New York Software Specifications Agreement

Description

How to fill out Software Specifications Agreement?

You can dedicate time online attempting to locate the sanctioned document template that complies with the federal and state requirements you need. US Legal Forms offers a vast array of legal forms that are vetted by specialists. It is easy to obtain or create the New York Software Specifications Agreement through our service.

If you have a US Legal Forms account, you may Log In and select the Download option. Afterwards, you can complete, modify, print, or sign the New York Software Specifications Agreement. Each legal document template you purchase is yours permanently. To obtain another copy of any purchased document, visit the My documents section and click on the corresponding option.

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below: First, ensure that you have chosen the correct document template for the region/city of your choice. Check the document description to confirm you have selected the appropriate form. If available, use the Preview option to view the document template simultaneously.

- To find another version of the document, use the Search field to locate the template that satisfies your needs and specifications.

- Once you have found the template you desire, click Buy now to proceed.

- Choose the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms.

- Complete the payment process. You can use your credit card or PayPal account to pay for the legal document.

- Select the format of the document and download it to your device.

- Make adjustments to the document if necessary. You can complete, modify, sign, and print the New York Software Specifications Agreement.

- Download and print a multitude of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

resident must file a New York tax return if they derive income from New York sources, such as rental income or sales made in the state. This includes businesses that might require a New York Software Specifications Agreement, illustrating services performed or products sold in New York. You can find detailed filing instructions and forms on US Legal Forms to assist nonresidents in meeting their tax obligations.

To file for an S Corp in New York, start by forming a domestic corporation by submitting your Articles of Incorporation. After your incorporation process, file Form 2553 with the IRS, ensuring to meet the deadlines set by them. If your business involves software, outline relevant operational guidelines in a New York Software Specifications Agreement, which can also be created with the help of US Legal Forms.

While you can file an S-corp yourself, the process can be complex, involving detailed forms and meeting specific requirements. Doing it on your own may lead to mistakes, especially if you're unfamiliar with New York's laws regarding business entities and the need for a New York Software Specifications Agreement for software businesses. Using a platform like US Legal Forms can simplify filing and ensure compliance.

Yes, New York does recognize S Corporations and allows entities that qualify for S-corp status federally to enjoy similar tax treatment at the state level. This means that income is typically passed through to shareholders, avoiding double taxation. If you are forming an S-corp and need a New York Software Specifications Agreement, make sure to align your contracts with state laws. You can access relevant documents on platforms like US Legal Forms.

New York additions and subtractions refer to adjustments made on your tax return that alter your federal income when calculating your state taxable income. Additions may include interest from government bonds, while subtractions can involve income earned outside New York. Understanding these components is crucial for accurate tax reporting, especially if your software business involves contracts under a New York Software Specifications Agreement. Using US Legal Forms can provide guidance and clarity on these adjustments.

To file an S-corp in New York, you must first establish a corporation by submitting your Articles of Incorporation to the New York Department of State. After your corporation is approved, you can file Form 2553 with the IRS to elect S-corp status. Additionally, ensure that you comply with state-specific requirements, such as obtaining a New York Software Specifications Agreement if your business involves software development. Consider using services like US Legal Forms to streamline the process.

The easiest government contracts to obtain often include small-scale bids and contracts for services that have fewer restrictions. Look for opportunities that involve local projects or simpler procurement needs. It's beneficial to present a strong and clear New York Software Specifications Agreement to demonstrate your readiness and reliability as a contractor. USLegalForms can assist you in drafting an effective agreement tailored to meet these requirements.

Doing business with New York City involves understanding the local regulations and procurement processes. You need to be registered with the City and comply with any specific licensing requirements. Building relationships with city agencies can also help. When preparing your proposal, ensure that you include details in your New York Software Specifications Agreement to meet the City’s standards.

To secure a contract with the City of New York, you can start by registering on the City’s procurement website. This platform provides access to current opportunities and outlines the necessary qualifications. Familiarizing yourself with the bidding processes and requirements is crucial. Additionally, crafting a thorough New York Software Specifications Agreement will enhance your proposal.

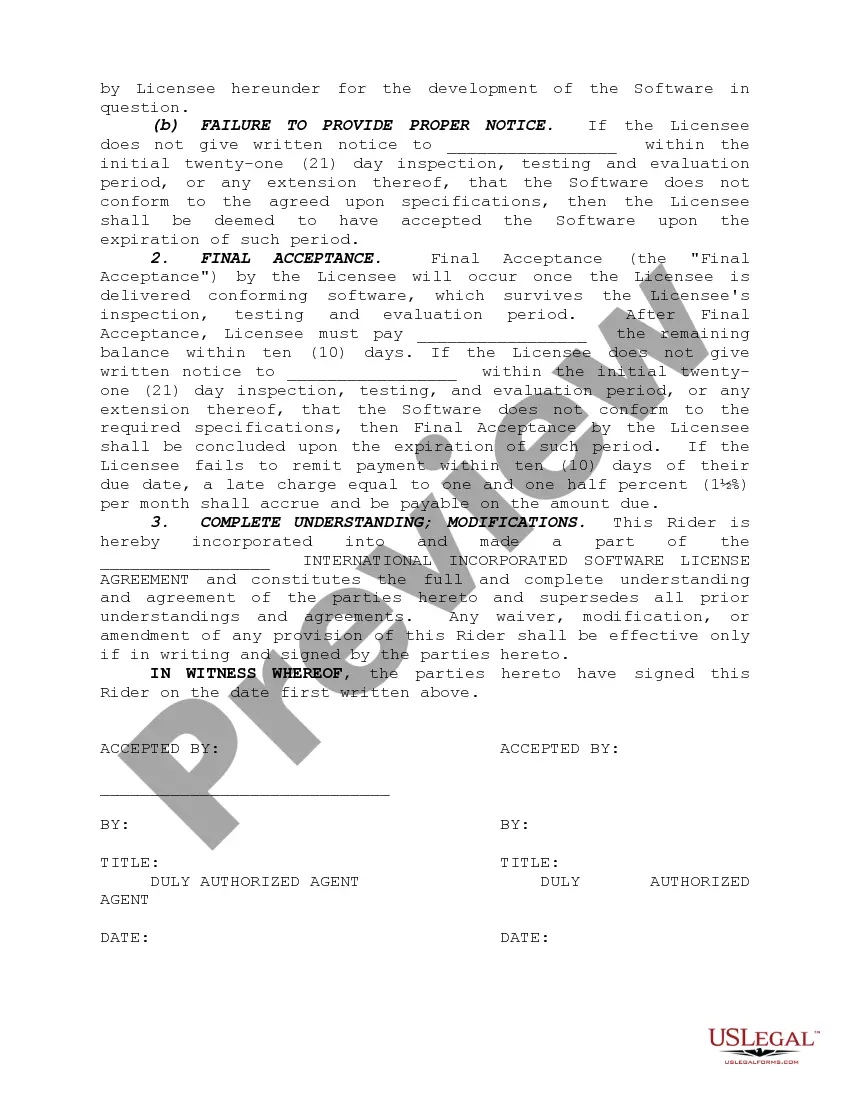

In New York, a contract becomes legally binding when it contains an offer, acceptance, and consideration. Both parties must demonstrate their intent to enter the agreement. It's important to ensure that the terms are clear and that both parties understand their obligations. A New York Software Specifications Agreement should satisfy these requirements to be enforceable.