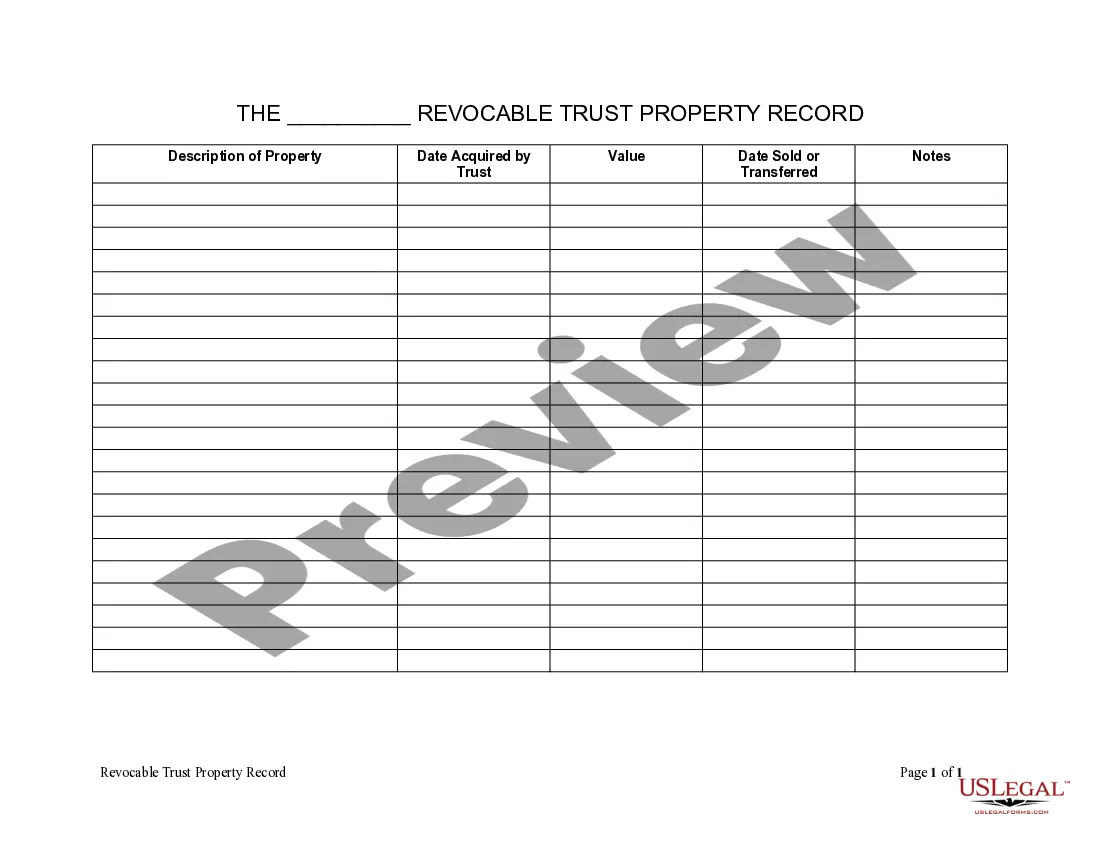

New York Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Living Trust Property Record?

In terms of completing New York Living Trust Property Record, you probably visualize an extensive procedure that involves choosing a perfect form among hundreds of very similar ones after which being forced to pay legal counsel to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific form in a matter of clicks.

For those who have a subscription, just log in and then click Download to get the New York Living Trust Property Record template.

If you don’t have an account yet but want one, follow the point-by-point guideline below:

- Be sure the document you’re downloading is valid in your state (or the state it’s required in).

- Do this by reading through the form’s description and through clicking on the Preview option (if accessible) to find out the form’s information.

- Click Buy Now.

- Select the appropriate plan for your financial budget.

- Subscribe to an account and select how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Professional lawyers draw up our templates so that after saving, you don't have to worry about modifying content material outside of your personal info or your business’s details. Sign up for US Legal Forms and get your New York Living Trust Property Record example now.

Form popularity

FAQ

What happens if you have lost your Trust?If a Trust is lost, and the decedent has assets titled in the name of the Trust, the court will require that the heirs/Successor Trustees spend a significant amount of time and money searching for the Trust and documenting the search process.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

Today clients who have living trusts normally keep the original copy. Having the attorney keep the original copy of the trust is not as important as keeping the original will used to be. At death, a copy of the trust generally suffices for all parties in place of the original.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.