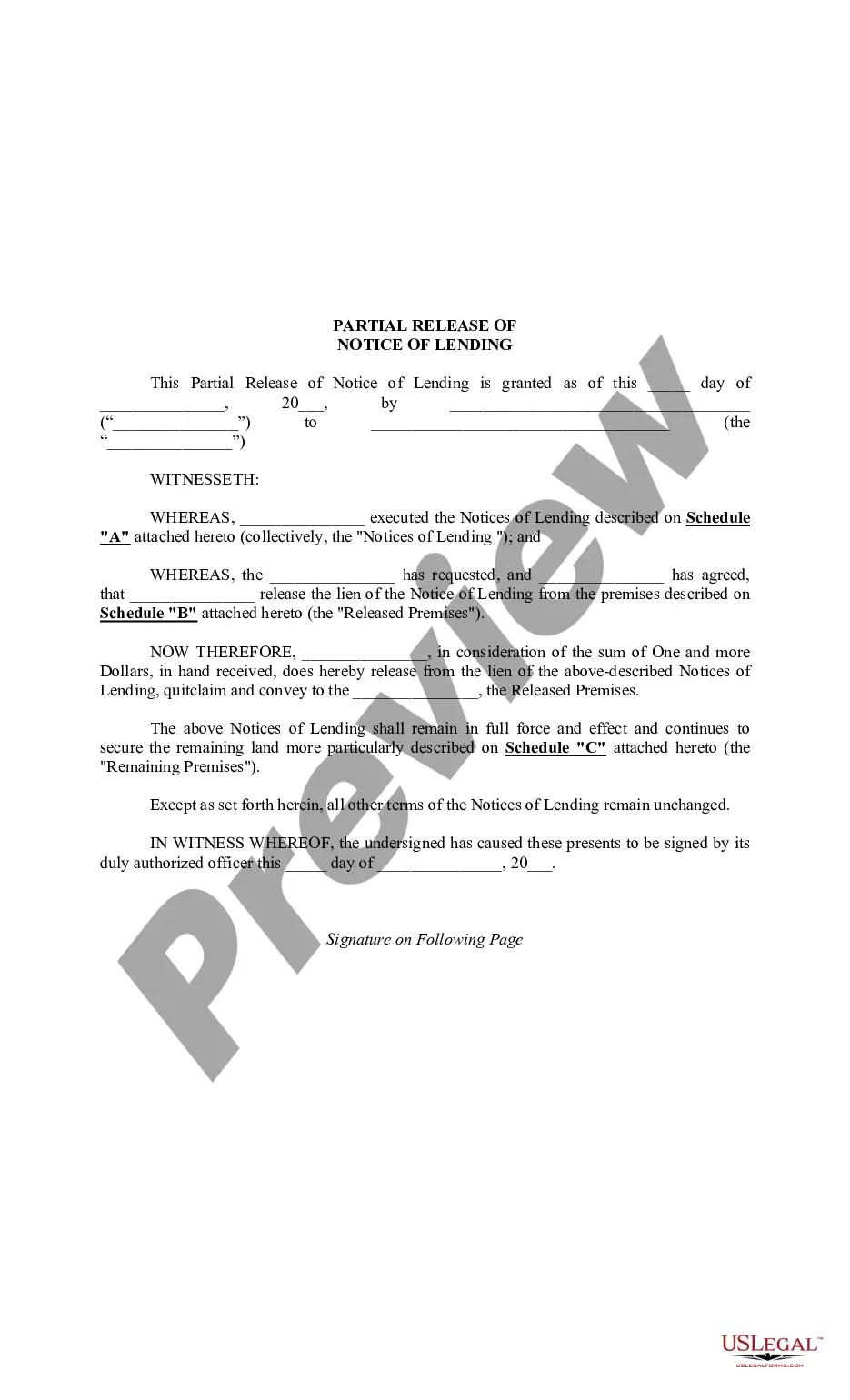

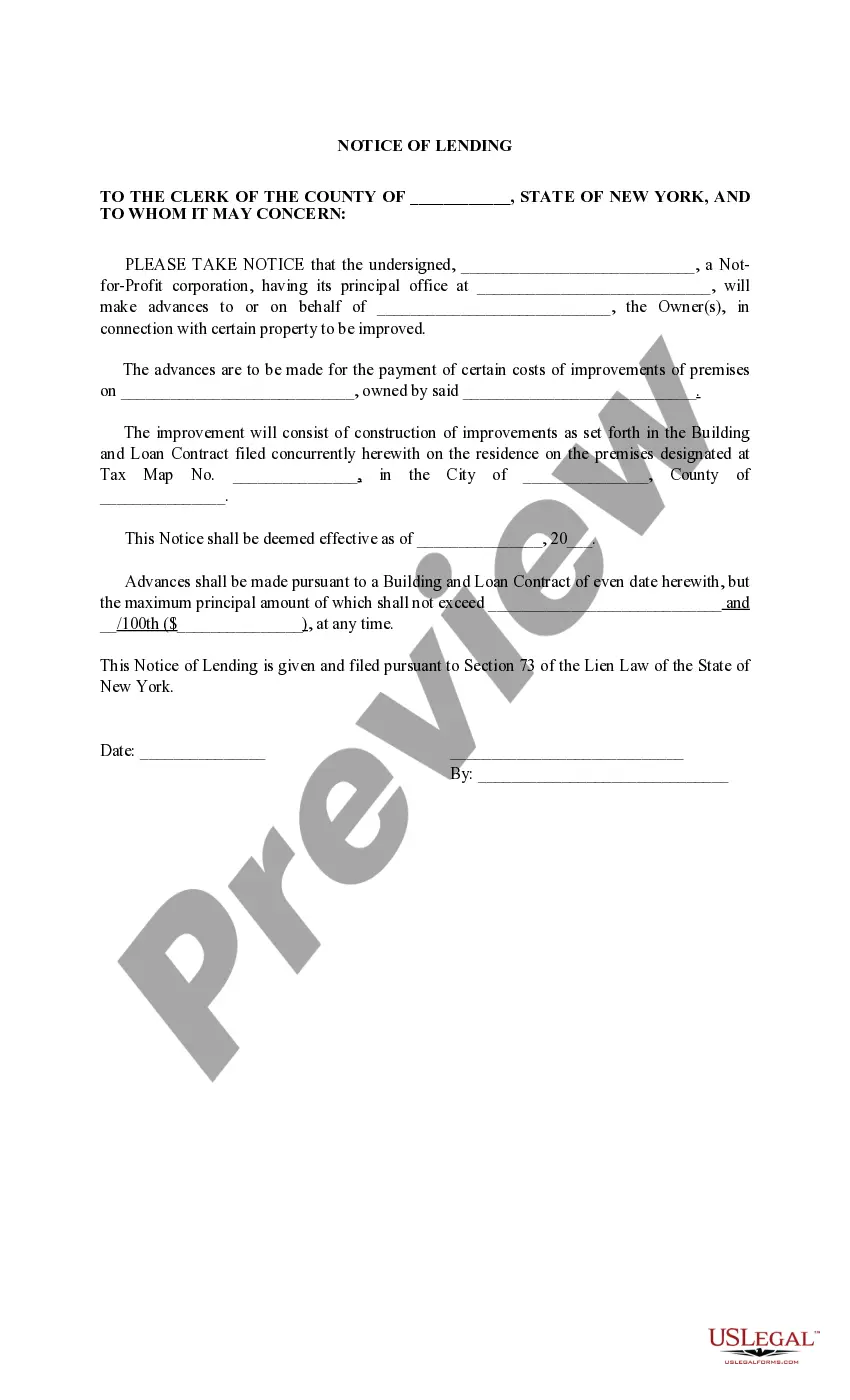

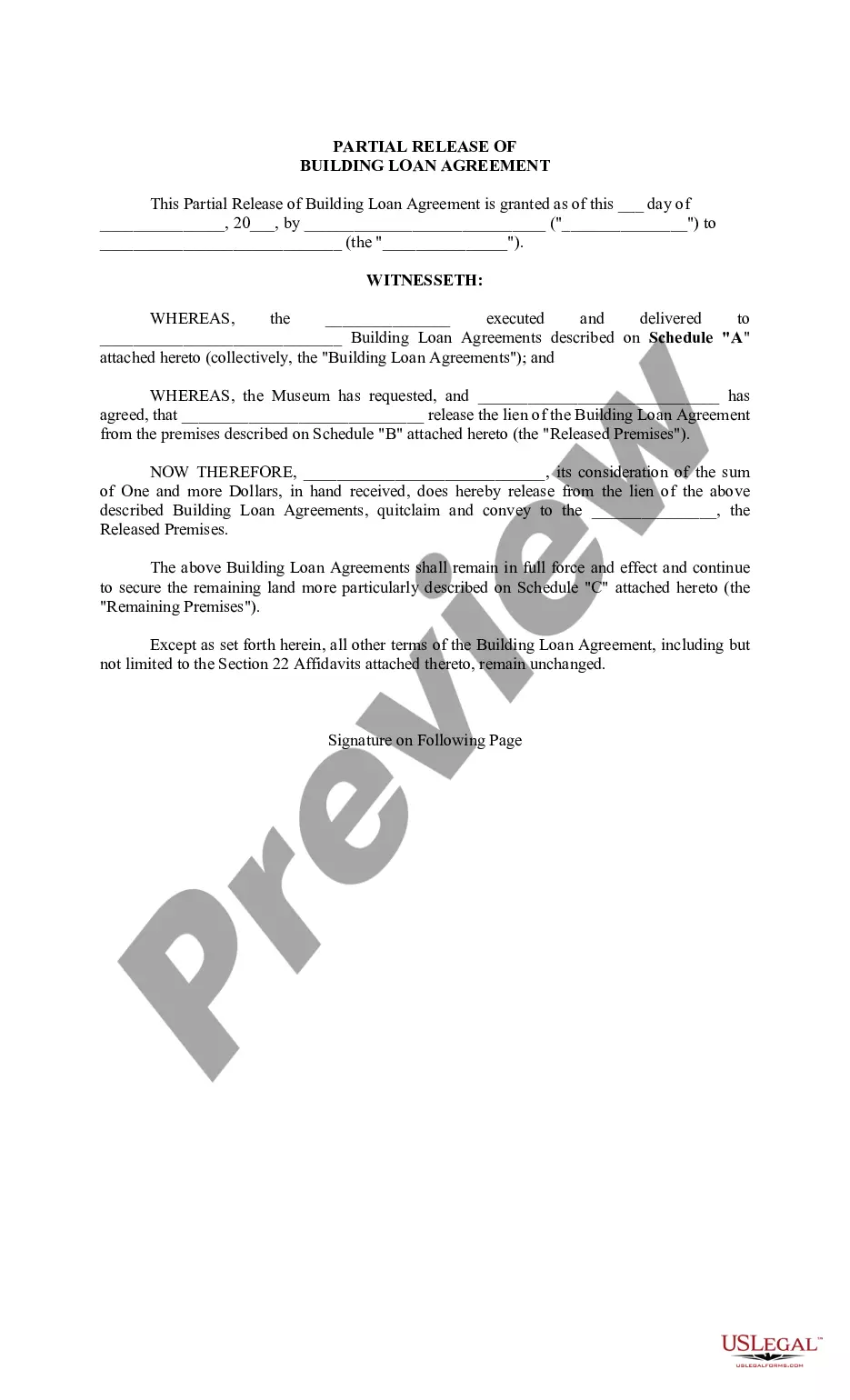

New York Partial Release of Notice of Lending

Description

How to fill out New York Partial Release Of Notice Of Lending?

When it comes to completing New York Partial Release of Notice of Lending, you most likely visualize a long procedure that consists of finding a perfect form among hundreds of very similar ones and after that needing to pay a lawyer to fill it out to suit your needs. In general, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific document within just clicks.

For those who have a subscription, just log in and click on Download button to have the New York Partial Release of Notice of Lending template.

If you don’t have an account yet but need one, keep to the step-by-step manual listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do so by looking at the form’s description and by clicking on the Preview function (if accessible) to find out the form’s information.

- Click Buy Now.

- Find the proper plan for your budget.

- Subscribe to an account and select how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Professional legal professionals work on creating our samples so that after saving, you don't need to worry about modifying content material outside of your individual info or your business’s information. Sign up for US Legal Forms and get your New York Partial Release of Notice of Lending document now.

Form popularity

FAQ

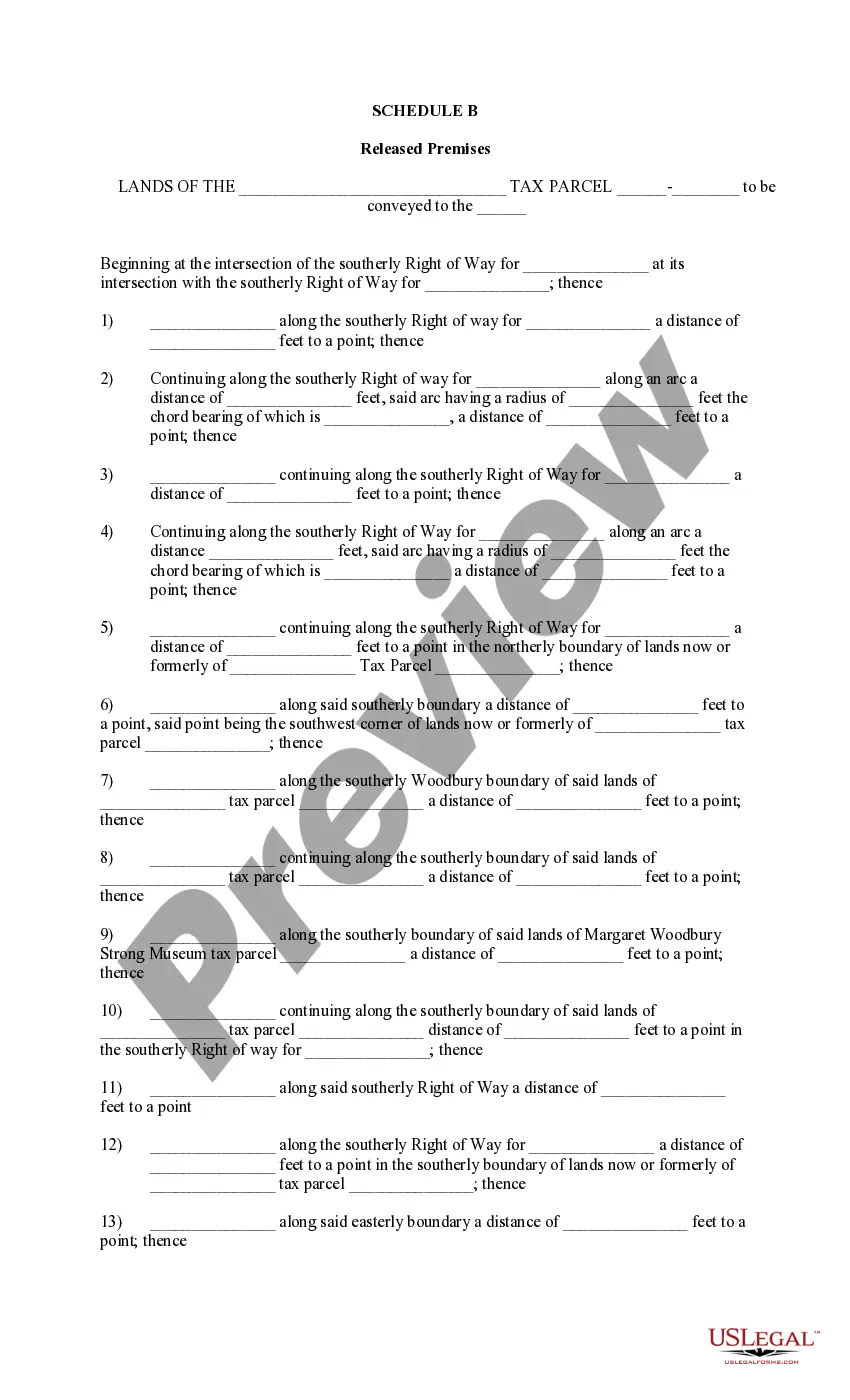

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

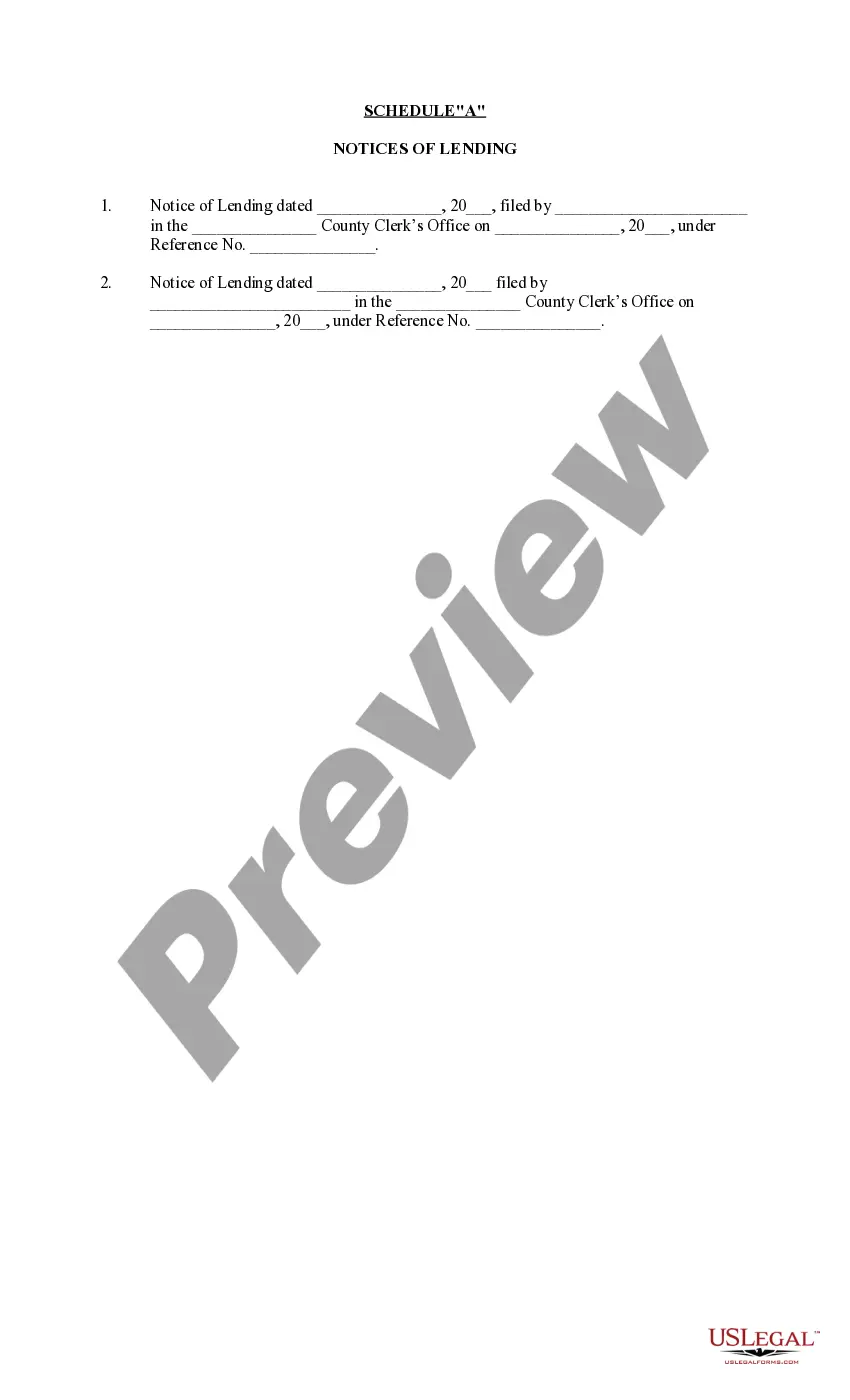

(a) If funds are advanced to or on behalf of a trustee, for the purposes of the trust, either the trustee or the person advancing the funds may file a "Notice of Lending" as provided in this subdivision.Each such notice shall be indexed by the name of the trustee to whom or on whose behalf the advances are made.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

When your lender releases a mortgage, you have paid off the loan balance. A release of a mortgage is the removal of the lender's lien on your home.Your lender must complete release of lien documents, provided by your state government, to eliminate the lender's interest in your home.