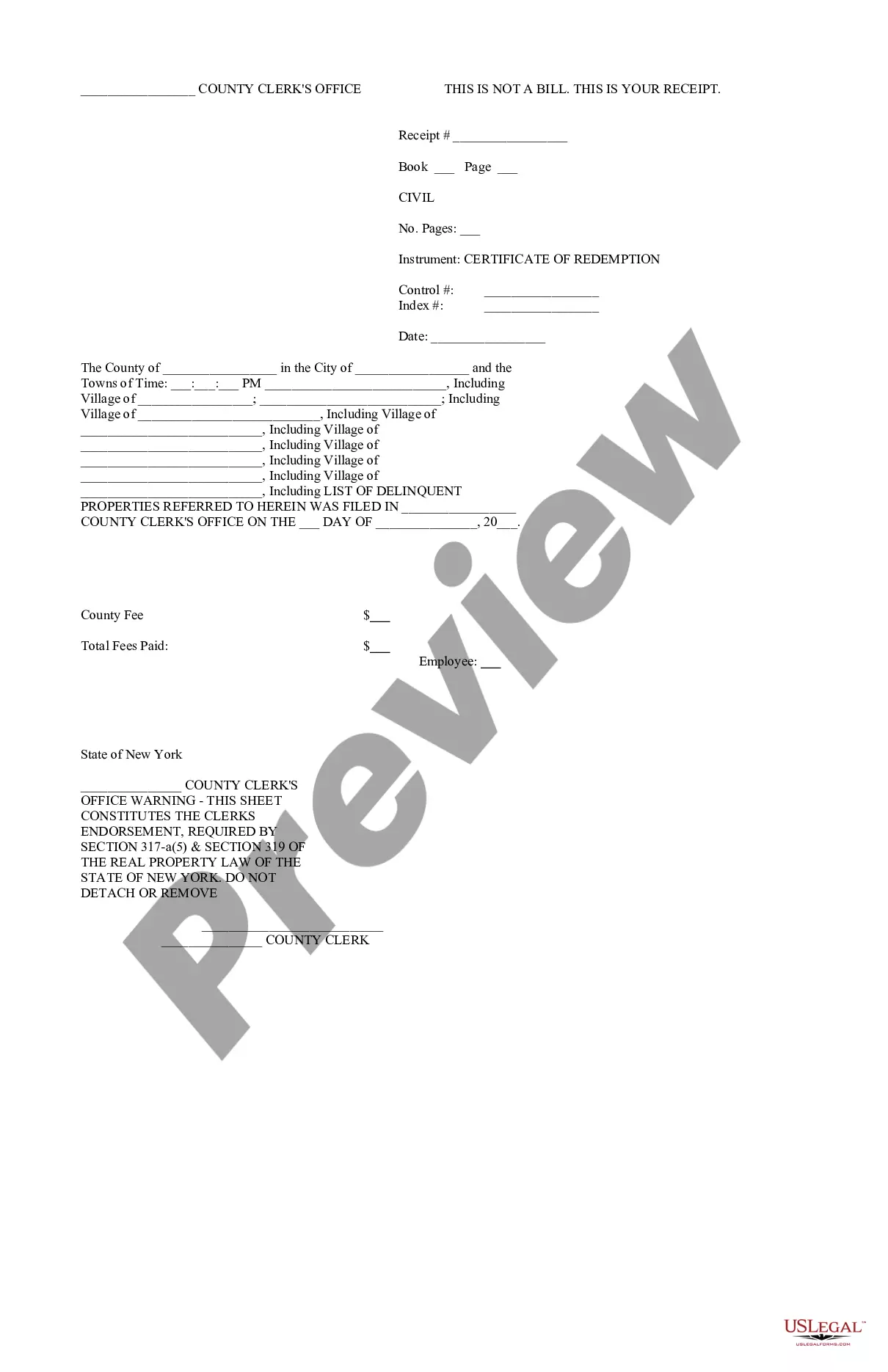

New York Certificate of Redemption

Description

Key Concepts & Definitions

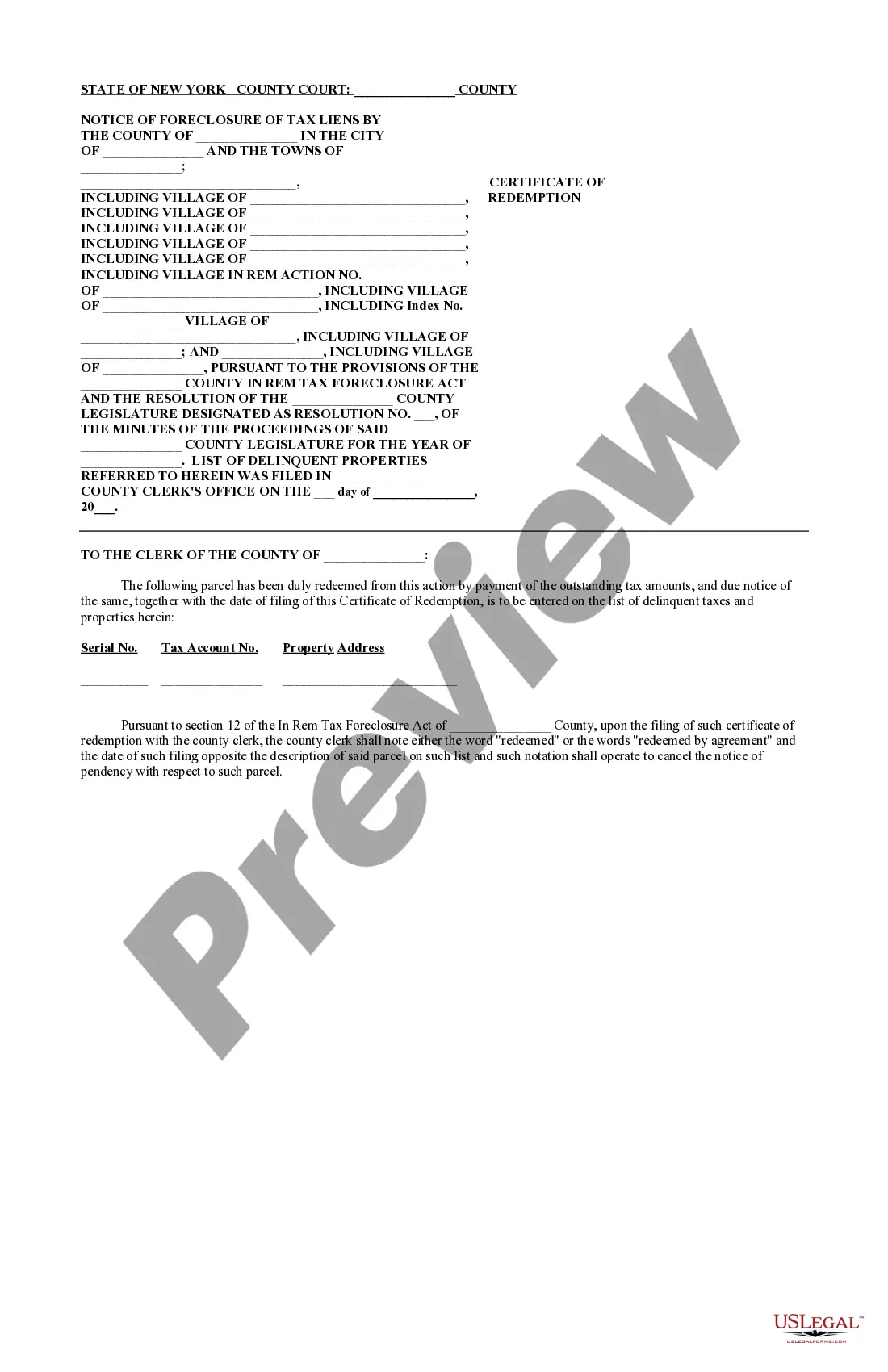

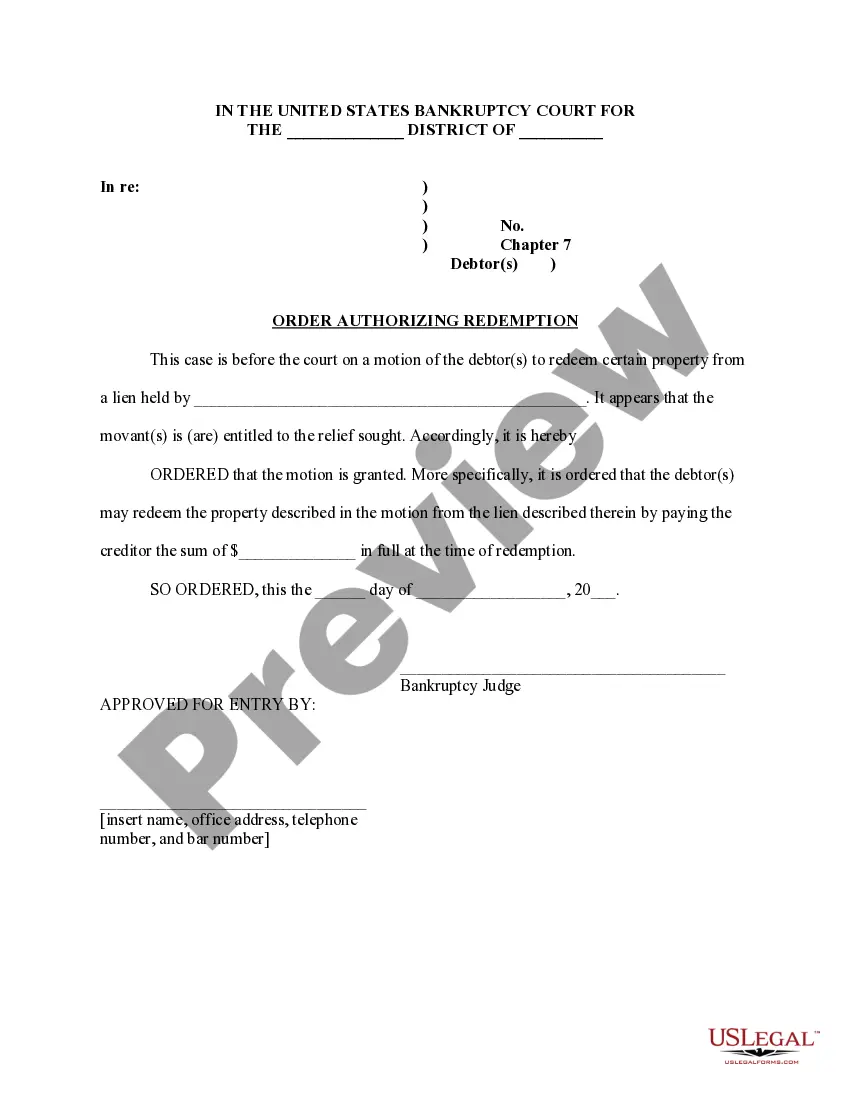

Certificate of Redemption: A legal document issued by the relevant governmental office, such as a county treasurer or tax collector, indicating that all outstanding debts or taxes on a property have been paid and the ownership rights to the property are now clear. This certificate is vital in real estate transactions and tax lien foreclosures in the United States.

Step-by-Step Guide

- Verify the Need for a Certificate of Redemption: Confirm that the property involved has been subject to a tax lien or similar issue requiring redemption.

- Clear All Debts: Pay all outstanding amounts owed, including taxes, fees, and other liens, in full to the local tax authority.

- Apply for the Certificate: Submit an application to the local governmental body responsible for issuing certificates of redemption, typically the county treasurer's office.

- Receive and Review the Certificate: Ensure all details are correct, such as property description, ownership details, and full payment confirmation.

- File the Certificate: Officially file the certificate with the county recorder to update the public record regarding the property's status.

Risk Analysis

- Legal Complications: Inadequate documentation or unresolved previous liens can invalidate the certificate of redemption, leading to potential legal challenges.

- Financial Burden: The cost of clearing debts and obtaining the certificate might be substantial, impacting financial planning.

- Time Delays: Administrative delays in processing redemption and certificate issuance can delay property transactions or refinancing plans.

Key Takeaways

Obtaining a certificate of redemption is crucial for clearing property titles from tax liens or other encumbrances in the United States. Ensuring all debts are paid and proper documentation is filed is essential for avoiding legal and financial complications.

FAQ

- What happens if you don't obtain a certificate of redemption? Failure to obtain a certificate can result in continued encumbrances on the property, affecting its sale or use.

- How long does it take to receive a certificate of redemption? The time varies by jurisdiction but generally can take a few weeks to several months, depending on the complexity of the situation and efficiency of the local government offices.

How to fill out New York Certificate Of Redemption?

When it comes to submitting New York Certificate of Redemption, you most likely think about a long process that requires finding a suitable sample among countless similar ones then needing to pay legal counsel to fill it out for you. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

If you have a subscription, just log in and click on Download button to have the New York Certificate of Redemption form.

In the event you don’t have an account yet but need one, keep to the step-by-step manual listed below:

- Be sure the file you’re getting is valid in your state (or the state it’s required in).

- Do so by reading through the form’s description and through clicking on the Preview option (if readily available) to find out the form’s information.

- Click Buy Now.

- Pick the appropriate plan for your budget.

- Join an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Professional legal professionals work on drawing up our samples so that after downloading, you don't need to worry about enhancing content outside of your personal information or your business’s info. Sign up for US Legal Forms and receive your New York Certificate of Redemption example now.

Form popularity

FAQ

Generally, the redemption period expires two years after the lien date (that is, when the tax or other legal charges became a lien). However, local law may provide a longer redemption period (N.Y. Real Prop. Tax Law § 1110).

A tax lien sale certificate is a document proving that the holder has purchased a property in a tax lien sale auction.

A redeemable tax deed is something in between a tax lien and tax deed. When you go to a redeemable tax deed sale, you are actually purchasing the deed to the property.The owner can redeem the property by paying the amount that was bid for the deed at the tax sale plus a hefty penalty or interest.

Property taxes are considered delinquent for purposes of this program under either of the following circumstances: The taxes remain unpaid one year after the last date on which they could have been paid without interest.

New York is an average state for tax lien certificates and a good state for tax deed sales, but rules vary and some municipalities have their own sales. New York Tax Lien Auctions are usually in April or August but can vary; New York Tax Deed Sales occur throughout the year.

What does it mean if a property is redeemed? Redeemed properties are those in which the delinquent taxes are paid prior to the issuance of the Tax Deed. If the delinquent taxes are paid prior to the start of the sale, the property will not be offered for sale.

What Is a Tax Lien Certificate? A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. 1feff Tax lien certificates are generally sold to investors through an auction process.

The owner of a property up for auction at our annual tax sale has the right to pay off all defaulted taxes, penalties, fees, and/or costs to avoid a sale. This is called right to redemption.The term REDEEMED means all defaulted taxes, penalties, fees, and/or costs have been paid in full.

A certificate of redemption is an official acknowledgment that a property owner has paid off in full all delinquent property taxes, penalties, fees and interest owed on the property.