Ohio Gift Deed for Individual to Individual

About this form

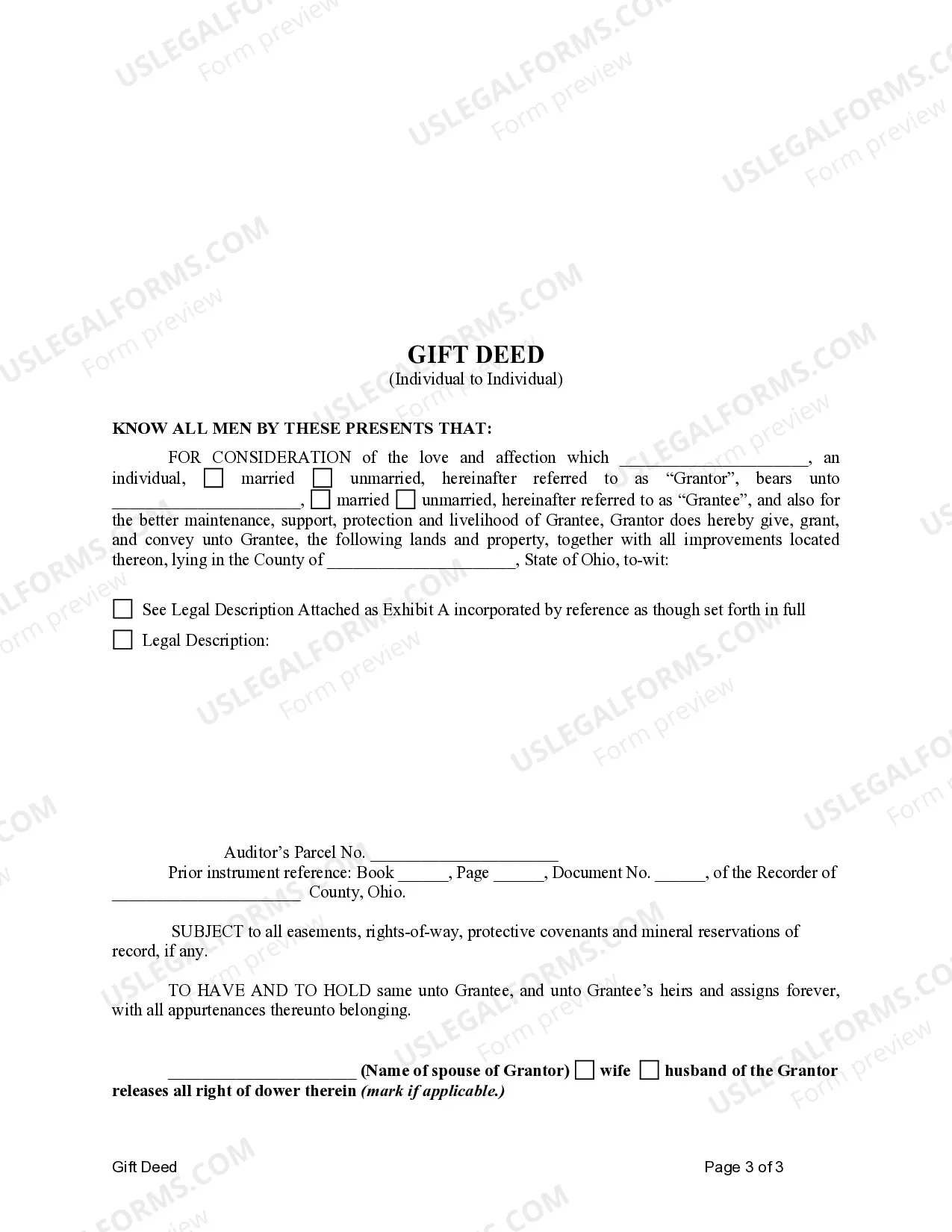

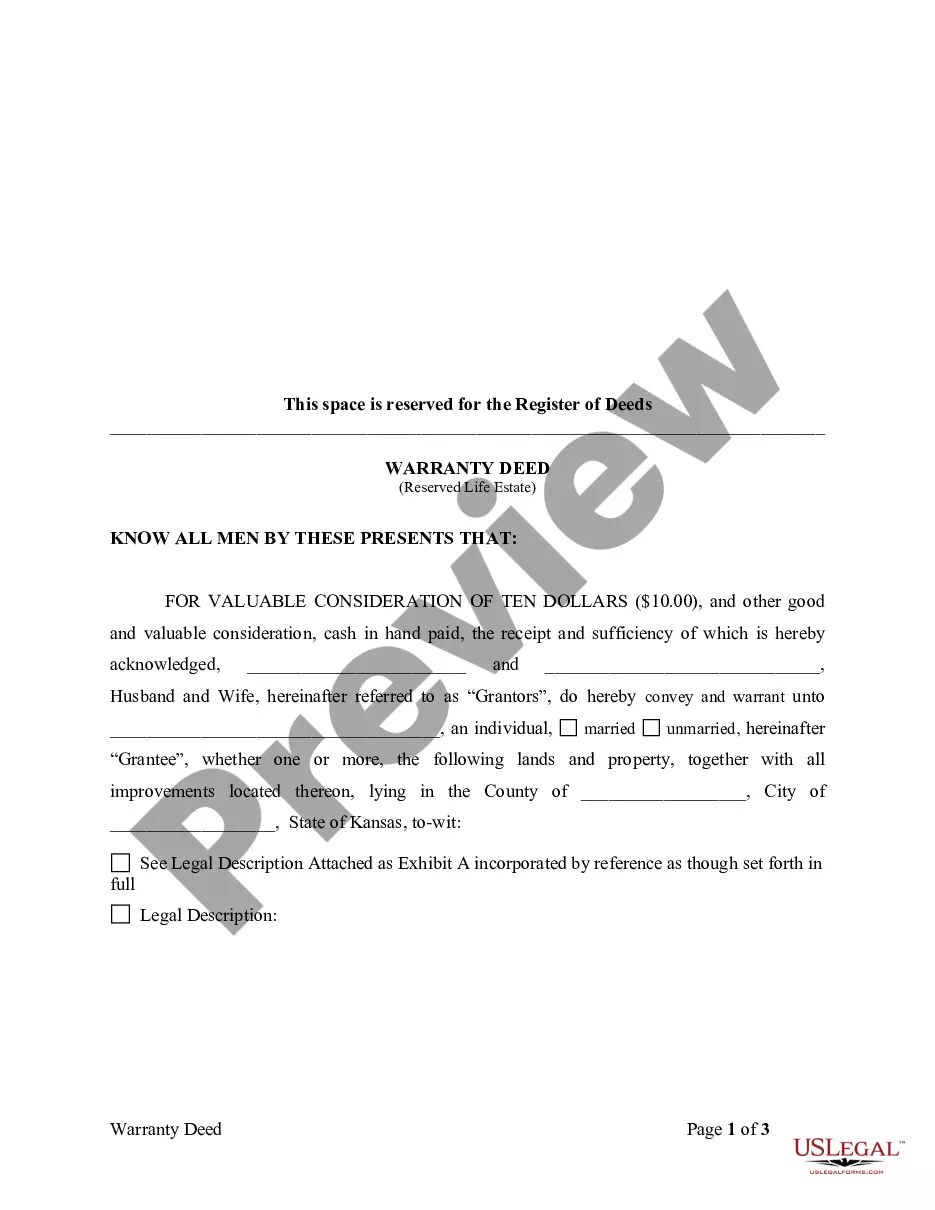

The Ohio Gift Deed for Individual to Individual is a legal document used to transfer ownership of property from one individual to another as a gift. Unlike a sale, this deed indicates that no money is exchanged for the transfer of property, reflecting the genuine intention of the giver to provide the property freely. This form is specifically tailored for Ohio law, ensuring it meets state-specific legal requirements for gift transfers.

Key components of this form

- Grantor and grantee details: Names and addresses of the individuals involved in the property transfer.

- Description of the property: A thorough description of the property being gifted, including any relevant identifiers.

- Statement of intention: A clause indicating that the property is being transferred as a gift, without monetary compensation.

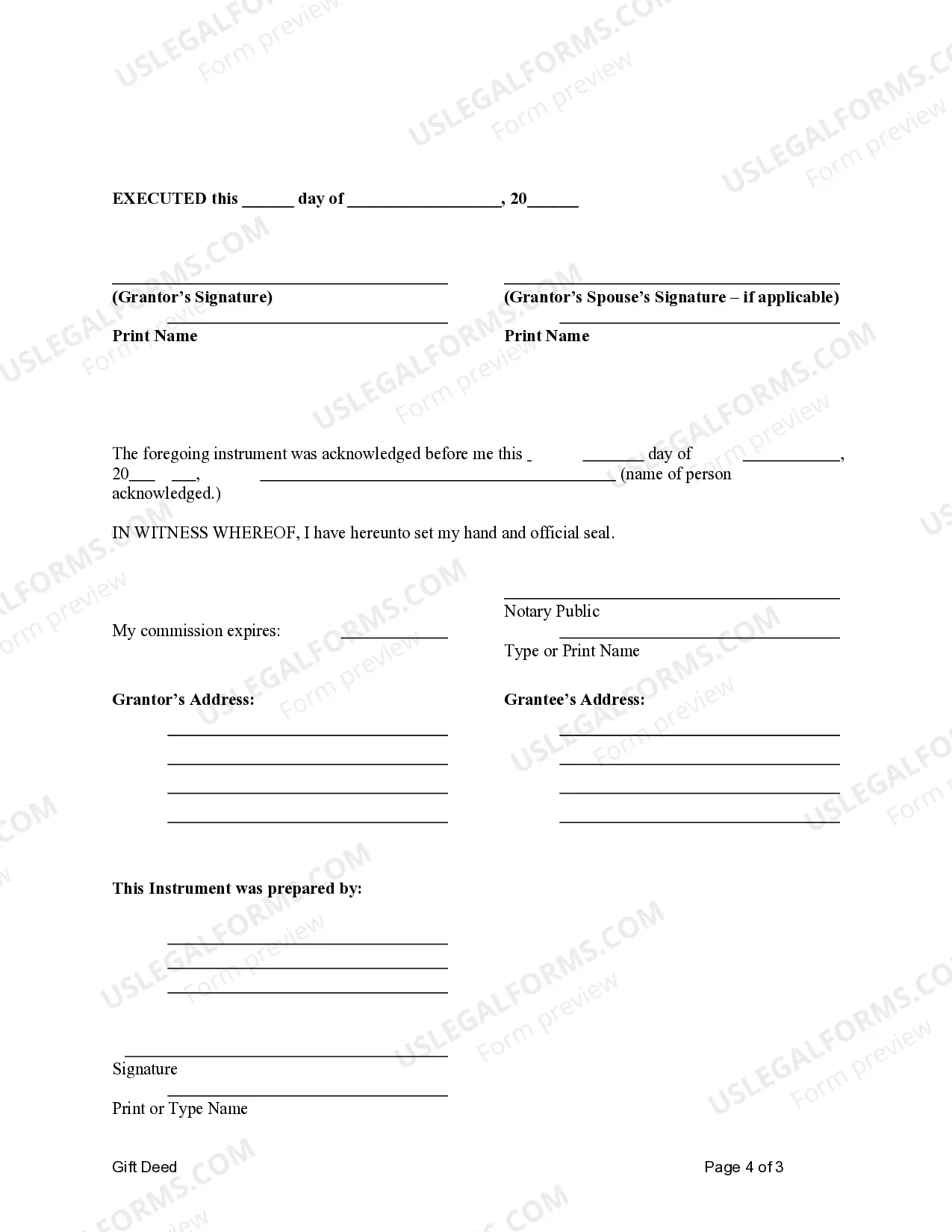

- Signatures: Signatures of both the grantor and grantee, authenticating the transaction.

- Notarization section: Depending on local laws, a section for notarization may be included to validate the deed.

Common use cases

This form is applicable in situations when one individual wishes to gift real property to another without charging for it. Common scenarios include transferring a family home to a child, giving land to a friend, or passing down inherited property. Using a Gift Deed helps clarify ownership and ensure that the grantee receives legal title to the property.

Who this form is for

This deed is intended for:

- Individuals giving or receiving property as a gift.

- Family members wishing to transfer ownership of real estate without financial transaction.

- Friends or acquaintances looking to gift property to one another.

- Anyone needing to formalize a non-sale property transfer to prevent disputes over ownership.

How to complete this form

- Identify the parties: Enter the full legal names and addresses of the grantor and grantee at the beginning of the document.

- Specify the property: Clearly outline the real property being gifted, including its full address and legal description.

- Enter the intent: Include a statement affirming that the property is gifted with no monetary exchange.

- Sign the form: Both parties must sign the deed to validate the transfer formally.

- Seek notarization if required: If Ohio law or the specific situation requires notarization, arrange for a qualified notary to witness the signing.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Mistakes to watch out for

- Failing to accurately describe the property, which can lead to confusion or disputes.

- Not providing full names or correct addresses of the parties involved.

- Omitting the statement of intent, which is essential for a valid gift transfer.

- Neglecting to sign the document, as all signatures are necessary for legality.

- Assuming notarization is unnecessary without checking specific requirements under Ohio law.

Benefits of using this form online

- Convenience: Easily download the Gift Deed from the comfort of your home.

- Editability: Modify the template to fit your specific situation quickly.

- Guidance: Access forms drafted by legal professionals, ensuring compliance with Ohio laws.

- Save time: Complete the forms at your own pace, without the need for in-person visits to legal offices.

Form popularity

FAQ

Date and Place where the deed is to be executed. Information about Donor and Donee like Name, Residential Address, Relationship among them, Date of Birth, etc. Details about the property. Two Witnesses. Signatures of Donor and Donee along with the witnesses.

Details of the donor and donee (name, date of birth, residence, relationship to each other, father's name, etc.) The amount of money being gifted, Reason for gifting, if any.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.