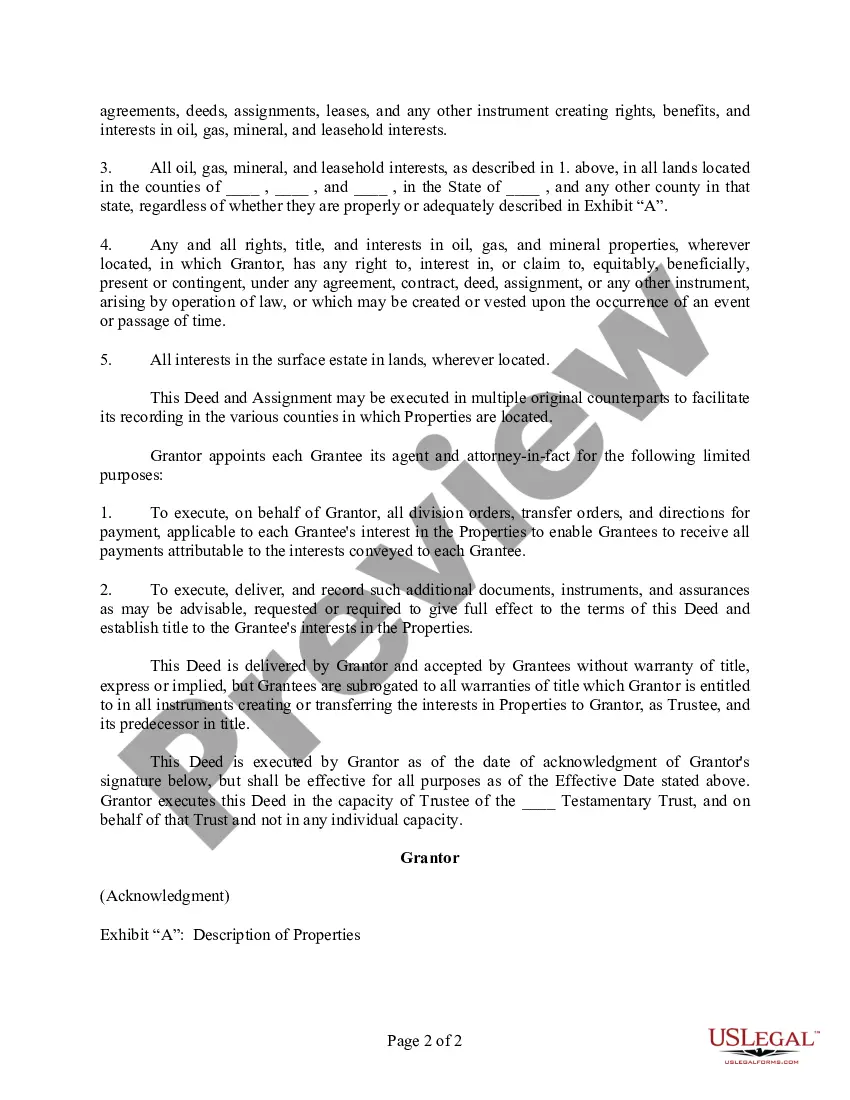

Nevada Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

Are you presently inside a position in which you require papers for either organization or specific purposes just about every day? There are a variety of authorized record layouts available online, but discovering ones you can rely is not straightforward. US Legal Forms provides 1000s of kind layouts, much like the Nevada Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries, that happen to be created to satisfy federal and state needs.

When you are already informed about US Legal Forms web site and get an account, basically log in. Following that, you are able to download the Nevada Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries template.

Unless you come with an bank account and would like to start using US Legal Forms, abide by these steps:

- Find the kind you will need and ensure it is for that proper metropolis/state.

- Utilize the Review button to check the form.

- See the outline to ensure that you have selected the correct kind.

- When the kind is not what you`re seeking, utilize the Search field to obtain the kind that fits your needs and needs.

- Whenever you obtain the proper kind, click Buy now.

- Select the rates plan you need, complete the required info to make your money, and pay money for the transaction utilizing your PayPal or credit card.

- Decide on a handy document format and download your copy.

Get each of the record layouts you might have purchased in the My Forms food selection. You may get a further copy of Nevada Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries anytime, if necessary. Just click on the required kind to download or print out the record template.

Use US Legal Forms, by far the most considerable assortment of authorized varieties, to conserve time as well as stay away from blunders. The service provides professionally produced authorized record layouts that you can use for a variety of purposes. Generate an account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes. Trust Fund Distributions to Beneficiaries: Can a Trustee ... keystone-law.com ? trust-fund-distributions-when... keystone-law.com ? trust-fund-distributions-when...

A grantor can appoint someone a trustee as long as the individual is at least 18 years old and is not likely to become bankrupt or mentally incompetent. Grantors can also be the trustee themselves, as long as the trust is a revocable living trust. This means the trust can be changed during the grantor's lifetime. What Is a Trustee and What Are Their Responsibilities? - SmartAsset smartasset.com ? estate-planning ? trustee smartasset.com ? estate-planning ? trustee

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations. Can a Trustee Withhold Money From a Beneficiary? mpopc.com ? blog ? trustee-withhold-money-fro... mpopc.com ? blog ? trustee-withhold-money-fro...

If you borrow from a commercial lender, it is most likely that the lender will determine the trustee, which is typically a title company, professional escrow company, or other company in the business of serving as a real estate trustee. Sometimes a real estate broker or an attorney serves in this role. Naming a trustee in your deed of trust - .com ? articles ? naming-a-trustee... .com ? articles ? naming-a-trustee...

The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

Beneficiaries of a trust typically pay taxes on the distributions they receive from a trust's income rather than the trust paying the tax. However, beneficiaries aren't subject to taxes on distributions from the trust's principal, the original sum of money put into the trust.

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.