New York Complex Will - Maximum Unified Credit to Spouse

Description

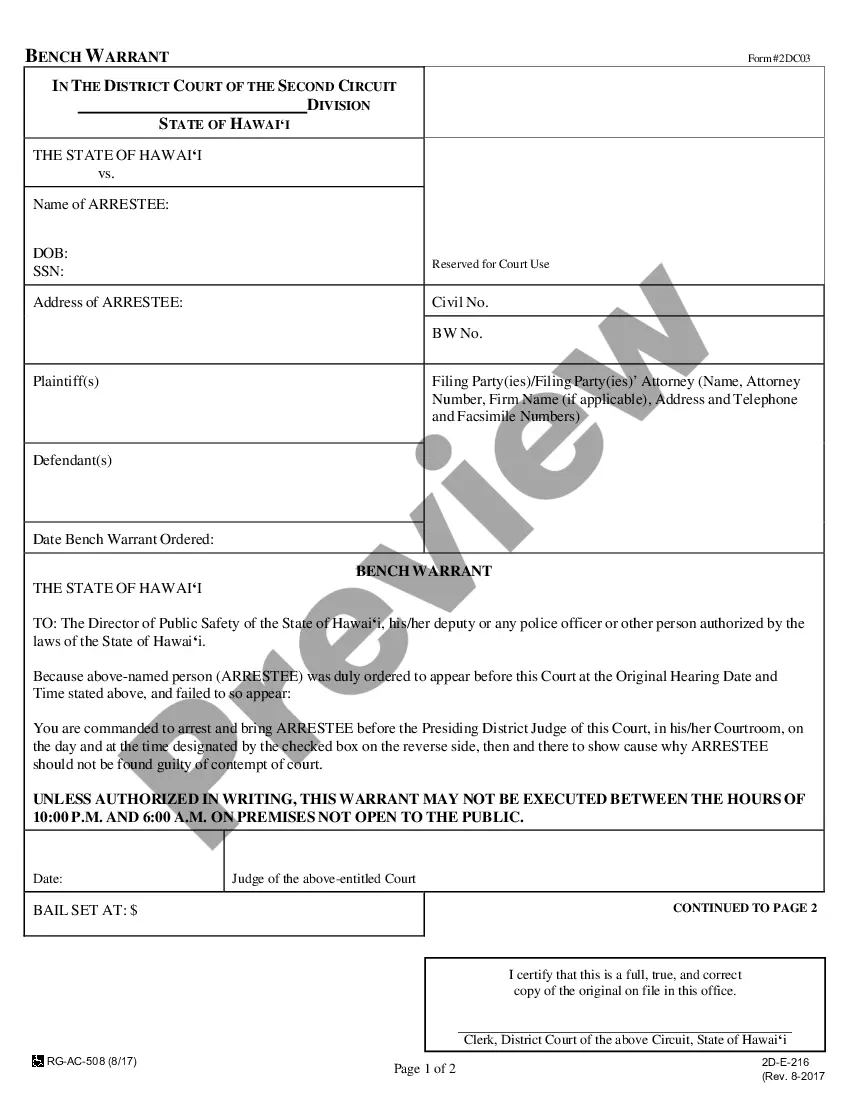

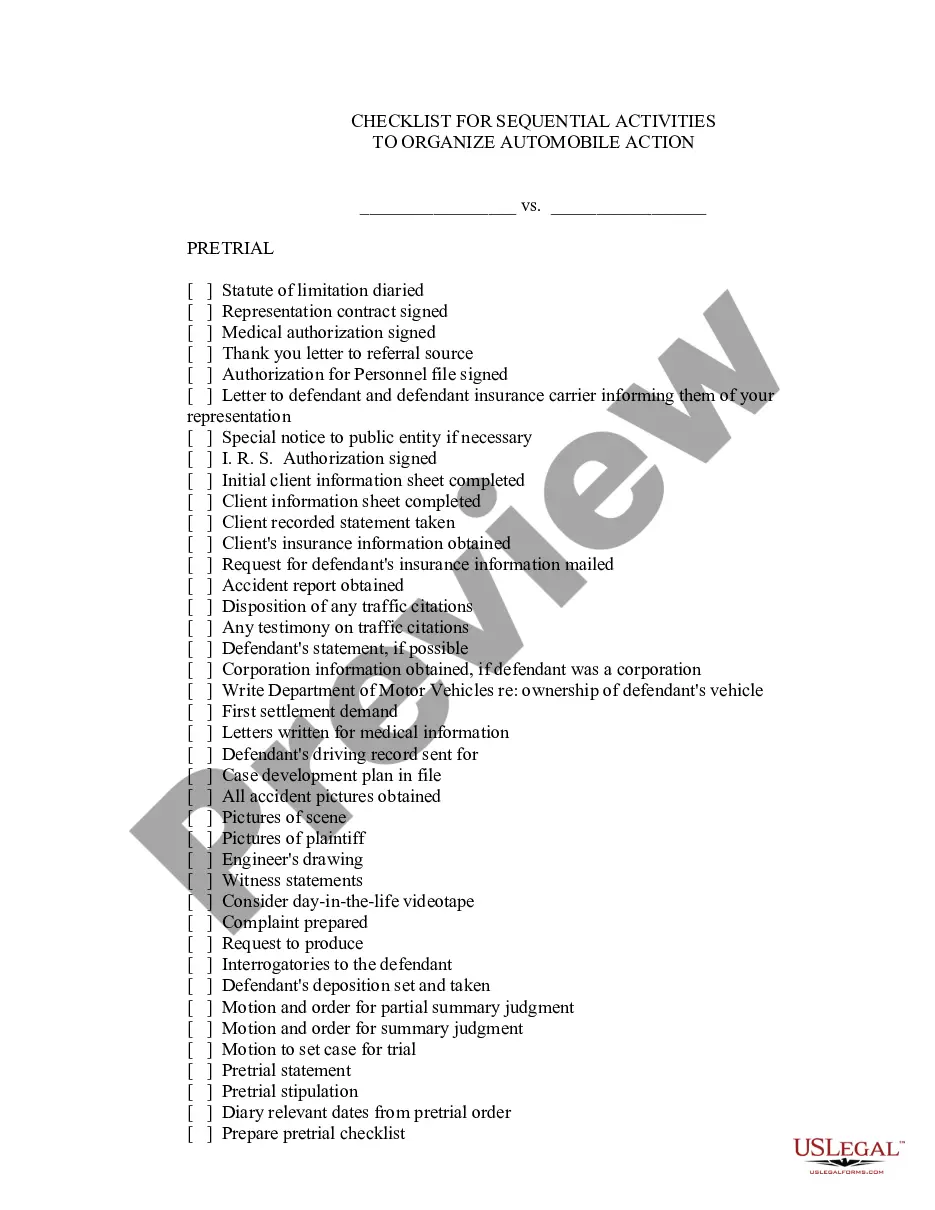

How to fill out Complex Will - Maximum Unified Credit To Spouse?

If you wish to complete, download, or print lawful file web templates, use US Legal Forms, the greatest assortment of lawful varieties, which can be found on-line. Utilize the site`s simple and convenient look for to find the files you want. Various web templates for company and personal reasons are categorized by types and states, or search phrases. Use US Legal Forms to find the New York Complex Will - Maximum Unified Credit to Spouse with a couple of click throughs.

Should you be already a US Legal Forms customer, log in for your bank account and click on the Acquire switch to get the New York Complex Will - Maximum Unified Credit to Spouse. You may also access varieties you previously downloaded in the My Forms tab of the bank account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that right metropolis/nation.

- Step 2. Utilize the Review solution to look through the form`s content material. Don`t forget to read the description.

- Step 3. Should you be unsatisfied with the form, utilize the Lookup field at the top of the monitor to discover other models of the lawful form template.

- Step 4. Upon having located the form you want, click on the Buy now switch. Select the rates prepare you choose and add your accreditations to register for the bank account.

- Step 5. Procedure the transaction. You can use your credit card or PayPal bank account to complete the transaction.

- Step 6. Select the structure of the lawful form and download it on the gadget.

- Step 7. Full, revise and print or signal the New York Complex Will - Maximum Unified Credit to Spouse.

Each and every lawful file template you purchase is yours eternally. You possess acces to every single form you downloaded within your acccount. Select the My Forms area and select a form to print or download yet again.

Remain competitive and download, and print the New York Complex Will - Maximum Unified Credit to Spouse with US Legal Forms. There are millions of professional and status-certain varieties you may use to your company or personal demands.

Form popularity

FAQ

The gift is treated as half from the taxpayer and half from the taxpayer's spouse. Because spouses may not file joint gift tax returns, each spouse would then report half the value of the gift on their respective Forms 709. Form 709 ? What Is It? When Should It Be Filed? - H&R Block hrblock.com ? other-income ? gift-tax-rules hrblock.com ? other-income ? gift-tax-rules

UNIFIED CREDIT AMOUNT: If your and your spouse's combined estimated estate value is below the unified credit exemption amount, currently $2 million, the marital deduction is enough to prevent any estate taxes at the federal level. marital deduction daytonestateplanninglaw.com ? 2013/09 daytonestateplanninglaw.com ? 2013/09

The federal estate tax exemption exempts $12.92 million over a lifetime in 2023, and $13.61 million over a lifetime as of 2024.222 There's no income tax on inheritances.

The spouse exemption is unlimited if neither of the spouses or civil partners is UK domiciled or if a non-UK domiciled individual makes gifts to a UK domiciled spouse or civil partner. However, the spouse exemption is capped when a UK domiciled individual gives assets to a non-UK domiciled spouse or civil partner. Inheritance tax: Non-UK domiciled spouses - TaxScape | Deloitte deloitte.com ? article ? inheritance-tax--n... deloitte.com ? article ? inheritance-tax--n...

The 2023 gift tax limit is $17,000. For married couples, the limit is $17,000 each, for a total of $34,000. This amount, formally called the annual gift tax exclusion, is the maximum amount you can give a single person without reporting it to the IRS.

The ?unlimited marital deduction? refers to the fact that gifts to a spouse, made during your lifetime or after death, are always exempt from the gift and estate tax. Moreover, there is no limit to the marital deduction.

The unlimited marital deduction is a provision in the US estate tax law that allows a married individual to transfer an unlimited amount of assets to their spouse, both during life and at death, without incurring any federal estate or gift taxes. Portability and the Unlimited Marital Deduction - Explained Step by Step wealthcarelawyer.com ? articles ? taxes ? portabili... wealthcarelawyer.com ? articles ? taxes ? portabili...

Spouse: You can transfer any amount of cash and property to your spouse tax-free as long as he or she is a U.S. citizen.