New York Receipt Template for Nanny Services: A Comprehensive Overview If you are a nanny or employing a nanny in the state of New York, it is essential to have a well-documented financial record for the services provided. Utilizing a New York Receipt Template for Nanny Services can save you time and effort by providing a professional and legally compliant document that outlines the payment details. The New York Receipt Template for Nanny Services is a customizable form that captures essential information related to nanny services and serves as a proof of payment for both parties involved. It ensures transparency, clarity, and compliance with state regulations. Key Components of a New York Receipt Template for Nanny Services: 1. Header Section: This includes the title of the document, such as "Nanny Services Receipt," along with the date it was issued, and a unique receipt number for easy reference. 2. Contact Details: The template should provide space to record the nanny's and employer's contact information, including their names, addresses, phone numbers, and email addresses. This information helps in establishing clear communication channels between the parties involved. 3. Nanny Service Details: This section allows you to record the specific services rendered by the nanny, including the date(s), hours worked, job descriptions, and any additional tasks performed (such as meal preparation, laundry, or transportation). 4. Payment Information: Here, you can include fields for recording the agreed-upon rate per hour, total hours worked, and the overall amount due. Additionally, you can include any applicable taxes, deductions (if any), and the net amount payable. 5. Mode of Payment: The form should contain fields to specify the mode of payment, whether by cash, check, or any other accepted method, along with relevant details such as check numbers or online transaction IDs. 6. Signatures: To validate the receipt, both the nanny and the employer should sign and date the document. This confirms their agreement on the provided services and payment details. Types of New York Receipt Template for Nanny Services: 1. Standard Receipt Template: This is a basic receipt template suitable for documenting general nanny services, with provisions to capture essential information, services provided, and the corresponding payment details. 2. Hourly Rate Receipt Template: In cases where the nanny's payment is based on an hourly rate, this template allows you to specify the number of hours worked, calculate the total payment accordingly, and provide a breakdown of hourly rates. 3. Supplementary Expense Receipt Template: If there are additional expenses incurred by the nanny for buying supplies, transportation, or other reimbursable costs, this template can be used to itemize such expenses and calculate the total reimbursement due separately. By utilizing a New York Receipt Template for Nanny Services, you ensure transparency, record-keeping, and adherence to legal requirements while providing a convenient structure for both nannies and employers to manage their financial transactions with ease.

New York Receipt Template for Nanny Services

Description

How to fill out New York Receipt Template For Nanny Services?

Have you ever found yourself in a situation where documentation is required for both business or personal purposes nearly every day of work.

There are numerous legal document templates accessible online, but locating those you can depend on is quite challenging.

US Legal Forms offers an extensive array of form templates, such as the New York Receipt Template for Nanny Services, that are crafted to comply with state and federal regulations.

After you locate the correct form, click on Purchase now.

Select the pricing plan that suits you, fill in the required information to create your account, and process your payment using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New York Receipt Template for Nanny Services design.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Obtain the form you require and ensure it corresponds with the correct city/state.

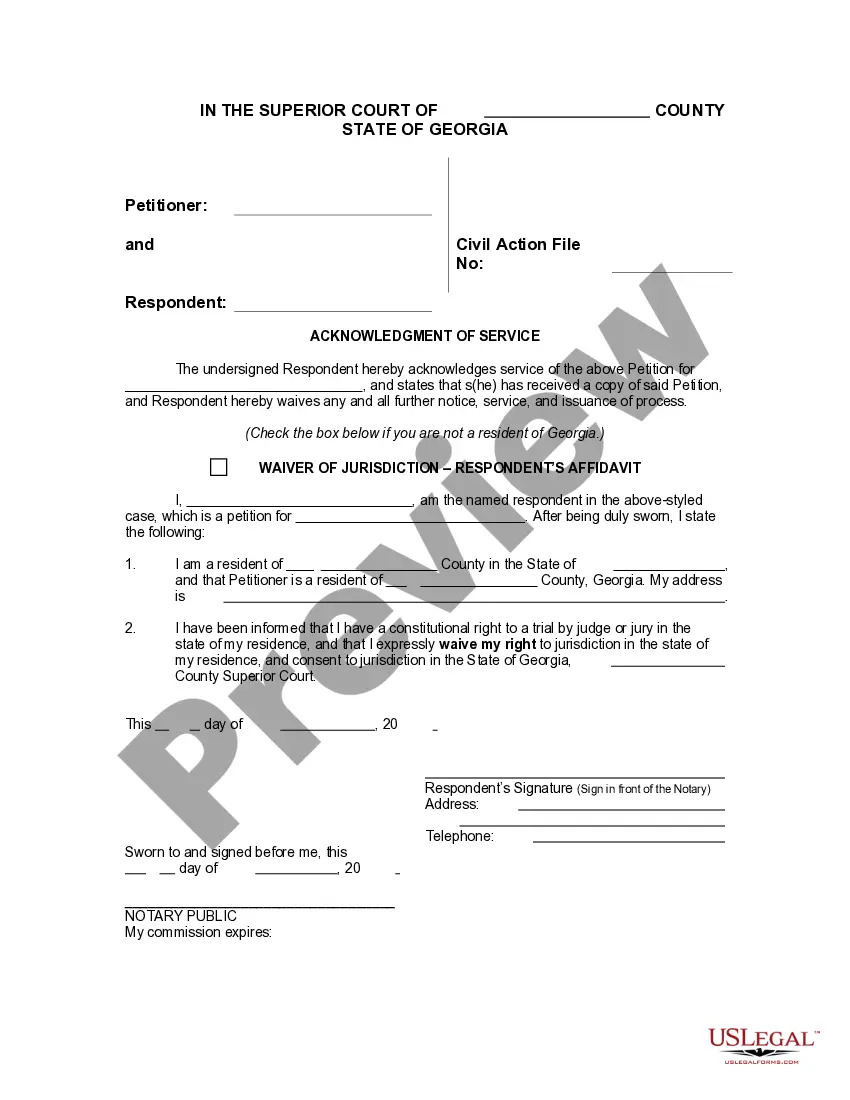

- Use the Review option to examine the document.

- Check the description to confirm that you have chosen the correct template.

- If the document does not meet your expectations, utilize the Search box to find the template that aligns with your needs.

Form popularity

FAQ

To prove childcare expenses, keep all receipts, invoices, and contracts related to care. This documentation serves as evidence of the costs incurred. By utilizing a New York Receipt Template for Nanny Services, you ensure your records are organized, accurate, and ready for any financial review or reimbursement request.

Writing a child support verification letter entails outlining the details of the child's needs and the support provided. Record specific amounts, dates, and details of care. Utilizing a New York Receipt Template for Nanny Services can add to the accuracy and professionalism of your letter, providing a clear view of the financial commitments involved.

To make a receipt for a babysitter, list the service dates, the number of hours worked, and the rate charged. Include both your and the babysitter's contact information to add legitimacy. For ease, consider a New York Receipt Template for Nanny Services which provides a structured format and necessary details to enhance clarity.

You can prove child care by providing documentation such as receipts, contracts, and letters from caregivers. Collecting records like a New York Receipt Template for Nanny Services reinforces your claims and offers clear evidence to any interested party. Always ensure that your documentation is detailed and accurate for the best results.

When writing a reference for child care, introduce yourself and state your relationship to the caregiver. Highlight specific skills and positive experiences you observed during their time providing care. Always conclude with a confident endorsement and suggest integrating a New York Receipt Template for Nanny Services to provide further transparency.

To write a proof of child care letter, start by including your contact information and the receiver's details. Clearly state the dates of care, the child's name, and any other essential details regarding the services provided. Lastly, sign the letter to validate it, and consider using a New York Receipt Template for Nanny Services to ensure you incorporate all necessary components.

Typically, the IRS will not pursue your babysitter directly unless there are issues with reported income. However, as a taxpayer, it's your responsibility to ensure that payments to your nanny or babysitter are properly documented. Utilizing a New York Receipt Template for Nanny Services can provide the necessary proof that you are compliant with tax regulations.

The IRS does request proof of childcare when taxpayers claim deductions or credits related to dependent care expenses. This proof often includes detailed receipts, which should ideally follow formats like the New York Receipt Template for Nanny Services. Having organized records can ease your tax filing process.

Yes, daycares are required to report income to the IRS, which includes payments received for services. They may issue a Form 1099 if they meet certain income thresholds. Keeping accurate records using a New York Receipt Template for Nanny Services can help ensure that you have all necessary documentation for your tax returns.

For dependents, the IRS typically requires documentation that proves their relationship to you, such as birth certificates or adoption papers. Additionally, they may ask for proof that you provide more than half of their financial support. Maintaining records with a New York Receipt Template for Nanny Services can substantiate childcare expenses linked to your dependents.