New York Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

US Legal Forms - one of the largest collections of official documents in the United States - offers a vast array of legal document templates that you can download or print.

Through the website, you can discover thousands of forms for both business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the New York Authority of Partnership to Open Deposit Account and to Procure Loans in a matter of seconds.

If you possess an account, Log In to access the New York Authority of Partnership to Open Deposit Account and to Procure Loans from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the saved New York Authority of Partnership to Open Deposit Account and to Procure Loans. Each template you added to your account does not expire and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the New York Authority of Partnership to Open Deposit Account and to Procure Loans with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your locality/region.

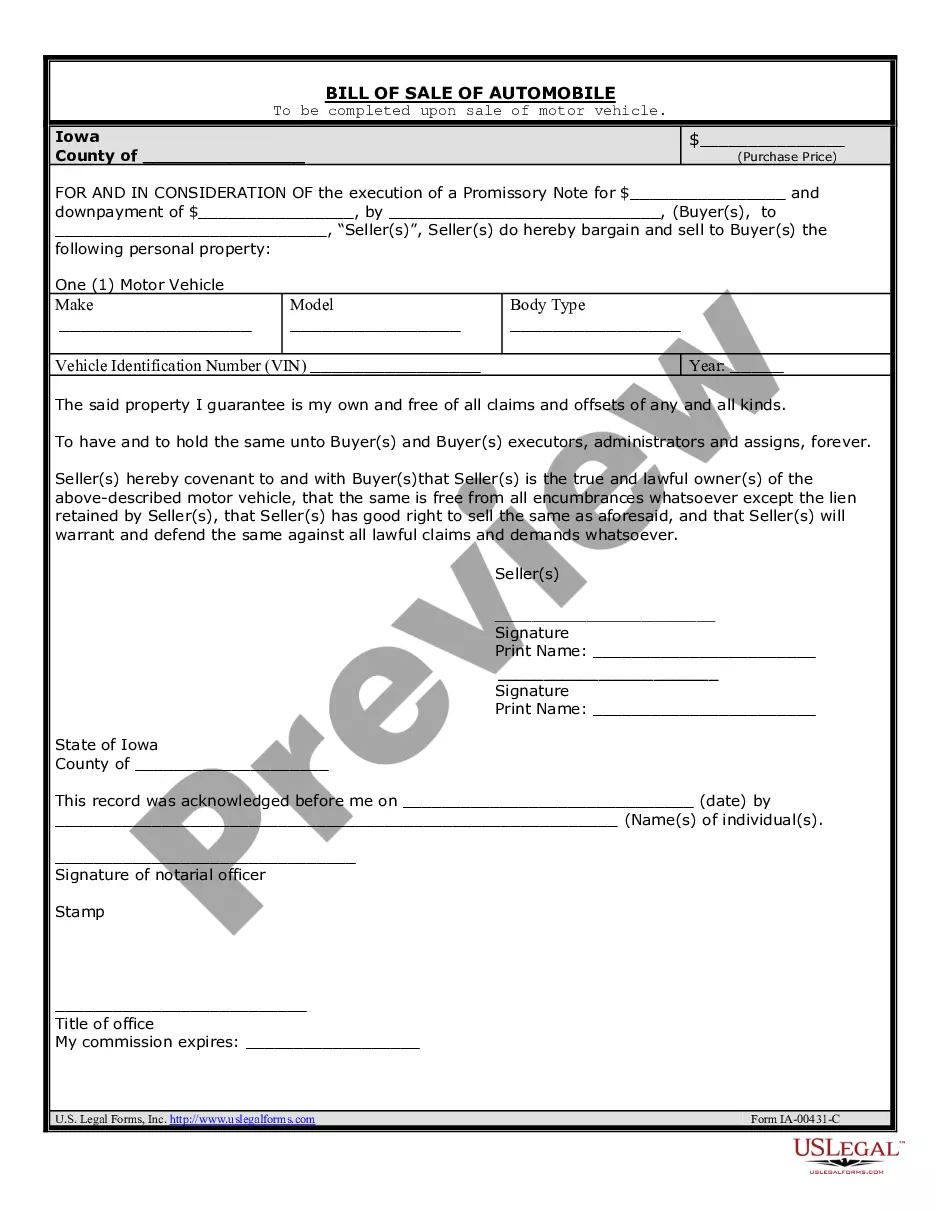

- Click on the Preview button to review the form's contents.

- Check the form description to ensure you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Opening a business bank account requires proof of identification for both you and your business. Examples include your state-issued driver's license or passport, your business license or your partnership agreements. Your business also may need to provide additional materials.

The Excelsior Linked Deposit Program was created in 1997 to assist small- and mid-size businesses in New York with expansions, modernizations, developments and other investment projects.

Many of the basic requirements include:DTI or SEC registration form.Barangay clearance.Zoning clearance.Sketch of the location.Land title or contract of lease.Community tax certificate.Public liability insurance.Occupancy permit.More items...

The linked deposit is simply an interest subsidy inducement to the bank to make a loan it has approved and is. responsible for at a lower rate of interest. The Lender makes the credit decision and services the loan.

What You Need to Open a Business Bank AccountSocial Security Number or Employer Identification Number (EIN)Personal Identification.Business License.Certificate of Assumed Name.Partnership Agreement.Organizing Documents.Monthly Credit Card Revenue.

A Low Deposit Premium (LDP) is a one-off, non-refundable, non-transferrable bank fee that we add to low deposit home loans. Designed to reflect the risk associated with low deposit loans, LDP is calculated based on the size of your deposit and how much you borrow.

The Linked Deposit program encourages banks to expand lending to disadvantaged businesses. Linked Deposit Program loans may be combined with other loan programs. The Linked Deposit interest rate is available for term loans only or loans with fixed rates with one disbursement.

Learn how to set up a business bank account using the following four steps.Choose a bank. The first step of setting up a business account is deciding on a bank.Prepare documents. The next step of opening a business account is to get your papers in order.Open the account online or in-person.Verify everything is correct.

Requirements for Company, Corporate or Commercial Bank AccountsArticles of Incorporation.Certificate of Registration with the Securities and Exchange Commission.Corporate By-Laws.Board Resolution duly notarized incorporating the following: Authority to open a bank account.