Arizona Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

Choosing the best authorized file format might be a have difficulties. Of course, there are a lot of web templates available online, but how can you discover the authorized form you need? Utilize the US Legal Forms internet site. The services offers 1000s of web templates, such as the Arizona Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop, which you can use for organization and private demands. Each of the kinds are examined by pros and fulfill federal and state needs.

In case you are currently authorized, log in to your account and click on the Download switch to get the Arizona Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop. Utilize your account to search from the authorized kinds you may have acquired earlier. Go to the My Forms tab of your respective account and have another backup in the file you need.

In case you are a brand new customer of US Legal Forms, allow me to share straightforward instructions for you to stick to:

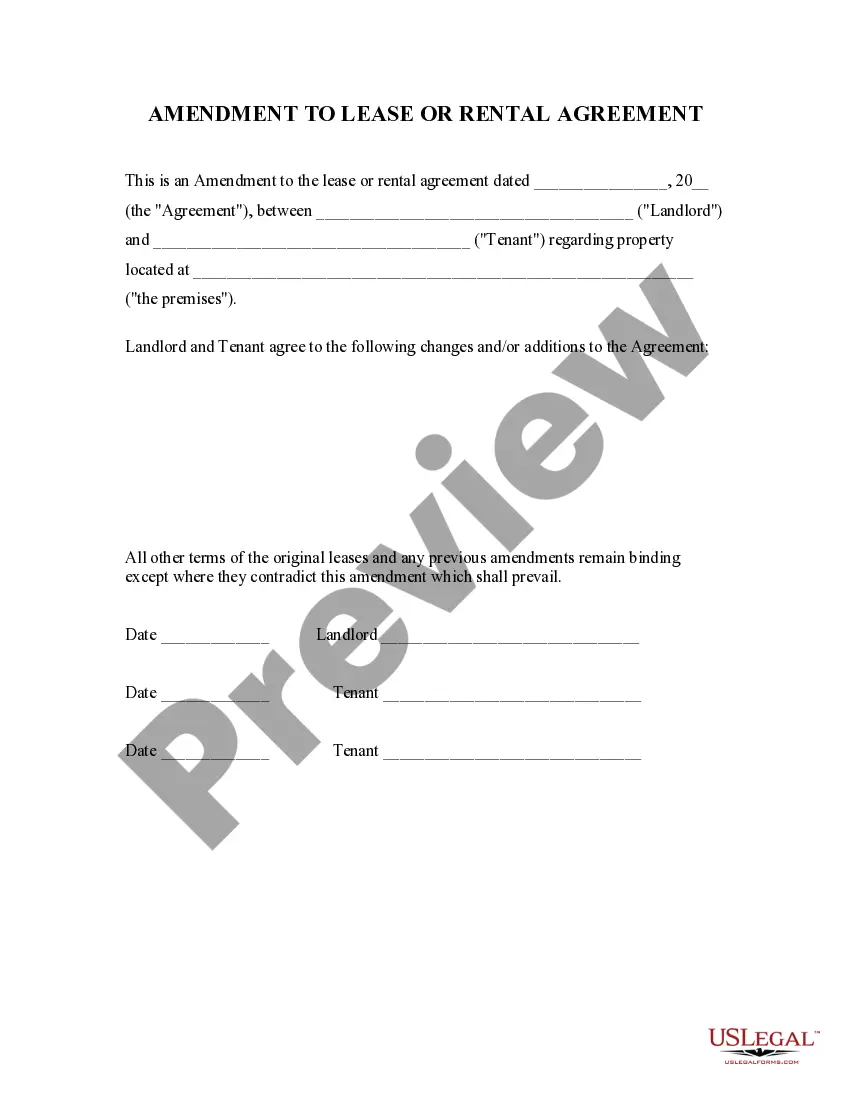

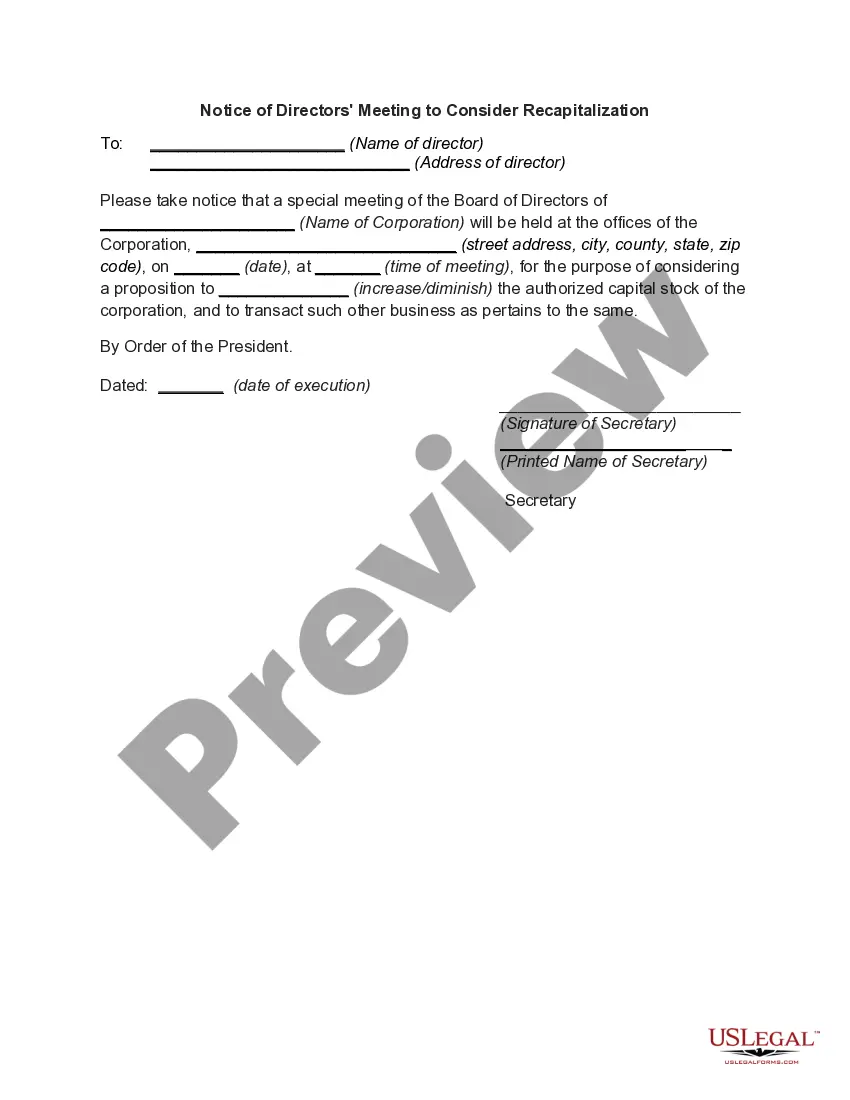

- First, make certain you have selected the right form for your metropolis/county. It is possible to examine the shape making use of the Preview switch and study the shape outline to make sure this is the right one for you.

- When the form is not going to fulfill your requirements, utilize the Seach area to get the proper form.

- When you are certain that the shape is acceptable, select the Acquire now switch to get the form.

- Pick the rates prepare you need and type in the required information and facts. Design your account and pay money for the order making use of your PayPal account or Visa or Mastercard.

- Select the file structure and obtain the authorized file format to your gadget.

- Complete, modify and printing and signal the obtained Arizona Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

US Legal Forms is the most significant collection of authorized kinds in which you can find numerous file web templates. Utilize the service to obtain professionally-produced files that stick to express needs.

Form popularity

FAQ

They have a dress code to follow, behavioral or procedural policies are in place, they need to arrive on time and their prices are determined by the salon owner. In this structure stylists are paid their agreed upon commission split throughout the year and then are handed a 1099 to file on their own.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

Taxgirl says: Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.

Some are more common to barber shops than others. You must also provide a 1099-MISC form to other contractors if they meet the following criteria: they provided a service, not a product. you paid them at least $600.

You income is reported on 1099-MISC (Box 7), 1099-K (Box 1a), or you receive cash, check or credit card sales transactions, instead of a W-2.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

Yes, beauty salon owners that are self-employed (meaning their business entity is not set up as a C Corporation) are eligible for the Qualified Business Deduction.

Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.

To write off your barber expenses, you must complete IRS Form 1040. Enter your business expenses in the 1040's "Deductions" section. You can take a standard deduction if your total expenses do not exceed the set dollar amount allowed.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.