Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

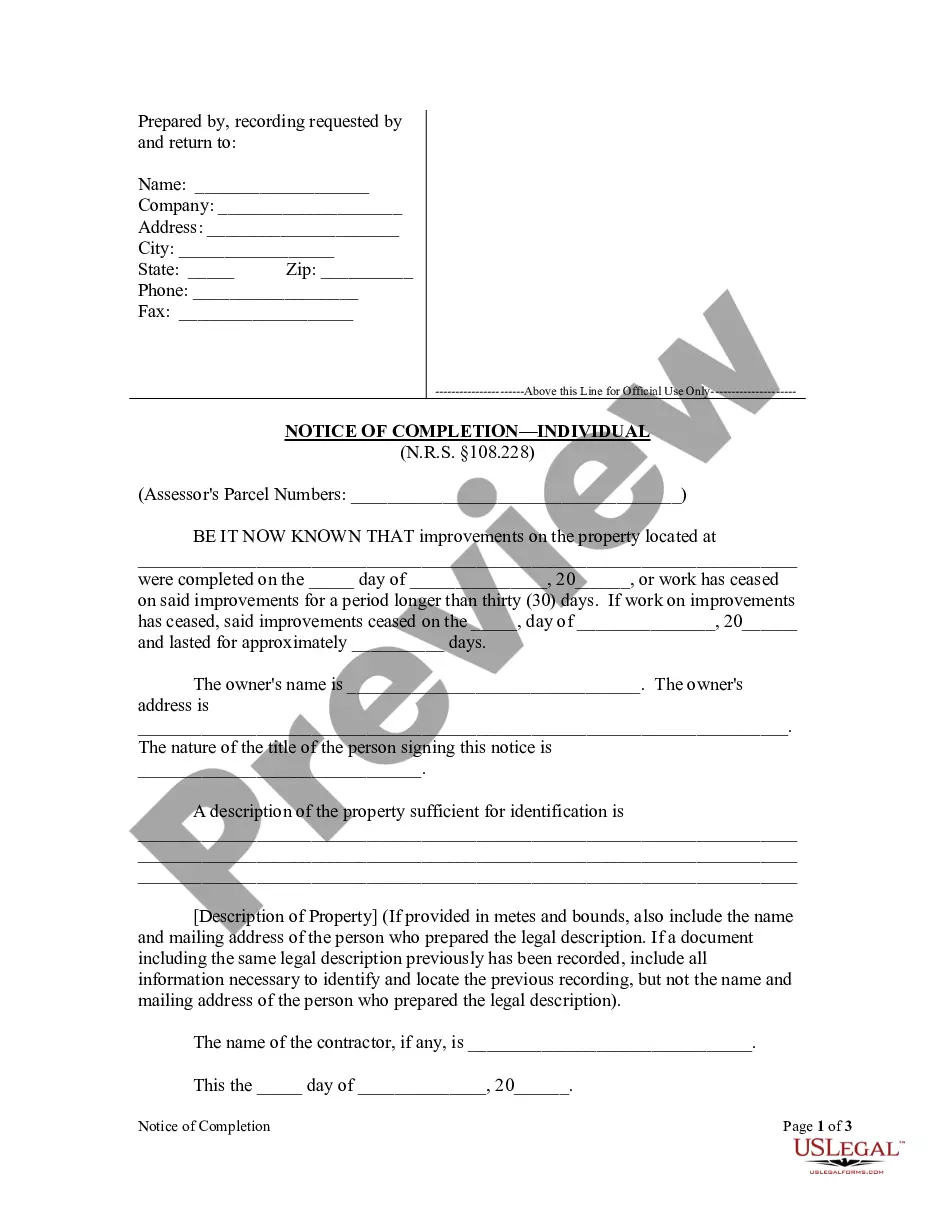

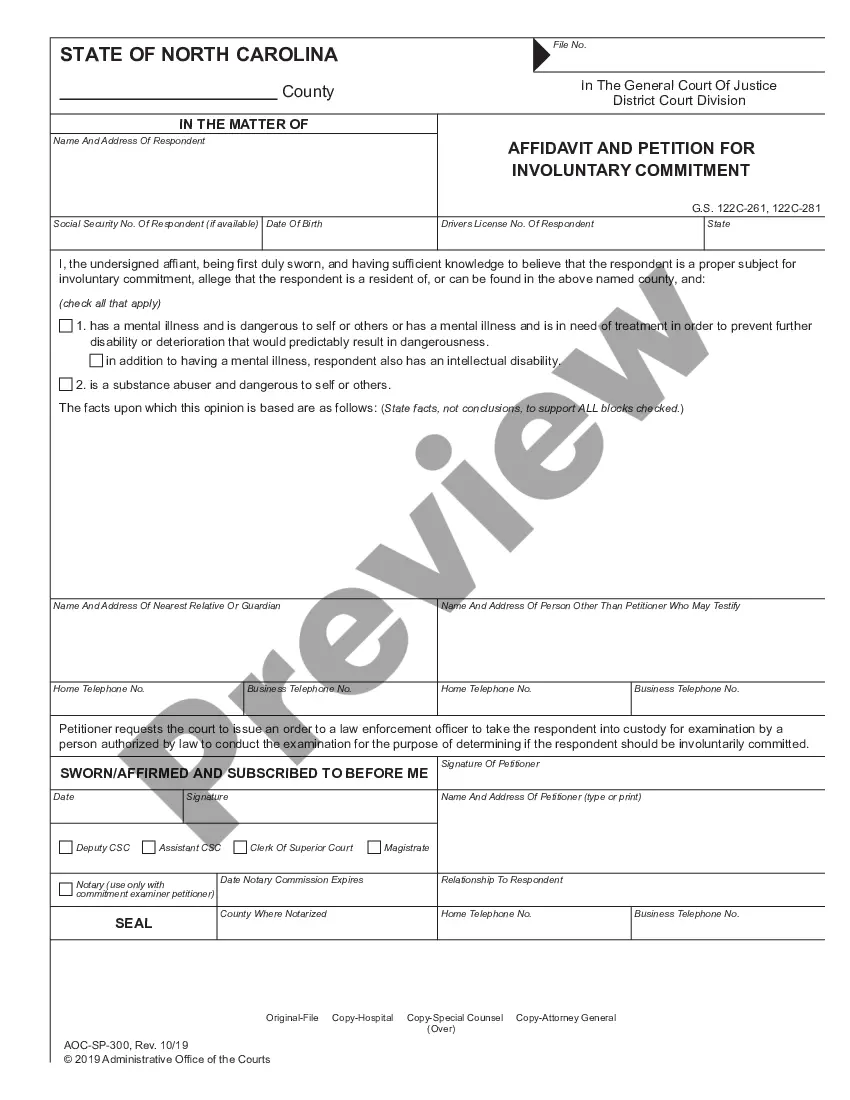

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

You can spend hours online searching for the valid document template that meets the local and national regulations you require.

US Legal Forms offers a vast array of legal forms that are examined by specialists.

You can easily download or print the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from the service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Every legal document template you acquire is yours permanently.

- To get another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form description to ensure you have chosen the correct template.

Form popularity

FAQ

Obtaining a Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can vary depending on your financial situation. Generally, lenders look for evidence of financial hardship and your ability to make modified payments. If you provide complete documentation and communicate clearly with your lender, your chances of approval improve significantly. Using resources like USLegalForms can help streamline the process and guide you through the necessary steps.

Yes, Congress passed several mortgage relief programs over the years, including the HAMP initiative. These programs aim to assist struggling homeowners by providing options like loan modifications. By taking advantage of the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can potentially benefit from the financial relief these programs offer.

Yes, HAMP modifications continue to be a valuable resource for homeowners seeking financial relief. Although the program has evolved and changes may have occurred, eligibility for HAMP can still provide a way to lower your monthly mortgage payments. To explore your options, consider using the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP and consult a qualified professional for guidance.

Requesting a mature modification for your loan requires clear communication with your mortgage servicer. Begin by explaining your current financial situation and the specific changes you seek. Reference the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP to guide your discussion, and ensure you have all necessary documentation ready for the servicer’s review.

The Home Owners’ Loan Corporation (HOLC) was a significant part of American mortgage history but is no longer in operation. It was created during the Great Depression to assist homeowners in refinancing their loans. Although HOLC has ended, programs like the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP continue to help homeowners facing difficulties in meeting their mortgage obligations.

To apply for a loan modification under the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, start by gathering your financial documents, including income statements and expense records. Then, contact your mortgage servicer to request the application form specifically for HAMP. Once you complete the form, submit it along with any required documentation to your lender, and be sure to follow up to ensure they received everything.

The HAMP loan modification program was designed to assist struggling homeowners by making mortgage payments more affordable. It provided homeowners with a chance to modify their loans through reduced interest rates or adjusted terms. Although the program is no longer available, learning about it can provide valuable insights into current alternatives. If you seek help with modifications, the Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can guide you toward available solutions.

The process for a loan modification typically begins with gathering financial documents and submitting a request to your lender. After reviewing your application, the lender will evaluate your financial situation and determine eligibility. If approved, you will receive new terms for your mortgage. Utilizing a Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can help streamline this process and offer clarity.

As of now, the Home Affordable Modification Program (HAMP) is no longer active; it officially ended in 2016. However, other alternatives and state-specific programs may offer similar relief options. To explore your options and find solutions tailored to your situation, consider using resources like uslegalforms, which can guide you in seeking assistance with a Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

The Home Affordable Modification Program (HAMP) modifies loan terms to make mortgages more affordable. It typically lowers monthly payments by reducing interest rates or extending loan terms. To benefit from the program, homeowners must submit an application and documentation to prove their financial situation. The Nevada Request for Loan Modification RMA Under Home Affordable Modification Program HAMP offers you a structured pathway to achieve a more manageable mortgage.