Nevada Dissolution of Unit

Description

How to fill out Dissolution Of Unit?

Are you presently within a situation that you need to have documents for either organization or specific reasons nearly every time? There are plenty of authorized record themes available online, but locating ones you can trust is not effortless. US Legal Forms offers a large number of form themes, just like the Nevada Dissolution of Unit, that are published in order to meet state and federal requirements.

When you are currently familiar with US Legal Forms web site and also have a merchant account, basically log in. Next, you can obtain the Nevada Dissolution of Unit format.

Should you not have an accounts and wish to start using US Legal Forms, abide by these steps:

- Find the form you will need and make sure it is for that right area/county.

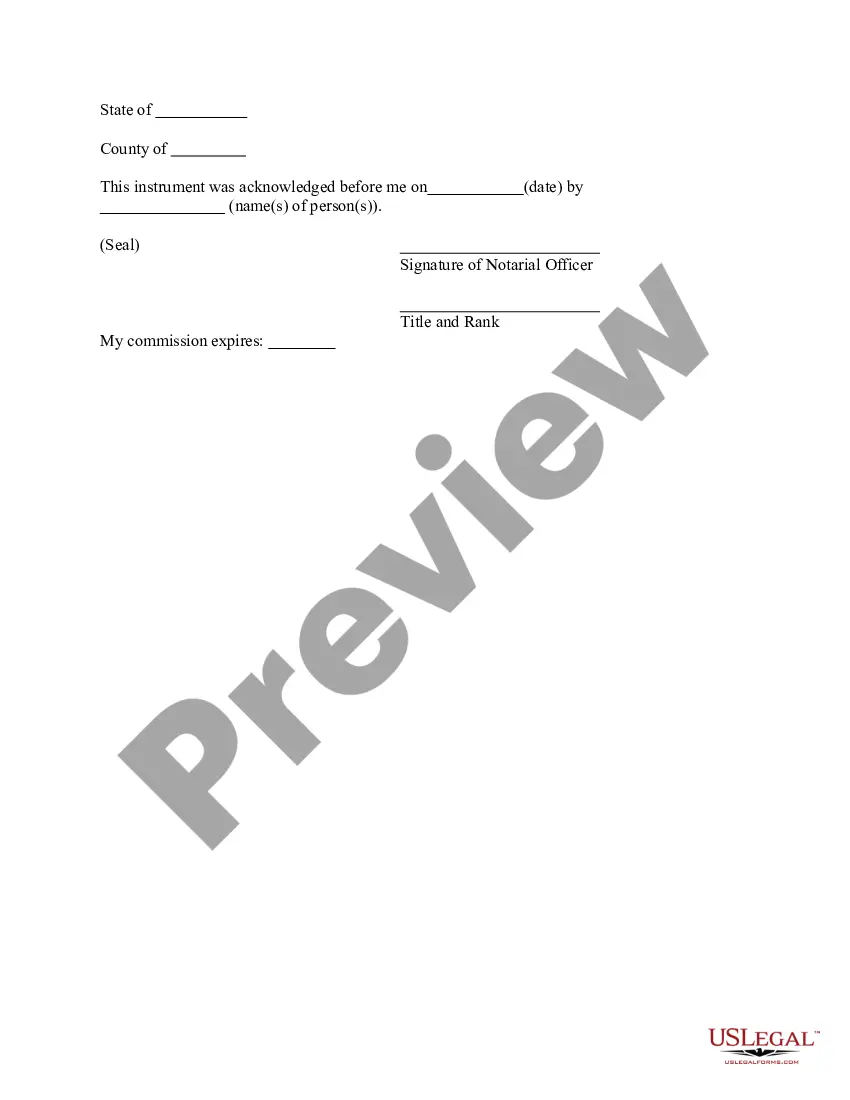

- Utilize the Review option to check the shape.

- Read the outline to ensure that you have chosen the proper form.

- In case the form is not what you are seeking, utilize the Look for industry to discover the form that meets your requirements and requirements.

- Once you get the right form, just click Buy now.

- Select the rates prepare you would like, complete the required information and facts to create your bank account, and buy your order utilizing your PayPal or charge card.

- Decide on a handy paper format and obtain your version.

Locate all the record themes you possess purchased in the My Forms food selection. You can aquire a further version of Nevada Dissolution of Unit anytime, if necessary. Just select the necessary form to obtain or produce the record format.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, to save lots of time and avoid mistakes. The services offers professionally manufactured authorized record themes which you can use for a selection of reasons. Make a merchant account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

To dissolve your limited liability company in Nevada, there is a $100 filing fee required. Expedited service within 24 working hours is available for an additional $125 fee. Expedited service within two hours is available for an additional $500 fee.

Once a company is dissolved, it no longer exists as a legal entity and cannot conduct business or enter into contracts. Dissolution may also trigger a number of certain legal obligations, such as the distribution of remaining assets to creditors or shareholders. It also might involve the filing of final tax returns.

The process to close Nevada LLC involves filing of dissolution documents with the secretary of state along with liquidating your business assets and settling any liabilities. The process for dissolving Nevada LLC will take 7-10 business days from the day you file the proper documents.

How do you dissolve a Nevada corporation? To dissolve your domestic corporation in Nevada, you submit the completed Certificate of Dissolution and Customer Order Instructions forms to the Secretary of State by mail, fax, email or in person, along with the filing fee.

How to Dissolve an LLC in Nevada in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

Lastly, the corporation must go through the process of dissolving assets, closing any other accounts, and distributing cash to creditors and shareholders. The selling off of assets can be a long process depending on the size and industry of the corporation.

File online at .nvsilverflume.gov or return the completed form to the Secretary of State by fax to (775) 684-5725; by email to newfilings@sos.nv.gov; or, by mail to 202 North Carson Street, Carson City, Nevada 89701-4201.

During a judicial dissolution of an LLC, the law states that a District Court can decree dissolution of an LLC whenever the circumstances dictate that it is not reasonably practicable to continue the company's business in line with either its articles of organization or operating agreement.