This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

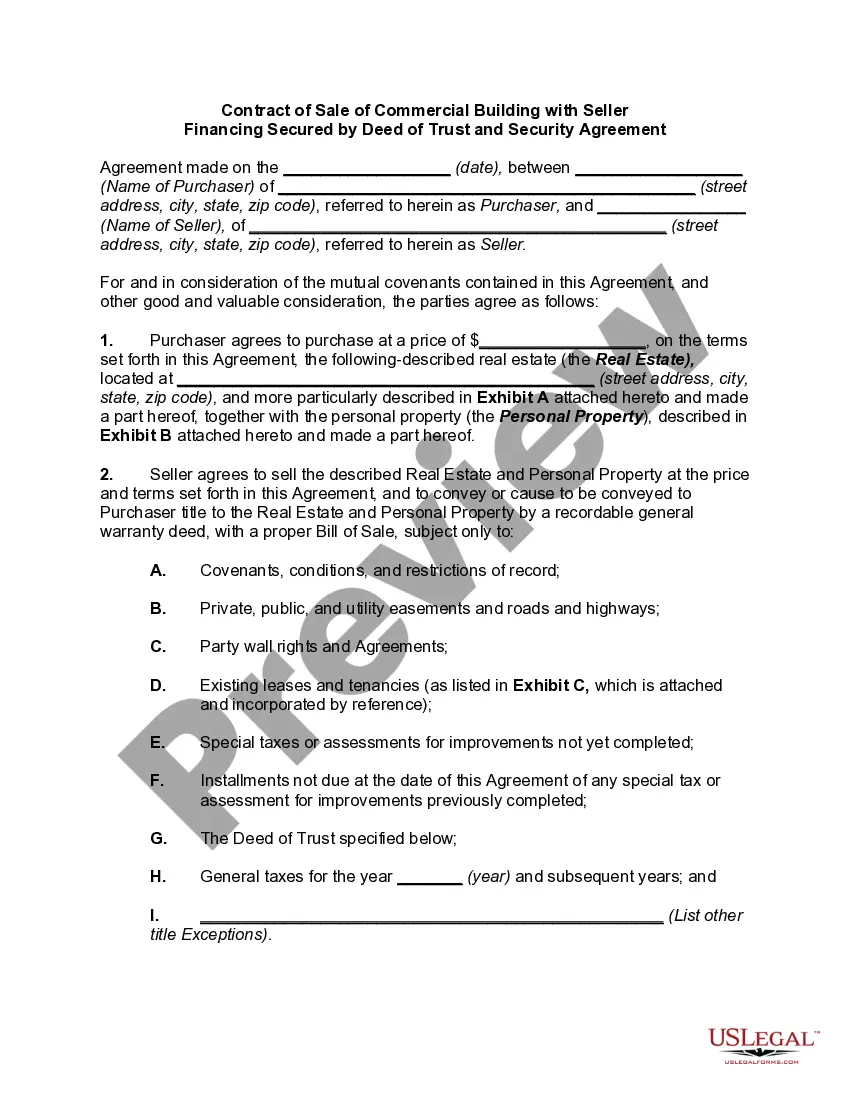

Utah Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement

Description

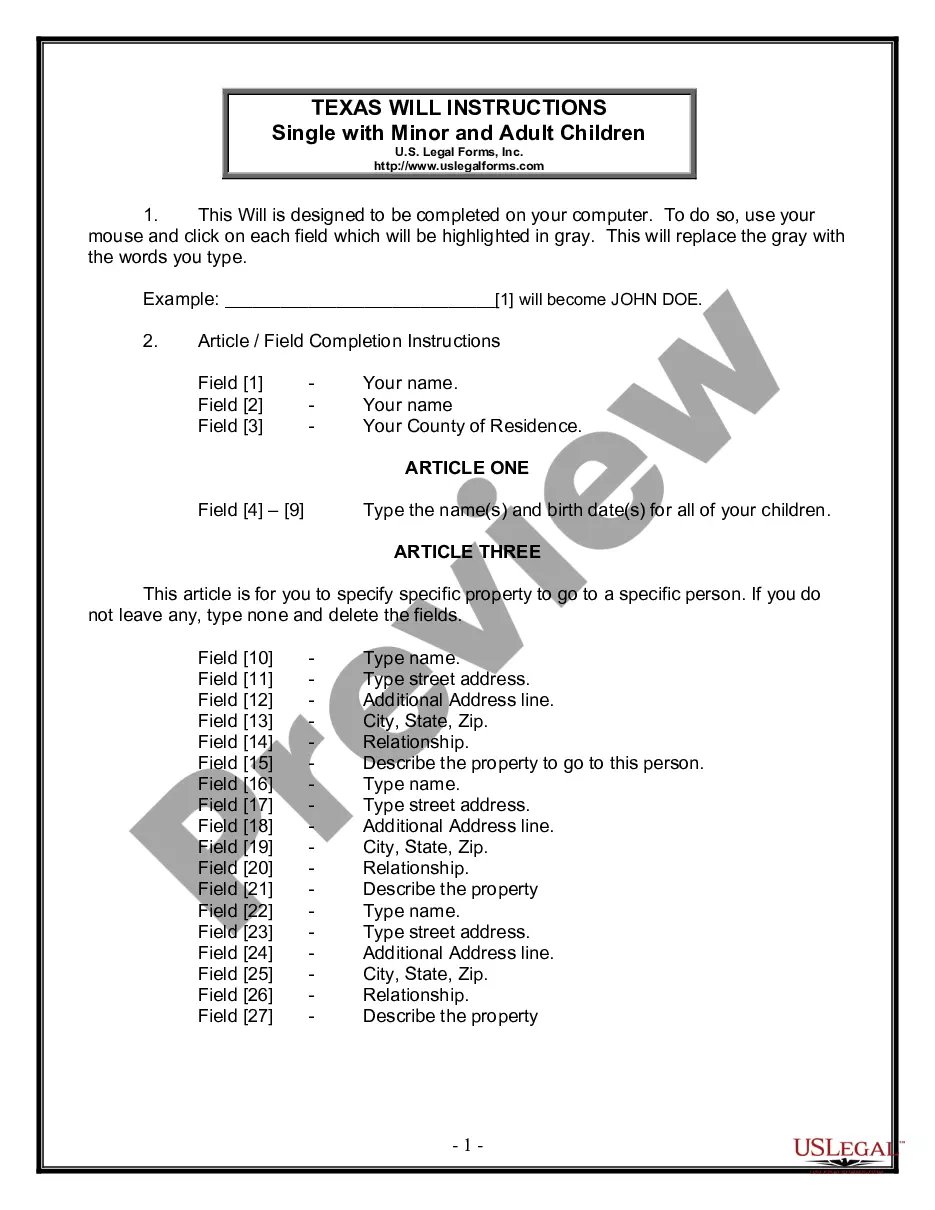

How to fill out Contract To Sell Commercial Property With Commercial Building - Seller Financing Secured By Mortgage And Security Agreement?

It is possible to spend hours on the web looking for the legitimate record format that meets the state and federal requirements you want. US Legal Forms offers a large number of legitimate kinds which are examined by specialists. It is possible to down load or print out the Utah Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement from our service.

If you have a US Legal Forms account, you may log in and click on the Download switch. After that, you may complete, change, print out, or indicator the Utah Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement. Each legitimate record format you purchase is yours forever. To obtain another copy for any obtained kind, check out the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms web site initially, adhere to the simple instructions beneath:

- First, be sure that you have selected the best record format for your county/town that you pick. Look at the kind outline to ensure you have picked out the correct kind. If available, make use of the Preview switch to appear through the record format at the same time.

- If you want to locate another variation of the kind, make use of the Research discipline to discover the format that meets your requirements and requirements.

- Upon having discovered the format you want, simply click Acquire now to move forward.

- Choose the rates plan you want, key in your credentials, and sign up for a free account on US Legal Forms.

- Full the purchase. You should use your bank card or PayPal account to pay for the legitimate kind.

- Choose the structure of the record and down load it in your system.

- Make changes in your record if needed. It is possible to complete, change and indicator and print out Utah Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement.

Download and print out a large number of record themes while using US Legal Forms site, that offers the most important assortment of legitimate kinds. Use skilled and express-distinct themes to deal with your small business or person demands.

Form popularity

FAQ

How Do You Structure a Seller Financing Deal? Don't use current market interest rates to create the interest rate for your seller financing loan. ... The higher the price?the longer the loan term. ... Bring as little cash to the deal as possible. ... Defer payments if possible. ... Exchange down payment for needed repairs.

For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year. In this scenario, a $100,000 loan at 8% would look like $666.67 in a monthly interest-only payment.

Here are three main ways to structure a seller-financed deal: Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar. ... Draft a Contract for Deed. ... Create a Lease-purchase Agreement.

The key documents in a seller financing transaction include: (1) Purchase Agreement; (2) Promissory Note; and (3) Deed of Trust. Depending on the particulars of the financing arrangement, other documents may also be needed.

A seller note is a form of financing wherein the seller formally agrees to receive a portion of the purchase price ? i.e. the acquisition proceeds ? in a series of future payments. It is important to remember that seller notes are a type of debt financing, thus are interest-bearing securities.

Seller financing can be used to defer capital gains taxes on the sale of a business or property. Deferring your capital gains tax means that you don't have to pay taxes on the money you make from the sale until a later date. Typically, when a business is sold, the seller will pay taxes on the entire profit.

The seller's financing typically runs only for a fairly short term, such as five years. At the end of that period, a balloon payment is due. The expectation is usually that the initial seller-financed purchase will improve the buyer's creditworthiness and allow them to accumulate equity in the home.

Disadvantages Of Seller Financing Buyers still vulnerable to foreclosure if seller doesn't make mortgage payments to senior financing. No home inspection/PMI may result in buyer paying too much for the property. Higher interest rates and bigger down payment required.