Virginia Revocable Living Trust for Minors

Description

How to fill out Revocable Living Trust For Minors?

Have you ever entered a location that requires documents for various business or particular purposes almost every day.

There are numerous legal document templates available online, yet locating reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the Virginia Revocable Living Trust for Minors, which can be downloaded to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, complete the required details to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Virginia Revocable Living Trust for Minors template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct jurisdiction/county.

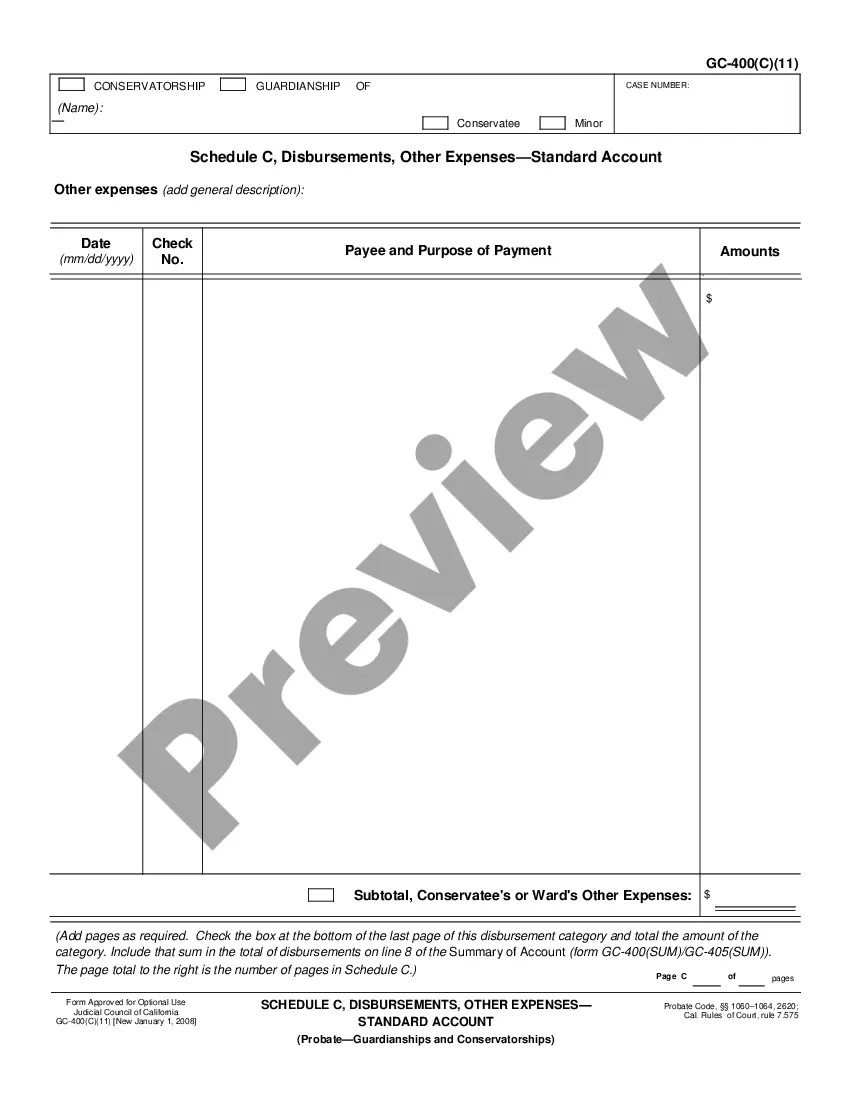

- Utilize the Review feature to examine the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search box to find a form that meets your needs and requirements.

Form popularity

FAQ

While a Virginia Revocable Living Trust for Minors offers many benefits, there are some downsides. First, creating a trust involves legal fees and paperwork, which can be more complex than simply writing a will. Additionally, you must actively manage the assets within the trust, which can be a time-consuming process. However, despite these challenges, a trust can provide significant advantages in protecting your child's inheritance.

Setting up a Virginia Revocable Living Trust for Minors involves a few straightforward steps. First, you need to draft the trust document that outlines the terms, beneficiaries, and assets. Next, transfer ownership of your assets into the trust, ensuring everything is legally designated. For assistance, you can use platforms like US Legal Forms to access templates and guidance tailored to create an effective trust.

While a Virginia Revocable Living Trust for Minors offers many benefits, one downside is that it may not protect your assets from creditors. Additionally, because these trusts are revocable, you can change or dissolve them at any time, which can lead to uncertainty about the distribution of assets. It is essential to consider potential implications on taxes and costs associated with managing and updating the trust.

A minor trust typically refers to any trust established for the benefit of a minor, like a Virginia Revocable Living Trust for Minors. This trust type is designed to manage and protect the minor's assets until they reach adulthood. It provides structure and security, ensuring responsible management of funds during the most formative years.

Choosing the best type of trust can depend on your specific goals, but many find the Virginia Revocable Living Trust for Minors appealing. It provides a straightforward way to manage and transfer assets to your minor children. This trust can be tailored to your family's needs, ensuring assets are available when your child needs them most.

A Virginia Revocable Living Trust for Minors is highly suitable, as it offers flexibility and control to parents. This trust allows modifications and revocation, adapting to changing life circumstances. It also ensures that the assets are used responsibly for the child's needs, such as education and health expenses.

The best type of trust for a child often depends on individual family needs, and a Virginia Revocable Living Trust for Minors is a top consideration. This trust allows parents to maintain control over the assets and modify the terms as needed. It also provides a clear structure for managing the child's inheritance, ensuring the funds benefit them directly and responsibly.

Trust funds for minors, including a Virginia Revocable Living Trust for Minors, are designed to hold and manage assets until the child reaches a certain age or meets specific conditions. The trust grants a trustee the responsibility to manage the assets on behalf of the minor, ensuring that funds are used for their benefit, such as education or healthcare. This system helps protect the child's financial future while ensuring responsible use of the assets.

Yes, a minor can have a revocable trust, specifically a Virginia Revocable Living Trust for Minors. This type of trust allows parents to set aside assets for their children while maintaining control over those assets during their lifetime. The trust can be modified or revoked at any time, giving parents flexibility as their circumstances change. Ultimately, it serves as a valuable estate planning tool.

To write a Virginia Revocable Living Trust for Minors, begin by identifying the assets you wish to include. Next, draft the trust document, detailing the terms, beneficiaries, and the trustee’s responsibilities. You may find it beneficial to consult resources like USLegalForms, which offers guidance and templates tailored to Virginia law. Completing the process ensures your minors are well cared for in the future.