Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

New York Structured Settlement Factoring Transactions

Description

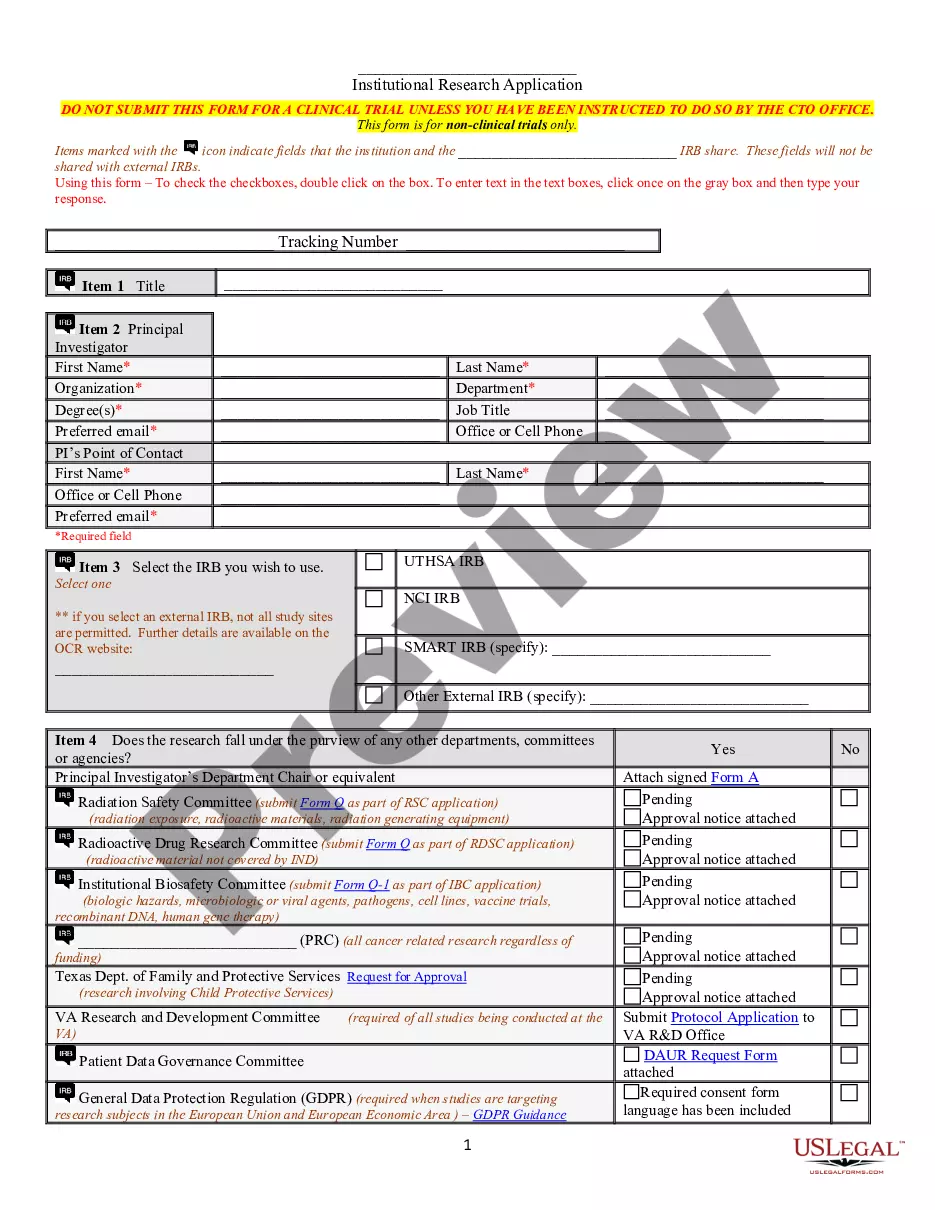

How to fill out Structured Settlement Factoring Transactions?

Have you been inside a position the place you need to have papers for sometimes enterprise or individual functions nearly every working day? There are tons of lawful file layouts available on the net, but discovering types you can rely isn`t simple. US Legal Forms offers 1000s of form layouts, much like the New York Structured Settlement Factoring Transactions, which can be written to fulfill state and federal demands.

When you are already acquainted with US Legal Forms website and get a free account, merely log in. After that, it is possible to download the New York Structured Settlement Factoring Transactions web template.

Unless you come with an profile and would like to start using US Legal Forms, follow these steps:

- Discover the form you want and make sure it is for your proper area/area.

- Take advantage of the Review option to review the shape.

- Look at the outline to ensure that you have chosen the right form.

- In the event the form isn`t what you are looking for, use the Lookup discipline to discover the form that suits you and demands.

- Whenever you discover the proper form, just click Get now.

- Opt for the pricing program you desire, fill in the necessary info to make your account, and purchase your order utilizing your PayPal or bank card.

- Pick a practical paper file format and download your duplicate.

Find all of the file layouts you possess bought in the My Forms food list. You can obtain a extra duplicate of New York Structured Settlement Factoring Transactions anytime, if possible. Just click the required form to download or printing the file web template.

Use US Legal Forms, the most comprehensive collection of lawful varieties, to conserve time as well as stay away from errors. The services offers professionally created lawful file layouts that can be used for an array of functions. Create a free account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Often, customers receive their funds from their structured settlement payment sale transaction within 60 to 90 days and funds from their annuity payment sale transaction within two to three weeks after their contract is finalized. Why JG Wentworth jgwentworth.com ? why-jg-wentworth jgwentworth.com ? why-jg-wentworth

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime.

Structured Settlement calls people on old and expired debts, to get your Debit or Credit Card and make payments that are usually outside the statute of limitations.

Different Types of Structured Settlement Payouts Temporary life annuity. Joint and survivor annuity. Deferred lump-sum. Percentage increase annuity. Step annuities. Structured Settlement Payout Options: Understanding Your Choices annuity.org ? structured-settlements ? payou... annuity.org ? structured-settlements ? payou...

Cashing out a structured settlement can be a good way to access a significant amount of cash. But before making such a significant decision, review all of the costs carefully. If you decide to proceed with a sale, get offers from at least two to three different buyers to ensure you're getting the best deal possible.

What is a Structured Settlement? A structured settlement annuity (?structured settlement?) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date. How To Sell Your Structured Settlement in 5 Steps - Annuity.org annuity.org ? structured-settlements ? selling annuity.org ? structured-settlements ? selling

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration. 26 U.S. Code § 5891 - Structured settlement factoring transactions cornell.edu ? uscode ? text cornell.edu ? uscode ? text