New York Compensation Administration Checklist

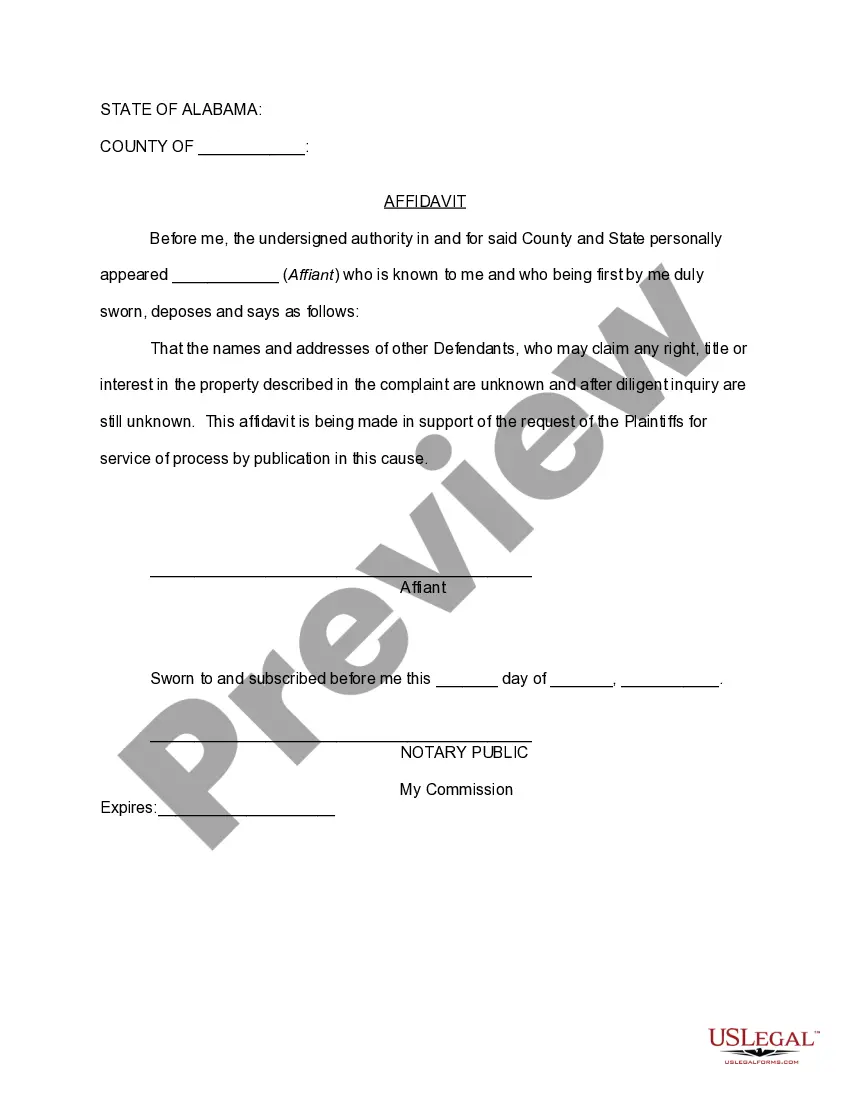

Description

How to fill out Compensation Administration Checklist?

It is feasible to spend numerous hours online attempting to locate the legal document template that meets the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that are evaluated by specialists.

It is straightforward to download or print the New York Compensation Administration Checklist from my service.

To acquire another version of the document, utilize the Lookup field to find the template that matches your requirements.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the New York Compensation Administration Checklist.

- Every legal document template you purchase is yours permanently.

- To retrieve another copy for any acquired form, navigate to the My documents tab and select the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- Initially, ensure that you have selected the correct document template for the county/town of your choice.

- Review the document description to ensure you have chosen the correct document.

Form popularity

FAQ

About. As of January 1, 2018, paid family leave is mandatory in New York State. Almost all employees are eligible for paid family leave, and employers must give their employees paid family leave.

The Paid Family Leave Program (PFL) is an insurance program administered by the state that will enable workers in New York to take up to 12 weeks of paid time off in order to care for a seriously ill family member, bond with a new child or to address certain issues related to family members' military service.

Important Note: An employer cannot discriminate or retaliate against an employee for requesting or taking Paid Family Leave. An employer must reinstate the employee to the same or a comparable position when the employee returns from Paid Family Leave.

No. The PFL program is 100% funded entirely through worker contributions to the State Disability Insurance program. Employers do not have to pay employees' salaries while they are on leave.

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4. See Employee Withholding Forms. Employers in certain industries must obtain statements from new hires.

Don't forget, in order to opt-out of Paid Family Leave, an employee must meet the specific requirement listed above in answer #1; and they must submit an opt-out waiver to their employer. The employer must keep the waiver on file for as long as the employee works for them whether the waiver is still in force or not.

Upon return from FMLA leave, you will be placed in the same job or an equivalent position with status, benefits, and other employment terms and conditions restored. An employer may not interfere with, restrain, or deny the exercise of any right provided under FMLA.

Important Note: An employer cannot discriminate or retaliate against an employee for requesting or taking Paid Family Leave. An employer must reinstate the employee to the same or a comparable position when the employee returns from Paid Family Leave.

If an employee does not provide either a complete and sufficient certification or an authorization allowing the health care provider to provide a complete and sufficient certification to the employer, the employee's request for FMLA leave may be denied.

New York Paid Family Leave is fully funded by employee payroll contributions. What coverage do employers need? Most private employers with one or more employees in employment in New York State are required to have Paid Family Leave insurance in place.