New York Credit Application

Description

How to fill out Credit Application?

Have you ever been in a position where you require documents for both a business or particular duties almost daily.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of document templates, including the New York Credit Application, which can be tailored to meet federal and state regulations.

Once you find the appropriate template, click Acquire now.

Choose a payment plan, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are currently acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New York Credit Application template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the template you need and ensure it corresponds to your specific jurisdiction/county.

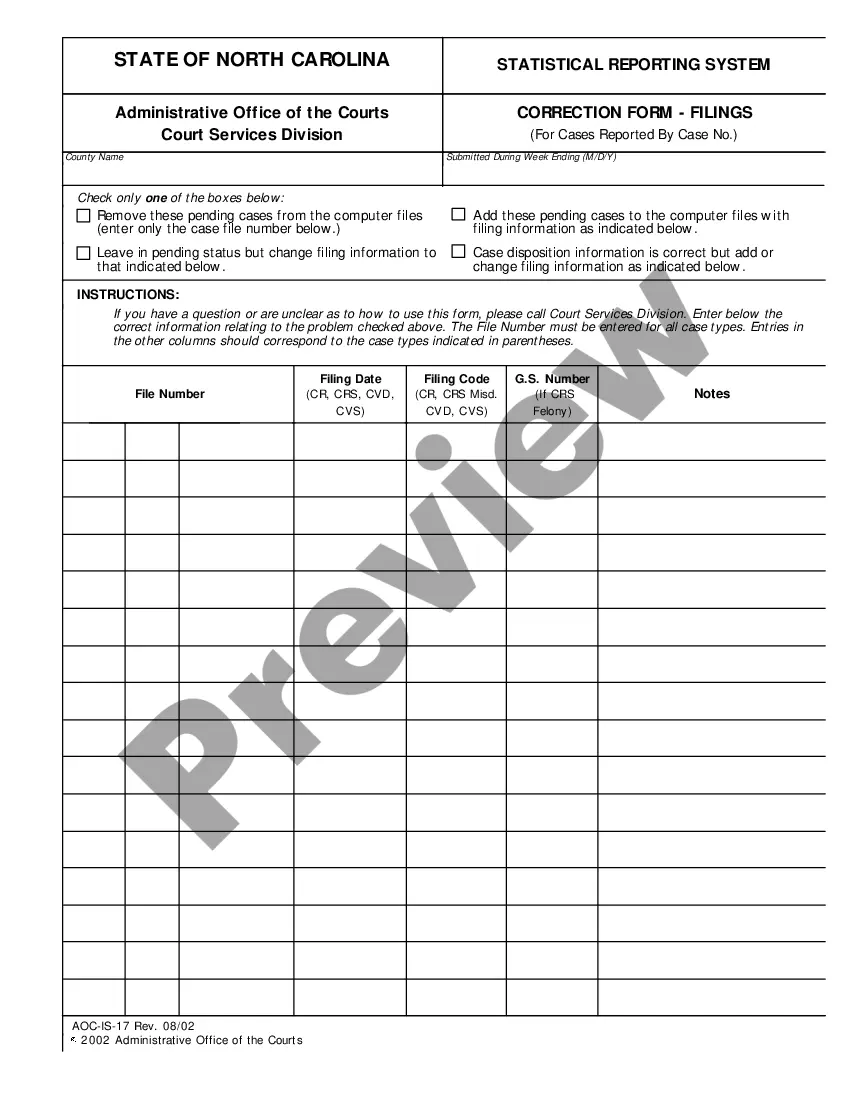

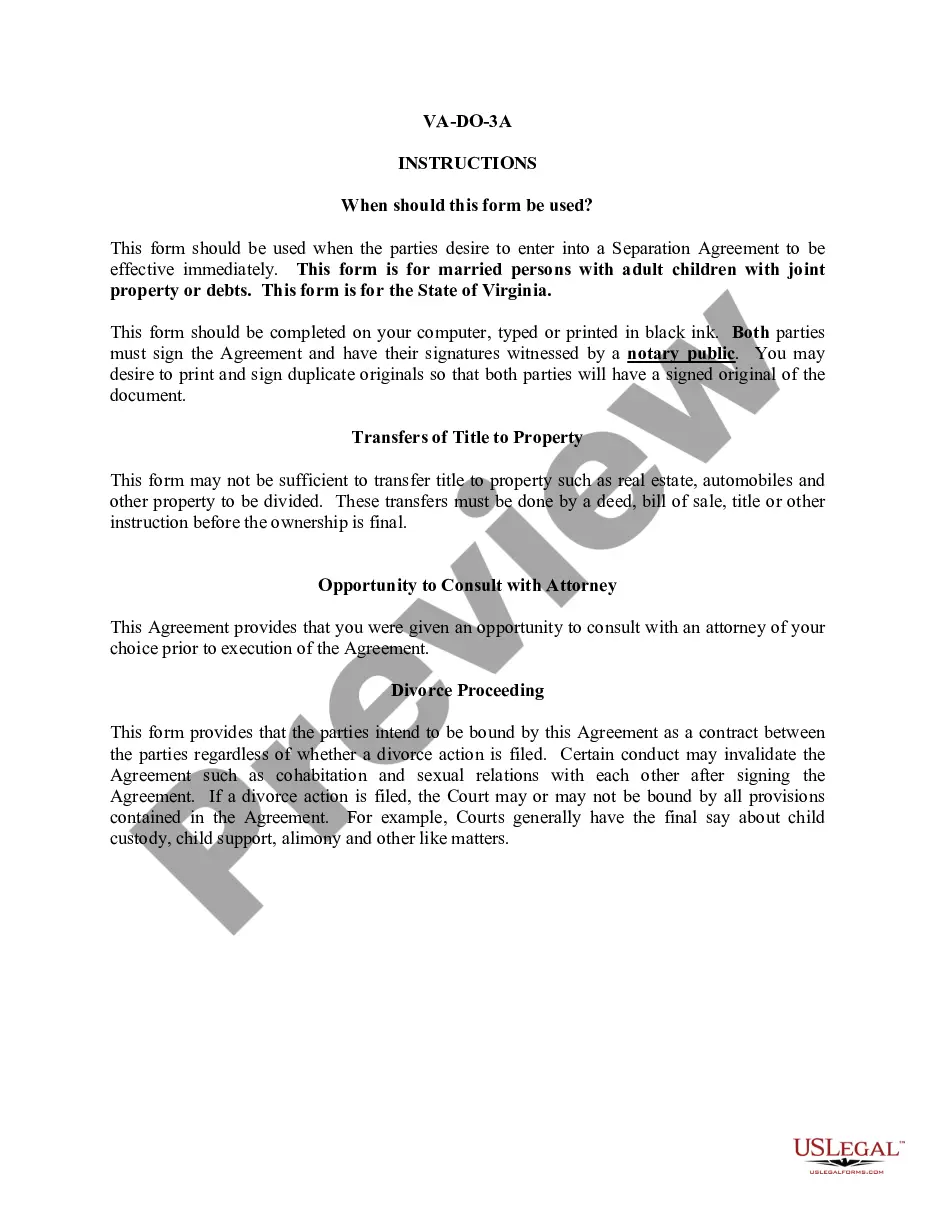

- Use the Preview feature to review the template.

- Verify the information to ensure you have selected the correct document.

- If the template does not meet your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

The New York City School Tax Credit is available to New York City residents or part-year residents who can't be claimed as dependents on another taxpayer's federal income tax return. You can take a refundable credit of $125 if you're married, file a joint return, and have an income of $250,000 or less.

New York State household creditfull- or part-year resident. married or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate) single with an FAGI of $28,000 or less.

You are entitled to this nonrefundable credit if you: cannot be claimed as a dependent on another individual's federal income tax return, and.

To file as head of household, you must: Pay for more than half of the household expenses. Be considered unmarried for the tax year, and. You must have a qualifying child or dependent.

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

Maximum Credit Amounts The maximum amount of credit: No qualifying children: $510. 1 qualifying child: $3,400. 2 qualifying children: $5,616.

The real property tax credit may be available to New York State residents who have household gross income of $18,000 or less, and pay either real property taxes or rent for their residence(s). If all members of the household are under age 65, the credit can be as much as $75.

Household Tax Credit The credit is worth up to $75 for single filers who earn less than $28,000. For other filers, the credit is based on the number of dependents claimed on your New York tax return.

It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to $1,000) can be refunded to you.

New York State household creditmarried or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate) single with an FAGI of $28,000 or less.