Alaska Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

You can dedicate hours online trying to locate the legal document template that fulfills the state and federal criteria you require.

US Legal Forms offers a vast selection of legal documents that are examined by professionals.

You can download or print the Alaska Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop from our services.

To find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you may sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Alaska Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

- Every legal document template you obtain is yours for a lifetime.

- To acquire another copy of an acquired template, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/area of your preference.

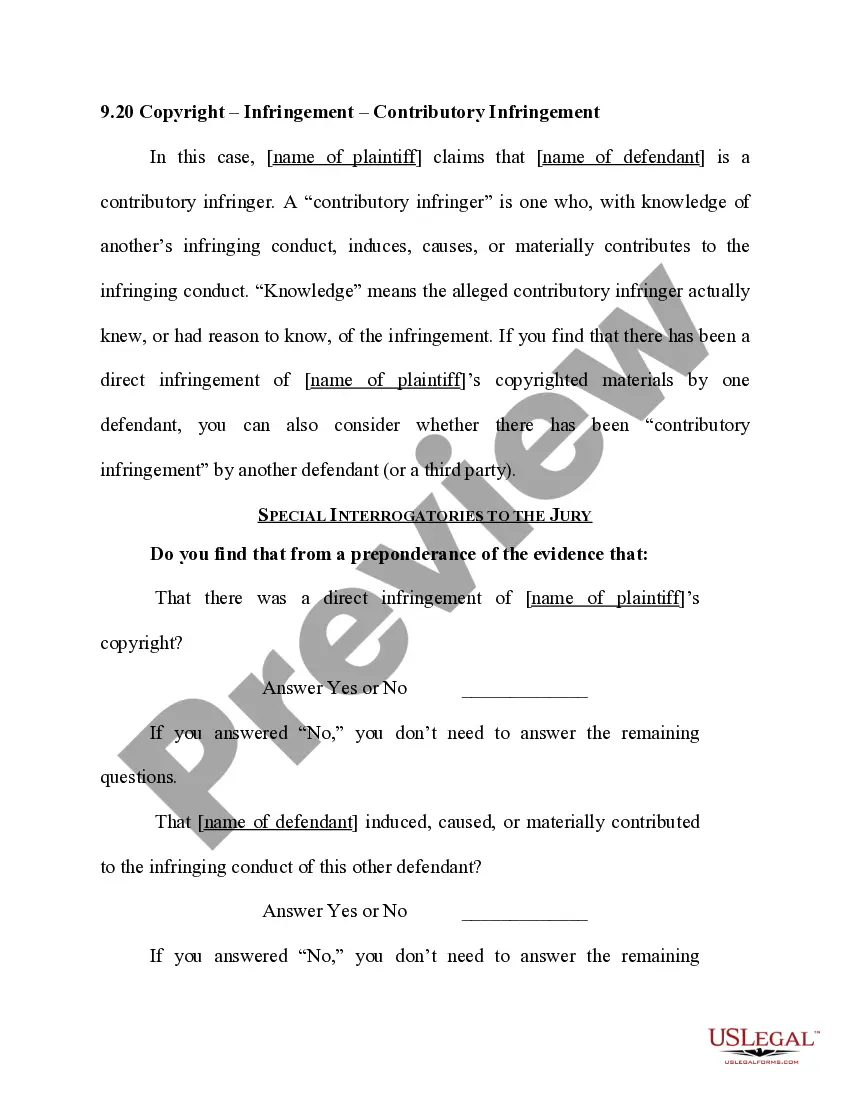

- Review the document details to ensure you have chosen the correct form. If available, utilize the Preview button to review the document template as well.

Form popularity

FAQ

Barbers usually serve male clients for shampoos, haircuts, and shaves. Some fit hairpieces and perform facials. Hairdressers, or hairstylists, provide coloring, chemical hair treatments, and styling in addition to shampoos and cuts, and serve both female and male clients.

A freelance job is one where a person (hairstylist in this case) works for themselves, rather than for a company. While freelancers do take on contract work for companies and organisations they are ultimately self employed. So think of you, the stylist, as a business working within a business.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

You earn money as a contractor, consultant, freelancer, or other independent worker. You income is reported on 1099-MISC (Box 7), 1099-K (Box 1a), or you receive cash, check or credit card sales transactions, instead of a W-2.

They have a dress code to follow, behavioral or procedural policies are in place, they need to arrive on time and their prices are determined by the salon owner. In this structure stylists are paid their agreed upon commission split throughout the year and then are handed a 1099 to file on their own.

Some are more common to barber shops than others. You must also provide a 1099-MISC form to other contractors if they meet the following criteria: they provided a service, not a product. you paid them at least $600.

LLC vs. Sole ProprietorshipBarbers who work as independent contractors will probably start out operating as a sole proprietorship. In fact, you don't have to do anything but earn extra income to operate as a sole proprietorship.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.

Taxgirl says: Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.