South Dakota Affidavit of Heirship for Real Property

Description

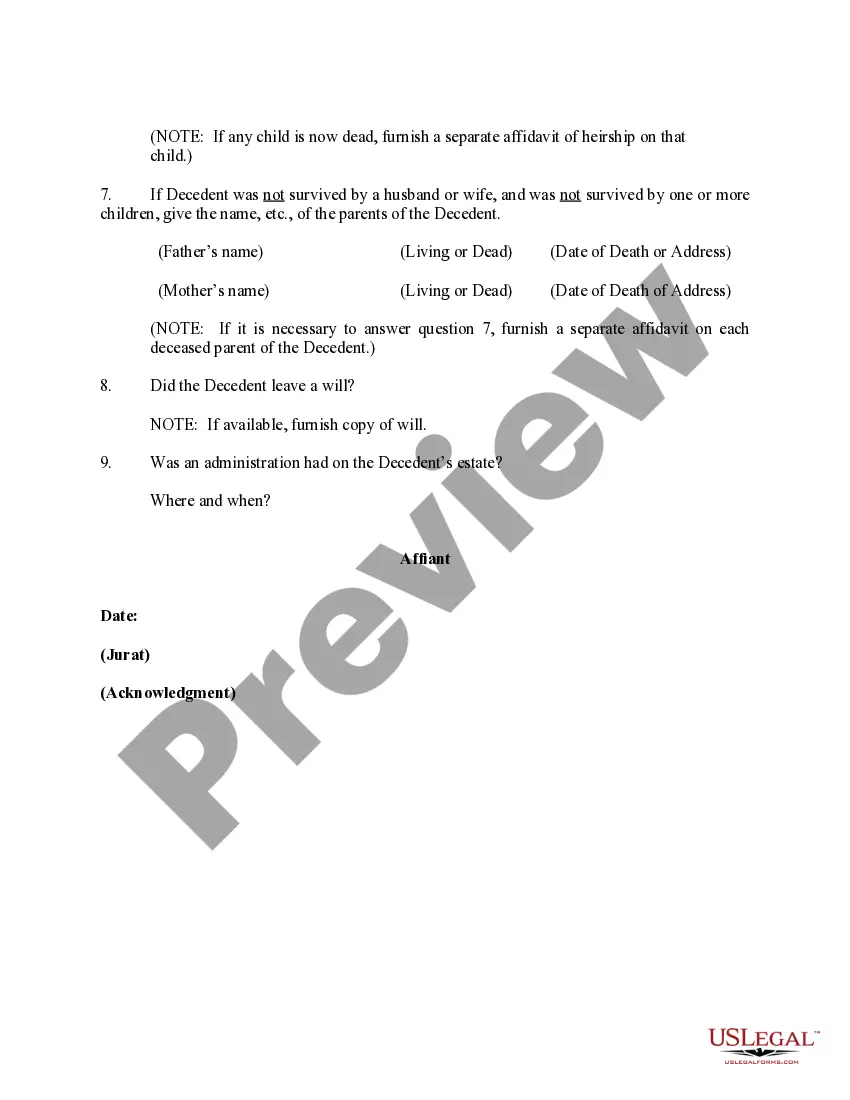

How to fill out Affidavit Of Heirship For Real Property?

US Legal Forms - one of several most significant libraries of authorized varieties in the United States - offers an array of authorized record themes it is possible to down load or print out. Utilizing the site, you may get a huge number of varieties for enterprise and personal uses, sorted by groups, claims, or key phrases.You will find the latest types of varieties just like the South Dakota Affidavit of Heirship for Real Property in seconds.

If you already have a subscription, log in and down load South Dakota Affidavit of Heirship for Real Property through the US Legal Forms local library. The Download switch will show up on every kind you perspective. You have access to all previously saved varieties within the My Forms tab of the profile.

If you would like use US Legal Forms initially, here are easy directions to help you get started:

- Be sure to have selected the right kind for your personal city/area. Click the Preview switch to review the form`s information. Browse the kind information to ensure that you have chosen the proper kind.

- In case the kind doesn`t suit your specifications, make use of the Research field near the top of the monitor to find the one who does.

- If you are content with the shape, validate your selection by simply clicking the Purchase now switch. Then, choose the pricing plan you favor and provide your accreditations to register on an profile.

- Process the financial transaction. Make use of bank card or PayPal profile to accomplish the financial transaction.

- Pick the file format and down load the shape on your product.

- Make modifications. Load, edit and print out and signal the saved South Dakota Affidavit of Heirship for Real Property.

Every single web template you included in your account lacks an expiry day and it is your own eternally. So, if you wish to down load or print out yet another backup, just proceed to the My Forms portion and click on around the kind you want.

Get access to the South Dakota Affidavit of Heirship for Real Property with US Legal Forms, the most extensive local library of authorized record themes. Use a huge number of specialist and state-particular themes that satisfy your business or personal requirements and specifications.

Form popularity

FAQ

Unmarried Individuals Without Children in South Dakota Inheritance Law Intestate Succession: Extended FamilyChildren, but unmarriedEntire estate to childrenParents, but no spouse, children, or siblingsEntire estate to parentsParents are deceased, and no spouse or childrenEntire estate goes to siblings.1 more row ?

Codified Law 29A-3-1201 | South Dakota Legislature. 29A-3-1201. Collection of personal property by affidavit. (5) The claiming successor is entitled to payment or delivery of the property.

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

Ultimately, an intestate estate could be distributed to the decedent's grandparents or their descendants. But if the decedent is not survived by a spouse, the decedent's grandparents, or any descendants of the decedent's grandparents, then the intestate estate will ?escheat? to the State of South Dakota.

Sixty days after the death of a decedent, any person claiming to be a successor to the decedent's interest in real property in this state may file, or cause to be filed on their behalf, an affidavit describing the real property owned by the decedent and the interest of the decedent in the property.

Inheritance and Estate Taxes: South Dakota does not have an inheritance tax. The voters of South Dakota repealed the state inheritance tax effective July 1, 2001. There is also no estate tax.

Inheritance Rights Of Children And Grandchildren In general, children and grandchildren have no legal right to inherit a deceased parent or grandparent's property. This means that if children or grandchildren are not included as beneficiaries, they will not, in all likelihood, be able to contest the Will in court.

A South Dakota small estate affidavit aids the transfer of personal property of a deceased individual (the "decedent") to their successors without formal probate proceedings. Any beneficiary entitled to the decedent's property may fill out this affidavit and use it to collect the assets from its current custodians.