Texas Answer To Writ of Garnishment

Description

Key Concepts & Definitions

A04 Answer to Writ of Garnishment refers to the formal response that a garnishee (usually an employer) must submit in court when they receive a writ of garnishment. The writ of garnishment is a legal order compelling a third party to hold or give up a portion of a debtor's wages or assets to satisfy a debt. The 'A04' code distinguishes this particular form or response type in jurisdictions within the United States.

Step-by-Step Guide to Responding to a Writ of Garnishment

- Review the Writ: Carefully study the details of the writ of garnishment. Understand the amount to be garnished, and the period it covers.

- Calculate the Garnishable Amount: Determine the portion of the debtors earnings that legally can be deducted, adhering to federal and state guidelines.

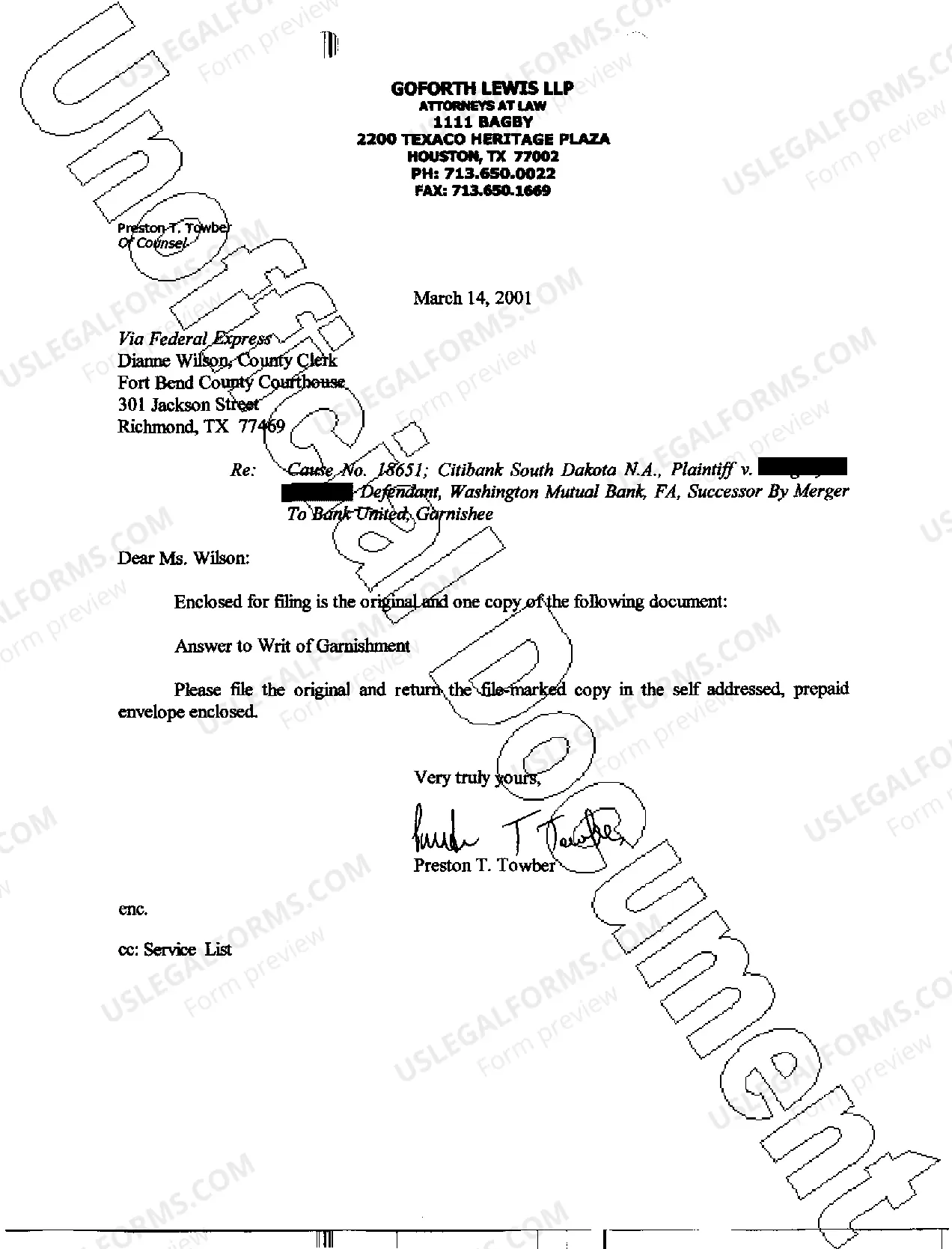

- Complete the A04 Form: Fill out the A04 Answer to Writ of Garnishment form, providing all the required information, such as employee earnings details and the calculated garnished amount.

- Submit the Form: File the completed form with the appropriate court, and serve copies on the debtor and the creditor as dictated by local law.

- Implement the Wage Garnishment: Begin withholding the specified amount from the debtors wages as directed by the court order, until further notice or until the debt is paid off.

Risk Analysis

- Legal Compliance: Failing to correctly calculate or remit garnished funds can result in penalties for the employer.

- Privacy Concerns: Mishandling sensitive employee information during this process could lead to breaches of privacy.

- Employee Relations: Poor communication regarding the garnishment can strain the relationship between employer and employee.

How to fill out Texas Answer To Writ Of Garnishment?

Get access to high quality Texas Answer To Writ of Garnishment templates online with US Legal Forms. Prevent days of lost time seeking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get over 85,000 state-specific legal and tax templates that you can save and fill out in clicks within the Forms library.

To find the example, log in to your account and then click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Find out if the Texas Answer To Writ of Garnishment you’re looking at is appropriate for your state.

- See the form making use of the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Pick a favored format to save the document (.pdf or .docx).

You can now open the Texas Answer To Writ of Garnishment sample and fill it out online or print it out and do it yourself. Take into account sending the file to your legal counsel to make certain everything is completed properly. If you make a error, print out and fill application again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get a lot more forms.

Form popularity

FAQ

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

The easiest and most direct way to end a wage garnishment is to enter into a payment agreement with the creditor, where you agree to make payments and they agree to stop the garnishment. That option, however, may not be available if you are unable to pay the monthly payment that the creditor is requesting.

The state of Texas has a statute of limitations of four years for consumer debt, which means most sole proprietors shouldn't see bank account garnishment beyond that for the personal debt.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.