New York Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

Locating the appropriate valid document template can be challenging. Naturally, there is a multitude of templates accessible online, but how can you acquire the correct one you desire.

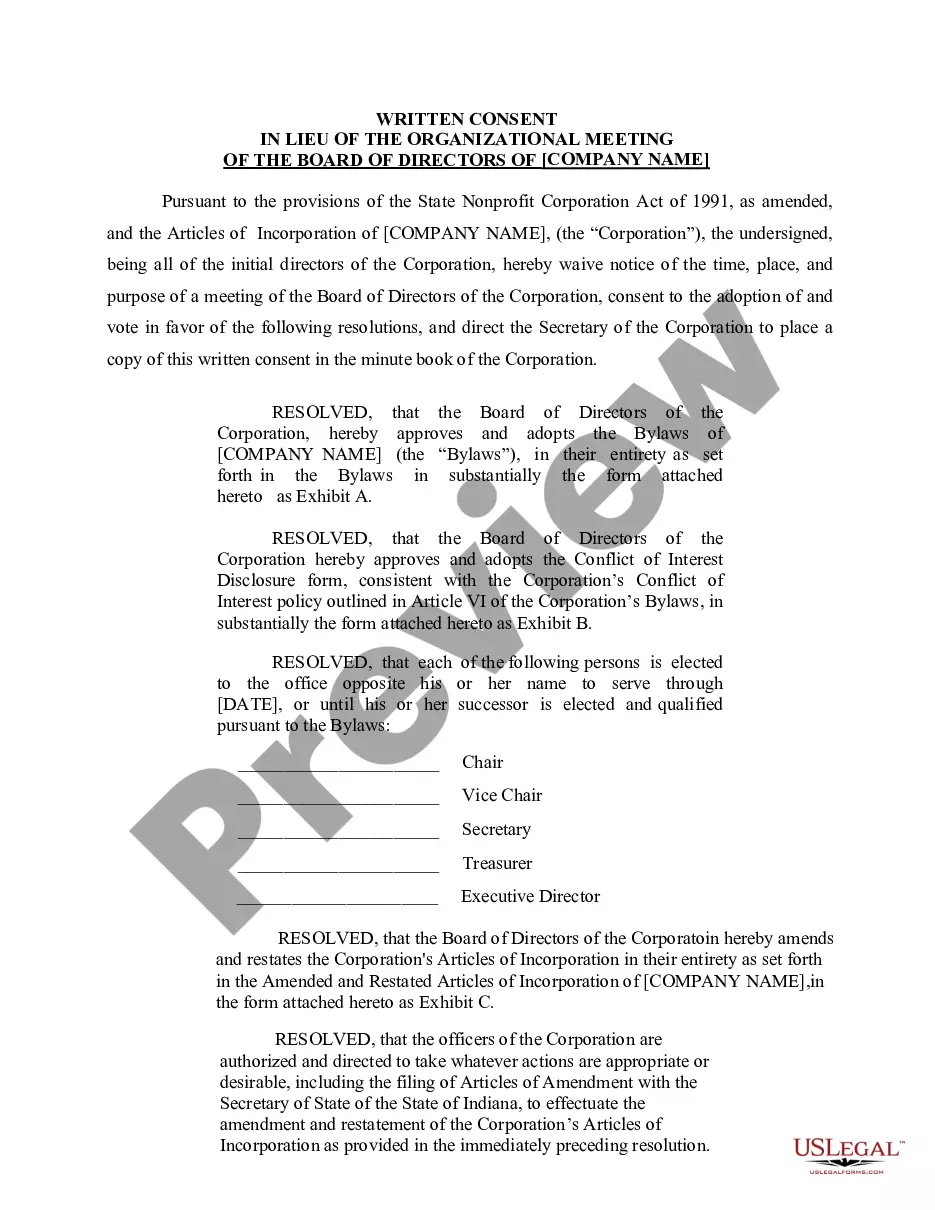

Utilize the US Legal Forms platform. This service offers a vast array of templates, such as the New York Pay in Lieu of Notice Guidelines, which you can use for both business and personal needs. Each of these forms is reviewed by experts and complies with federal and state regulations.

If you are already registered, Log In to your account and then select the Download option to obtain the New York Pay in Lieu of Notice Guidelines. Use your account to access the valid forms you have previously acquired. Visit the My documents section of your account to obtain another copy of the document you require.

Choose the file format and download the valid document template to your device. Complete, modify, print, and sign the acquired New York Pay in Lieu of Notice Guidelines. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download properly crafted documents that adhere to state regulations.

- Firstly, ensure that you have selected the correct form for your locality/state.

- You can view the form using the Preview option and read the form description to confirm it is the right one for you.

- If the form does not meet your requirements, use the Search function to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase now button to acquire the form.

- Select the pricing plan you prefer and enter the necessary details.

- Create your account and process your payment using your PayPal account or credit card.

Form popularity

FAQ

The 4 hour rule in New York stipulates that employees who report to work and are sent home early must be compensated for a minimum of four hours of pay. This rule is part of the New York Pay in Lieu of Notice Guidelines, ensuring that workers receive fair compensation for their time. Knowing this rule helps employees assert their rights and understand their entitlements when faced with sudden changes in work schedules. For more information on complying with these regulations, consider using the US Legal Forms platform.

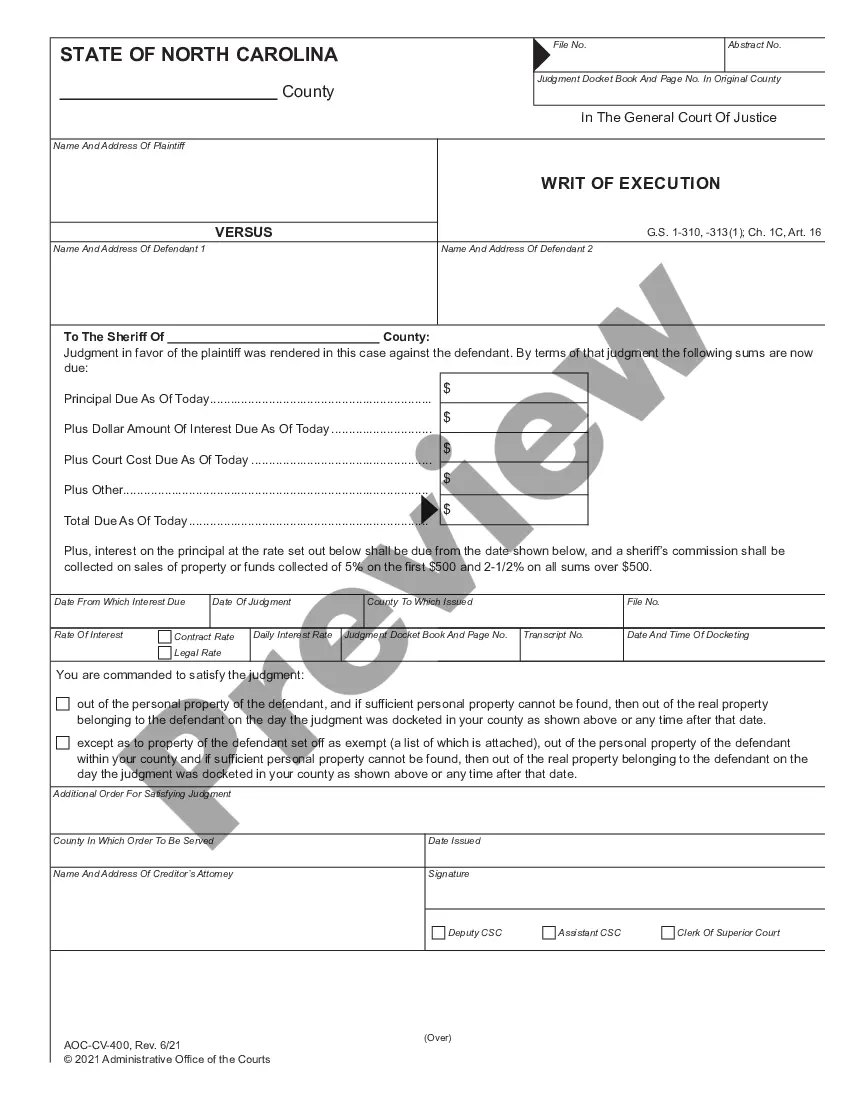

The term 'in lieu of notice' refers to a situation where an employer provides compensation to an employee instead of giving advance notice of termination. Under the New York Pay in Lieu of Notice Guidelines, employers choose to make a monetary payment instead of allowing the employee to work through a notice period. This practice can help both parties avoid prolonged transitions and reduce misunderstandings. It’s essential to understand these guidelines to ensure compliance and fair treatment.

Processing payment in lieu of notice involves calculating the amount due based on the employee's earnings and the duration of the notice period they would have worked. Employers should refer to the New York Pay in Lieu of Notice Guidelines to comply with legal requirements during this process. Platforms like US Legal Forms offer resources and templates that help simplify this process, ensuring that both parties understand the necessary steps and forms.

Payment in lieu of leave occurs when an employee does not take their entitled leave and instead receives compensation for it. This payment is typically calculated based on the employee's salary and the amount of leave they have accrued. Understanding New York Pay in Lieu of Notice Guidelines can help ensure that both employers and employees are aware of their rights and responsibilities regarding leave compensation.

Payment in lieu of notice refers to the compensation an employer provides when they choose not to give an employee the standard notice period before termination. Instead of working through this notice, the employer compensates the employee for the time they would have typically worked. According to New York Pay in Lieu of Notice Guidelines, employers must adhere to state regulations, ensuring fair treatment for employees during this process.

To process payment in lieu of notice, first ensure compliance with New York Pay in Lieu of Notice Guidelines. Then, calculate the payment amount based on the employee's regular earnings for the notice period. Finally, document the transaction clearly and provide the employee with a payment summary, which might include a formal letter detailing the payment specifics.

To calculate payment in lieu of notice, determine the employee's regular wage and multiply it by the notice period. Under New York Pay in Lieu of Notice Guidelines, factors like bonuses or benefits may also need to be included in this calculation. Doing this ensures that employees receive fair compensation upon termination.

A letter payment in lieu of notice by an employer is a formal document confirming the payment made to an employee instead of serving the notice period. This letter outlines the terms of the payment, detailing the amount and any relevant deductions, as guided by New York Pay in Lieu of Notice Guidelines. Crafting this letter accurately is crucial for legal clarity and compliance.

Payment in lieu of notice in New York means that an employer pays an employee for a specified notice period instead of requiring them to work it. According to New York Pay in Lieu of Notice Guidelines, this practice helps employees receive compensation while allowing companies to manage workforce changes effectively. Understanding these guidelines can help ensure fair treatment during employment transitions.

Payment in lieu of leave refers to monetary compensation provided to an employee for unused leave days, as per New York Pay in Lieu of Notice Guidelines. Instead of granting additional time off, employers may choose to compensate employees for their unused leave at the time of termination. This approach allows for smoother transitions for both the employer and employee.