Texas Affidavit of Heirship for the Owner of the Property

Description

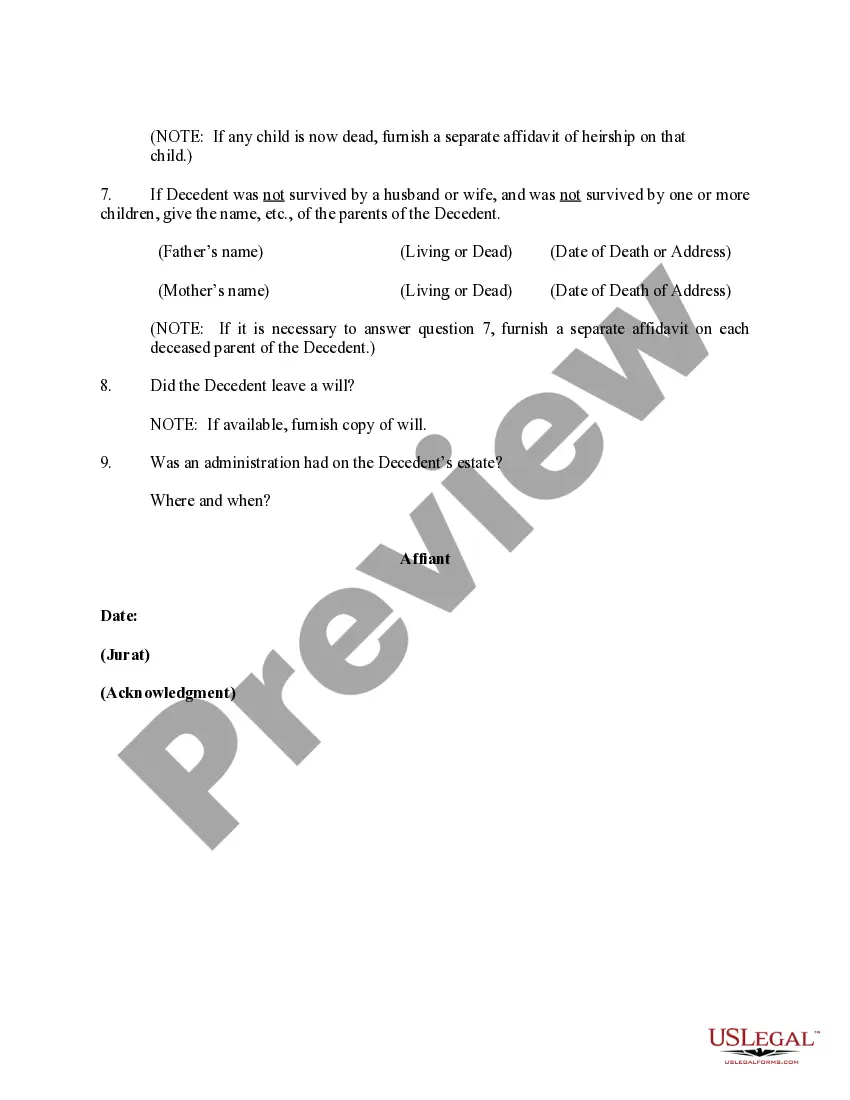

How to fill out Affidavit Of Heirship For The Owner Of The Property?

Discovering the right legitimate file format might be a battle. Obviously, there are plenty of templates available on the Internet, but how will you obtain the legitimate kind you need? Utilize the US Legal Forms web site. The services offers a large number of templates, for example the Texas Affidavit of Heirship for the Owner of the Property, that you can use for organization and private requirements. Each of the kinds are examined by professionals and meet state and federal specifications.

In case you are presently authorized, log in for your account and click the Down load switch to get the Texas Affidavit of Heirship for the Owner of the Property. Make use of account to check throughout the legitimate kinds you possess acquired earlier. Go to the My Forms tab of your own account and acquire an additional duplicate of the file you need.

In case you are a brand new user of US Legal Forms, allow me to share basic directions for you to follow:

- Very first, make certain you have selected the proper kind for the city/area. You may look through the form using the Preview switch and study the form outline to ensure this is the best for you.

- In the event the kind fails to meet your preferences, make use of the Seach discipline to find the proper kind.

- When you are certain that the form would work, click on the Purchase now switch to get the kind.

- Opt for the pricing strategy you would like and enter the essential info. Build your account and pay for the order using your PayPal account or bank card.

- Opt for the file format and obtain the legitimate file format for your device.

- Comprehensive, change and print and indicator the acquired Texas Affidavit of Heirship for the Owner of the Property.

US Legal Forms is definitely the biggest catalogue of legitimate kinds that you can discover a variety of file templates. Utilize the company to obtain expertly-manufactured files that follow state specifications.

Form popularity

FAQ

The County Clerk only requires an Affidavit of Death to make the transfer effective. You do not need additional proof of death to take ownership. However, you must give the title company a death certificate, obituary, or other acceptable document if you want to sell the property or use it as collateral.

If you are the only person named as the property's beneficiary, you have control over whether you sell it. But if you're one of multiple co-owners, you'll need your co-heirs' input about selling the house. Still, if one person wants to sell, they can force the sale. Do All Heirs Have to Agree to Sell the Property? - Home Bay Home Bay ? Blog Home Bay ? Blog

In intestate succession, spouses inherit first, then children, then parents and siblings. Stepchildren do not automatically receive a share of the estate unless the decedent legally adopted them. Grandchildren only inherit when the decedent's children are not alive to receive their share of an inheritance.

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.

If the property owner is deceased, he or she can no longer sign the deed. In that case, you need something different such as an Affidavit of Heirship, a probated Will or a court order determining heirship. First the deceased owner's name must be removed from the record ownership of the house (the title). How Do You Transfer a Deed After Death in Texas texaspropertydeeds.com ? how-do-you-trans... texaspropertydeeds.com ? how-do-you-trans...

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

If one sibling is living in an inherited property and refuses to sell, a partition action can potentially be brought by the other siblings or co-owners of the property in order to force the sale of the property. In general, no one can be forced to own property they don't want, but they can be forced to sell. Guide to Inheriting a House With Siblings - Keystone Law Group keystone-law.com ? inheriting-a-house-with-siblings keystone-law.com ? inheriting-a-house-with-siblings

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale. Can the Executor Of An Estate Sell Property Without Approval? glendoralaw.com ? can-an-executor-sell-esta... glendoralaw.com ? can-an-executor-sell-esta...