Nevada Pipeline Service Contract - Self-Employed

Description

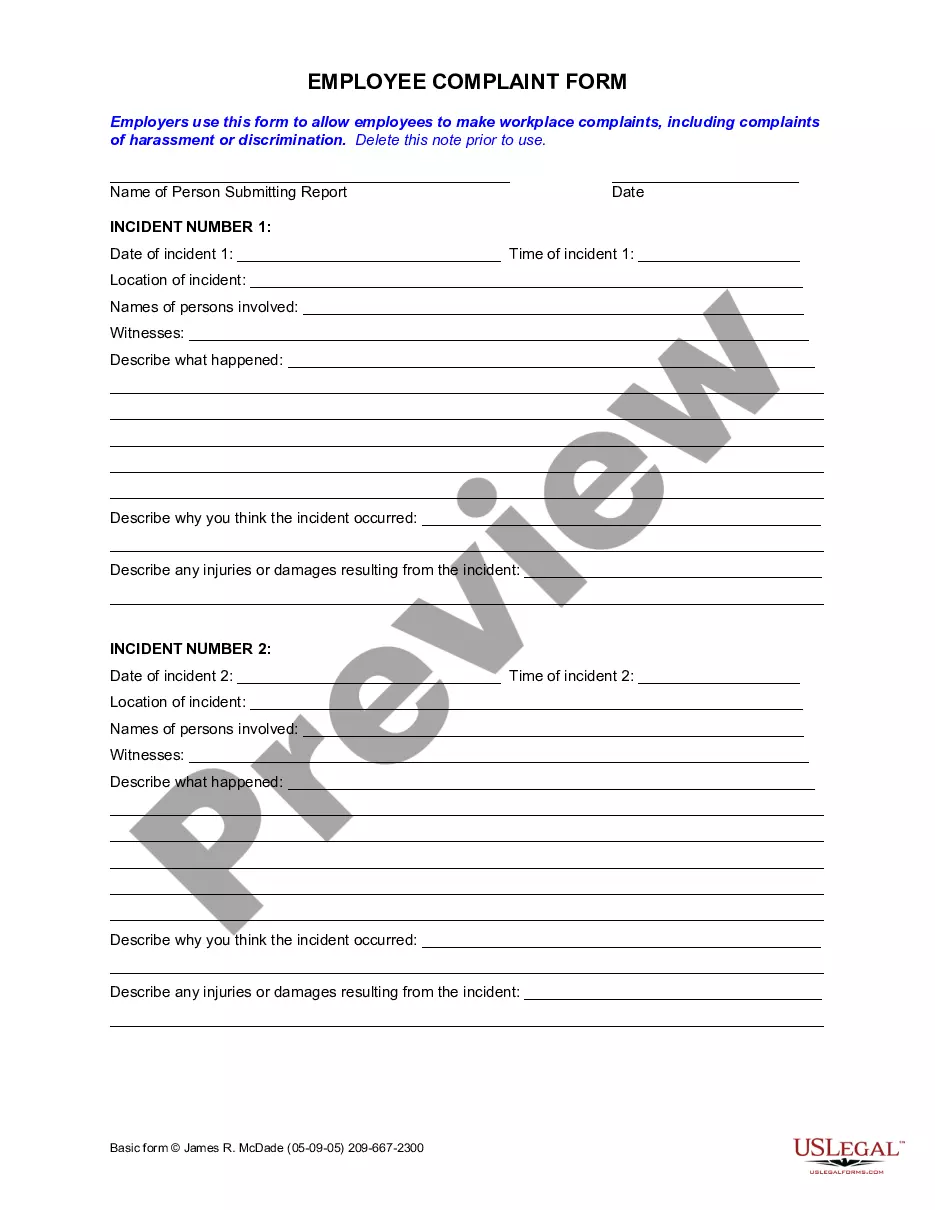

How to fill out Pipeline Service Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Nevada Pipeline Service Contract - Self-Employed in just a few seconds.

If the form does not meet your needs, use the Search area at the top of the page to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Afterwards, choose your preferred payment plan and provide your credentials to register for an account.

- If you already possess an account, Log In and download the Nevada Pipeline Service Contract - Self-Employed from the US Legal Forms library.

- The Download button appears on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have chosen the correct form for your city/county. Click the Review button to review the form's content.

- Check the form summary to verify that you have selected the right form.

Form popularity

FAQ

A solid self-employed contract should clearly outline the scope of work, payment terms, and deadlines. In a Nevada Pipeline Service Contract - Self-Employed, include details about deliverables, confidentiality, and termination clauses. Clear agreements prevent misunderstandings and protect both parties’ rights. Utilizing uslegalforms can help you create a comprehensive and enforceable contract.

Contract employees often fall into the self-employed category. When you sign a Nevada Pipeline Service Contract - Self-Employed, you provide services independently, rather than as an employee of a single company. This distinction allows for greater flexibility and autonomy in how you manage your work. Understanding this classification helps to navigate tax and legal requirements.

In Nevada, independent contractors generally do not need workers' comp insurance, but it may be advisable. If you're operating under a Nevada Pipeline Service Contract - Self-Employed, consider the nature of your work and associated risks. This insurance safeguards you against workplace injuries, even though you are not an employee. Evaluating your unique situation can help you make informed decisions.

Most 1099 employees are indeed considered self-employed. In the context of a Nevada Pipeline Service Contract - Self-Employed, receiving a 1099 tax form signifies that you work independently. These individuals manage their business-related expenses and taxes. However, not all independent contractors will fit into every definition of self-employment.

Yes, contract workers are typically considered self-employed. When you engage in a Nevada Pipeline Service Contract - Self-Employed, you take on the responsibility for your business affairs, allowing for more flexibility. While you provide services to clients, you are not bound by the same regulations as traditional employees. This creates opportunities for growth and independence.

Contract work and self-employment are closely related but not exactly the same. A Nevada Pipeline Service Contract - Self-Employed means you have a contract to provide services, and you handle your taxes and insurance. Self-employment encompasses various roles, including those without formal contracts. Thus, all self-employed individuals may not strictly work under contract.

Contract work does not count as traditional employment. When you engage in a Nevada Pipeline Service Contract - Self-Employed, you maintain greater control over your work arrangements and schedule. While you are still performing services, you operate as an independent entity, rather than an employee of a company. This distinction is important for tax purposes and legal liabilities.

Qualifying as an independent contractor involves meeting specific criteria set by the IRS. Generally, you must exhibit control over how you perform your work, such as deciding your hours and methods. Additionally, obtaining a Nevada Pipeline Service Contract - Self-Employed can help clarify your status and obligations. Consider seeking guidance from resources like US Legal Forms to ensure you meet all the necessary requirements and documentation.

To set up as a self-employed contractor, start by choosing a business name and structure that fits your needs. After that, register your business with the appropriate state authorities, which often involves obtaining a Nevada Pipeline Service Contract - Self-Employed to ensure legality. Don't forget to apply for an Employer Identification Number (EIN) from the IRS for tax purposes. Finally, consider using platforms like US Legal Forms to simplify the document preparation process.

Yes, you can be classified as a 1099 employee without a formal contract; however, this may lead to uncertainties. Being a 1099 worker typically means you operate as an independent contractor, but having a contract clarifies roles and expectations. By implementing the Nevada Pipeline Service Contract - Self-Employed, you can bolster your position and ensure a more secure working relationship.