New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

Have you found yourself in a situation where you need documents for either business or personal reasons on a daily basis.

There are numerous legitimate document templates accessible online, but locating ones you can trust is not easy.

US Legal Forms provides a vast selection of form templates, including the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor, that are designed to comply with federal and state regulations.

Once you discover the correct form, click Acquire now.

Select the payment plan you prefer, complete the necessary information to create your account, and process your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- From there, you can download the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

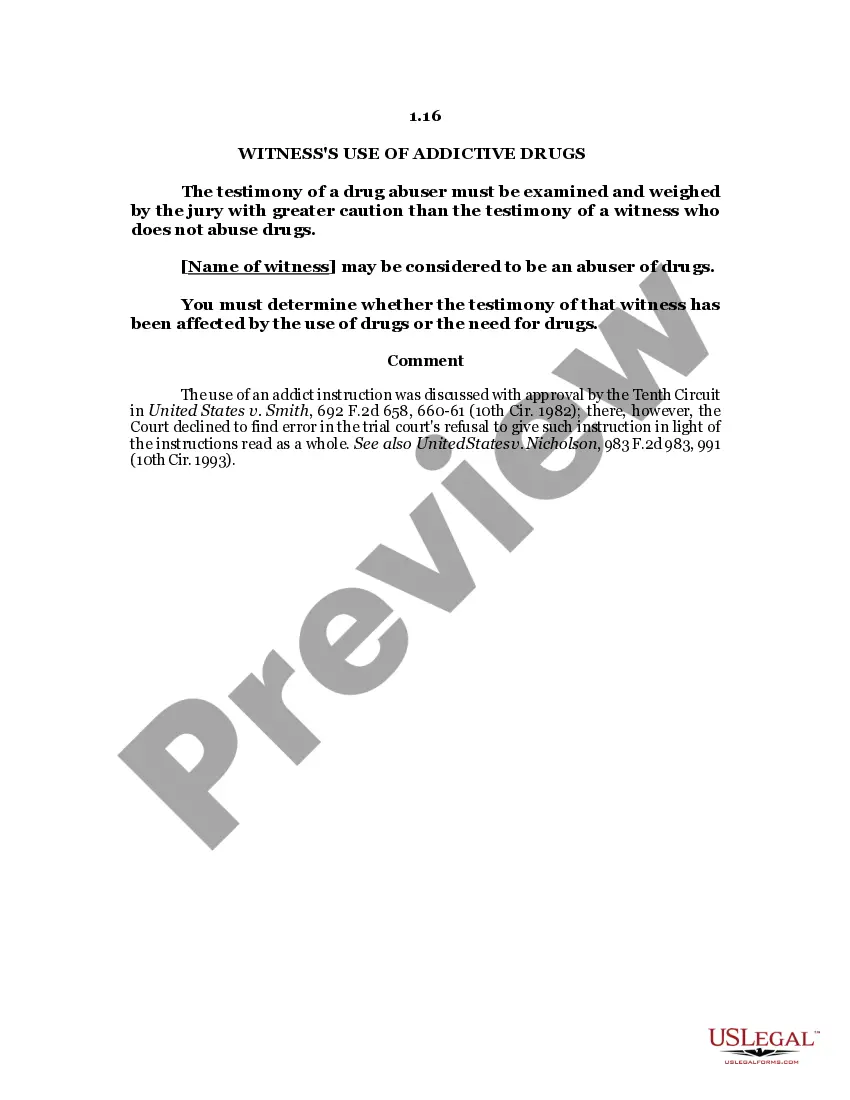

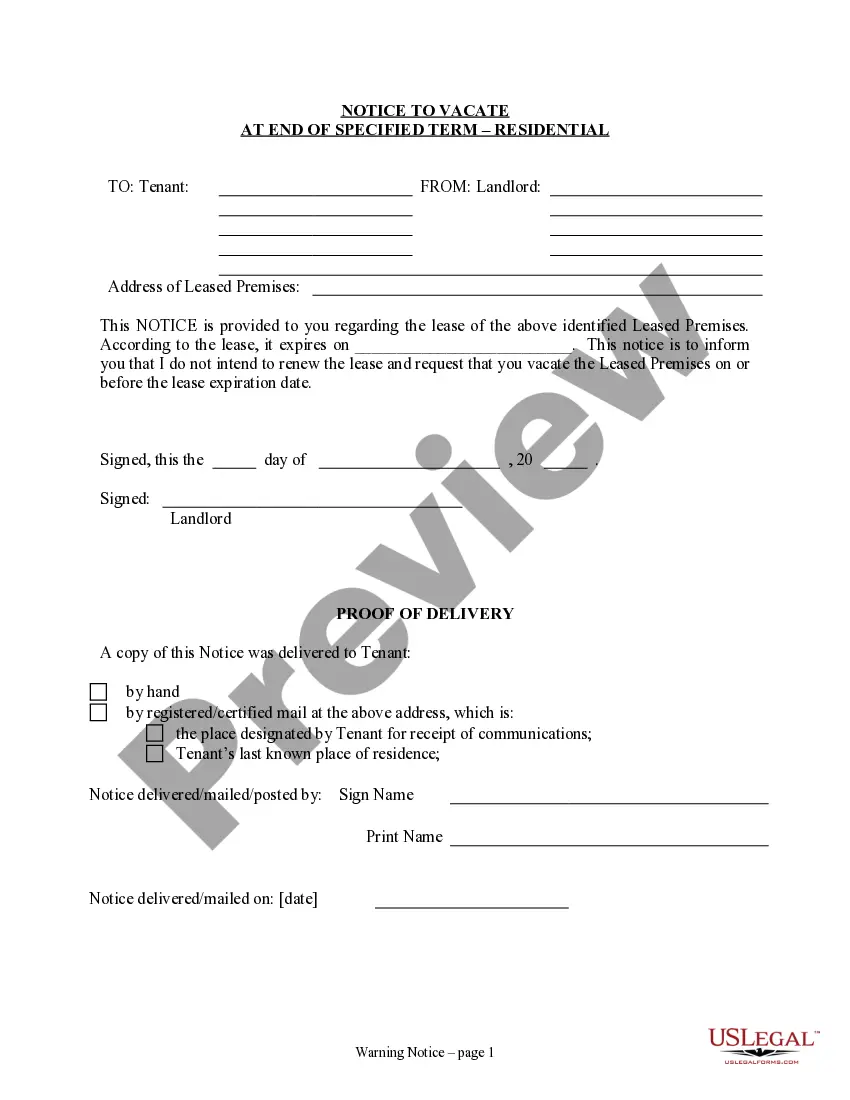

- Click the Review button to assess the form.

- Read the details to make sure you have chosen the right form.

- If the form is not what you are seeking, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

The 777 rule refers to regulations that impact how debt collectors must communicate about their claims. It mandates that debt collectors must provide detailed information about the debt and their collection practices to the debtor. This aligns with the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor, promoting fairness and clarity in the debt collection process. Understanding this rule helps consumers gain insight into their rights and responsibilities.

The new debt collection laws in New York aim to protect consumers from aggressive collection practices. These regulations require collection agencies to provide clearer disclosures about debts and their rights. This aligns with the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor, ensuring transparency during the collection process. It's essential for consumers to understand these laws to better navigate their financial obligations.

Yes, debt collectors must validate the debt if you ask them to do so. This validation process is part of your rights under the Fair Debt Collection Practices Act. When engaging with the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor, this validation helps you confirm the legitimacy of the debt and protects you from paying incorrect claims. Always remember to request validation as it empowers you in your financial dealings.

Writing a letter to a collection agency to request proof of debt is straightforward. Begin by clearly stating your name, account number, and the specific debt in question. Request that they provide evidence supporting their claim, mentioning your rights under the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor. This approach helps ensure that you receive accurate information and can establish your course of action.

Yes, creditors are required to provide proof of debt when requested. Under the Fair Debt Collection Practices Act, you have the right to ask a collection agency for verification of the debt. This process is vital in the context of New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor, as it ensures that you acknowledge only valid debts. By obtaining proof of the debt, you can address any inaccuracies and protect your financial standing.

Yes, a debt collection agency must prove you owe the debt if you request verification. They are required to provide documentation to support their claims within a reasonable time frame. This process allows you to contest any discrepancies and ensures that you have a clear understanding of your financial obligations, in line with the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

The new debt collection law in New York includes various protections for consumers, such as requiring debt collectors to provide more information about the debts they are collecting. It aims to ensure transparency and accountability in the collection process. Understanding these laws can help you navigate challenges with collection agencies, particularly in relation to the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

The 777 rule refers to the provisions in New York law that govern debt collection practices. Specifically, it mandates that debt collectors must provide certain disclosures to consumers regarding their debts. This rule ensures that individuals receive fair treatment during the collection process, aligning with the principles of the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

You can request verification of your debt by writing to the collection agency and asking them to validate the debt. Include your account information and state that you want proof of the debt's legitimacy. The agency is legally required to respond with documentation that proves you owe the stated amount. Engaging with the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor can guide you through these steps.

To ask a debt collector to validate a debt, send a written request for validation within 30 days of their initial contact. This request should clearly state that you are asking for proof of the debt. The collector must provide documentation to verify that you owe the amount claimed. This process is a crucial part of the New York Acceptance of Claim by Collection Agency and Report of Experience with Debtor.