No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

New York Rejection of Claim and Report of Experience with Debtor

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Have you found yourself in a situation where you require documentation for occasional business or specific reasons almost every workday.

There are numerous valid form templates available online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of document templates, including the New York Rejection of Claim and Report of Experience with Debtor, tailored to meet state and federal requirements.

If you find the right form, click Buy now.

Select the pricing plan you desire, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the New York Rejection of Claim and Report of Experience with Debtor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

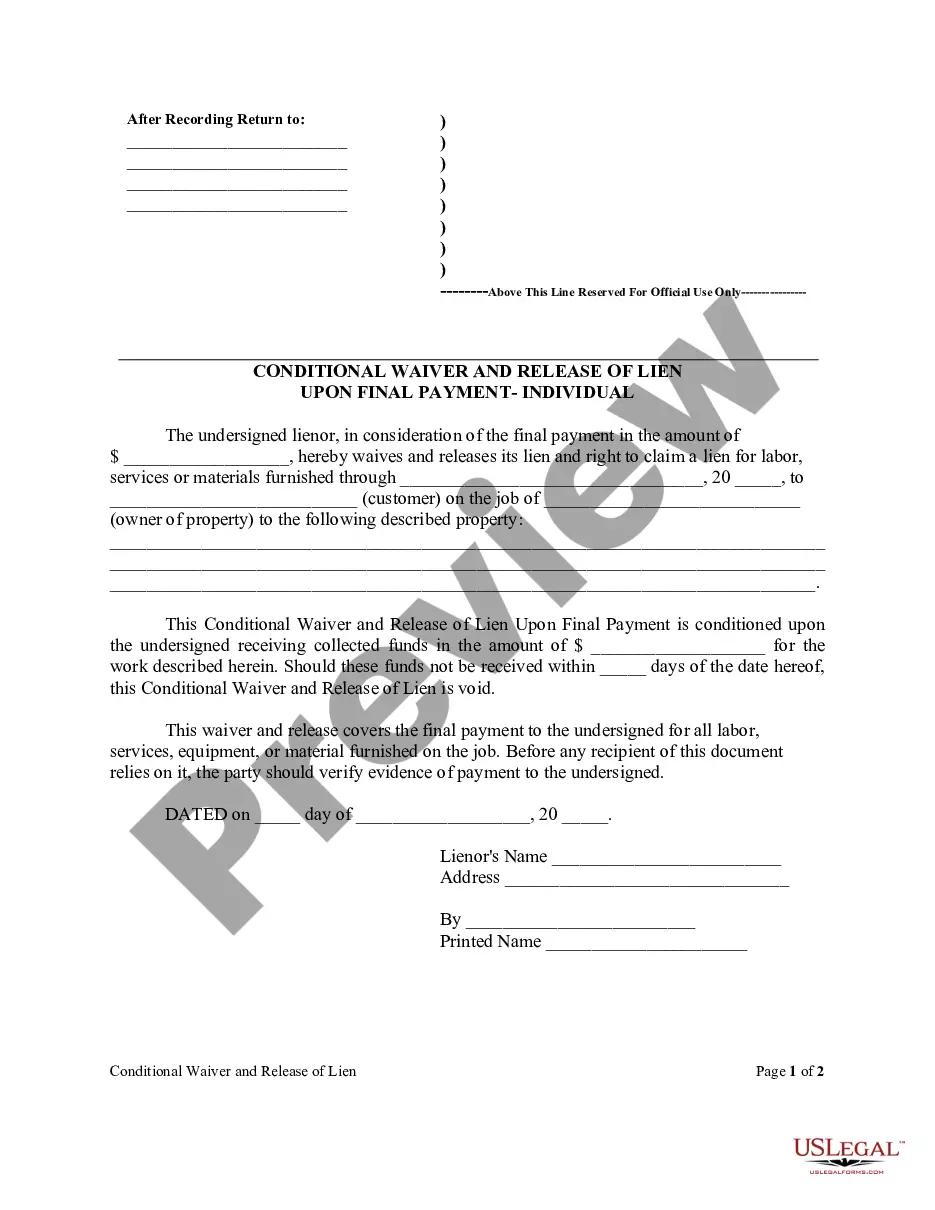

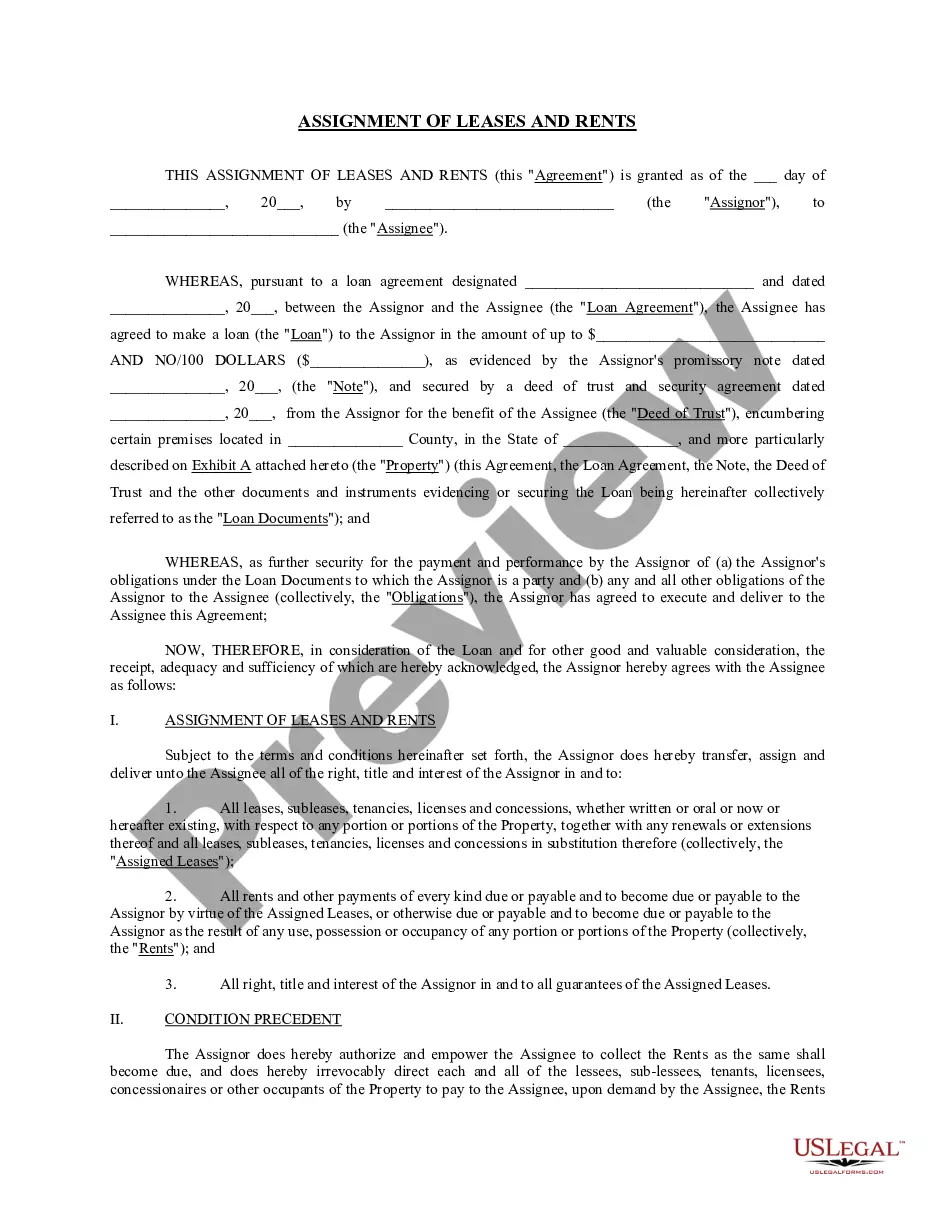

- Use the Review option to inspect the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Lookup section to find the document that meets your requirements.

Form popularity

FAQ

To find out if there is a judgment against you in New York, you can conduct a search through the New York State Unified Court System’s online database or visit your local county clerk's office. Checking your credit report can also provide insight into any judgments that may exist. Being proactive in this search is essential, particularly in relation to the New York Rejection of Claim and Report of Experience with Debtor. Uslegalforms can guide you through obtaining your legal documents efficiently.

In New York State, a judgment remains on your record for an initial period of 20 years. However, this can be renewed, which means the judgment could affect your credit and financial status for an extended time. It's crucial to monitor your record for any judgments, especially regarding the New York Rejection of Claim and Report of Experience with Debtor. For assistance, consider visiting uslegalforms to manage your legal documents effectively.

In New York, personal property that can be seized due to a judgment includes bank accounts, vehicles, and specific assets like jewelry or valuable electronics. However, certain items are exempt from seizure, including basic household goods and necessary personal items. Knowing what can be taken is vital, particularly with regards to the New York Rejection of Claim and Report of Experience with Debtor. Using resources from uslegalforms can help clarify these details.

Yes, it is possible to have a judgment against you without your knowledge. This can happen if you do not receive a court summons or fail to respond in time. Consequently, it’s wise to regularly check your legal status, especially in connection to the New York Rejection of Claim and Report of Experience with Debtor. Having tools like uslegalforms can help you stay informed about any potential judgments.

In New York, there are three primary types of judgment: a default judgment, a summary judgment, and a contested judgment. A default judgment occurs when a defendant fails to respond to a lawsuit, while a summary judgment is granted when there is no dispute over material facts. Contested judgments result from a trial where both parties present evidence. Understanding these judgments is crucial, especially in regard to the New York Rejection of Claim and Report of Experience with Debtor process.

A notice of intent to contest is a formal document filed to indicate that you dispute or challenge a claim or decision. This notification allows the relevant parties to prepare for the upcoming dispute. It's an integral part of ensuring your voice is heard in legal matters, particularly in cases related to debts or claims. US Legal Forms can provide you with the tools necessary to create and file this notice effectively.

A notice of intention to file a claim against the State of New York informs the state that you intend to file a formal claim. This notice must align with specific legal requirements, making it a crucial step in the process. By submitting this notice, you ensure that the state is alerted to your situation and prepares for potential legal action. Understanding the New York Rejection of Claim and Report of Experience with Debtor can enhance your approach.

In New York, the statute of limitations for filing a notice of claim against a governmental entity is generally 90 days from the date of the incident. Failing to file within this period can result in the loss of your right to claim damages. It is vital to be aware of these deadlines to protect your interests. Consult US Legal Forms for clear, structured guidance to help you stay informed and timely.

Yes, a debtor can file a proof of claim to assert their rights during bankruptcy proceedings. This document provides the court with information about the debts owed and is essential for creditors to recover any amounts. It allows for a transparent process where all parties can verify the debt details. If you encounter challenges, remember that the New York Rejection of Claim and Report of Experience with Debtor scenario can provide insights on this matter.

To file a claim against the State of New York, you must first submit a notice of claim within a specified timeframe, which typically is 90 days. Following this, you will need to prepare a formal claim that adheres to the state's guidelines. Completing this process requires attention to detail, as missing information may lead to a dismissal of your claim. Using US Legal Forms can simplify this procedure with templates and step-by-step instructions.