Nevada Pump Installation And Repair Services Contract - Self-Employed

Description

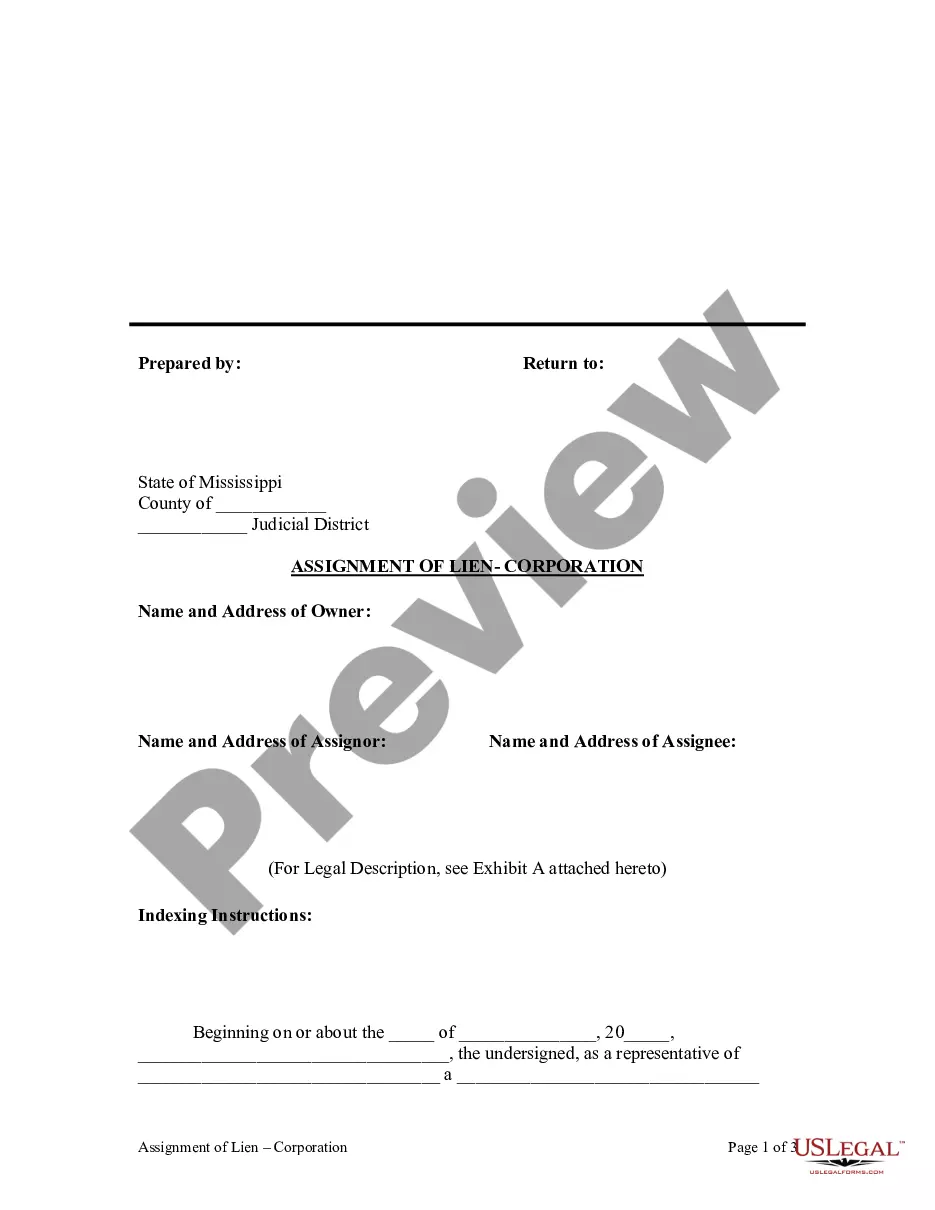

How to fill out Pump Installation And Repair Services Contract - Self-Employed?

Finding the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how can you obtain the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Nevada Pump Installation And Repair Services Contract - Self-Employed, which can be utilized for both business and personal needs. All the forms are reviewed by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click the Obtain button to download the Nevada Pump Installation And Repair Services Contract - Self-Employed. Use your account to review the legal forms you may have purchased previously. Proceed to the My documents tab of your account and acquire another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Acquire now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Nevada Pump Installation And Repair Services Contract - Self-Employed.

- US Legal Forms is the largest collection of legal forms from which you can find numerous document templates.

- Utilize the service to acquire properly crafted papers that adhere to state requirements.

- Access a wide range of templates for various legal needs.

- Ensure all documents are compliant with legal standards.

- Streamline your legal documentation process with ease.

- Find the exact form you need with a user-friendly interface.

Form popularity

FAQ

A B2 contractor license in Nevada allows individuals to legally perform pump installation and repair services. This type of license is crucial for self-employed contractors who want to ensure compliance with state regulations while providing quality services. Obtaining a Nevada Pump Installation And Repair Services Contract - Self-Employed not only enhances your credibility but also protects you and your clients by adhering to legal requirements. You can utilize uslegalforms to obtain necessary documents and streamline the licensing process.

Yes, in most cases, you need a contractor's license to perform work that exceeds the value of $1,000 or involves specialized trades. This includes various installations and services that require skilled labor, like those covered by a Nevada Pump Installation And Repair Services Contract - Self-Employed. If you are considering entering this field, investing in proper licensing will protect you and your clients.

In Nevada, homeowners can generally perform repair work valued under $1,000 without a contractor's license. However, this limitation doesn't always cover all types of work. For projects that involve installations or significant repairs, such as those specified in a Nevada Pump Installation And Repair Services Contract - Self-Employed, hiring a licensed contractor is advisable to ensure compliance and safety.

A contractor can face legal consequences for failing to complete a job, but jail time is unlikely unless there are issues like fraud involved. Clients may pursue financial compensation for unfulfilled contracts, especially for projects under a Nevada Pump Installation And Repair Services Contract - Self-Employed. Being aware of your rights can help you address any disputes with contractors effectively.

Whether a handyman needs a license in Nevada can depend on the type and scale of the work they perform. Handymen can usually handle minor jobs without a contractor's license, but significant repairs or installations, such as those covered by a Nevada Pump Installation And Repair Services Contract - Self-Employed, typically require a licensed professional. It’s essential to understand the specific regulations to avoid potential legal issues.

In Nevada, certain minor repair or maintenance tasks do not require a contractor's license. You can often perform work such as basic landscaping, painting small areas, or repairing your own appliances. However, when it comes to complex projects like those covered under a Nevada Pump Installation And Repair Services Contract - Self-Employed, it’s best to be careful. Undertaking larger jobs without a licensed contractor can complicate your situation.

Hiring an unlicensed contractor in Nevada can lead to serious issues for you as a homeowner. While it's not always illegal, you may find yourself without legal protections if something goes wrong. This can be particularly problematic in matters involving a Nevada Pump Installation And Repair Services Contract - Self-Employed. It is advisable to hire licensed contractors to ensure quality work and compliance with state laws.

Contractors in Nevada may typically ask for an upfront amount between 10% and 50% of the total estimate, depending on the type and scale of the project. For a Nevada Pump Installation And Repair Services Contract - Self-Employed, the upfront amount helps cover initial costs in mobilization and materials. Always validate these terms in your written contract to maintain clarity.

Yes, you may drill your own water well in Nevada, but you need to obtain the proper permits first. There are specific regulations governing water well drilling under Nevada law, which you must follow. Consulting with an expert in Nevada Pump Installation And Repair Services Contract - Self-Employed can help ensure compliance with state requirements.

Yes, it is common for contractors to ask for half the payment upfront, particularly for larger projects. This practice is especially prevalent in services like Nevada Pump Installation And Repair Services Contract - Self-Employed. Clients should ensure they trust their contractor and that a formal agreement accompanies the upfront payment.