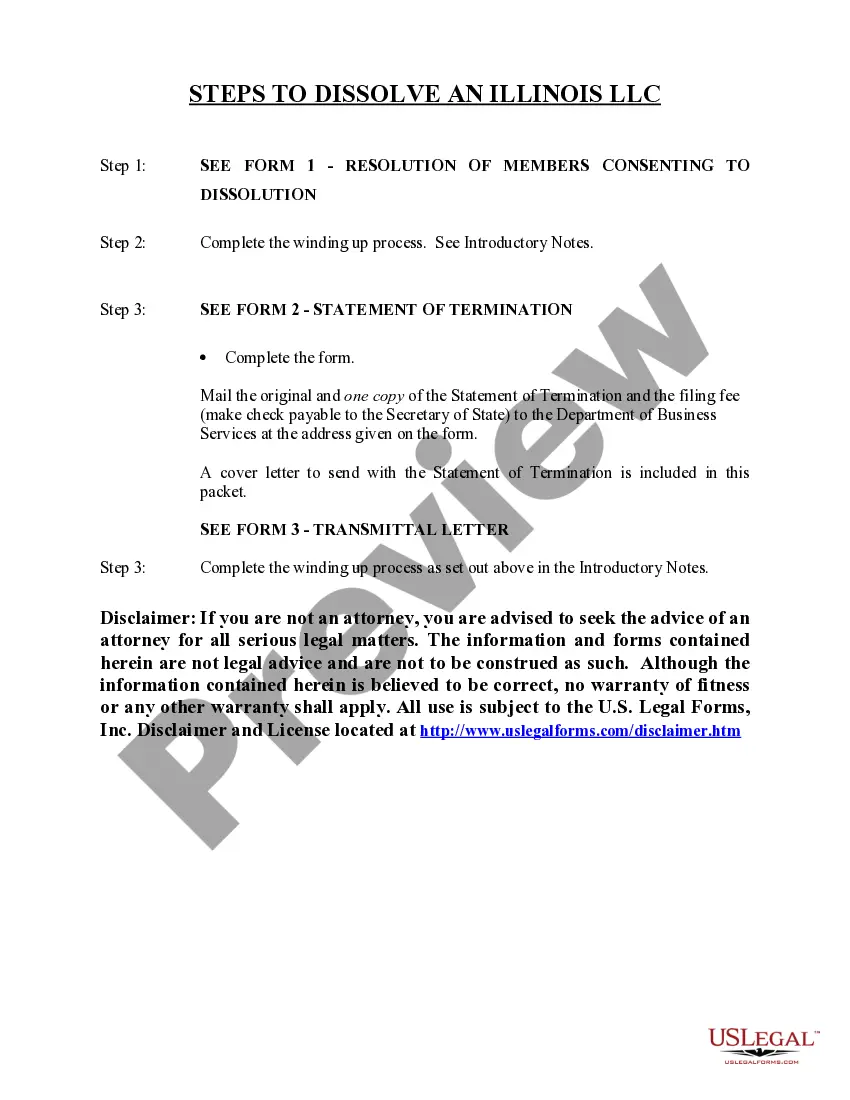

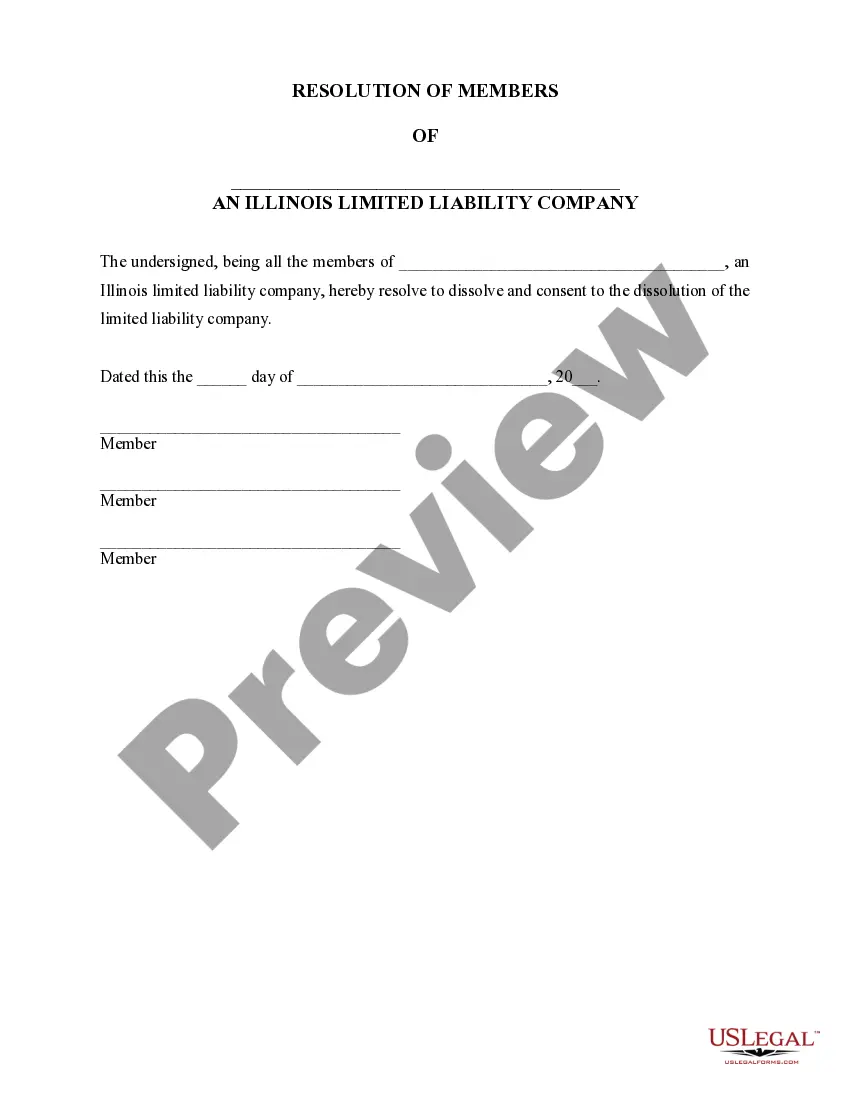

- Resolution of members consenting to dissolution

- Statement of termination form for filing with the Secretary of State

- Guidelines for conducting the winding-up process

- Transmittal letter template for submitting the statement

- Step-by-step instructions for completing the dissolution

Situations where this form applies

You should use the Illinois dissolution package when your LLC has reached a decision to voluntarily dissolve. Common scenarios include when the members agree to close the business, when the business has fulfilled its purpose, or when it becomes impractical to continue operations. This form is essential to ensure that the dissolution is conducted legally and that all necessary legal steps are taken to properly wind up the business's affairs.

Who needs this form

- All members of the LLC who are involved in the decision to dissolve

- Members looking to protect their legal rights and responsibilities during the dissolution process

- Business owners seeking a formal and compliant method to wind down their LLC

- Members transitioning to a new business structure and needing to dissolve the current LLC

Instructions for completing this form

- Step 1: Obtain and complete the resolution of members consenting to dissolution form.

- Step 2: Follow the guidelines provided to complete the winding-up process, addressing any outstanding obligations and liabilities.

- Step 3: Fill out the Statement of Termination form and prepare the necessary copy for filing.

- Step 4: Prepare a transmittal letter to accompany your filing.

- Step 5: Mail the completed Statement of Termination, transmittal letter, and applicable filing fee to the Department of Business Services.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to obtain unanimous consent from all members for the resolution.

- Not completing the winding-up process before filing the Statement of Termination.

- Forgetting to include the correct filing fee when submitting paperwork.

- Neglecting to maintain clear records of the dissolution process.

Advantages of online completion

- Convenience of downloading and completing forms from anywhere.

- Editability allows customization for specific business needs.

- Reliable access to forms that comply with current Illinois law.

- Step-by-step instructions simplify the dissolution process for users.

Looking for another form?

Form popularity

FAQ

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

File the Articles of Dissolution with the Illinois Secretary of State. Fulfill all tax obligations with the state of Illinois, as well as with the IRS. Cancel any relevant licenses and permits, along with closing your business bank account. Notify customers, vendors, and creditors of your dissolution.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.