The New York Rate and Information Sheet (NY RIS) is a document issued by the New York Department of Financial Services (DFS) to provide information about the rates, fees, and other terms associated with particular insurance policies in New York State. It includes information on the policy’s coverage, deductible, renewal options, and premium payment options. It also provides contact information for the insurer and includes a summary of the insurer’complairecordedrNNNNNNNY NYNY RISIS documents are available for most types of insurance policies, including auto, health, life, homeowners, and business. In addition, there are specific NY RIS documents issued for long-term care and disability insurance, annuities, and Medicare supplement insurance.

New York Rate and Information Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

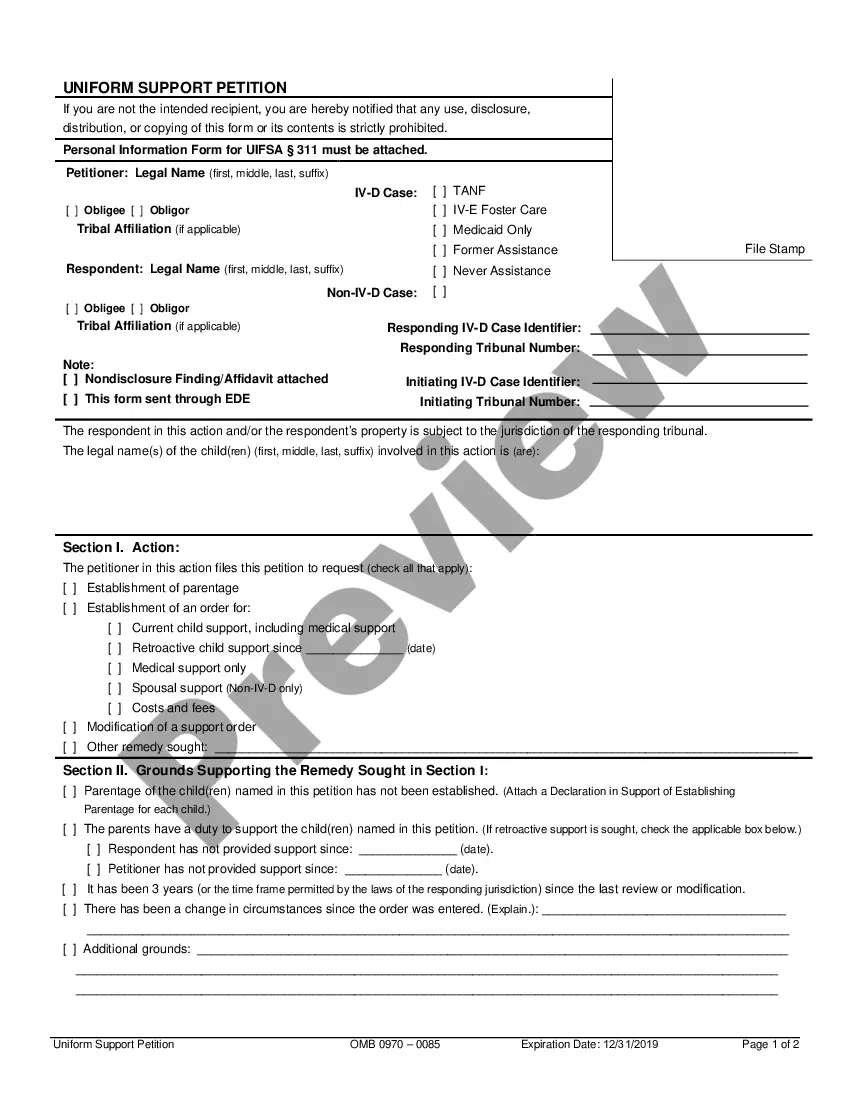

How to fill out New York Rate And Information Sheet?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are examined by our experts. So if you need to complete New York Rate and Information Sheet, our service is the perfect place to download it.

Obtaining your New York Rate and Information Sheet from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Later, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance verification. You should carefully review the content of the form you want and check whether it satisfies your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now once you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Rate and Information Sheet and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

How Are Prevailing Wages Determined? Employers can obtain this wage rate by submitting a request to the National Prevailing Wage Center (NPWC), or by accessing other legitimate sources of information such as the Online Wage Library, available for use in some programs.

Highest Prevailing Wage Threshold States Connecticut has the highest mentioned prevailing wage threshold at $1,000,000 for its new construction landscape. This means developers are often required to pay their workforce an average wage rather than a minimum one if they are on a federal contract.

Minimum wage rates in New York YearMinimum Wage Rate for Employers2020$11.80 an hour2021$12.50 an hour2022$13.20 an hour2023$14.20 an hour2 more rows

As of , the average annual pay for a H1B in New York City is $115,115 a year. Just in case you need a simple salary calculator, that works out to be approximately $55.34 an hour. This is the equivalent of $2,213/week or $9,592/month.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

Currently, the New York State minimum wage rate for New York City is $15.00 per hour, which is higher than both living wage rates.

On January 1, 2024, the minimum wage will increase to $16 in New York City and the counties of Nassau, Suffolk and Westchester, and to $15 in all other parts of the State.

How much does a Labor Union make in New York? As of , the average annual pay for the Labor Union jobs category in New York is $39,315 a year.