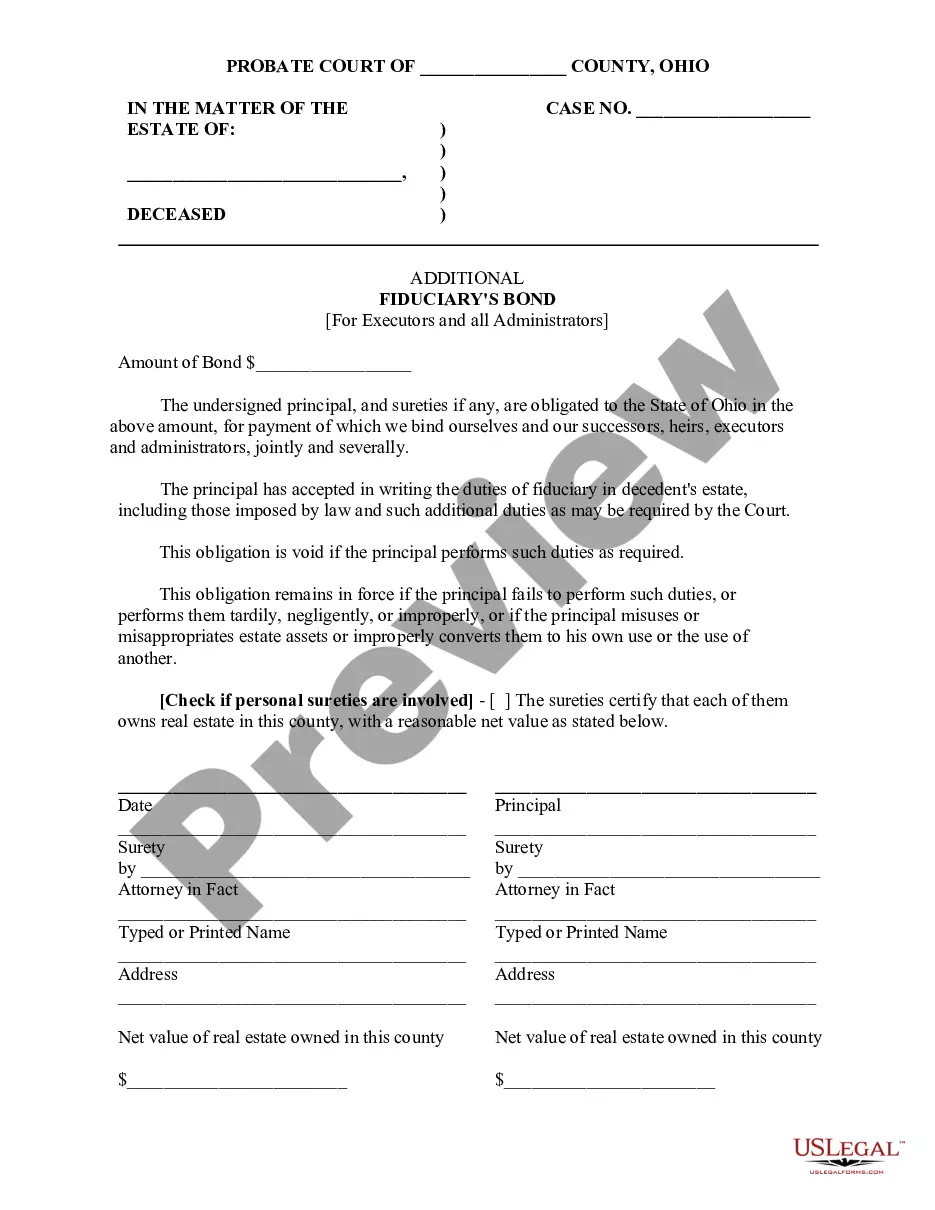

This sample form is a Fiduciary's Bond document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Fiduciary's Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Ohio Fiduciary's Bond?

When it comes to completing Ohio Fiduciary's Bond, you almost certainly imagine an extensive process that involves choosing a perfect form among numerous very similar ones after which needing to pay an attorney to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific template within just clicks.

For those who have a subscription, just log in and click Download to have the Ohio Fiduciary's Bond template.

If you don’t have an account yet but need one, stick to the point-by-point guide listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and by clicking on the Preview option (if accessible) to see the form’s content.

- Click on Buy Now button.

- Find the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Skilled lawyers work on creating our templates to ensure that after saving, you don't have to worry about editing and enhancing content outside of your individual details or your business’s info. Join US Legal Forms and get your Ohio Fiduciary's Bond document now.

Form popularity

FAQ

The purpose of the bond is to protect the beneficiaries or creditors of the estate from harm caused by the malfeasance or negligence of the executor or administrator. In California, a probate court bond is issued to administrators, executors, conservators and guardians in probate estates.

What is a Guardianship Bond? A Guardianship Bond is a type of court bond that ensures a court-appointed individual will perform and fulfill their obligations.

A personal representative of an estate (either an executor or an administrator) purchases a probate bond from a surety company. They pay a portion of the value of the estate usually around 0.5%.

Without bond means the executor has not been required by the court to post a bond with the court to insure that he does his job. Likely he also has been relieved of a duty to do inventories and accountings to the court.

The purpose of a Guardianship or Conservatorship is to ensure that continuing care is provided for individuals who are unable to take care of themselves or their property because of incapacity. A Guardianship or Conservatorship is generally only considered after other alternatives have been explored.

Generally speaking, a guardian is not personally responsible for the ward's (person being taken care of) debts or bills.He or she is not required to pay the ward's bills with their personal assets, and if the ward's bills are sent to collections it will have no impact on the guardian's credit.

A Probate Bond guarantees the appointed individual will comply with state laws and the terms of the will, trust, or court order. If the appointed individual does not comply with the terms of the will, trust, or court order, someone can make a claim against the bond.

There are two types of guardianships, a full guardianship and a limited guardianship.

A probate bond is a type of court bond that ensures the wishes of a deceased person are carried out ethically and honestly. If an error does occur, the bond promises you will compensate the beneficiaries for any money lost. Probate Bonds are also called Fiduciary Bonds.