Statutory Guidelines [Appendix A(5) Tres. Regs 1.46B and 1.46B-1 to B-5] regarding designated settlement funds and qualified settlement funds.

New York Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5

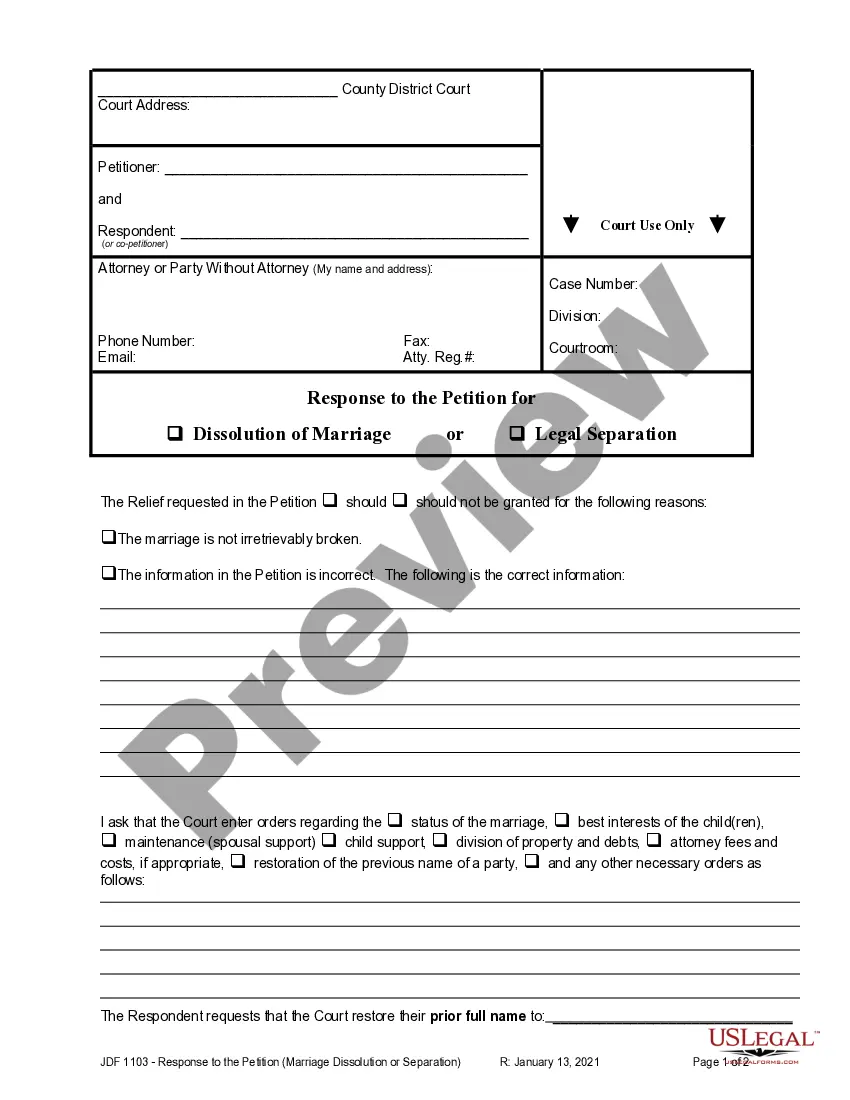

Description

How to fill out Designated Settlement Funds Treasury Regulations 1.468 And 1.468B.1 Through 1.468B.5?

If you want to complete, obtain, or print authorized file templates, use US Legal Forms, the biggest assortment of authorized forms, which can be found on-line. Take advantage of the site`s basic and hassle-free lookup to get the paperwork you will need. A variety of templates for business and personal functions are sorted by classes and states, or keywords and phrases. Use US Legal Forms to get the New York Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 in just a number of mouse clicks.

If you are previously a US Legal Forms customer, log in to the profile and click the Download option to get the New York Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5. You can even gain access to forms you previously saved inside the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for that proper area/region.

- Step 2. Make use of the Review option to check out the form`s articles. Never forget about to read through the description.

- Step 3. If you are unsatisfied with all the type, utilize the Look for area on top of the display screen to get other models in the authorized type format.

- Step 4. After you have found the shape you will need, go through the Buy now option. Choose the costs program you like and include your accreditations to register for an profile.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal profile to complete the transaction.

- Step 6. Pick the file format in the authorized type and obtain it on your own system.

- Step 7. Comprehensive, modify and print or indication the New York Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5.

Every single authorized file format you buy is your own permanently. You possess acces to each type you saved with your acccount. Select the My Forms area and choose a type to print or obtain once more.

Remain competitive and obtain, and print the New York Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 with US Legal Forms. There are thousands of skilled and state-distinct forms you can utilize for your business or personal needs.

Form popularity

FAQ

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

Legal settlements that are taxable (including previously deducted medical expenses related to physical injury or illness) are entered as miscellaneous (other) income. Interest earned on settlements is taxable income and should be entered as a Form 1099-INT.

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds.

§ 1.468B. Modified gross income of the FUND consists of income from intangible property, including obligations of the United States exempted from state tax by section 3124, Title 31, United States Code.

A structured settlement is an arrangement in which the settlement payment is paid out over time, rather than in a lump sum. This can help to avoid taxes on the settlement payment by spreading out the tax liability over a longer period of time.

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

Tax deduction A QSF enables the defendant (or insurer) to accelerate its tax deduction to the date that the settlement amount paid is to the Qualified Settlement Fund in exchange for a general release, rather than when each plaintiff, signs and is paid.