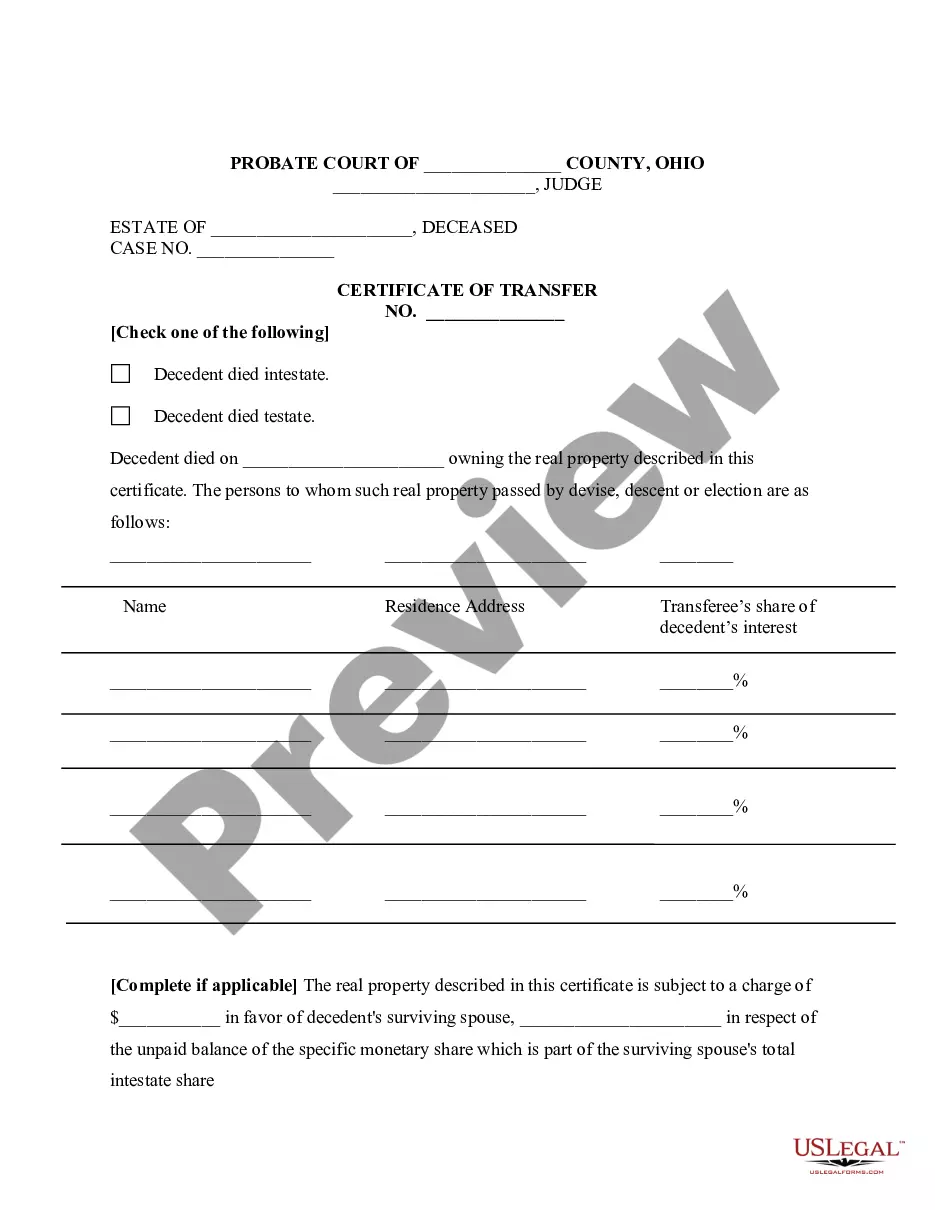

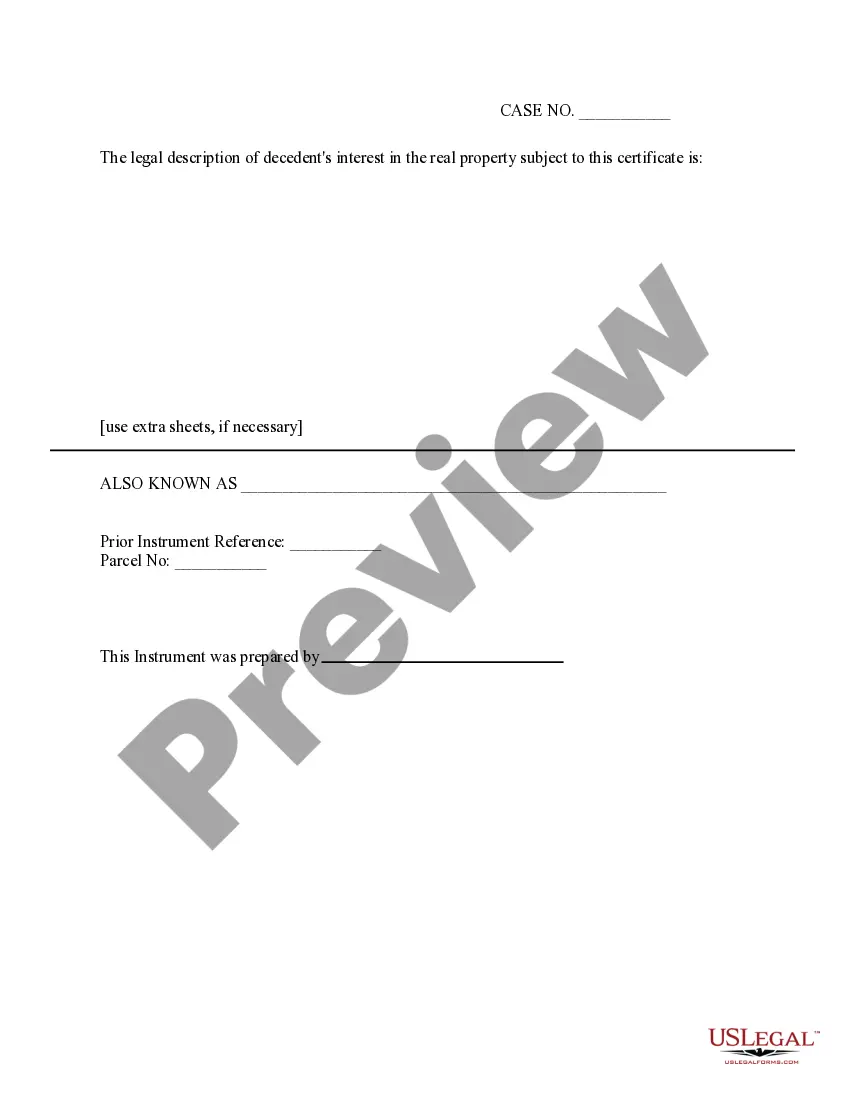

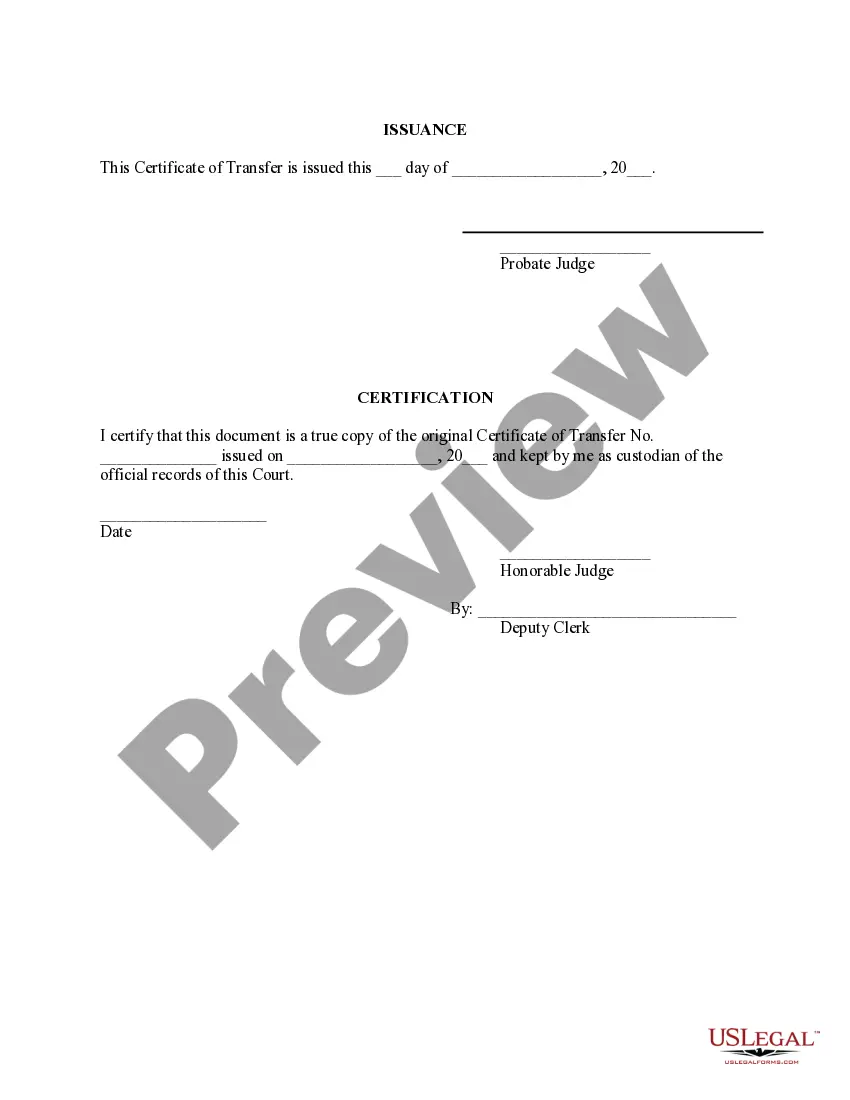

Ohio Certificate of Transfer

Description

How to fill out Ohio Certificate Of Transfer?

In terms of filling out Ohio Certificate of Transer, you almost certainly think about an extensive procedure that requires finding a ideal sample among hundreds of very similar ones then being forced to pay out a lawyer to fill it out for you. In general, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific document within clicks.

In case you have a subscription, just log in and click on Download button to find the Ohio Certificate of Transer sample.

In the event you don’t have an account yet but want one, follow the step-by-step manual listed below:

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do so by reading the form’s description and also by visiting the Preview function (if available) to view the form’s content.

- Click on Buy Now button.

- Pick the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional attorneys work on drawing up our templates to ensure that after saving, you don't have to worry about editing and enhancing content outside of your personal information or your business’s information. Be a part of US Legal Forms and receive your Ohio Certificate of Transer example now.