New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

It is feasible to invest hours online trying to locate the legal document format that satisfies the federal and state requirements you need. US Legal Forms offers a vast selection of legal forms that are assessed by experts.

It is straightforward to download or print the New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose from the service.

If you already have a US Legal Forms account, you may Log In and then click the Obtain button. After that, you can complete, modify, print, or sign the New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose. Every legal document format you purchase is yours permanently. To obtain another copy of the purchased form, visit the My documents tab and click the relevant button.

Choose the document format and download it to your system. Make alterations to your document if necessary. You can complete, modify, sign, and print the New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose. Download and print a wide range of document templates using the US Legal Forms Website, which offers the largest variety of legal forms. Utilize professional and state-specific templates to meet your business or personal requirements.

- If you are using the US Legal Forms site for the first time, follow these simple instructions.

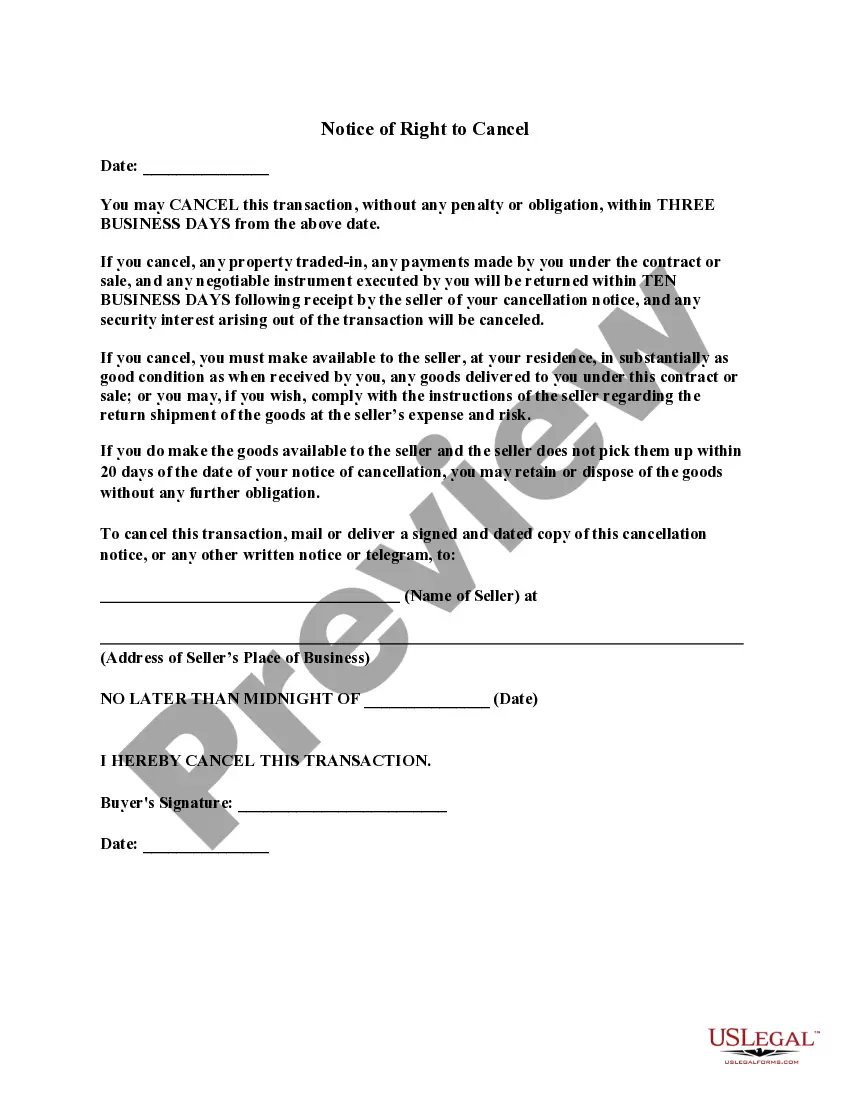

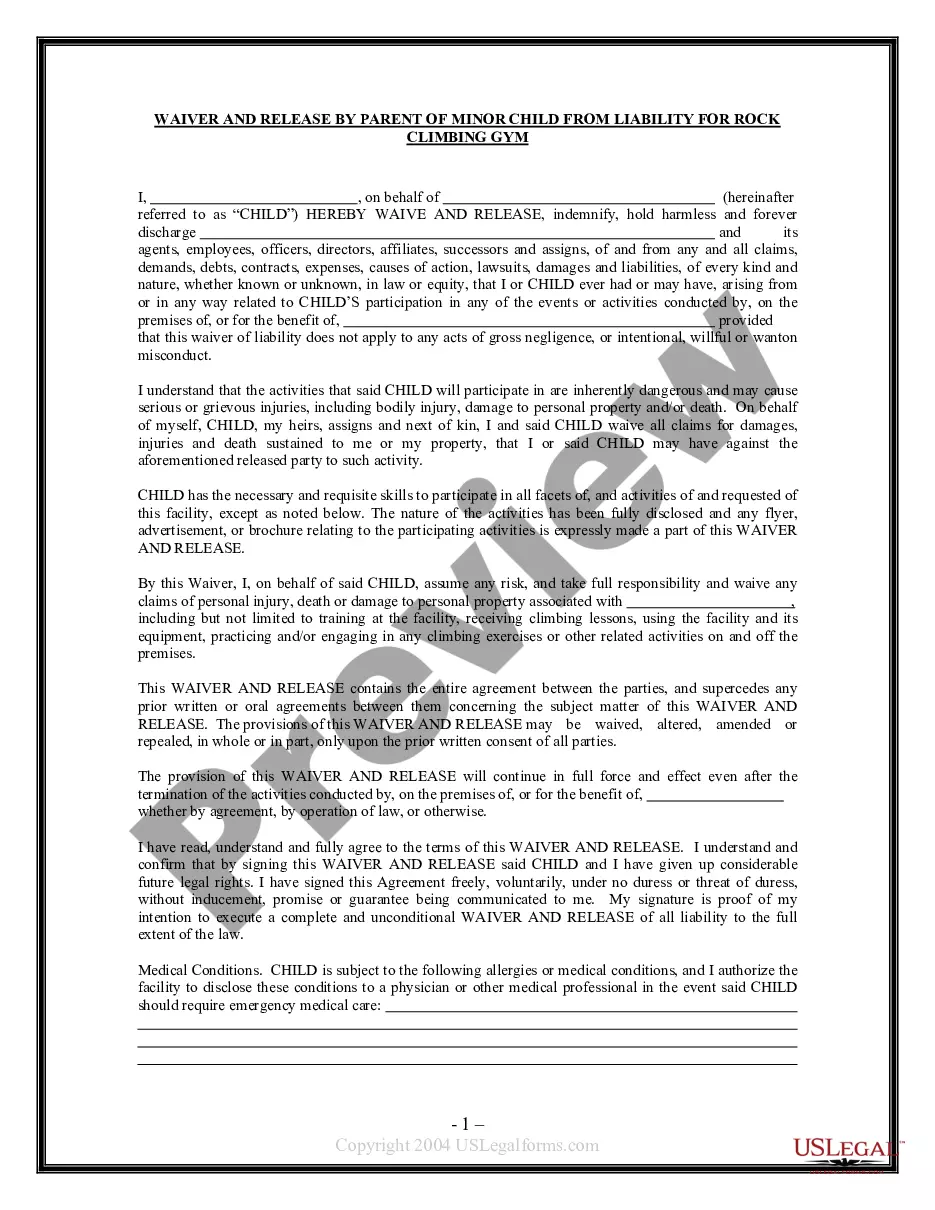

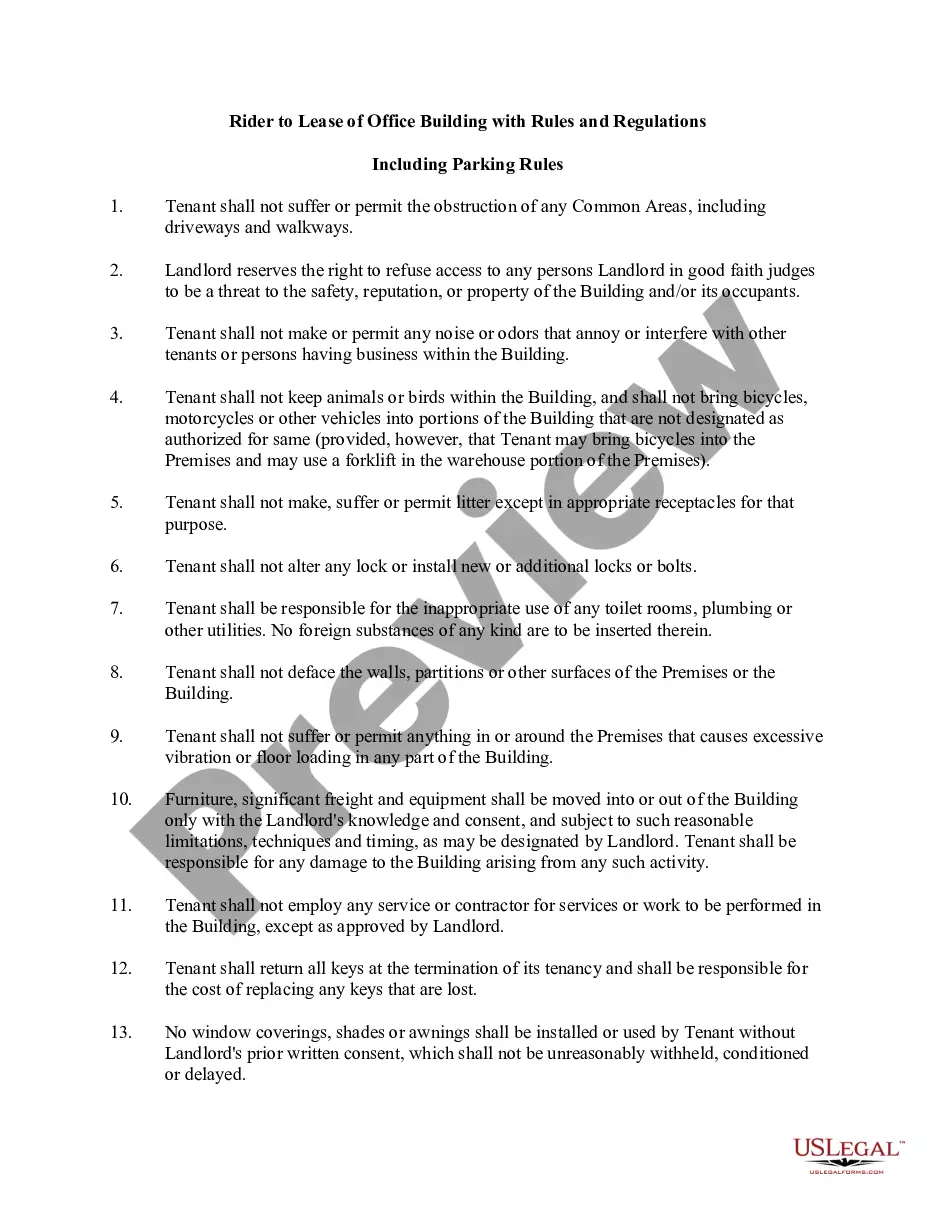

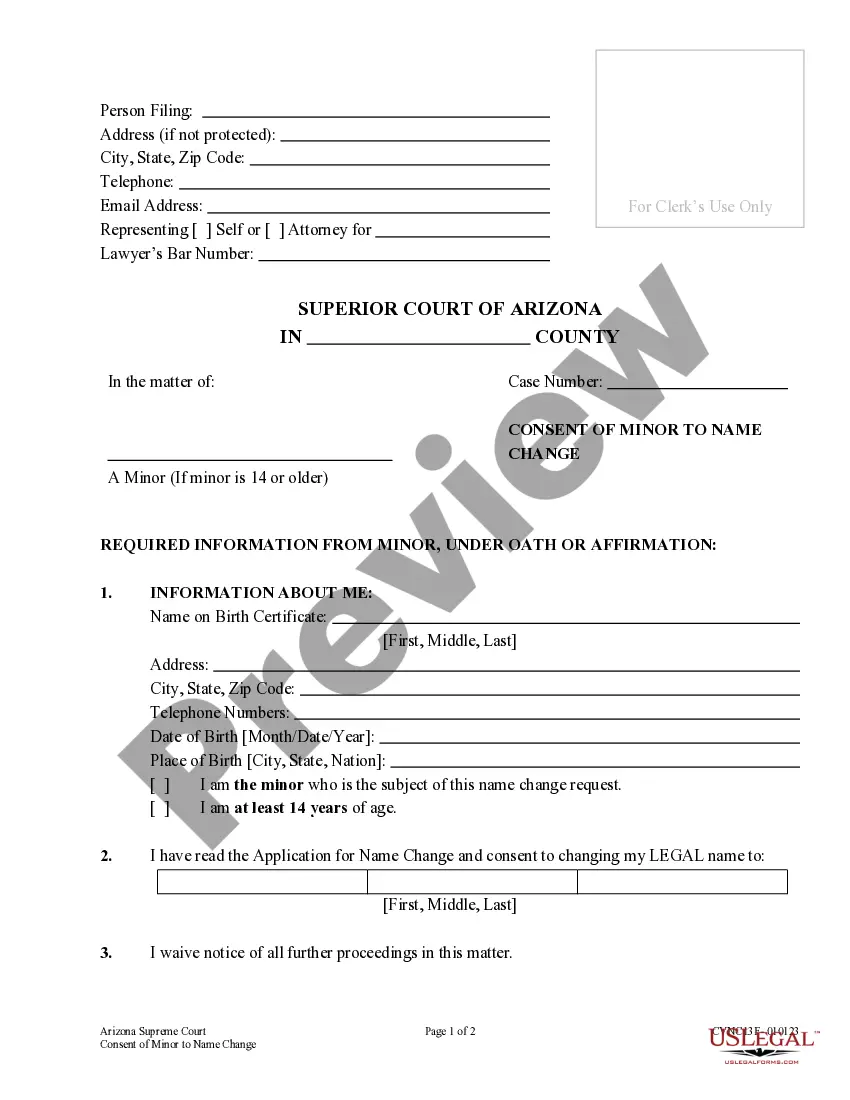

- First, ensure that you have selected the correct document format for your county/area of choice. Review the form details to verify that you have chosen the right form.

- If available, utilize the Preview button to review the document format as well.

- If you want to obtain another version of the form, use the Search box to locate the format that meets your needs.

- Once you have identified the format you want, click Buy now to proceed.

- Select the payment plan you desire, enter your details, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

Subject to the terms of the trust deed, the trustee can distribute income or capital to a charity.

Charitable remainder trust A CRT is an irrevocable trust that is funded with cash or securities. The CRT provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting to the charity upon your death or the expiration of the trust period.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

A charitable trust is essentially a way to set up your assets to benefit you, your beneficiaries and a charity all at the same time. A charitable trust could offer many financial advantages for philanthropically minded individuals with nonessential assets, such as stocks or real estate.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

Benefits of a Charitable Remainder TrustConvert an appreciated asset into lifetime income.Reduce your current income taxes with charitable income tax deduction.Pay no capital gains tax when the asset is sold.Reduce or eliminate your estate taxes.Gain protection from creditors for the gifted asset.More items...

The Trusts Act 2019 (Act) comes into force on 30 January 2021. The Act codifies the obligations of trustees and the rights of beneficiaries, with the aim of making trustees more accountable and trust law more understandable. The Act applies to charitable trusts and other permitted purpose trusts.

A public trust, also known as a charitable trust, is an express trust created for a charitable purpose. If an express trust is not a charitable trust, it is deemed to be a private trust. A private trust is an express trust created to benefit a few persons.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.