South Dakota Affidavit of Heirship for the Owner of the Property

Description

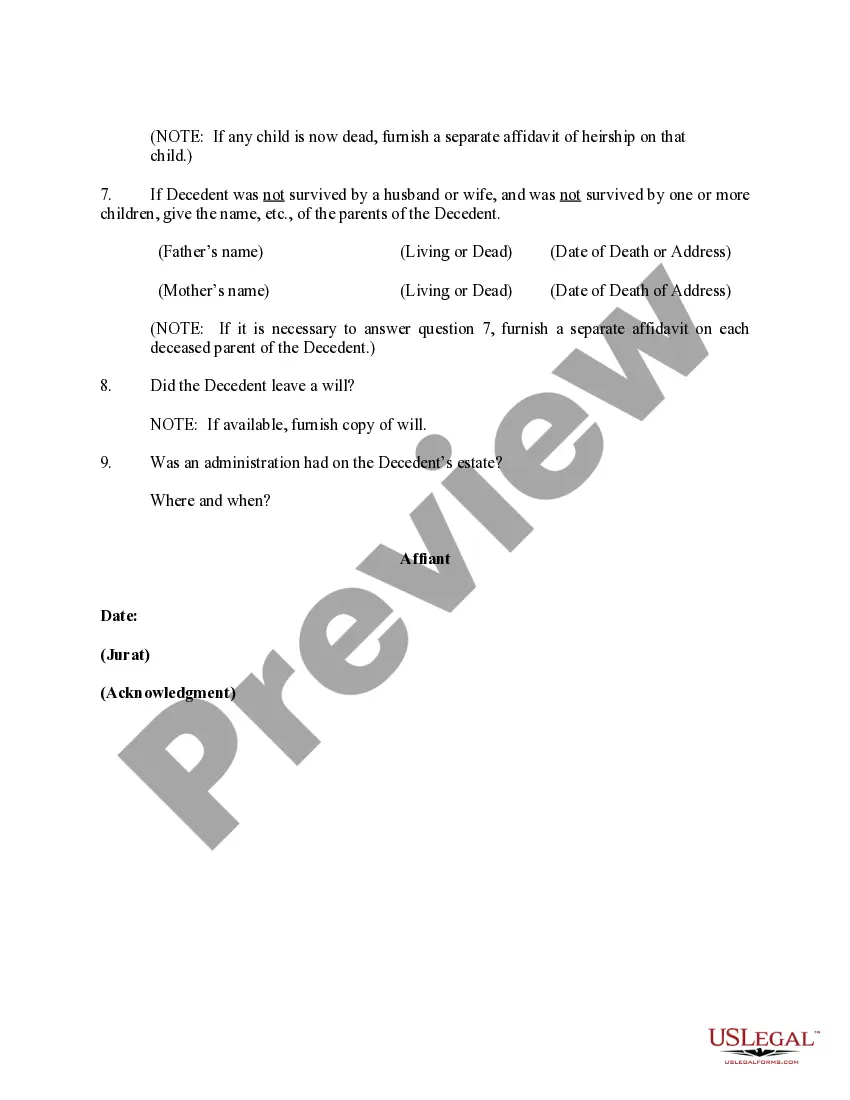

How to fill out Affidavit Of Heirship For The Owner Of The Property?

You can devote several hours on-line trying to find the legal document design that fits the federal and state requirements you will need. US Legal Forms supplies thousands of legal kinds that happen to be analyzed by pros. It is possible to download or print out the South Dakota Affidavit of Heirship for the Owner of the Property from your service.

If you already have a US Legal Forms profile, it is possible to log in and click on the Acquire switch. Next, it is possible to total, change, print out, or indicator the South Dakota Affidavit of Heirship for the Owner of the Property. Each legal document design you acquire is yours permanently. To have one more backup associated with a acquired kind, proceed to the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms internet site the very first time, follow the basic recommendations under:

- Very first, make certain you have selected the right document design to the region/area of your choosing. Browse the kind explanation to ensure you have selected the correct kind. If readily available, use the Preview switch to search through the document design too.

- In order to locate one more edition of your kind, use the Search industry to discover the design that meets your requirements and requirements.

- Upon having found the design you would like, click on Get now to carry on.

- Pick the costs strategy you would like, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal profile to cover the legal kind.

- Pick the format of your document and download it to the gadget.

- Make changes to the document if possible. You can total, change and indicator and print out South Dakota Affidavit of Heirship for the Owner of the Property.

Acquire and print out thousands of document layouts making use of the US Legal Forms website, that provides the biggest variety of legal kinds. Use specialist and status-specific layouts to handle your company or specific needs.

Form popularity

FAQ

It involves proving the will is valid, identifying and inventorying the deceased person's property, having the property appraised, paying debts and taxes, and distributing the remaining property as the will directs. In South Dakota, the cost for probate can range from $2,700 to $6,950 or more.

Under South Dakota statute, where as estate is valued at less than $50,000, an interested party may issue a small estate affidavit to collect any debts owed to the decedent. South Dakota Requirements: South Dakota requirements are set forth in the statutes below. § 29A-3-1201.

South Dakota: Personal representatives are entitled to ?reasonable compensation,? either specified in the will or outlined by the state as 5 percent of the first $1,000, 4 percent of the next $4,000 and 2.5 percent of any amount over $5,000.

A South Dakota small estate affidavit aids the transfer of personal property of a deceased individual (the ?decedent?) to their successors without formal probate proceedings. Any beneficiary entitled to the decedent's property may fill out this affidavit and use it to collect the assets from its current custodians.

South Dakota probate law requires the probate process to begin within three years of the individual's death. However, certain circumstances may affect this timeline.

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

Sixty days after the death of a decedent, any person claiming to be a successor to the decedent's interest in real property in this state may file, or cause to be filed on their behalf, an affidavit describing the real property owned by the decedent and the interest of the decedent in the property.

A South Dakota small estate affidavit is a document that can help a person using it, known as an ?affiant,? avoid traditional probate proceedings.