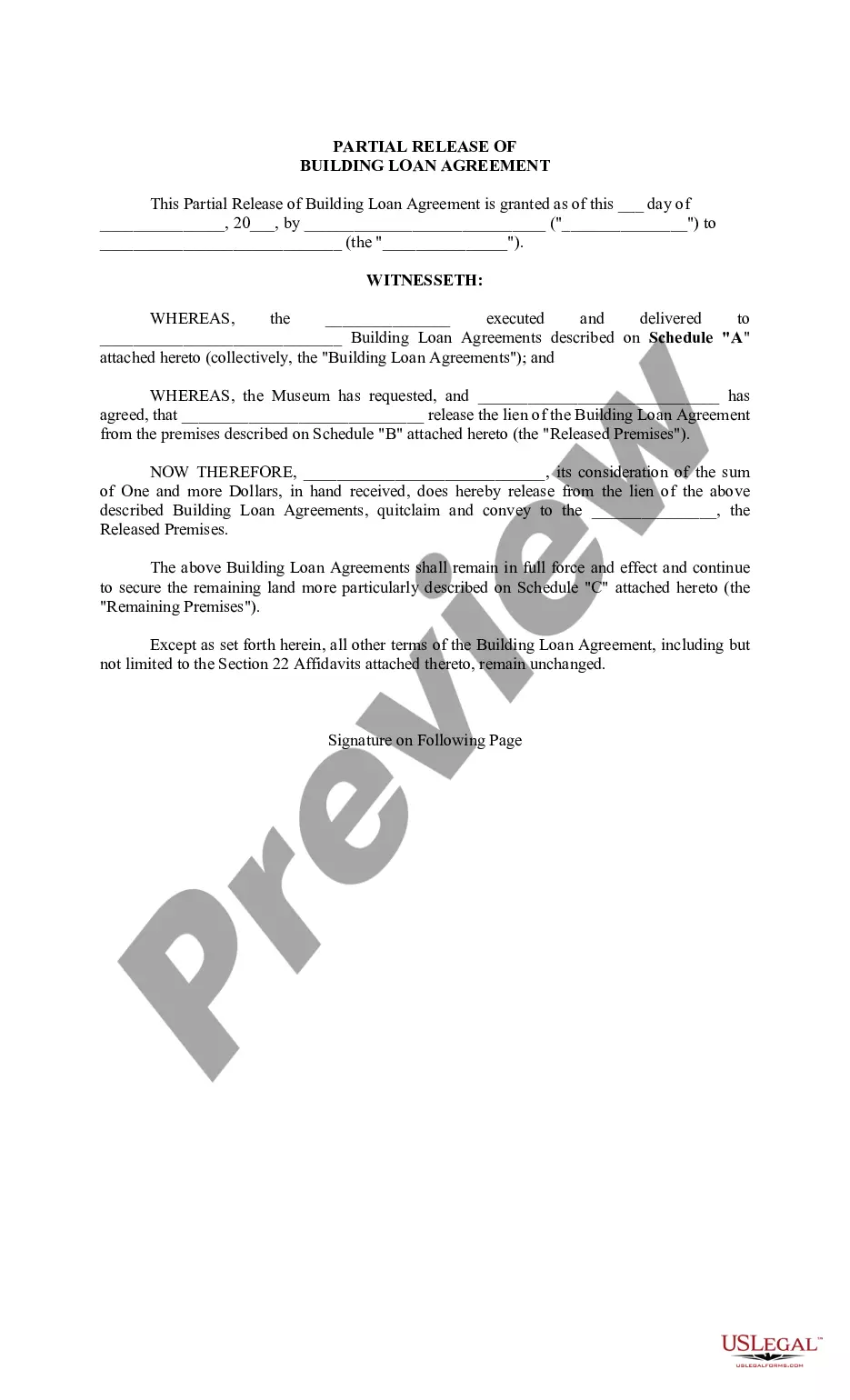

New York Partial Release of Building Loan Agreement

Description

Key Concepts & Definitions

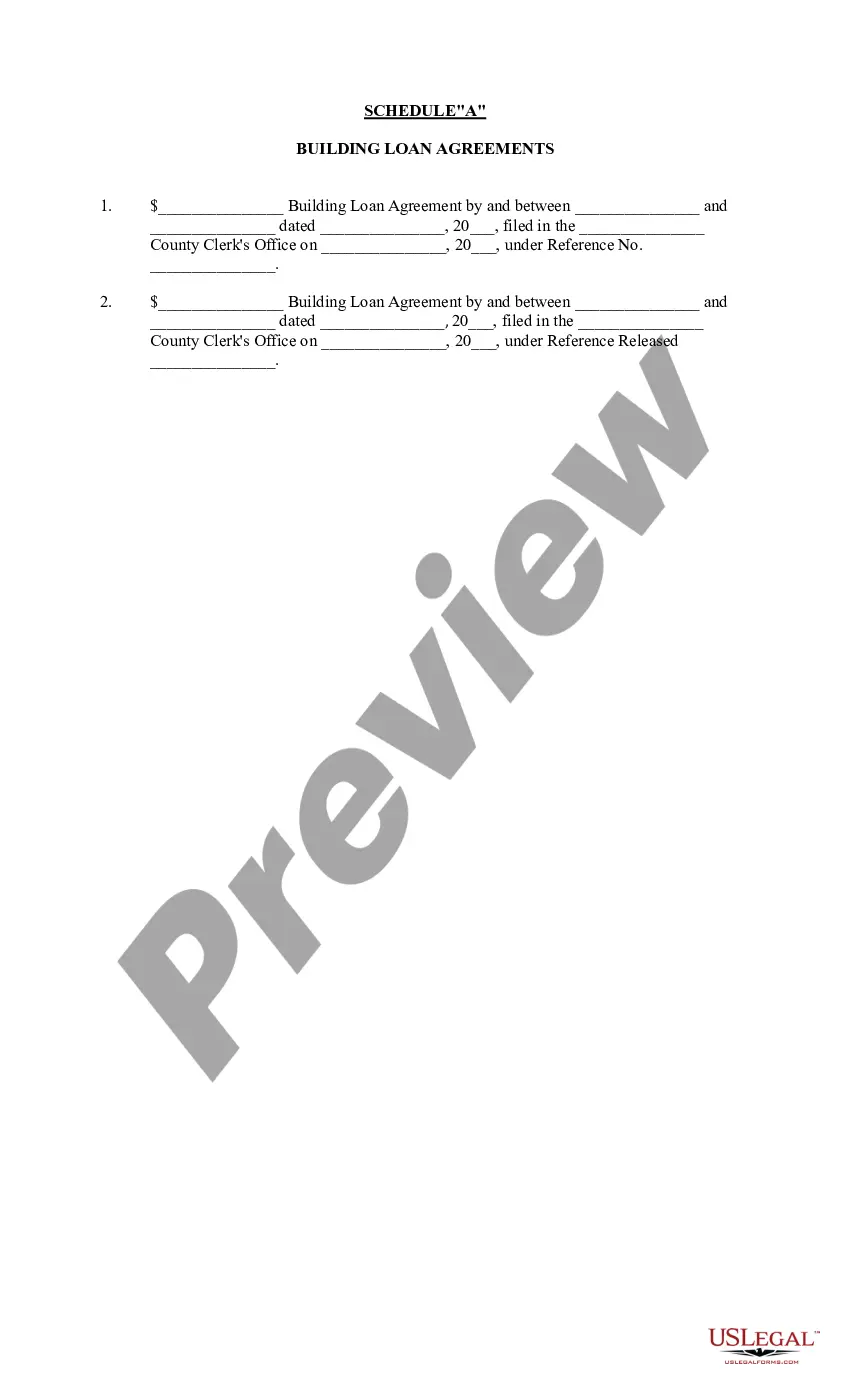

Partial Release of Building Loan Agreement: In the context of real estate development in the United States, a partial release of building loan agreement is a legal provision that allows developers to request a release of a specific part of the property from the mortgage obligations to a lender as the development progresses. This enables the sale or refinancing of that part of the property, often used in large projects segmented into phases.

Step-by-Step Guide

- Review Loan Agreement: Assess your building loan agreement for terms related to partial release. These terms define eligibility, conditions, and processes.

- Complete Development Phases: Ensure that the development meets the criteria set out in the loan agreement for a partial release, such as completion of certain construction stages or pre-sales targets.

- Application for Partial Release: Submit a formal request to your lender detailing the reasons for the partial release along with supporting documentation like construction progress reports.

- Lender Evaluation: The lender will evaluate the request based on the contractual requirements and the project's compliance.

- Agreement Adjustment: If approved, the loan agreement will be adjusted to reflect the partial release, usually requiring legal adjustments and potential fees.

- Completion: Upon agreement adjustment, the portion of the property can be legally released from the original mortgage obligations.

Risk Analysis

- Financial Risks: Inaccurate estimation of project completion stages may lead to denial of the release request, impacting project liquidity.

- Legal Risks: Non-compliance with the terms stipulated in the agreement could result in legal actions or financial penalties.

- Market Risks: Changes in the real estate market could affect the property's value and desirability, impacting the feasibility of release and subsequent sale or refinancing.

Key Takeaways

Importance of Compliance: Adhering strictly to the terms of the building loan agreement is crucial. Professional Advice: Consulting with real estate attorneys and financial advisors can greatly aid in navigating the process. Documentation and Reporting: Maintaining comprehensive records and timely reporting to the lender are key to ensuring the success of a partial release request.

How to fill out New York Partial Release Of Building Loan Agreement?

In terms of filling out New York Partial Release of Building Loan Agreement, you almost certainly imagine a long procedure that consists of choosing a perfect sample among numerous similar ones and then needing to pay legal counsel to fill it out to suit your needs. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form in a matter of clicks.

In case you have a subscription, just log in and click Download to find the New York Partial Release of Building Loan Agreement sample.

In the event you don’t have an account yet but need one, keep to the point-by-point guideline below:

- Make sure the file you’re getting is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and also by clicking on the Preview option (if accessible) to view the form’s content.

- Click Buy Now.

- Find the suitable plan for your budget.

- Join an account and choose how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional attorneys draw up our templates to ensure that after saving, you don't need to bother about enhancing content outside of your personal info or your business’s details. Sign up for US Legal Forms and get your New York Partial Release of Building Loan Agreement sample now.

Form popularity

FAQ

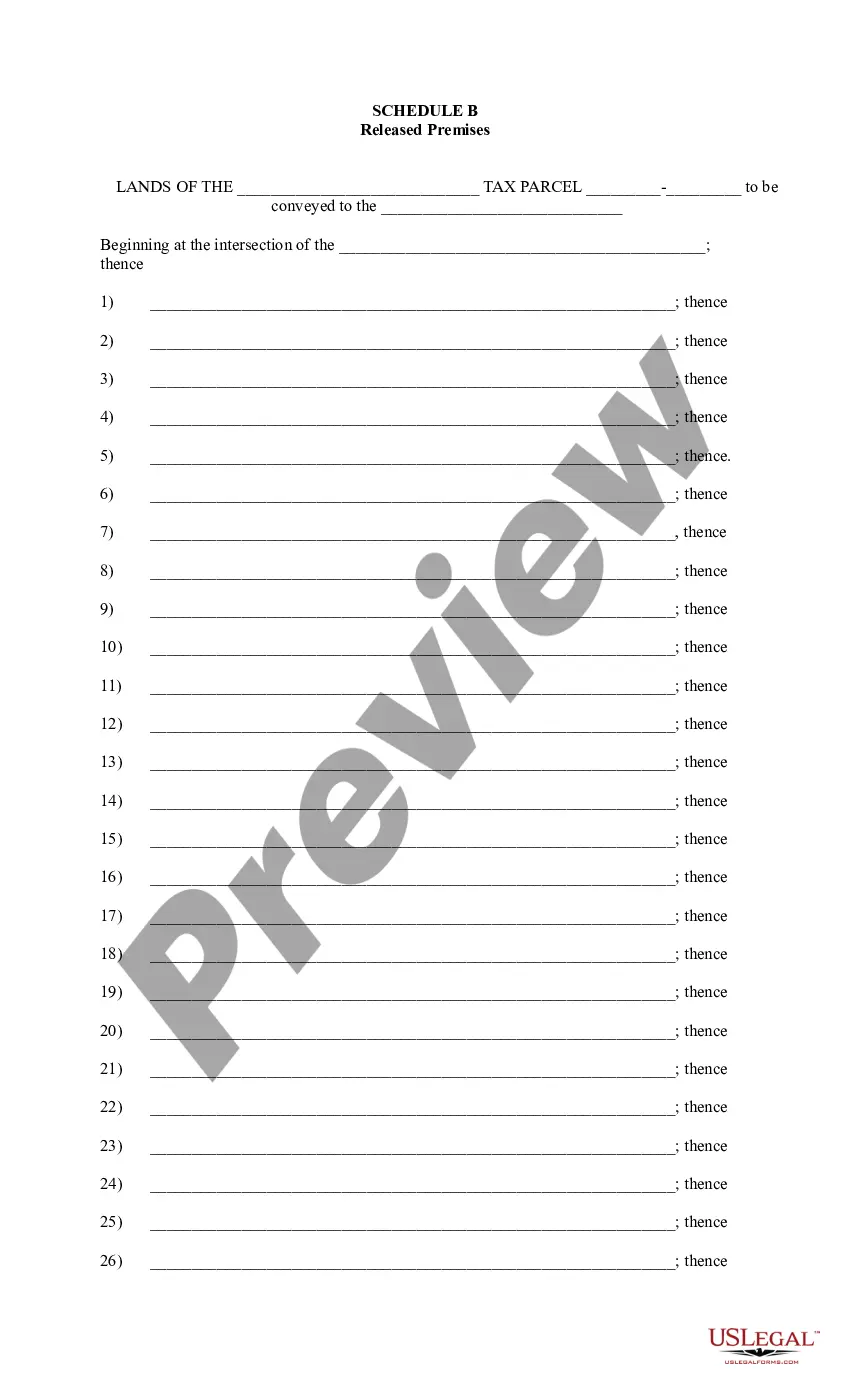

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Loan Release means the process that Party B issues an instruction to Party A to cancel the suspension of payment of all bidding funds for certain subject in the case of fulfillment of the conditions of loan release, and transfer them to the payment account designated by the borrower, and to credit any amount receivable

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

When your lender releases a mortgage, you have paid off the loan balance. A release of a mortgage is the removal of the lender's lien on your home.Your lender must complete release of lien documents, provided by your state government, to eliminate the lender's interest in your home.

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.