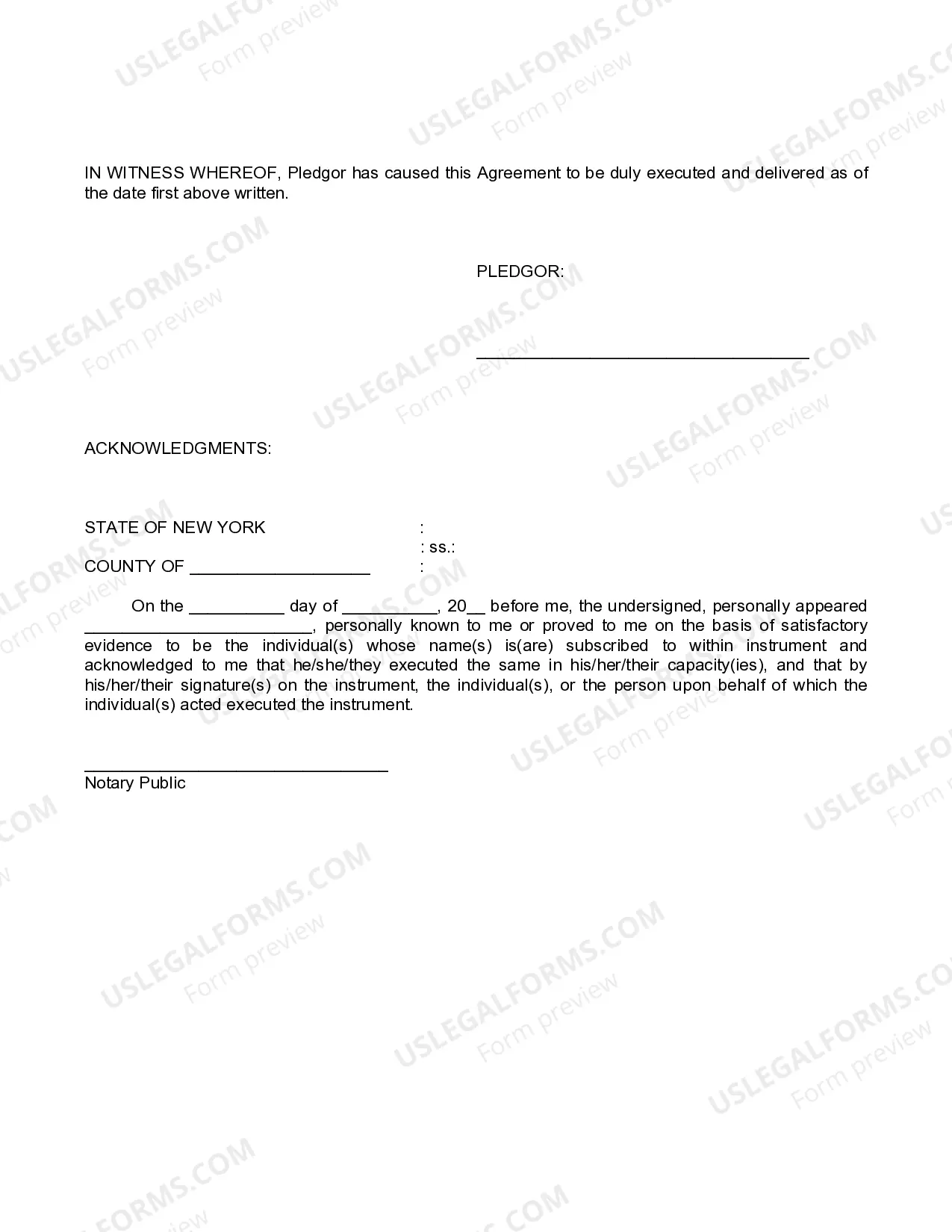

A New York LLC Pledge Agreement is a legal document used to secure a loan with the assets of a New York limited liability company (LLC). This type of agreement allows an LLC member to pledge their membership interest in the company as collateral for a loan. The borrower agrees to forfeit their ownership in the LLC in the event of default on the loan. There are two types of New York LLC Pledge Agreement: a standard pledge agreement and a secured pledge agreement. The standard pledge agreement is the most common type of New York LLC Pledge Agreement. This agreement outlines the terms and conditions of the loan, including the loan amount, repayment terms, interest rate, and the ownership interest of the borrower that is being pledged as collateral. The agreement also must be signed by both the borrower and the lender to be legally binding. The secured pledge agreement is similar to the standard pledge agreement, but it adds a layer of security for the lender. In secured pledge agreements, the borrower must provide additional collateral to secure the loan. This could include real estate, vehicles, equipment, inventory, or other assets. The secured pledge agreement also includes language that states the borrower will forfeit their ownership interest in the LLC if they default on the loan. Both types of New York LLC Pledge Agreement must be filed with the New York Secretary of State in order to be legally binding.

New York LLC Pledge Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York LLC Pledge Agreement?

How much time and resources do you often spend on composing formal paperwork? There’s a better way to get such forms than hiring legal experts or spending hours browsing the web for a proper template. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the New York LLC Pledge Agreement.

To acquire and prepare a suitable New York LLC Pledge Agreement template, follow these simple instructions:

- Look through the form content to make sure it complies with your state laws. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, find a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the New York LLC Pledge Agreement. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your New York LLC Pledge Agreement on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

1. A promise. 2. A type of security interest in which a lender takes possession of personal property as security for an obligation. The personal property involved is also called a pledge.

A pledged asset is an asset that is used by a lender to secure a debt or loan and can include cash, stocks, bonds, and other equity or securities. A pledged asset is collateral held by a lender in return for lending funds.

Pledged LLC Interests means all interests in any limited liability company including, without limitation, all limited liability company interests listed on Schedule 4.4(A) under the heading ?Pledged LLC Interests? (as such schedule may be amended or supplemented from time to time) and the certificates, if any,

Title pledge agreement means a thirty-day written agreement whereby a title pledge lender agrees to make a loan of money to a pledgor, and the pledgor agrees to give the title pledge lender a security interest in unencumbered titled personal property owned by the pledgor.

To effectuate this, a lender and business owner enter into a Pledge Agreement (PA): the business owner (or pledgor) conveys possessory and other rights in the membership interest to the lender (or secured party) as security for the repayment of the loan.

This is mentioned in Section 173 of the Act. For example: 'A' pledged his house with a bank for a loan of INR 2,50,000. The interest on the same was INR 10,000. The bank can retain the pledged house until 'A' repays the entire amount along with the interest i.e. INR 2,60,000.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.