Illinois Limited Liability Company LLC Formation Package

Description

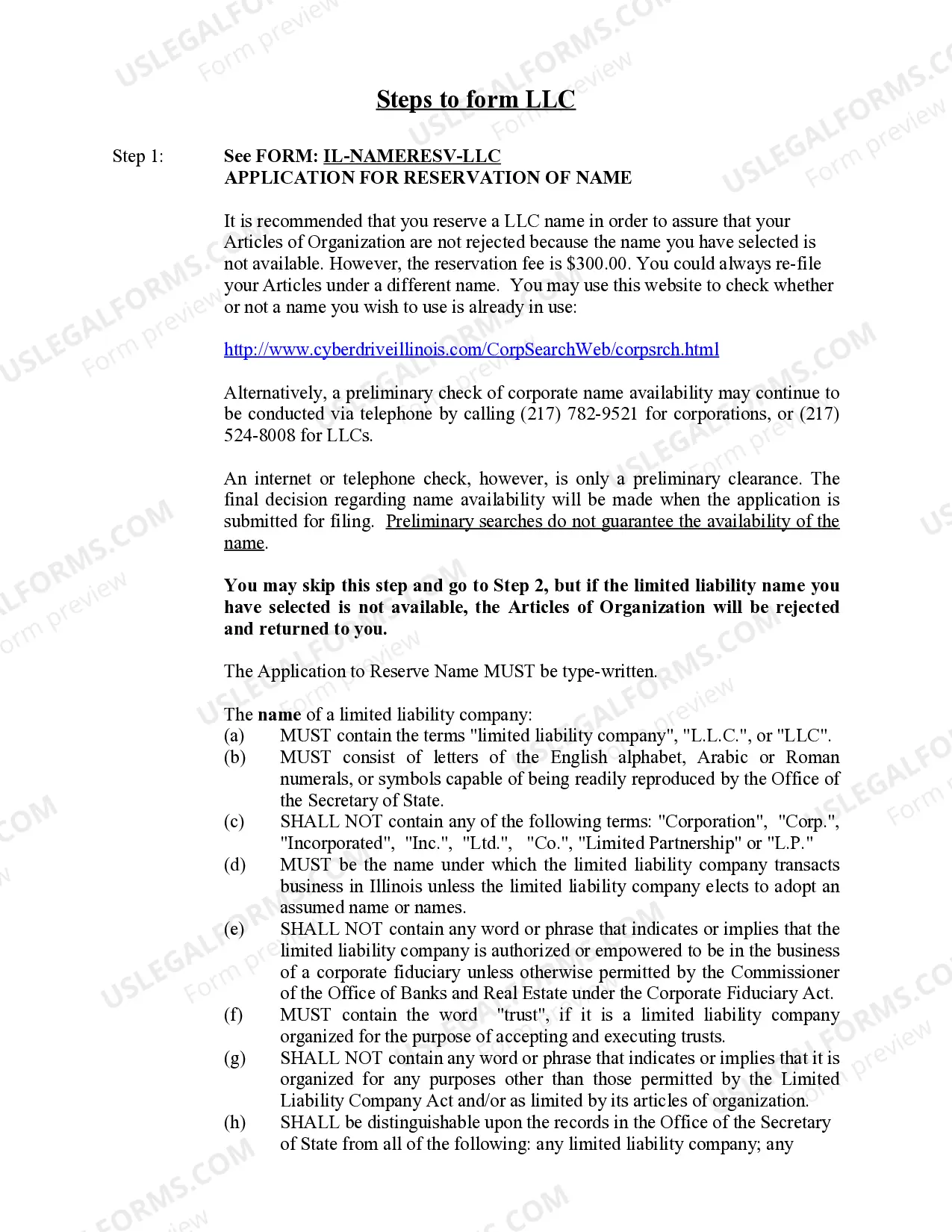

How to fill out Illinois Limited Liability Company LLC Formation Package?

Searching for a sample of the Illinois Limited Liability Company LLC Formation Package and completing it may pose a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the suitable template specifically for your state in just a few clicks.

Our lawyers prepare every document, so you merely have to complete them. It truly is that straightforward.

Select your payment method, either by card or through PayPal. Download the sample in your chosen format. Now you can print the Illinois Limited Liability Company LLC Formation Package form or complete it using any online editor. Don't worry about errors as your form can be used and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- Your downloaded samples are kept in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you need to sign up.

- Review our detailed guidelines on how to acquire the Illinois Limited Liability Company LLC Formation Package form in a few minutes.

- To acquire a valid form, check its applicability for your state.

- Examine the form using the Preview feature (if available).

- If there's a description, read it to grasp the specifics.

- Click on the Buy Now button if you found what you're seeking.

Form popularity

FAQ

An LLC's operating agreement typically includes the LLC's name, purpose, member roles, management structure, and how profits will be distributed. It may also detail procedures for adding or removing members. To ensure you cover all necessary aspects, consider using the Illinois Limited Liability Company LLC Formation Package as a comprehensive resource.

Choose your management structure. There are two forms of management for LLCs: member-managed and manager-managed. Choose your title. In a single-member LLC, you have the freedom to choose whatever title best reflects your role. Create an Operating Agreement.

In most cases, business owners can amend the articles of organization of an LLC to change to a PLLC. For example, the state of Arizona requires that a company complete a form to amend its articles of organization and change the name of the company from LLC to PLLC.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Step One) Choose a PLLC Name. Step Two) Designate a Registered Agent. Step Three) File Formation Documents with the State. Step Four) Create an Operating Agreement. Step Five) Handle Taxation Requirements. Step Six) Obtain Business Licenses and Permits.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

How much does it cost to form an LLC in Illinois? The Illinois Secretary of State charges $150 to file the Articles of Organization. You can reserve your LLC name with the Illinois Secretary of State for $25.

To form an Illinois LLC you will need to file the Articles of Organization with the Illinois Secretary of State, which costs $150. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Illinois limited liability company.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

Illinois requires LLCs to file an annual report during the 60-day period before the first day of the anniversary month of the incorporation date. The annual report fee is $250. Taxes. For complete details on state taxes for Illinois LLCs, visit Business Owner's Toolkit or the State of Illinois .