Virginia Revocable Trust for Child

Description

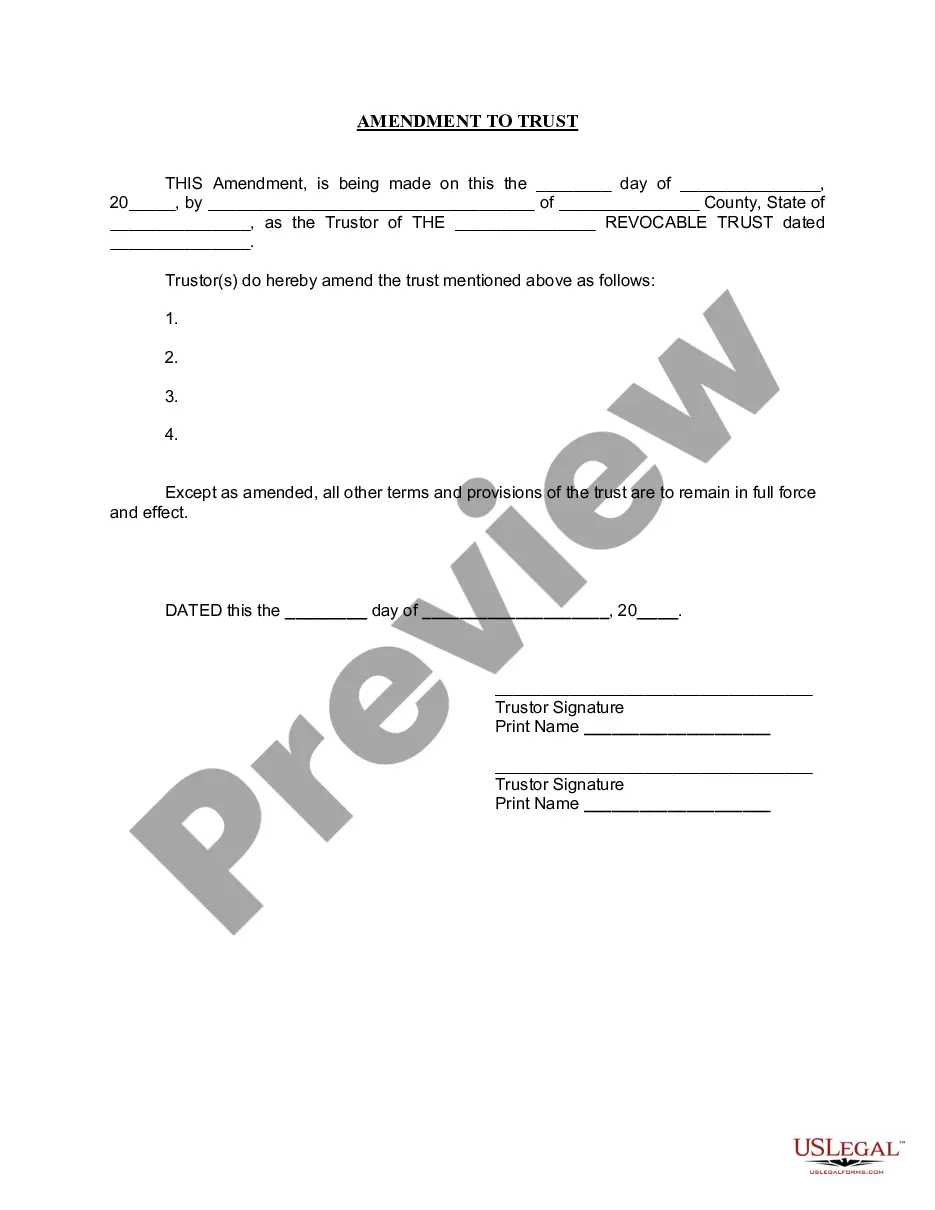

How to fill out Revocable Trust For Child?

Selecting the optimal authentic document template can be somewhat challenging.

Of course, there are numerous templates available online, but how do you locate the appropriate legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Virginia Revocable Trust for Child, which can be utilized for both business and personal purposes.

If the form does not fulfill your requirements, use the Search feature to find the appropriate form. Once you are certain that the document is correct, click the Buy now button to obtain the form. Select your desired pricing plan and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the downloaded Virginia Revocable Trust for Child. US Legal Forms is the largest library of legal templates where you can find a variety of document forms. Use this service to download professionally crafted documents that adhere to state regulations.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, sign in to your account and click the Download button to access the Virginia Revocable Trust for Child.

- Use your account to browse the legal templates you have previously purchased.

- Navigate to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have chosen the correct form for your city/county. You can review the document by clicking the Review button and inspect the document outline to confirm it is the right one for you.

Form popularity

FAQ

The main difference between a Virginia Revocable Trust for Child and an irrevocable trust lies in control and flexibility. A revocable trust can be changed or canceled at any time by the grantor, providing adaptability as life evolves. In contrast, an irrevocable trust cannot be easily altered once established, offering more permanence. Understanding these distinctions is crucial, and UsLegalForms can guide you in selecting the best option for your family.

A Virginia Revocable Trust for Child offers numerous benefits, including flexibility and control over your assets. You can easily modify or revoke the trust during your lifetime, allowing you to adapt to changing circumstances. Additionally, this type of trust can help avoid the lengthy probate process, ensuring your child receives their inheritance more quickly. Using UsLegalForms makes it straightforward to create a trust that meets your specific needs.

Reiterating the benefits, a Virginia Revocable Trust for Child remains the best way to leave your house to your children. This trust offers flexibility during your life and efficient transfer after your death, ensuring that your children inherit the property without the burden of probate. It grants peace of mind, knowing your wishes will be fulfilled. Plus, using tools available on platforms like uslegalforms can simplify the setup process.

A Virginia Revocable Trust for Child can be a tax-efficient strategy for leaving a home to a child. By using this trust, you can potentially avoid significant capital gains taxes that could arise if the property were transferred through a will. The trust structure allows for a step-up in basis upon your passing, which can minimize tax implications for your heirs. Consulting with a financial advisor can enhance this strategy according to your unique situation.

Establishing a Virginia Revocable Trust for Child can be one of the best ways to leave an inheritance to your children. This method provides you with control over your assets during your lifetime while outlining how the assets will be distributed after your death. A trust can help protect your children's inheritance from creditors and ensure that they receive the intended benefits. It simplifies management and distribution, creating a smooth transition.

Using a Virginia Revocable Trust for Child is an excellent option for leaving your house to your kids. This trust allows you to plan for the distribution of your home while ensuring that your wishes are carried out effectively. With this arrangement, your children can receive the property without enduring the lengthy probate process. Furthermore, it provides a layer of protection for the assets you intend to pass down.

One effective method to transfer your house to your children is by using a Virginia Revocable Trust for Child. This trust allows you to maintain control over the property while designating your children as beneficiaries. This approach not only simplifies the transfer process upon your passing but also helps in avoiding probate. Additionally, a trust can provide protection for your children's inheritance.

To establish a Virginia Revocable Trust for Child, begin by defining your objectives and the assets you want to include. Consider working with a legal professional who can guide you through the process and ensure everything complies with state laws. Once set up, regularly review the trust to adjust for any changes in your family's needs or financial situation. Using a platform like uslegalforms can simplify this process with easy-to-follow templates.

A Virginia Revocable Trust for Child is frequently regarded as the best option for protecting your child's assets. This trust allows you to specify how and when your child can access their inheritance. By creating this vehicle, you can mitigate potential financial mismanagement and provide your child with a secure future. It combines the benefits of revocability with the assurance of asset protection.

A Virginia Revocable Trust for Child is often ideal for many families. This type of trust lets you maintain control over the assets while providing for your children's future needs. It offers flexibility, allowing you to modify the trust as circumstances change. By establishing this trust, you can ensure that your children receive their inheritance under your terms.