Illinois Limited Liability Company LLC Formation Package

Understanding this form package

The Illinois Limited Liability Company (LLC) Formation Package is designed to provide all the necessary forms and guidance to establish an LLC in Illinois. This package includes step-by-step instructions, Articles of Organization, an Operating Agreement, and other essential forms, streamlining the formation process compared to similar offerings. With this package, users can easily navigate through the legal requirements to create a legally recognized business entity in Illinois.

Forms included in this package

- Limited Liability Company LLC Operating Agreement

- Single Member Limited Liability Company LLC Operating Agreement

- Illinois Articles of Organization for Domestic Limited Liability Company LLC

- LLC Notices, Resolutions and other Operations Forms Package

- Sample Cover Letter for Filing of LLC Articles or Certificate with Secretary of State

- Illinois Application for Reservation of LLC Name

- I.R.S. Form SS-4 (to obtain your federal identification number)

Common use cases

This form package is useful when you need to establish a limited liability company in Illinois, particularly in situations such as:

- You are starting a new business and want to limit your personal liability.

- You are transitioning an existing sole proprietorship or partnership to an LLC for legal protections.

- You want to formalize the structure and governance of your business with an operating agreement.

- You need to reserve a business name prior to submitting your Articles of Organization.

Who should use this form package

- Entrepreneurs planning to start a business in Illinois.

- Small business owners looking for liability protection.

- Individuals or groups that want to formalize their business structure.

- Professionals such as consultants, freelancers, or real estate investors seeking an LLC structure.

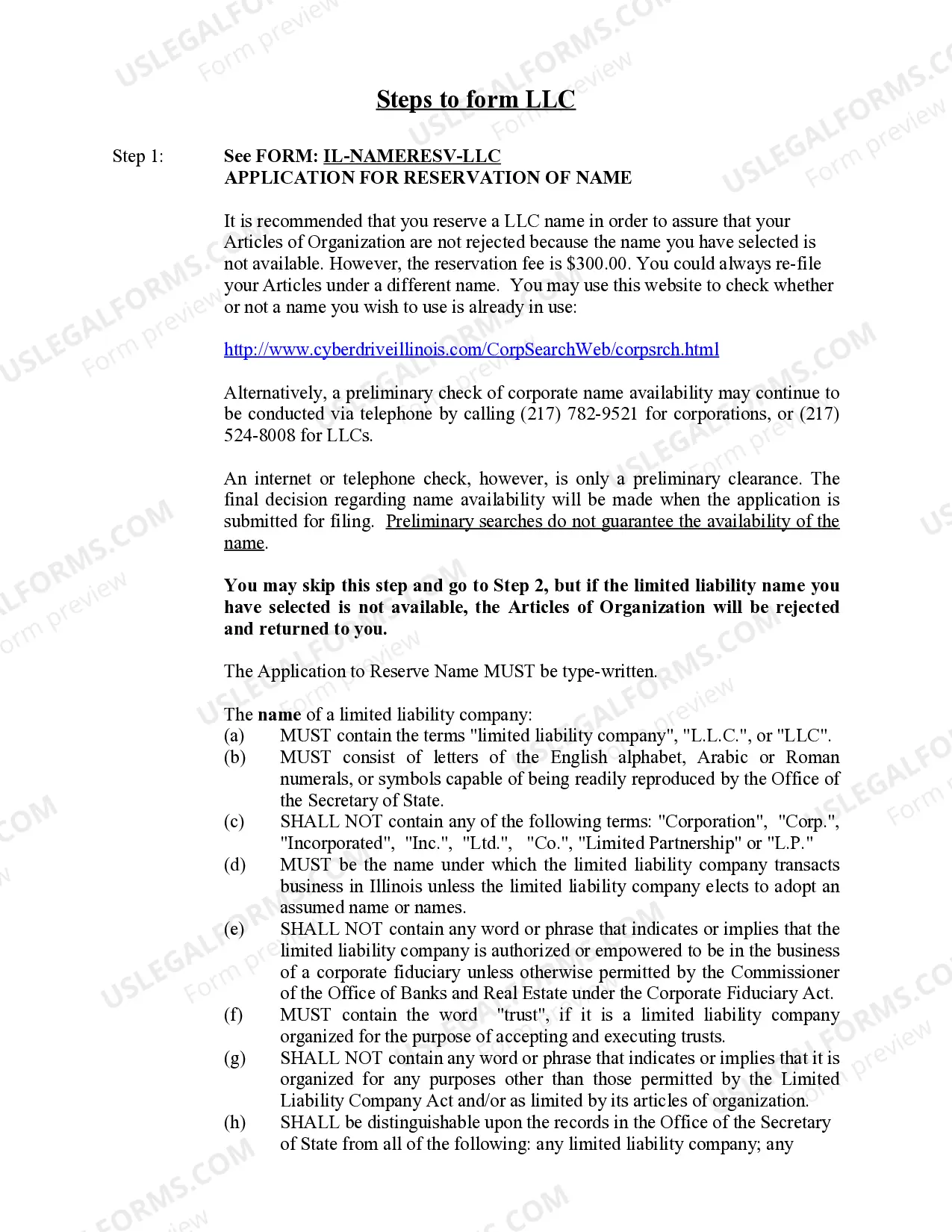

Steps to complete these forms

- Review the included forms and instructions thoroughly.

- Choose your LLC name and reserve it if necessary.

- Complete the Articles of Organization form with the required details.

- Draft an Operating Agreement tailored to your LLC's management structure.

- File the Articles of Organization with the Illinois Secretary of State and pay the associated fees.

- Apply for a Federal Tax Identification Number if required.

Notarization requirements for forms in this package

Notarization is not commonly needed for forms in this package. However, if your state’s laws require it, our notarization service, powered by Notarize, allows you to finalize documents online 24/7 without in-person visits.

Common mistakes

- Selecting an unavailable or non-compliant business name.

- Failing to complete the Articles of Organization correctly.

- Not having a written Operating Agreement, which can lead to conflicts.

- Overlooking state-specific filing fees and deadlines.

Benefits of using this package online

- Convenient access to all necessary forms in one package.

- Editable forms to customize according to your specific needs.

- Guidance throughout the completion process to ensure accuracy.

- Time-saving option by allowing you to prepare documents at your own pace.

Form popularity

FAQ

An LLC's operating agreement typically includes the LLC's name, purpose, member roles, management structure, and how profits will be distributed. It may also detail procedures for adding or removing members. To ensure you cover all necessary aspects, consider using the Illinois Limited Liability Company LLC Formation Package as a comprehensive resource.

Choose your management structure. There are two forms of management for LLCs: member-managed and manager-managed. Choose your title. In a single-member LLC, you have the freedom to choose whatever title best reflects your role. Create an Operating Agreement.

In most cases, business owners can amend the articles of organization of an LLC to change to a PLLC. For example, the state of Arizona requires that a company complete a form to amend its articles of organization and change the name of the company from LLC to PLLC.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Step One) Choose a PLLC Name. Step Two) Designate a Registered Agent. Step Three) File Formation Documents with the State. Step Four) Create an Operating Agreement. Step Five) Handle Taxation Requirements. Step Six) Obtain Business Licenses and Permits.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

How much does it cost to form an LLC in Illinois? The Illinois Secretary of State charges $150 to file the Articles of Organization. You can reserve your LLC name with the Illinois Secretary of State for $25.

To form an Illinois LLC you will need to file the Articles of Organization with the Illinois Secretary of State, which costs $150. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Illinois limited liability company.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

Illinois requires LLCs to file an annual report during the 60-day period before the first day of the anniversary month of the incorporation date. The annual report fee is $250. Taxes. For complete details on state taxes for Illinois LLCs, visit Business Owner's Toolkit or the State of Illinois .