Illinois LLC Notices, Resolutions and other Operations Forms Package

Description

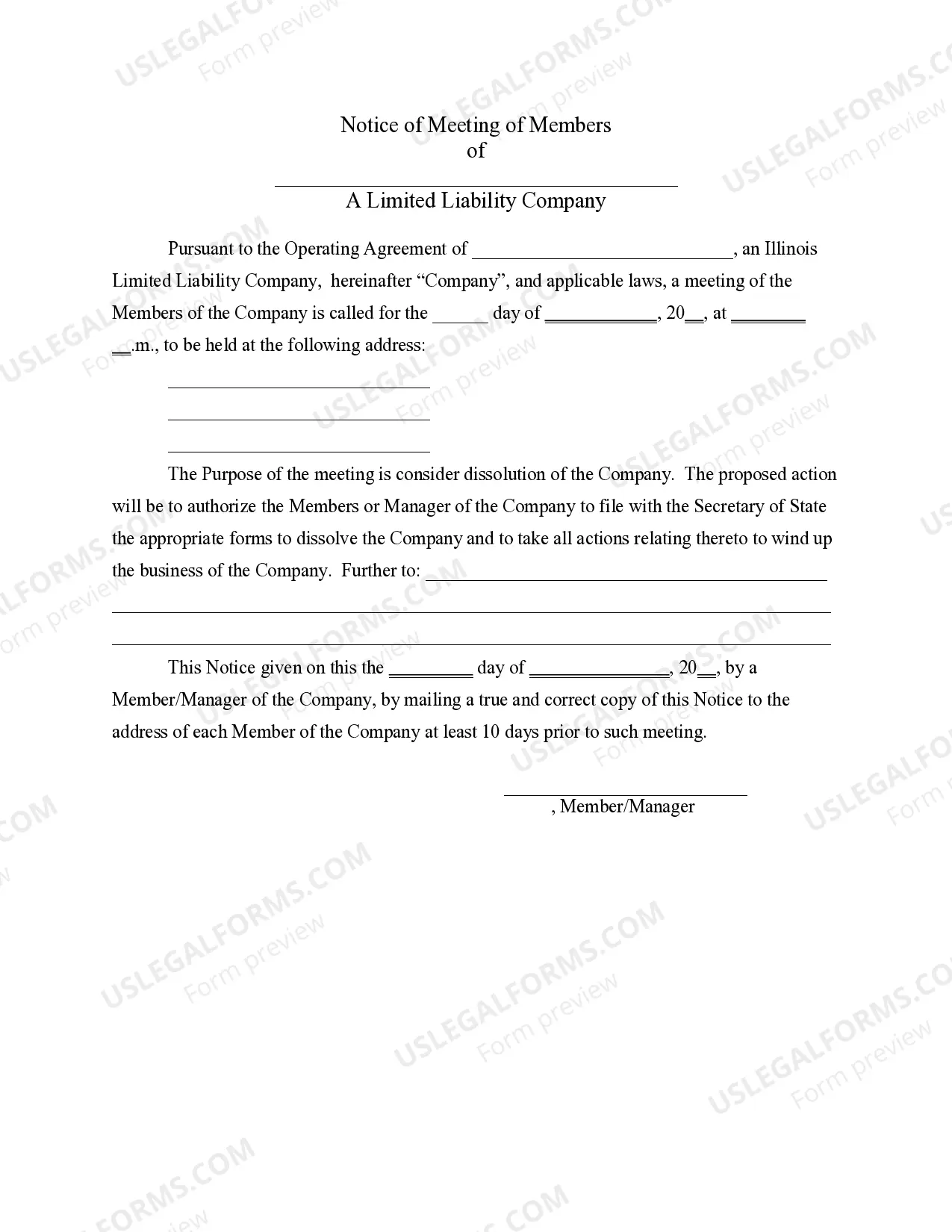

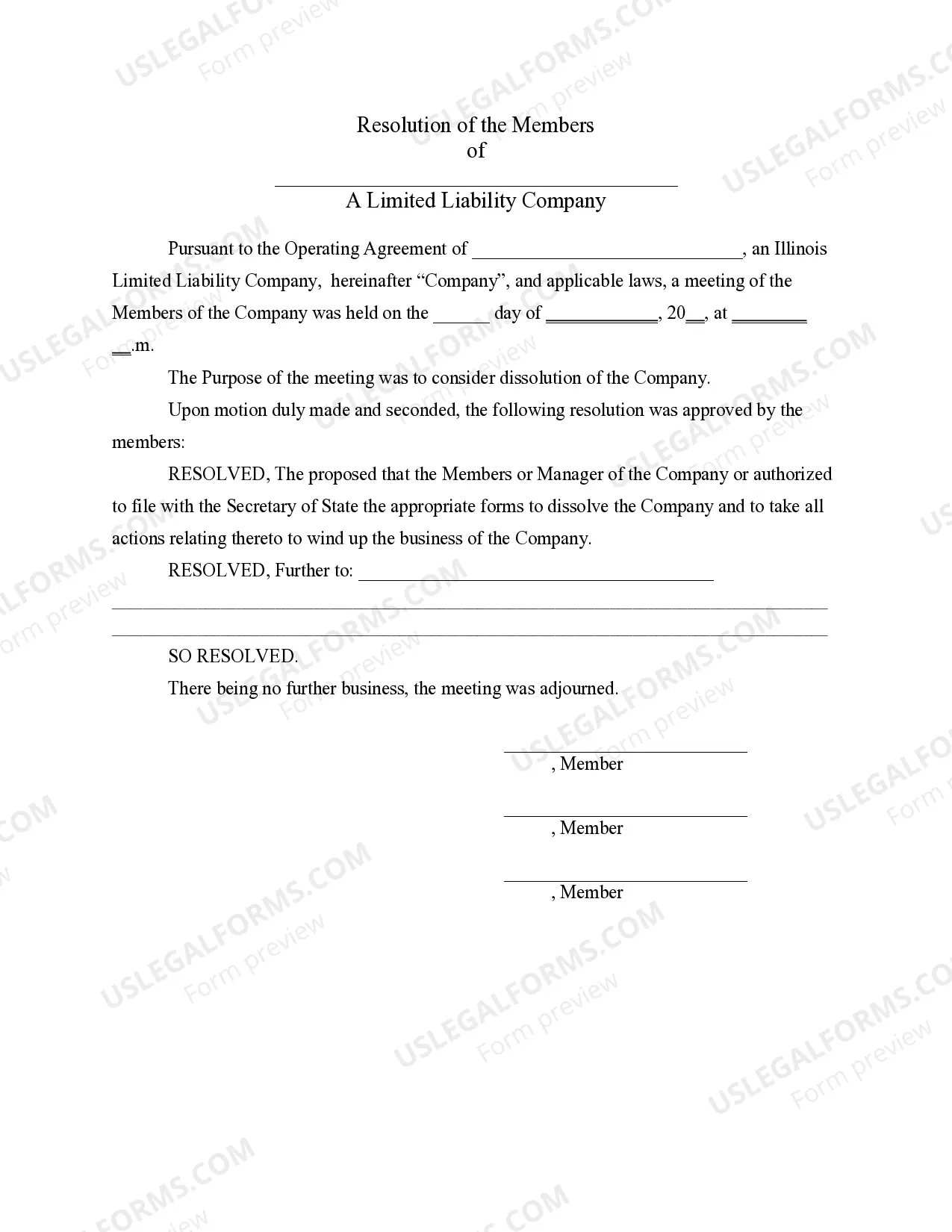

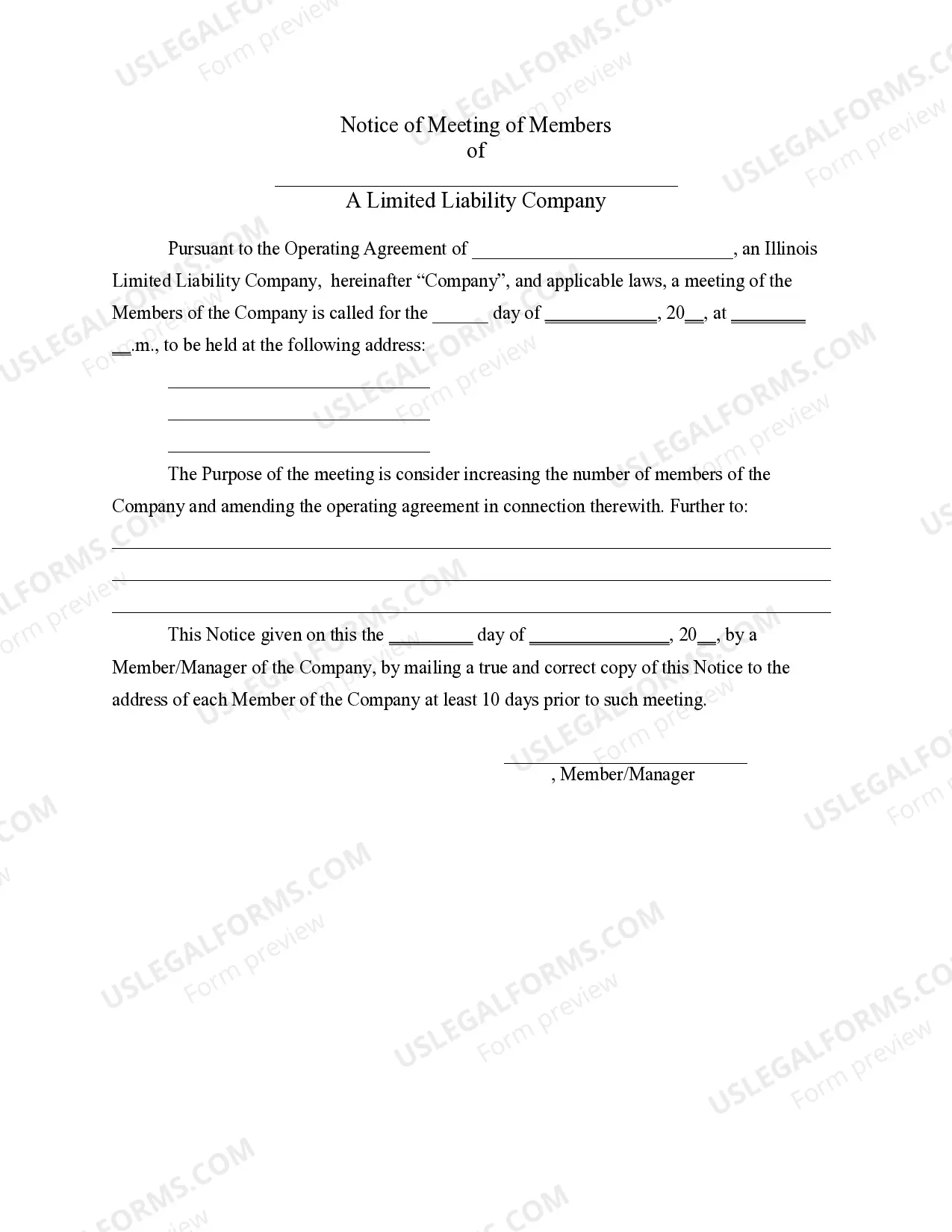

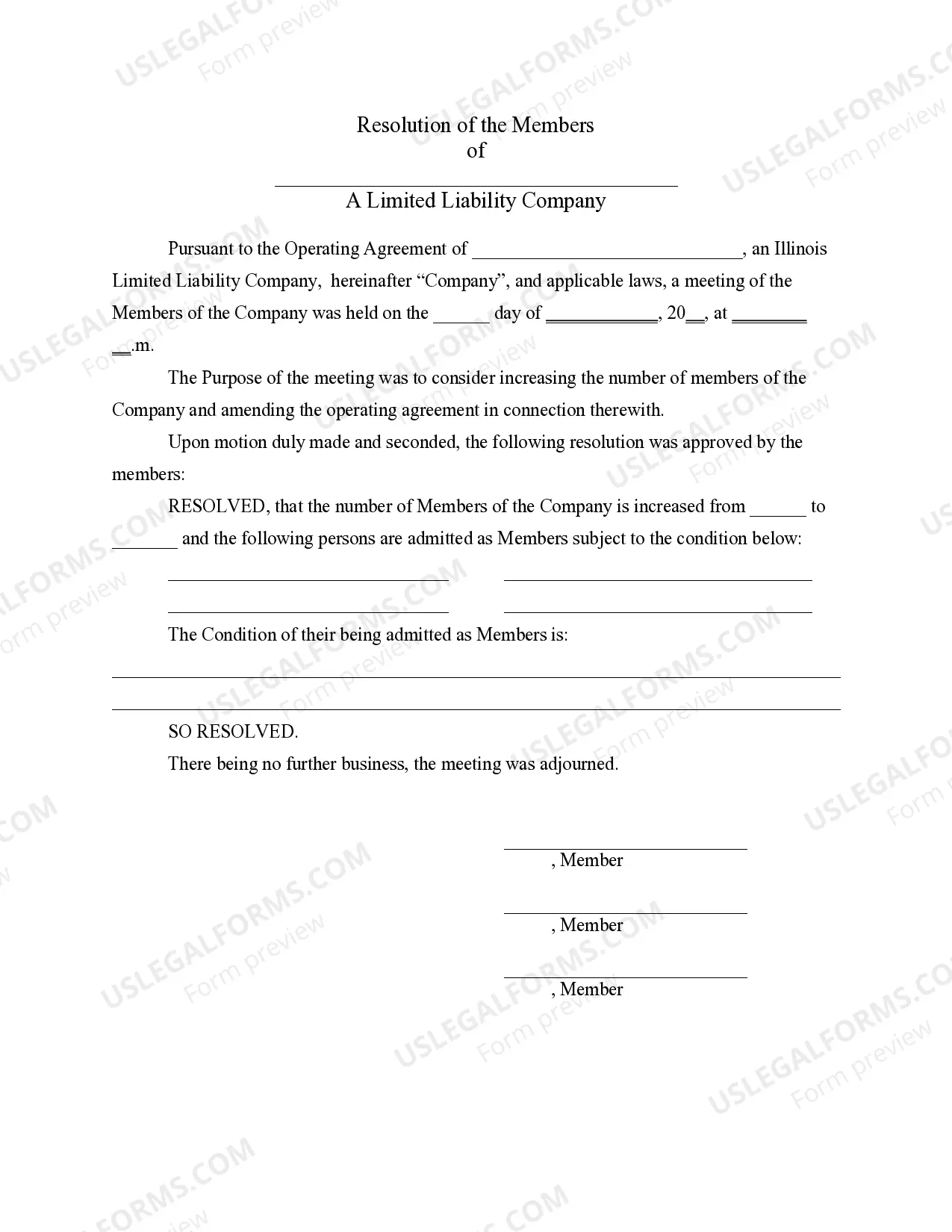

How to fill out Illinois LLC Notices, Resolutions And Other Operations Forms Package?

Searching for Illinois LLC Notifications, Resolutions, and other Operational Forms Package documents and completing them may pose a difficulty.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the suitable template specifically for your state with just a few clicks.

Our attorneys prepare each document, so you only need to complete them. It really is that straightforward.

Press the Buy Now button if you found what you are looking for. Select your plan on the pricing page and create an account. Choose to pay by card or through PayPal. Save the document in your preferred file format. Now you can print the Illinois LLC Notifications, Resolutions, and other Operational Forms Package template or fill it out using any online editor. Don't worry about making typos because your template can be utilized and submitted, and printed as many times as you wish. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the template.

- Your saved files are stored in My documents and are available at all times for future use.

- If you haven't signed up yet, you need to register.

- Review our comprehensive instructions on how to obtain the Illinois LLC Notifications, Resolutions, and other Operational Forms Package template in just a few minutes.

- To acquire an authorized template, verify its validity for your state.

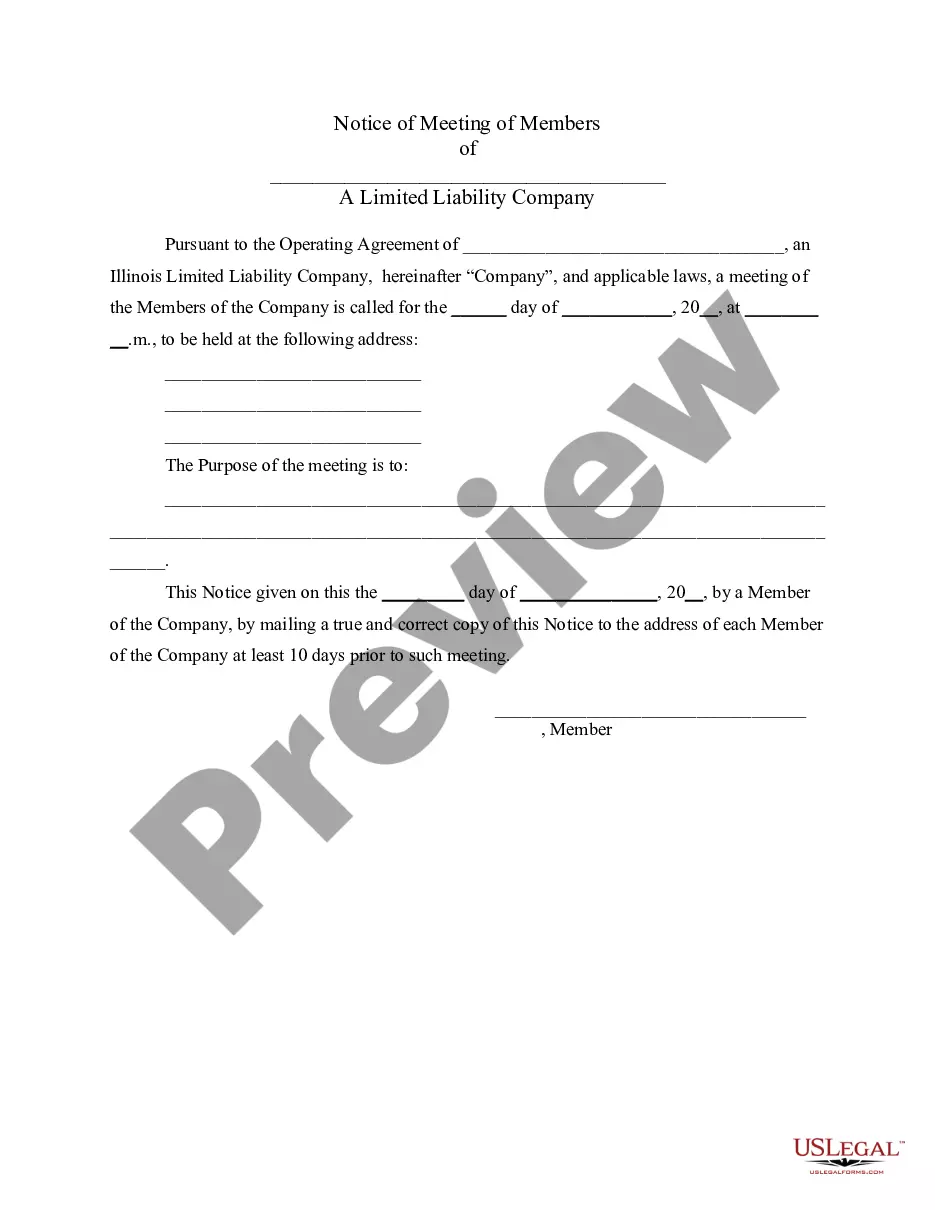

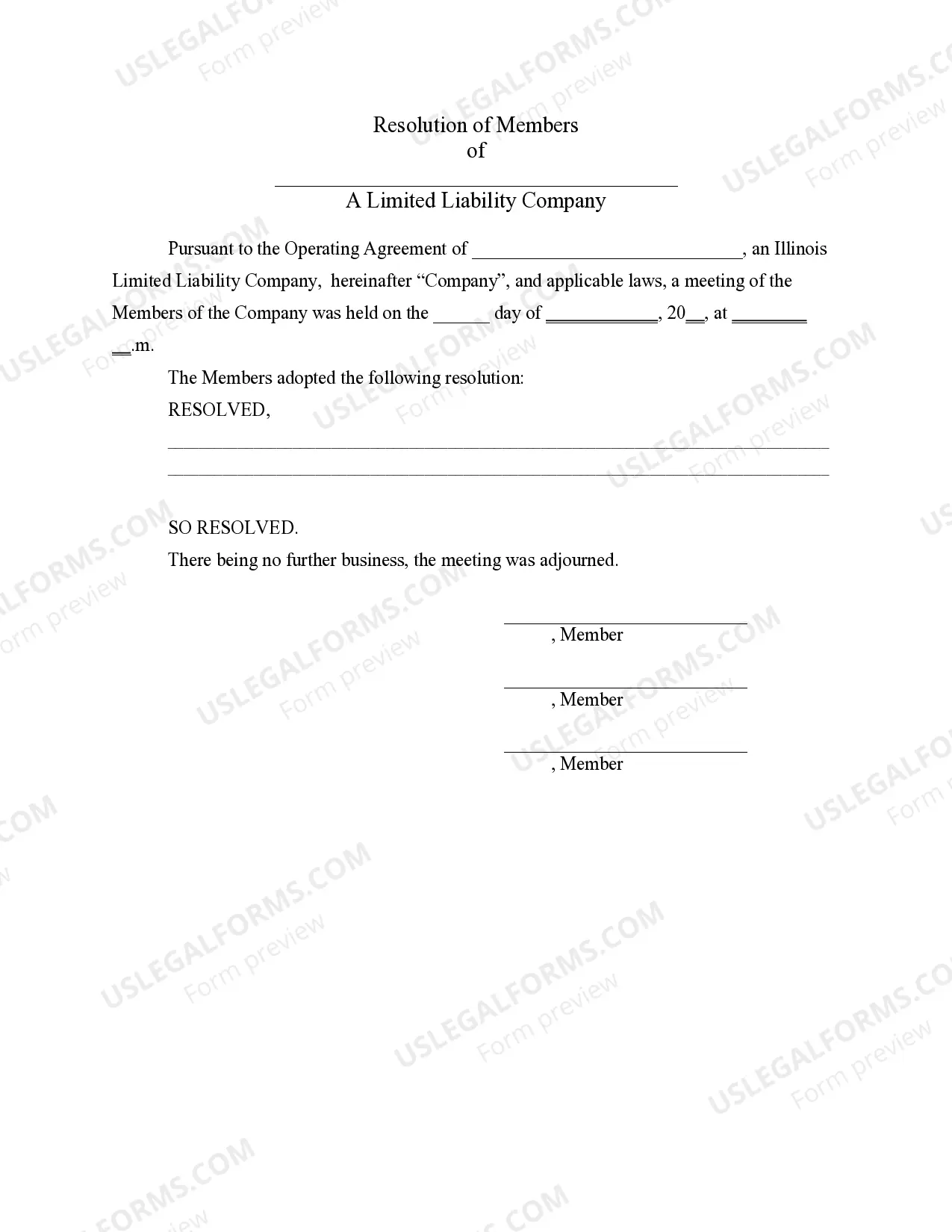

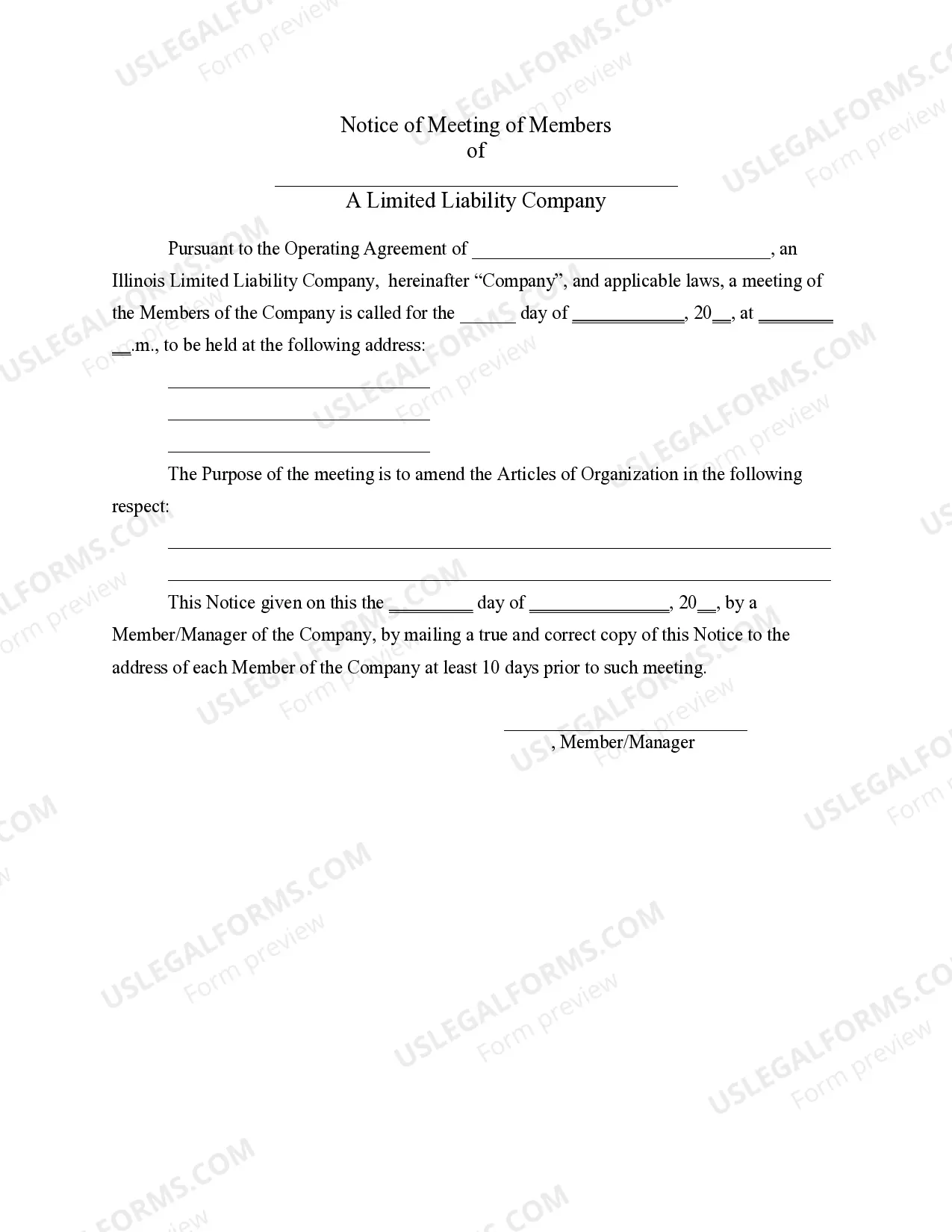

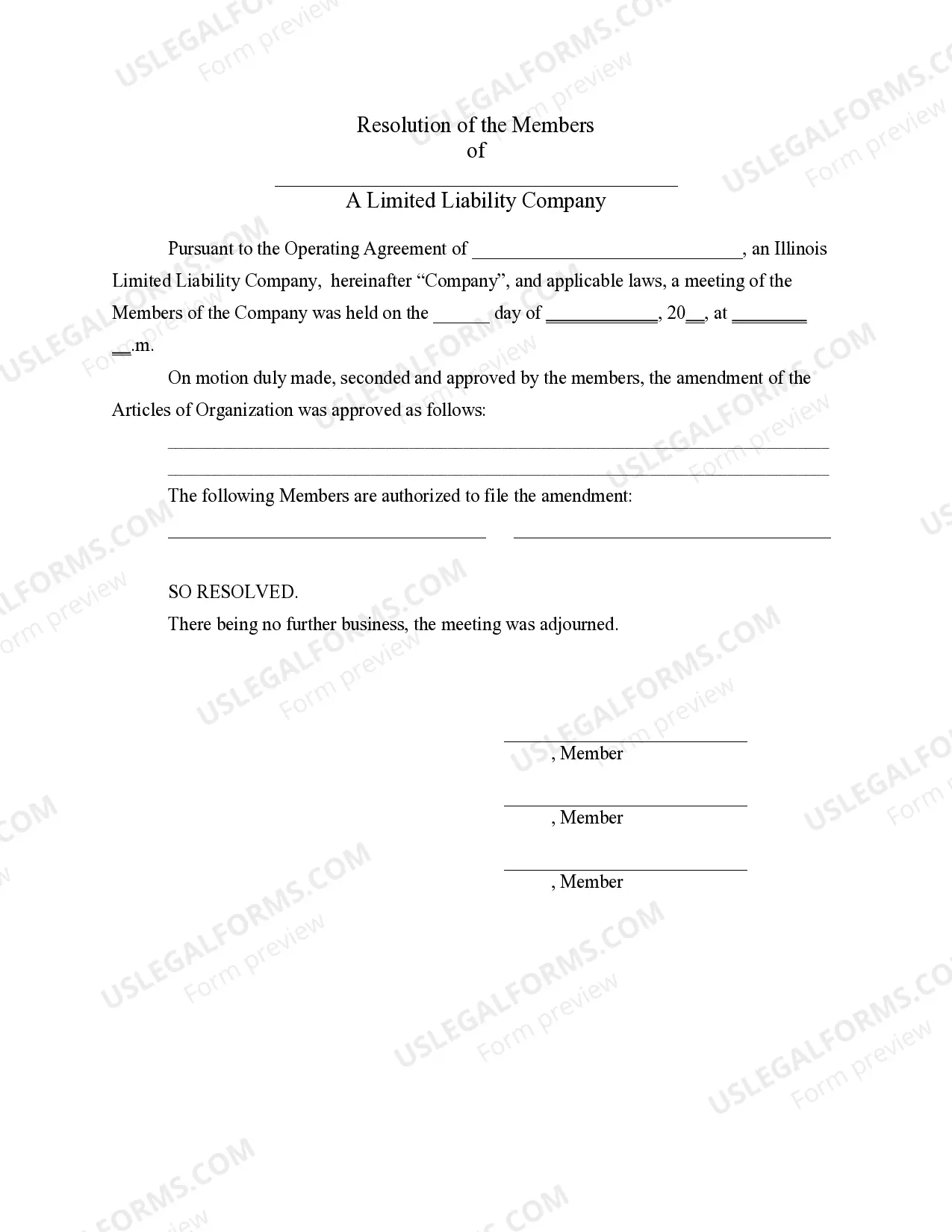

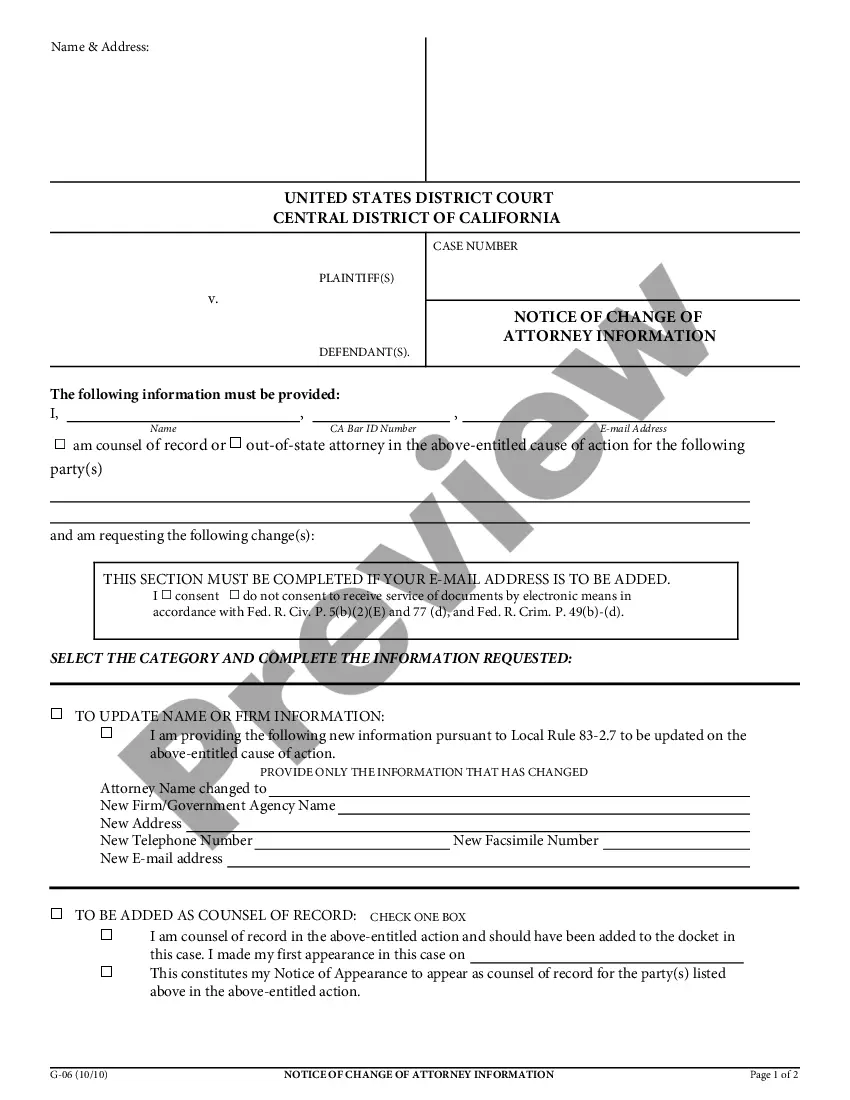

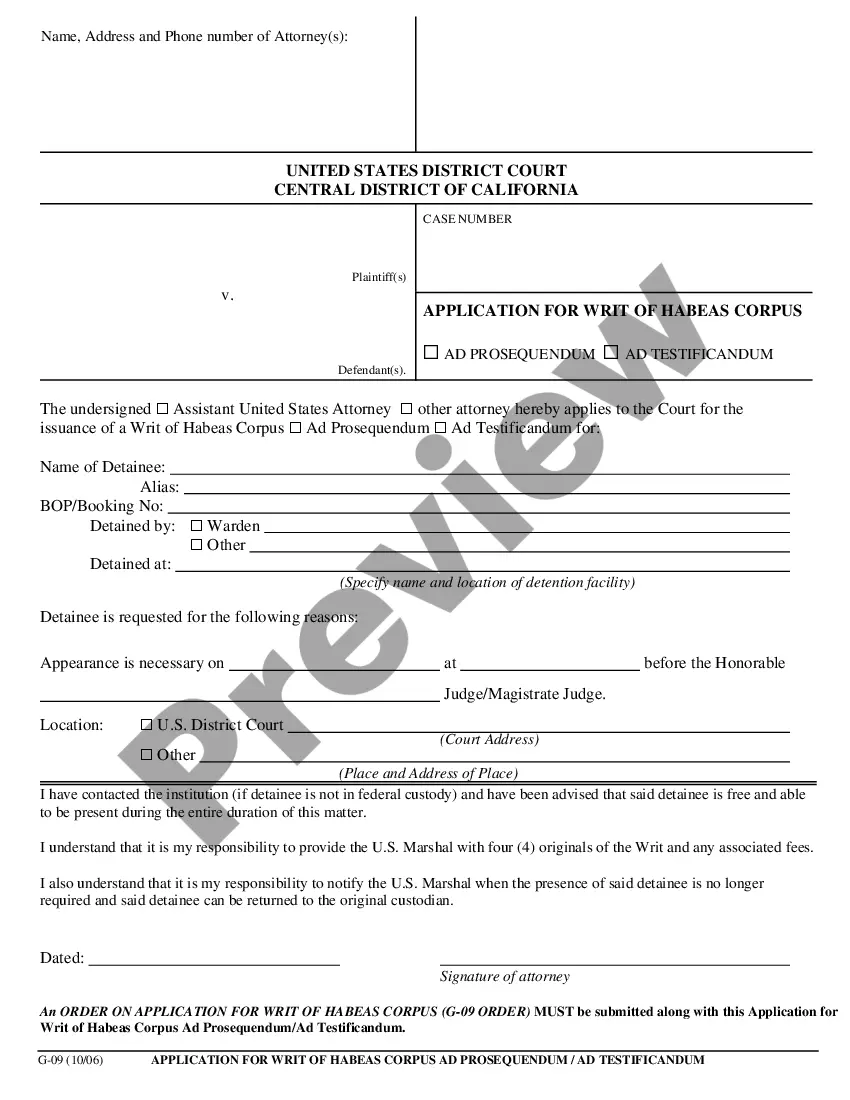

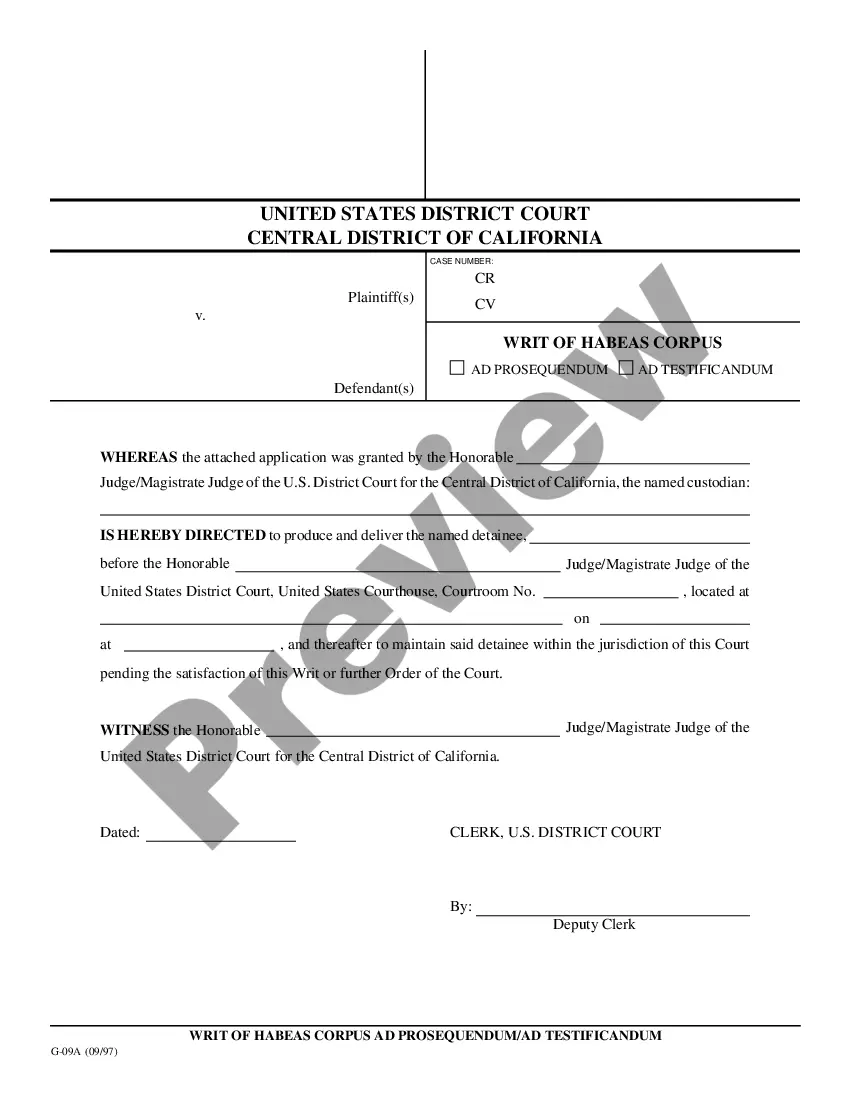

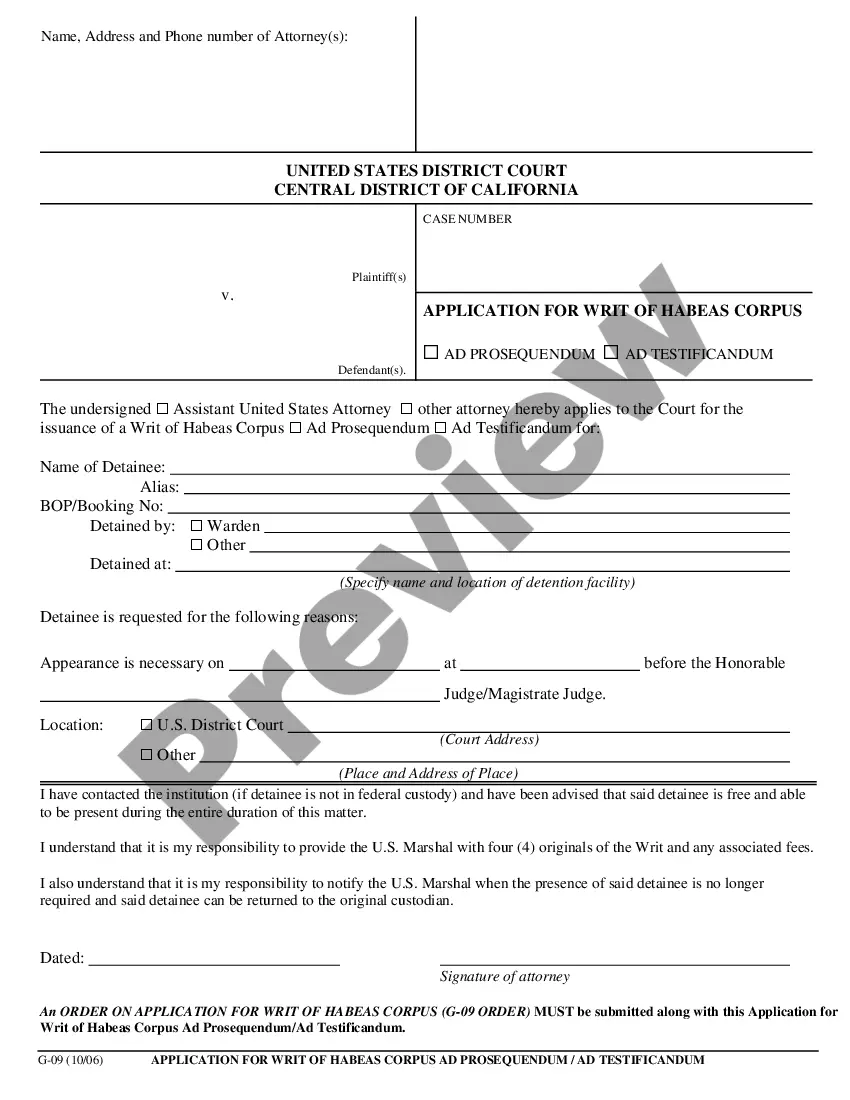

- Examine the form using the Preview feature (if it's available).

- If there's a description, read it to understand the key details.

Form popularity

FAQ

The answer is yes--it is possible and permissible to operate multiple businesses under one LLC. Many entrepreneurs who opt to do this use what is called a "Fictitious Name Statement" or a "DBA" (also known as a "Doing Business As") to operate an additional business under a different name.

Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

You should always include LLC on all invoices, contracts, leases, legal records, tax returns, letterheads and other purposes. In most states, it is required to add LLC to your business name when forming your business, filing for an EIN or paying taxes.

Profits subject to social security and medicare taxes. In some circumstances, owners of an LLC may end up paying more taxes than owners of a corporation. Salaries and profits of an LLC are subject to self-employment taxes, currently equal to a combined 15.3%.

An LLC separates your personal possessions such as your house, vehicle, investments, etc. from your business assets.LLC Insurance is a type of coverage that protects LLC companies explicitly against certain liabilities that might compromise the financial aspect of the business such as lawsuits or accidents.

So, do you need to incorporate LLC in your logo? In short, the answer is no. In fact, none of your branding/marketing needs to include LLC, Inc. or Ltd. If it is included, this may look amateur.Logos are an extension of a company's trade name, so marketing departments don't need to include legal designation.

Who Should Form an LLC? Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

Cons of Using To Form an LLC More expensive than some other services: The cost of forming a LLC ranges from $79 to $359 plus filing fees. Other websites provide similar services for filing fees only (as part of a trial) or from $49 plus filing fees.