New York Executor's Deed

Overview of this form

The Executor's Deed is a legal document used by an executor or personal representative of an estate to transfer real property owned by a deceased person to designated beneficiaries or heirs. Unlike a general warranty deed or quitclaim deed, an Executor's Deed specifically verifies that the transfer is made in accordance with the deceased person's will or, if there is no will, state law regarding intestate succession. This form is crucial in settling the estate and ensuring the legal title of the property passes to the rightful owners.

Main sections of this form

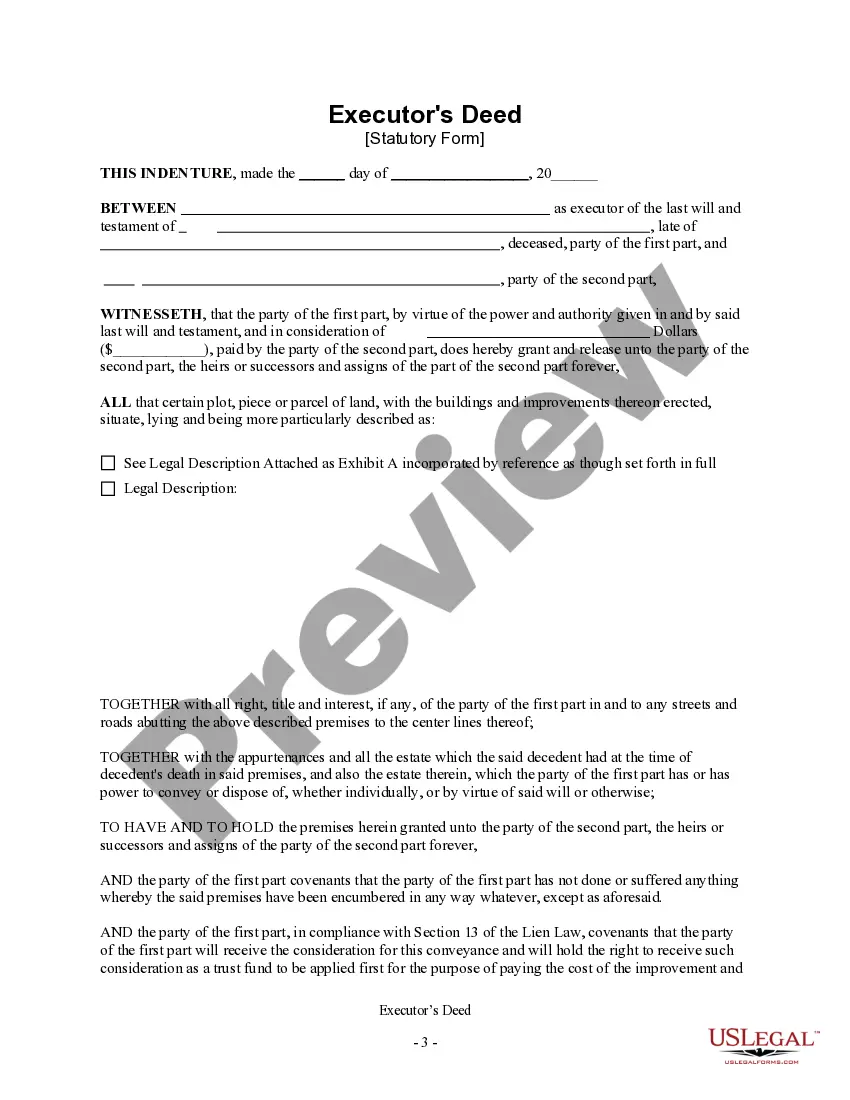

- Description of the property being transferred, including its legal description.

- Details of the deceased person, including their name and date of death.

- Statement of authority from the executor, affirming their right to convey the property.

- Signatures of the executor and witnesses, if required by local law.

- Consideration or payment details, if applicable.

When this form is needed

Who this form is for

This form is intended for:

- Executors or personal representatives of a deceased estate.

- Beneficiaries who have been granted authority to manage estate property.

- Individuals involved in the probate process of an estate.

Completing this form step by step

- Identify the deceased by entering their full name and date of death.

- Provide the legal description of the property being transferred.

- Fill in your name and title as the executor of the estate.

- Detail any consideration received for the property, if applicable.

- Sign and date the form in the presence of witnesses or a notary if required.

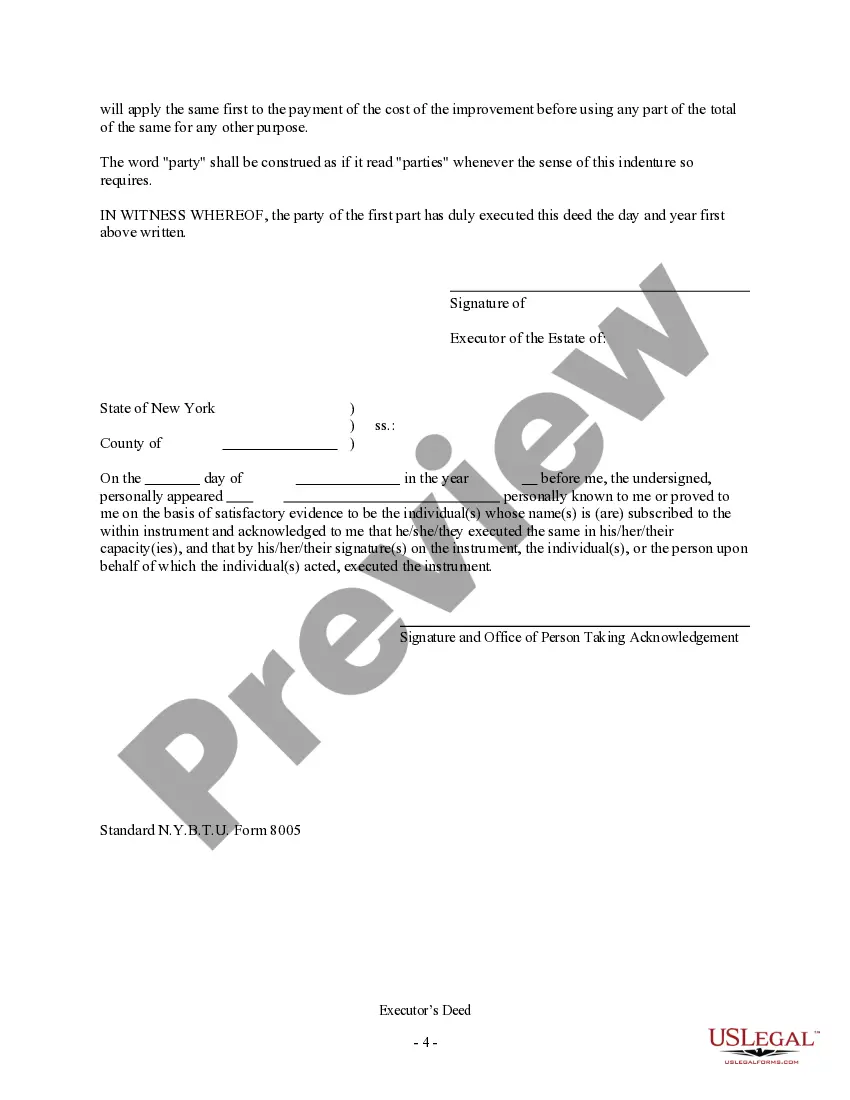

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include the legal description of the property.

- Omitting required signatures or witnesses.

- Not using the correct form version for your state.

- Forgetting to check for local notarization requirements.

Why use this form online

- Convenient access to essential legal forms from anywhere, anytime.

- Edit and customize the form easily to suit your specific situation.

- Reliable and up-to-date templates drafted by licensed attorneys.

What to keep in mind

- The Executor's Deed is crucial for transferring property after death.

- Complete the form accurately to avoid delays in the probate process.

- Consult an attorney if you have questions about your responsibilities as executor.

Looking for another form?

Form popularity

FAQ

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

The executor can sell property without getting all of the beneficiaries to approve.Once the executor is named there is a person appointed, called a probate referee, who will appraise the estate assets. Among those assets will be the real estate and the probate referee will appraise the real estate.

Upon the death of an owner of registered real property, it shall be incumbent upon the executor or administrator of the estate of the deceased, to present to the registrar a petition on the annexed form, for the transfer of title into the name of the executor or administrator, or upon filing of a deed executed by the

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

These deeds are called Transfer on Death (TOD) deeds. However, Transfer on Death deeds are not permissible in New York. Instead you must deed your property directly to the beneficiary, or to a trust to be held for your beneficiary, during your lifetime.