Nevada MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

If you require to aggregate, download, or produce legal document templates, utilize US Legal Forms, the most significant collection of legal forms, available online.

Employ the site’s straightforward and user-friendly search to locate the documents you seek.

A selection of templates for business and personal use is organized by types and categories, or keywords. Use US Legal Forms to access the Nevada MHA Request for Short Sale in just a few clicks.

Each legal document template you purchase is yours permanently. You can access every form you acquired through your account. Go to the My documents section and select a form to print or download again.

Stay ahead and download, and print the Nevada MHA Request for Short Sale with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to acquire the Nevada MHA Request for Short Sale.

- You can also retrieve forms you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the correct form for your area.

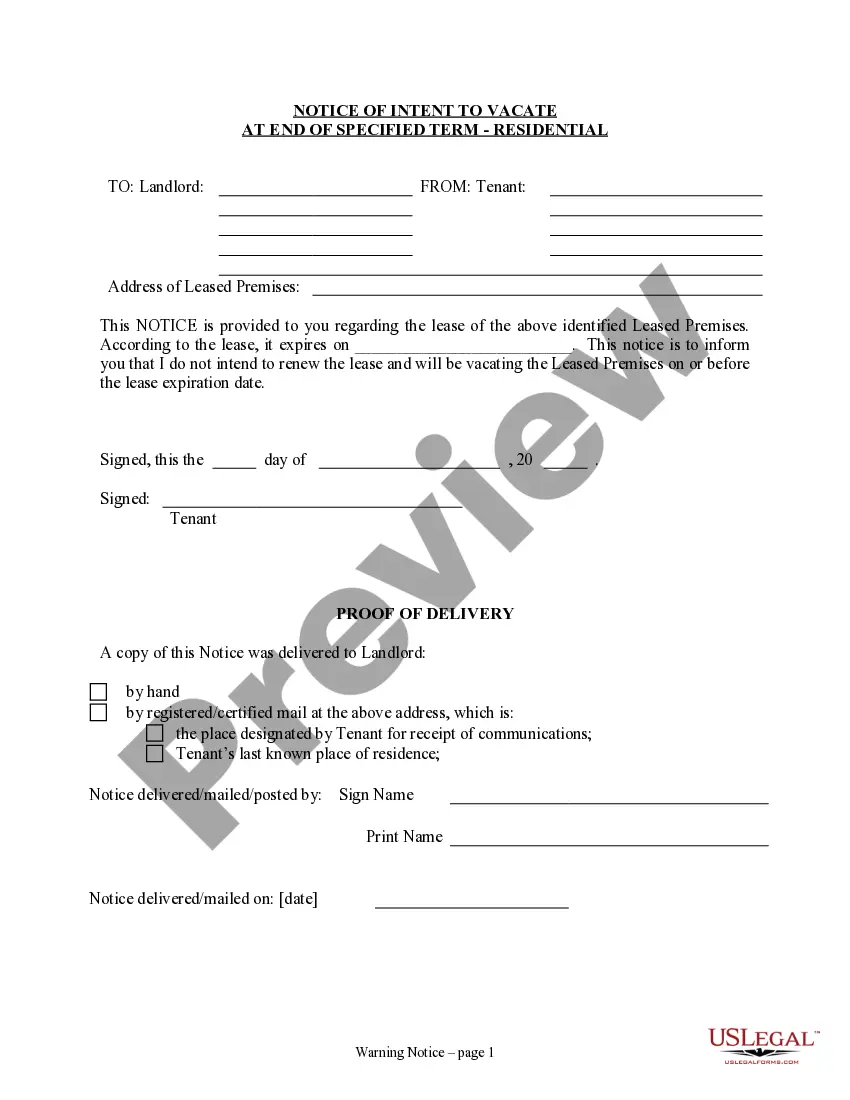

- Step 2. Utilize the Preview option to review the form’s details. Make sure to read through the overview.

- Step 3. If you are not satisfied with the template, make use of the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. After identifying the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada MHA Request for Short Sale.

Form popularity

FAQ

When writing a hardship letter for a short sale, begin by clearly stating your current financial situation and the reasons you can no longer afford your mortgage payments. Be honest and concise, detailing any unexpected circumstances that have impacted your finances. Mention your intention to pursue a Nevada MHA Request for Short Sale as a solution to avoid foreclosure. This letter should convey your sincerity and willingness to cooperate with your lender.

Yes, a short sale can potentially affect your security clearance since financial issues may be scrutinized during the clearance process. However, proactively demonstrating your efforts to manage your mortgage, such as submitting a Nevada MHA Request for Short Sale, can help mitigate concerns. Transparency with authorities about your financial situation is also beneficial.

Whether a short sale or a deed in lieu of foreclosure is better often depends on individual circumstances. A short sale allows you to sell your property for less than what you owe while avoiding foreclosure on your credit report. However, a deed in lieu may be simpler and quicker, especially if your Nevada MHA Request for Short Sale is not viable. Consulting with a legal expert can help you decide which option suits you better.

A common requirement for a short sale to proceed is the lender's approval of the sale terms. For a Nevada MHA Request for Short Sale, homeowners must demonstrate that they are facing financial hardship. Additionally, the property's market value must be less than the outstanding mortgage balance, which aids in justifying the request to your lender.

In Nevada, the most commonly used foreclosure process is a non-judicial foreclosure. This method allows lenders to foreclose on a property without going through the court system, provided they follow specific statutes. Homeowners facing foreclosure may find assistance through the Nevada MHA Request for Short Sale, which can help facilitate the sale of a home for less than the mortgage owed, thus avoiding foreclosure altogether. Understanding the different foreclosure processes can empower you to make informed decisions.

To get approved for a short sale in Nevada, you should first communicate with your lender about your financial situation. They typically require documentation to show you are facing hardship, such as proof of income, monthly expenses, and any relevant financial statements. Once your lender reviews this information, they will evaluate your request for the Nevada MHA Request for Short Sale. It is essential to provide accurate and complete documentation to enhance your chances of approval.

Whether a deed in lieu is better than a short sale depends on your unique situation. A deed in lieu may seem faster, but it could harm your credit more than a short sale, depending on how your lender reports it. The Nevada MHA Request for Short Sale allows you to potentially retain some of your equity while avoiding foreclosure. Therefore, considering all options and possibly consulting with uslegalforms can provide clarity and guidance tailored to your needs.

A HUD short sale involves selling a property for less than what is owed on the mortgage, with the approval of the lender. This type of sale requires the lender's consent to pardon the remaining debt after the sale. The Nevada MHA Request for Short Sale is a specific program that may help you navigate through this process, ensuring that you meet the requirements and maximize your benefits. Engaging with a platform like uslegalforms can simplify the necessary paperwork.

One disadvantage of a deed in lieu of foreclosure is that it may impact your credit score significantly. While it can provide a quicker resolution to financial troubles compared to other options, it often results in a negative mark on your credit record. It is essential to consider alternatives like the Nevada MHA Request for Short Sale, which may offer a less detrimental effect on your credit history and provide you with more time to settle your finances.